FUTU currently supports trading some index options. These options are all European-style, which means they can only be exercised at expiration.

When european-style index options expire, the following scenarios exist:

● Automatic exercise

○ Index options that are $0.01 or more in-the-money at expiration will be automatically exercised by the OCC. No instructions are needed.

● Automatic lapse

○ Index options that are less than $0.01 in-the-money or out-of-the-money at expiration will automatically lapse if the position holder does not submit an exercise instruction in advance.

Since index options are settled in cash and incur no additional exercise fees, opting for instructed exercise or lapse at expiration is disadvantageous for clients holding long positions. Consequently, FUTU does not currently support requests for instructed exercise or lapse of such options.

Index options are cash-settled as there are no underlying assets for delivery.

Calculation method for settlement amount:

● Lapsed Options: settlement Amount = 0

● Automatically exercised options:

○ Calls: Settlement Amount = (Settlement Price - Exercise Price) × Contract Multiplier × Contract Quantity

○ Puts: Settlement Amount = (Exercise Price - Settlement Price) × Contract Multiplier × Contract Quantity

The settlement amount is paid by the option seller to the option buyer.

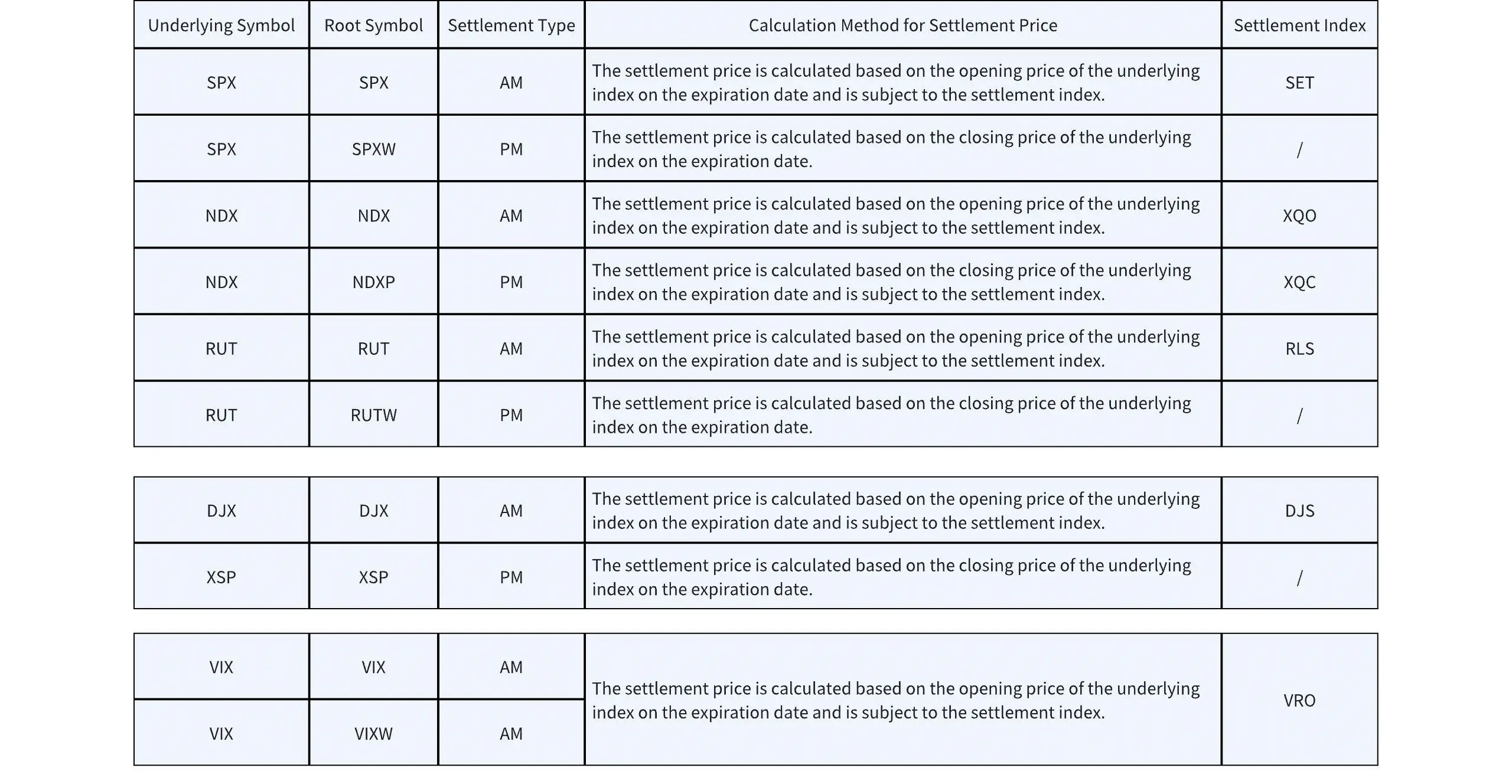

The settlement prices of index options are determined by their settlement types. Details are as follows:

- No more -