1. How Do Corporate Actions Affect Option Contracts?

When the underlying stock undergoes a corporate action, the HKEX will issue an announcement in advance to announce such changes to the capital structure of the stock by way of a special dividend, capital restructuring, rights issue, bonus issue, etc and the corresponding ex-entitlement date.

The option contracts issued before the ex-date will be adjusted accordingly. Generally speaking, the process will involve changes in the option ticker, the strike price, and the contract size. The specific adjustment ratio is subject to the figures announced by the HKEX.

Please note:

1. The total value of an option contract generally does not change due to corporate actions.

2. After the option ticker is updated, the liquidity of the contract may decrease.

3. After the corporate action, if the exchange does not announce the margin requirement of the adjusted contract, Futu may increase the margin of the contract due to risk considerations until the exchange updates the relevant margin requirements.

For more details, please visit the the relevant information by the HKEX.

2. Do Corporate Actions Affect Option Strategies?

Yes. Since coporate actions generally involve changes in the contract size of the options, if you hold a covered call position, there is a high probability that the short call positions will be "De-covered", resulting in an increase in account margin requirements.

For SEOCH's rules for handling option strategies, you can visit here.

For your covered call positions, you can choose the following market operations to mitigate the account risk associated with "De-covering":

1. Closing the short option positions in your covered calls, and reconstructing the strategy after the corporate action;

2. Buy additional shares to account for the possible increase in option contract size;

3. Hold still for the time being, and wait until after corporate action has been completed.

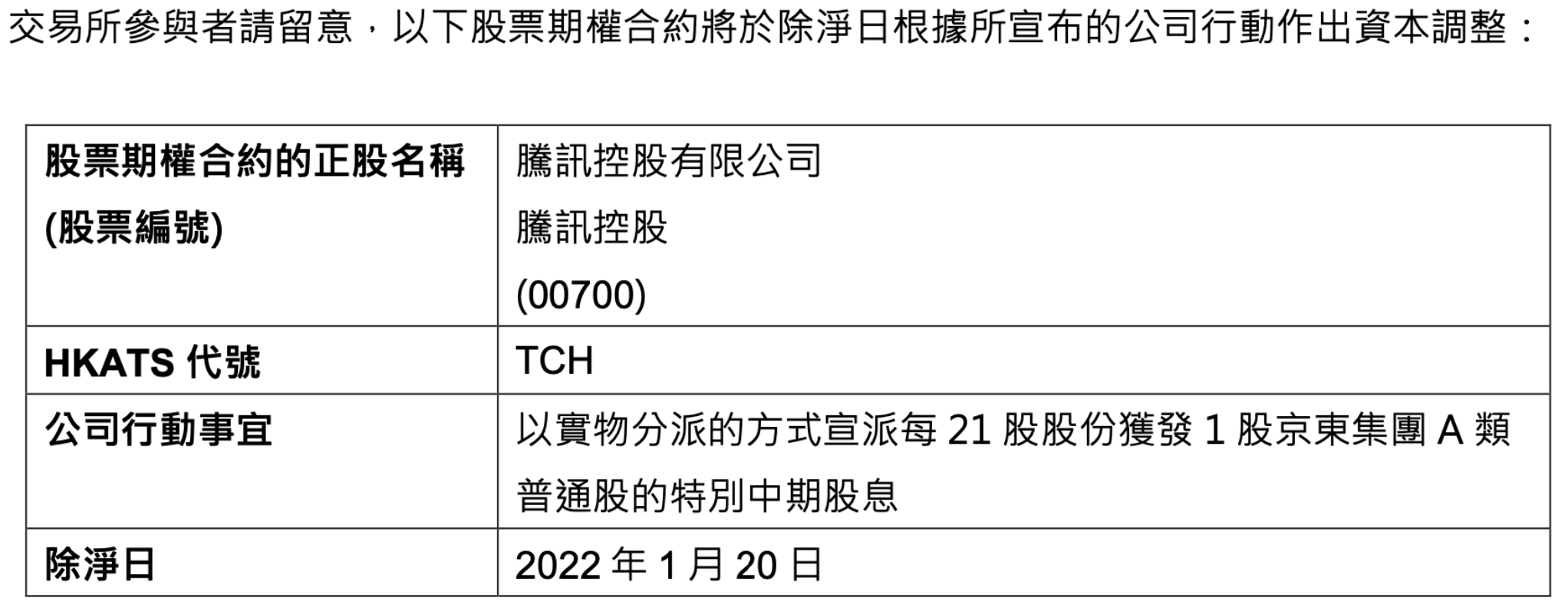

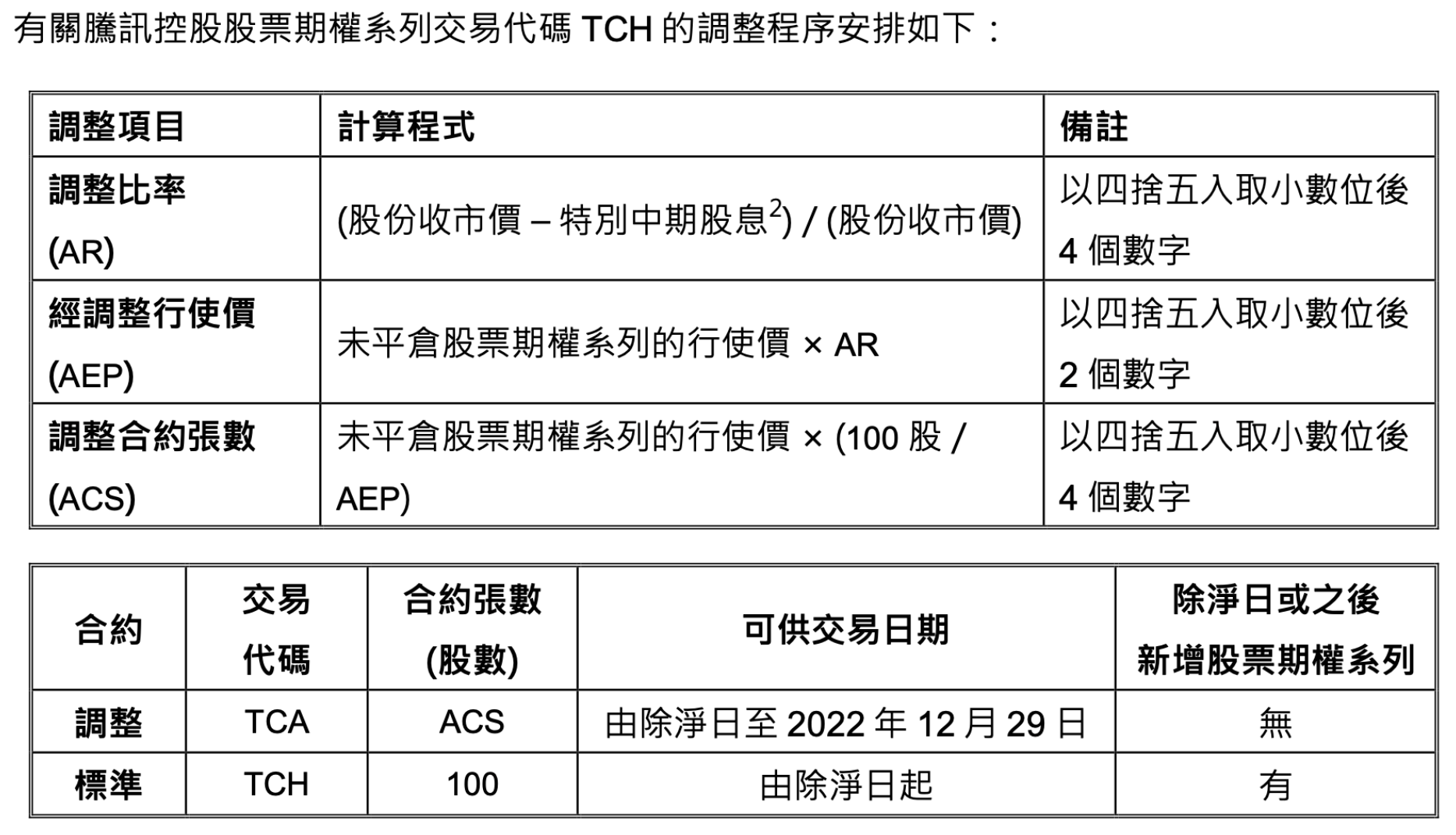

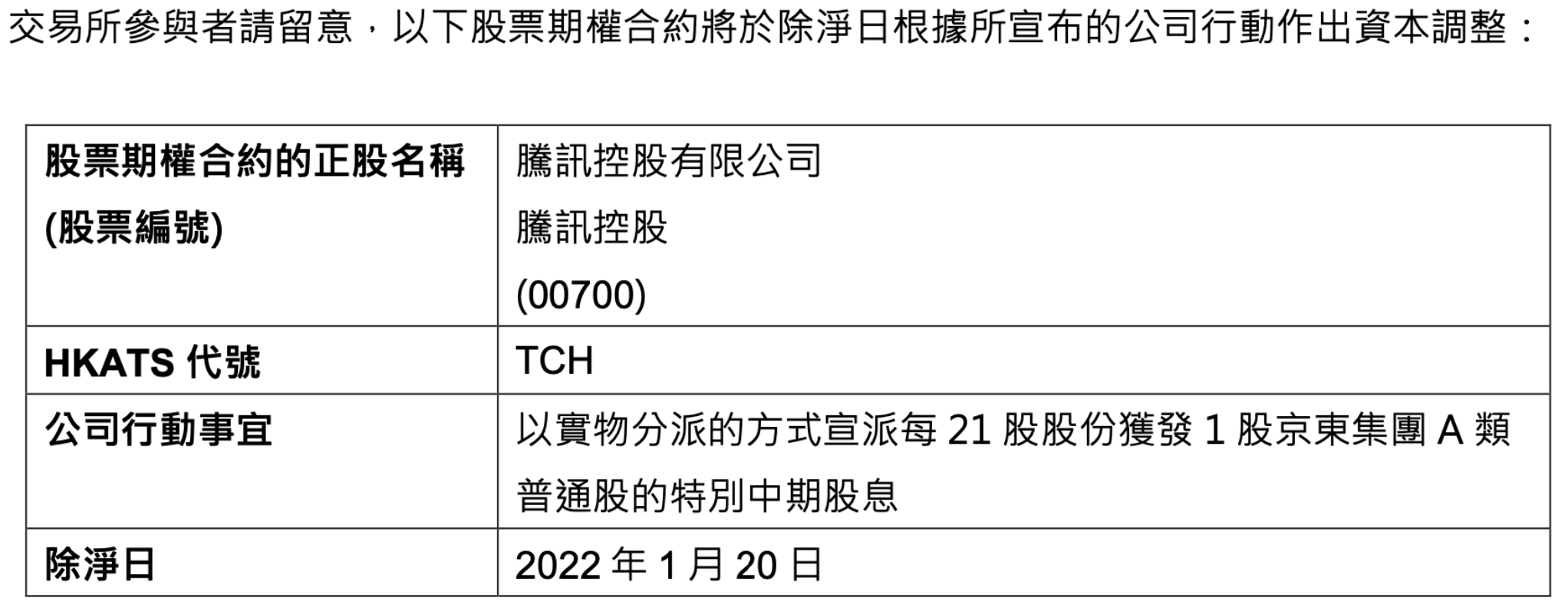

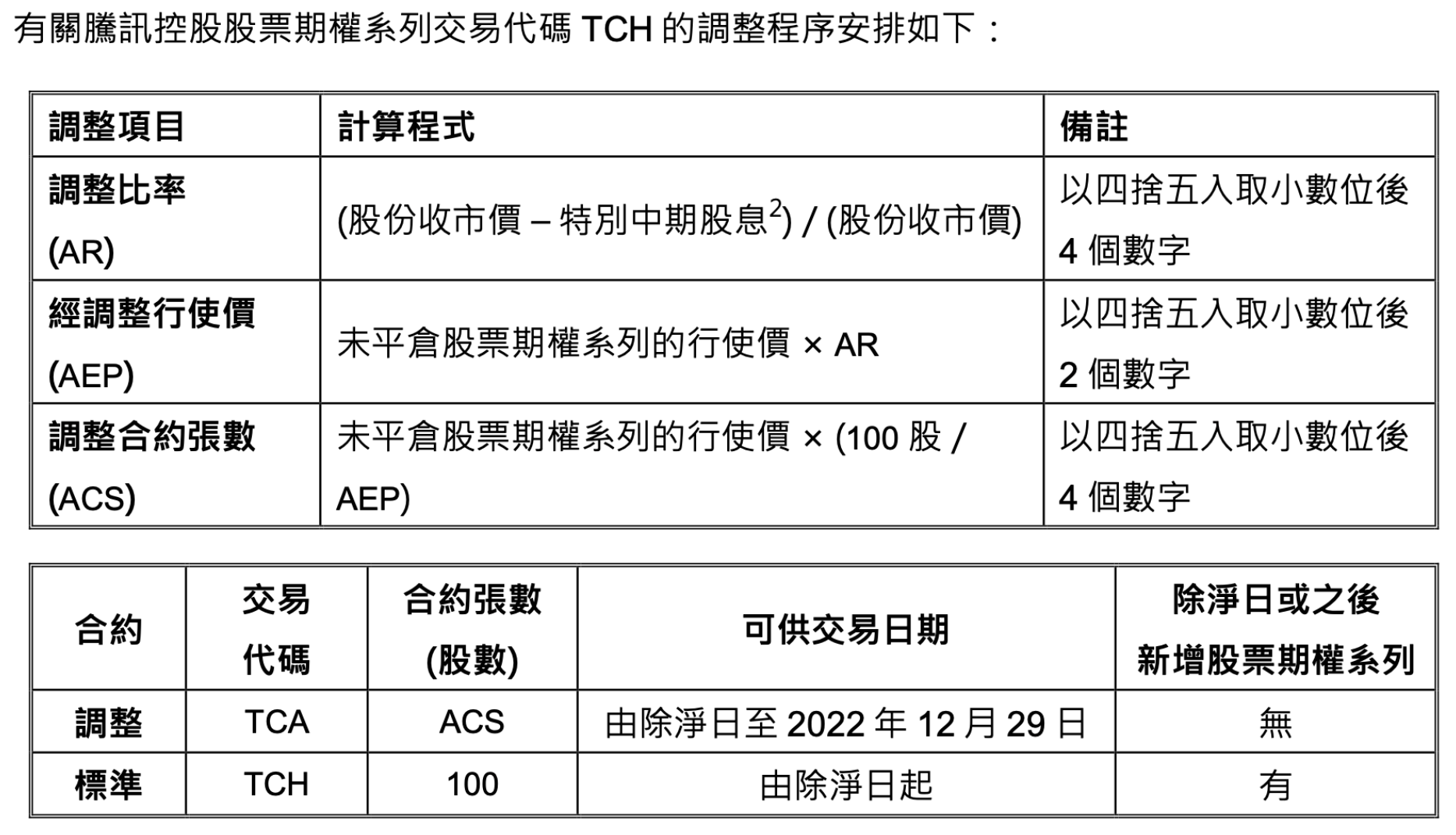

For example - Tencent Holdings (00700.HK) announced corporate action of "other forms of distribution" which include special dividend, capital restructuring, rights issue, bonus issue, etc, with January 20, 2022 as the ex-entitlement date. If you hold TCH options before the market opens on January 20, 2022, the contract ticker will be automatically updated to TCA, and it will trade under the new symbol.

Option adjustment rules are as follows:

1. Adjustment of option symbol from TCH to TCA

2. Adjustment of strike price: new strike price = original strike price * adjustment ratio

3. Adjustment of contract size: new contract size = original strike price * (original contract size / new strike price)

Note: The adjustment ratio will be announced by the Hong Kong Stock Exchange

Announcement screenshot:

Assuming that the closing price of Tencent's Hong Kong stock is 460HKD on January 19, and the closing price of JD is 280HKD. Then the [Adjustment Ratio] is about [460-(280/21)] / 460 = 97.1014%. If you hold 100 shares of Tencent stock and a short position of a TCH option, the option size is 100 and the call is exactly covered by the underlying stock.

After the corporate action, you will hold 100 Tencent underlying shares and a short position of a TCA option. At this point however, the option size is about 100/97.1014%= 102.9851, therefore the option is "De-covered" due to the insufficient number of underlying shares.

In the above example, you can close the TCH option or add 3 shares of Tencent stock before the corporate action to prevent an sudden increase in account margin requirements and an elevation in account risk due to "De-covering".

3. Large Open Position Reporting of Hong Kong Stock Options

According to Section 35 of Chapter 571 of the Securities and Futures Ordinance, Securities and Futures (Contracts Limits and Reportable Positions) Rules, Enhanced Regulation of LOPR in Index Futures and Options, unless authorized, a declaration to the exchange is required when a customer's account holds options contracts in excess of the large open position reporting level.

3.1 Filing conditions

Stock option classes (with the same underlying, the same option class) with aggregate after-hours positions of more than 1,000 shares require declaration.

3.2 Reporting methods

1) When customers who open an account in FUTU hold positions reaching the reporting level, FUTU will act as an agent to report on behalf of customers and customers do not need to do any operation.

2) When the combined positions of multiple brokers reach the reporting level, the customer may entrust any one of the brokers as an agent to make a unified report to the Exchange, or authorize the brokers to report their positions to the Exchange separately.

3.3 Related links

1) The rules on the large open positions and position limits for derivatives shall be subject to the announcement of the regulatory authority.

2) Guidance Note on Position Limits and Large Open Position Reporting Requirements.