A-share trading follows the rules of the Shanghai and Shenzhen Stock Exchanges, as follows:

1. tradable stock

2. Transaction date arrangement

3. trading hours

4. Buying and selling indicators

5. Settlement currency and cycle

6. Units per lot and odd lot

7. Price limit

1. tradable stock

Please refer to the website of the Hong Kong Stock Exchange for the list of eligible stocks.

(1) Among the current product types listed on the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE), only eligible A-shares and ETFs are included in Shanghai and Shenzhen Stock Connect. Other products such as B shares, bonds, and other securities are temporarily unavailable for Northbound trading.

(2) Second-board Market currently only supports institutional transactions

2. Transaction date arrangement

Northbound trading will only be open when both markets are trading days and both markets have settlement services on the money settlement day (that is T+1).

For a specific northbound trading calendar, click to view the Hong Kong Stock Exchange's annual calendar.

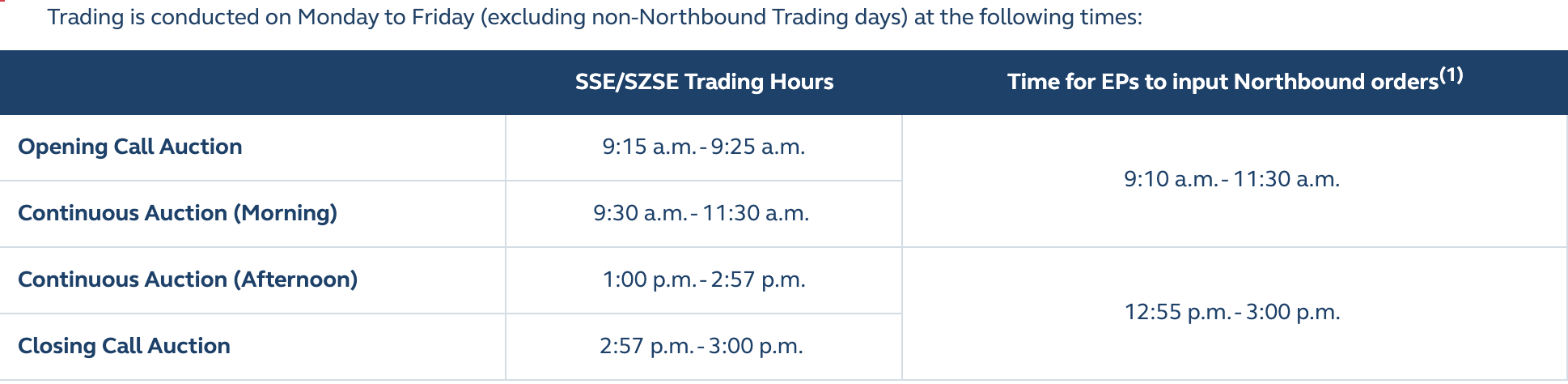

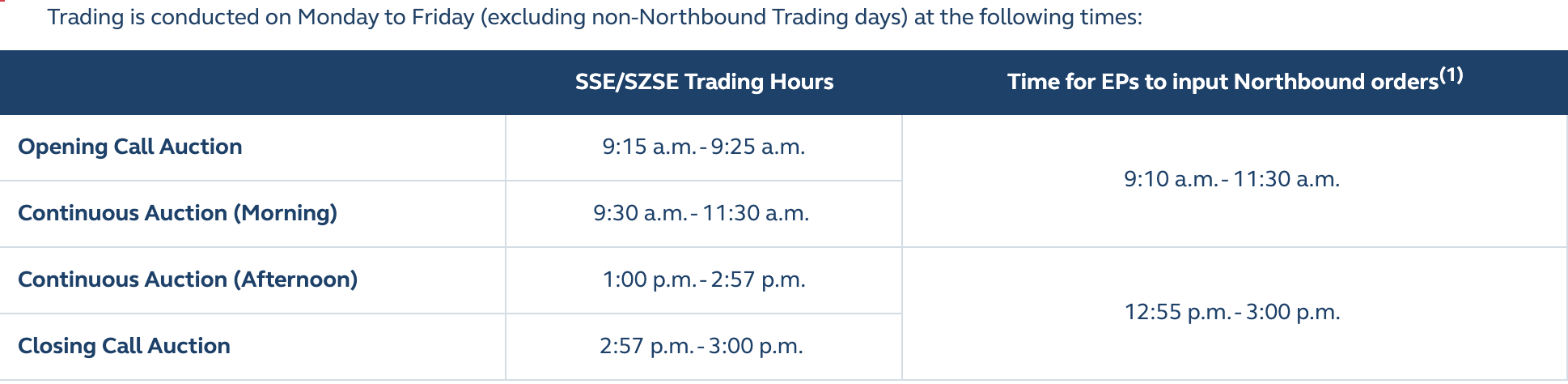

3. trading hours

The trading hours of A-shares follow the Shanghai Stock Exchange and Shenzhen Stock Exchange. The specific time periods are shown in the table below.

click here for more information on trading hours

(1) 09:20~09:25 and 14:57~15:00: Shenzhen Stock Exchange does not accept cancellation orders; 09:20~09:25: Shanghai Stock Exchange does not accept cancellation orders

(2) Orders that are not matched during the opening call auction period will automatically enter the continuous auction period

The Shanghai Stock Exchange implements closing call auctions from August 20, 2018: click here

4. Buying and selling indicators

(1) FUTU supports limit orders and conditional orders. You can issue trading instructions during any trading hours of A-shares, or you can place orders in advance during non-trading hours through the ability to place orders provided by FUTU.

(2) There is no operation type to modify the order. If you need to change the order, you need to cancel the unexecuted order, and then place the order again after the cancellation is successful.

(3) T+0 trading of stocks is not allowed. A-shares purchased by customers on T day can only be sold on or after T+1 day

5. Settlement currency and cycle

(1) Trading and settlement in RMB

(2) Stock trading implements the T+1 trading system, that is, the stocks bought on T day can only be sold on T+1 day; the stocks sold on the same day can only be withdrawn after settlement on T+1 day, but the money can be used to buy other stocks stock.

6. Units per lot and odd lot

The number of A-share transactions has the following regulations:

(1) All A-shares are 100 shares per lot

(2) The buy order must be a whole lot order

(3) When only selling, odd lots can be sold. But investors must sell all odd shares of the A shares;

(4) The odd lot sell order will be matched with the complete unit order on the same trading platform and bid at the same price. Therefore, odd lots may appear in the final transaction of the customer's buy instruction.

7. Price limit

7.1 Quote change limit

The current price limit of the Shanghai Stock Exchange/Shenzhen Stock Exchange is generally not more than ±10% of the closing price of the previous day (the price limit of A-shares (ie ST stocks and *ST stocks) included in the risk warning board is ±5%). Orders that exceed the price limit will be rejected by the Shanghai Stock Exchange/Shenzhen Stock Exchange.

7.2 Purchase price limit

(1) To use the trading quota more effectively, the Stock Exchange has established a price floor for buy orders

(2) The buy instruction price cannot be entered as a percentage lower than the following price, otherwise, the buy instruction will be rejected by the CSC system.

Current buying price:

Or if there is no current purchase price, use the latest transaction price;

Or if there is no current buying price and the latest transaction price, the closing price of the previous day will be used.

(3) According to the provisions of the Stock Exchange, the current percentage is 2%, please click here to get more information.

(4) Customers should note that your buy instruction price is still subject to the price limit set by the Shanghai Stock Exchange/Shenzhen Stock Exchange