>>Click here to sign up for the Futures Preferential Margin Program<<

Note: After you apply to participate in the Futures Preferential Margin Program, it is expected to take about 1-3 business days for us to review and approve your application. Please check your account for any change to your margin.

● CME Group Futures Preferential Margin

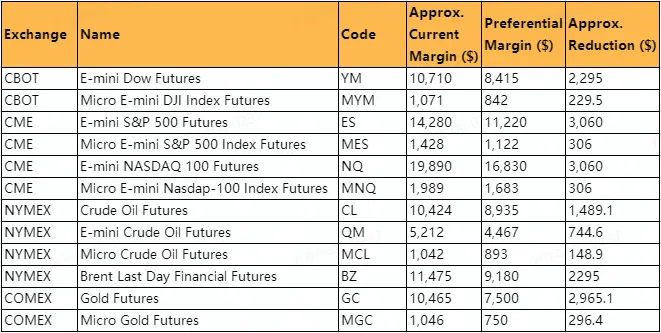

Supported Futures: some CME Group futures contracts with large trading volume and high liquidity level, including E-mini Dow Futures, E-mini S&P 500 Futures, E-mini NASDAQ 100 Futures, Crude Oil Futures, and Gold Futures.

Preferential Margin: The preferential margins are about 78-85% of the original margins, details of which are as follows:

(These margins are subject to change at any time according to the adjustment by the relevant exchanges without prior notice. The above information is for reference only)

Eligibility: To participate in the CME Group futures preferential margin program, you must meet all the following three conditions.

a. You have more than 20 futures trades with Futu;

b. Your account has a good credit record;

c. You have an equity of more than 10,000 USD in your futures account;

Keep in mind:

The CME Group futures preferential margin program is designated for futures veterans with certain trading experience and strong risk management abilities. Considering the risk management strategy for newbies, this offer is not suitable for novice futures investors. We hope you can understand.

The CME Group will adjust the margin requirements for individual products at any time based on market risk factors. Futu will adjust the preferential margins according to any adjustment by the CME. Please check your account in a timely manner for any change to the preferential margins.

● HKFE Futures Intraday Preferential Margin

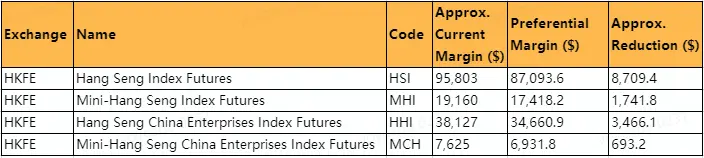

Supported Futures: Hang Seng Index Futures, Mini-Hang Seng Index Futures, Hang Seng China Enterprises Index Futures , and Mini-Hang Seng China Enterprises Index Futures.

Preferential Margin: The intraday preferential margins are about 90% of the original margins, details of which are as follows:

(These margins are subject to change at any time according to the adjustment by the relevant exchanges without prior notice. The above information is for reference only)

Trading hours (Hong Kong Time) available for application of intraday preferential margins:

[Full-Day Trading]: 8:45 AM - 4:00 PM

[Half-Day Trading]: 8:45 AM - 12:00 PM

In case of early market close due to emergencies: a final decision will be made15 minutes before the futures market closes or based on the actual market conditions.

Preferential Margin Rules:

During the intraday hours, the intraday margins will apply;

After the intraday hours, the original margins will apply.

————————

Keep in mind: Investing in futures involves high risk. Higher leverage means increased risk. It is recommended not to use excessive leverage, especially when the market goes against you. Always keep a close eye on your account’s risk status and deal with it in a timely manner.