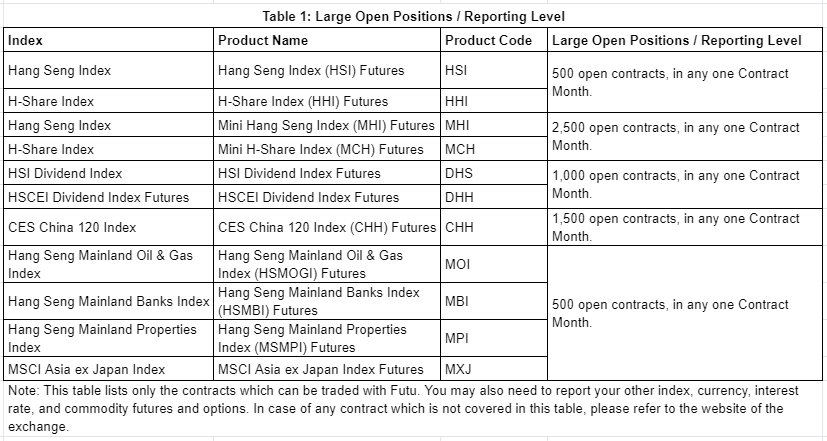

1.1 If your daily open positions after market close reach or exceed the large open position reporting level, you need to file a report. See Table 1 for the large open position reporting levels of HK futures (Contracts, which are executed during the T+1 session, are included in the calculation for the next trading day). For the the large open position reporting levels of CME futures and options, Click here. For the the large open position reporting levels of CFTC futures and options, Click here.

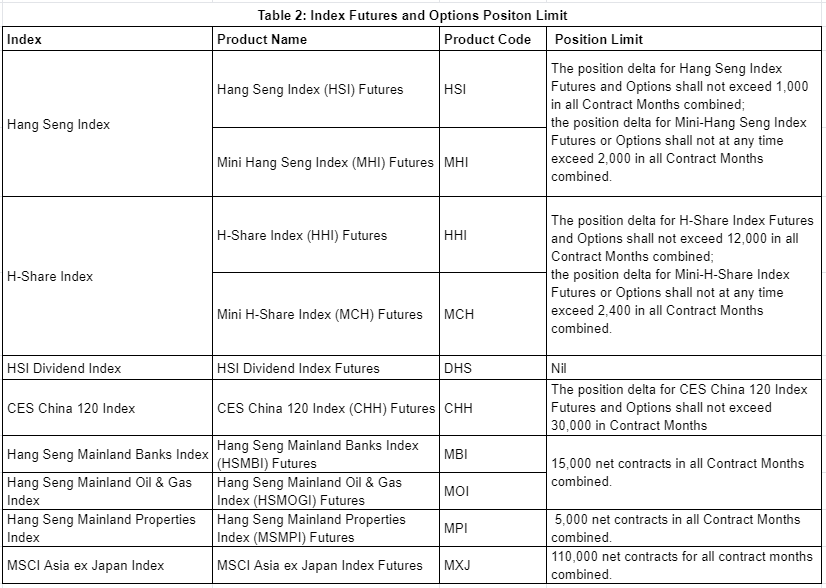

1.2 If your positions in HK Index Options and Futures, at any time or cumulatively on a single day, exceed 60% of the position limit, you need to report all your positions in the Index Options and Futures (Contracts, which are executed during the T+1 session, are included in the calculation for the next trading day). The position limits of HK index Futures and Options are shown in Table 2.

2.1 Futu will, acting as your agent, file a report on your behalf only if you hold positions with Futu, which have reached the reporting level. In such case, Futu will report the information about your account (account ID, name, etc.) and your contract positions that need to be reported (contract name, positions, etc.) to the exchange, and you do not need to do anything.

2.2 If your positions with each brokerage reach, after being aggregated, the reporting level, you can appoint any one of the brokerages as your agent to report your positions as a whole to the exchange, or authorize the brokerage so appointed to report your positions with each brokerage separately to the exchange.

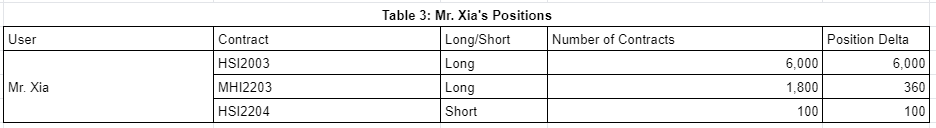

Suppose Mr. Xia opened an account only with Futu, and his positions are shown in Table 3: Mr. Xia holds more than 500 HSI2003 contracts, which reach the large open position reporting level; less than 2,500 MHI2003 contracts; and less than 500 HSI2004 contracts. Therefore, Mr. Xia needs to report only the HSI2003 positions. The HSI2003, HSI2004, and MHI2003 contracts he holds, all being Hang Seng Index (HSI) futures contracts, have a position delta of 6,460 (i.e. 6,000+360+100), which exceeds 60% of the position limit of HSI futures contracts (i.e. 60% x 10,000 delta = 6,000 delta), so Mr. Xia needs to report all his HSI products (including mini futures and options). To sum up, Mr. Xia needs to report the HSI2003, MHI2003 and HSI2004 contracts he holds. Futu will, acting as his agent, report directly to the exchange, and Mr. Xia does not need to do anything.

Note: Table 3 serves as an example. Position delta = number of contracts x delta of each contract as determined in the DCASS report "RP009 – Series Greek Data File".

- No more -