1. Block trade basics

1.1 Definitions about block trades

Cross trade, also known as direct trade, refers to the direct trading between buyers and sellers of the same stock on Futu rather than through the Hong Kong Stock Exchange's automatic matching system. Futu is also required to report direct trades to the Hong Kong Stock Exchange.

Futu must strictly adhere to the quotation rules designated by the Hong Kong Stock Exchange and the general principles within the Code of Conduct for Persons Licensed or Registered with the Securities and Futures Commission. Both parties to the transaction must understand and agree to trade the same target stock at a specified reasonable price and quantity.

1.2 Trading hours and quotation rules

Trades completed during the pre-opening session must be inputted no later than 15 minutes after the start of the morning trading session.

According to the Rules of the Exchange, the price of each cross-trade transaction during the continuous trading session must be within the range of the lowest price among the twenty-four spreads below the previous day's closing price, the lowest buy quote, and the lowest sell quote at the time of trade on the current day, and the highest price among the twenty-four spreads above the previous day's closing price, the highest buy quote, and the highest sell quote at the time of trade on the current day.

For trades related to stocks in the closing auction session, they must be inputted no later than the end of the closing auction session.

Once a cross-trade transaction is recorded in the system, it can't be cancelled. If an error is discovered and reported to the Exchange, the cross-trade transaction may only be cancelled with the approval of the Exchange.

2. How to make block trades with Futu

2.1 Online operation process

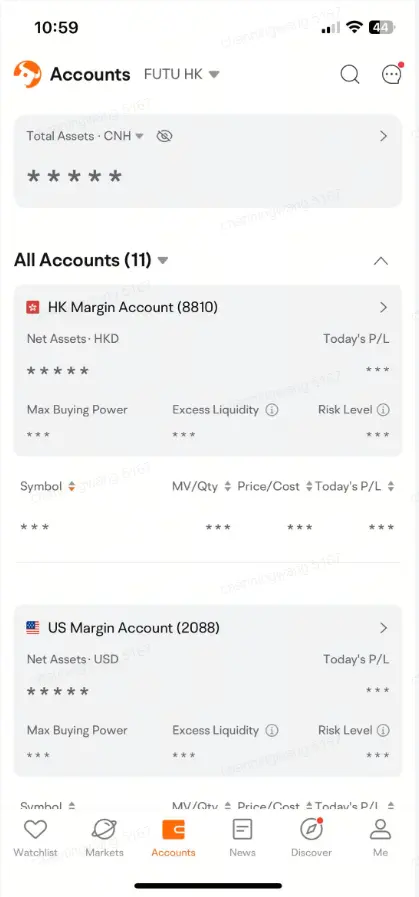

2.1.1 Path

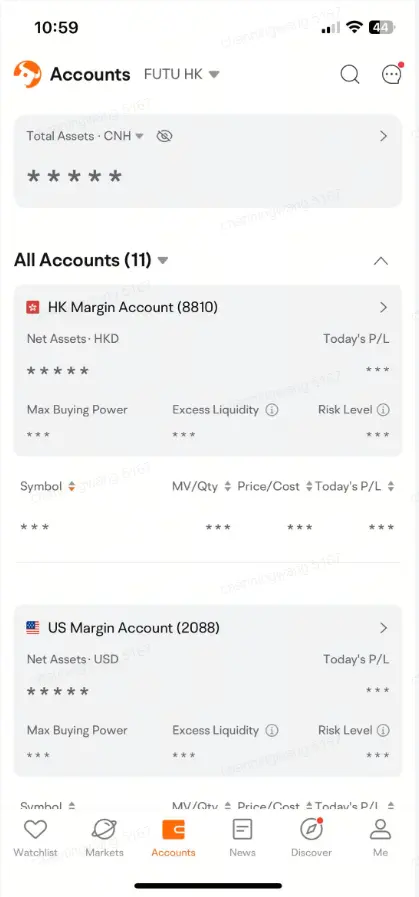

Path: Accounts > Account Details > More > Block Trade

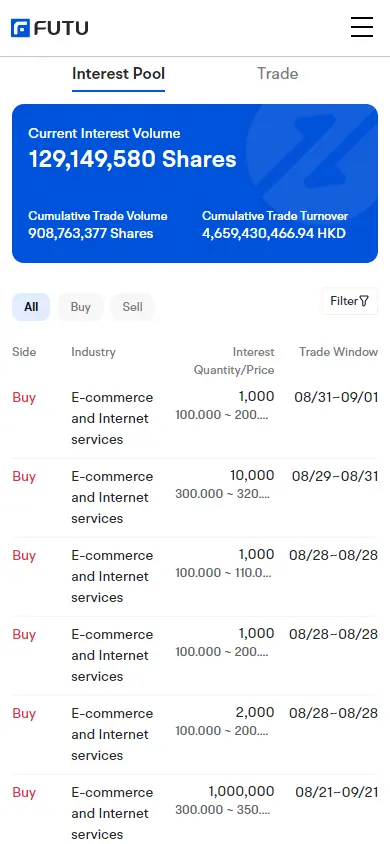

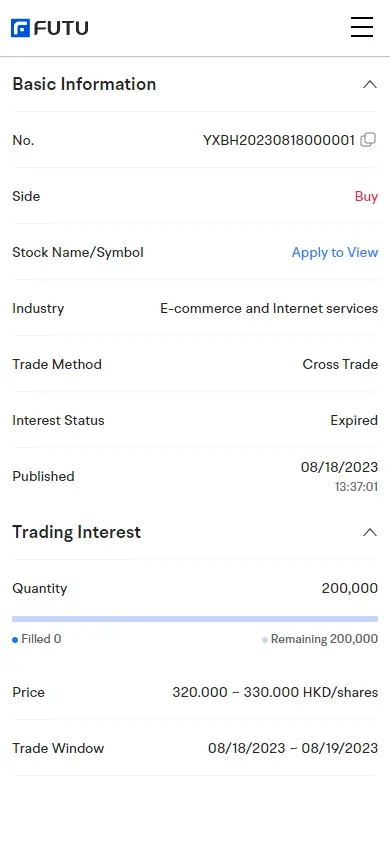

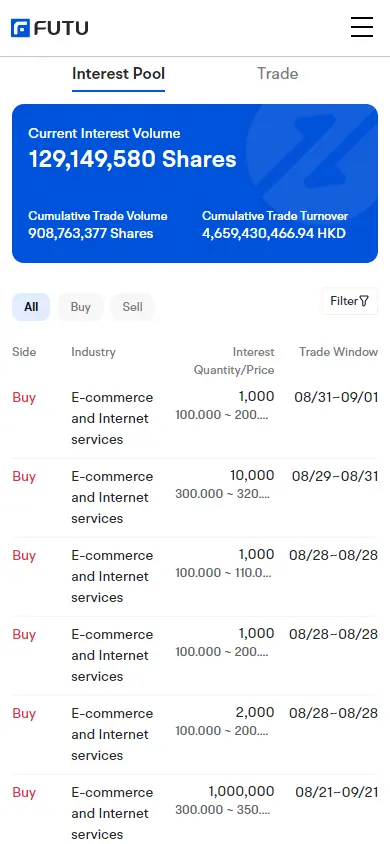

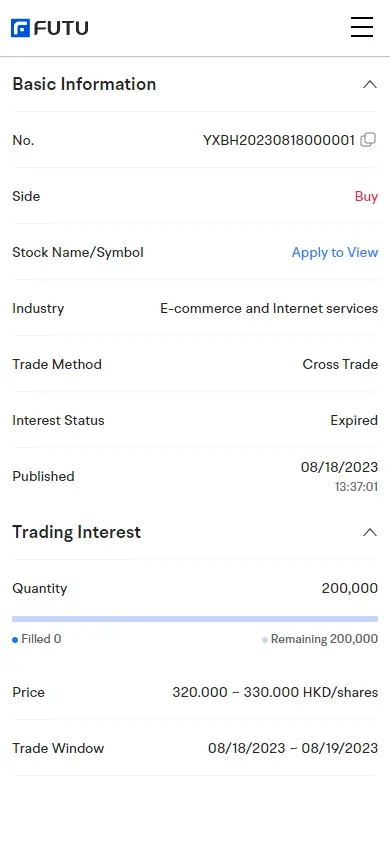

2.1.2 Interest pool

You can view all the pending and active trade interests in the interest pool. If you want to know more information about the interest, you can click "Apply to View" on the details page. Our account manager will contact you as soon as possible.

2.1.3 Submit a block trade interest

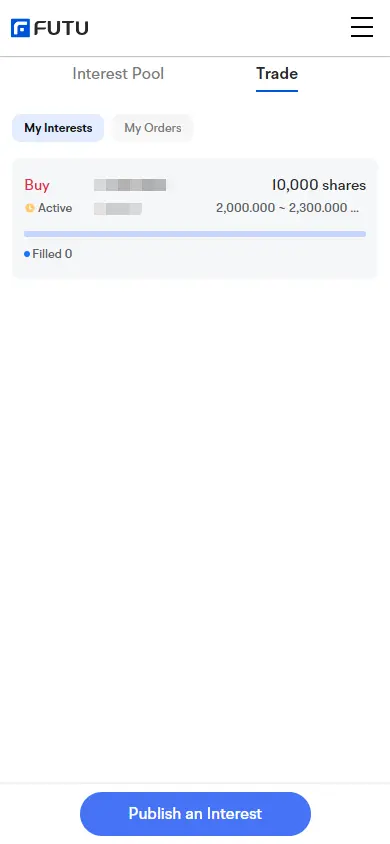

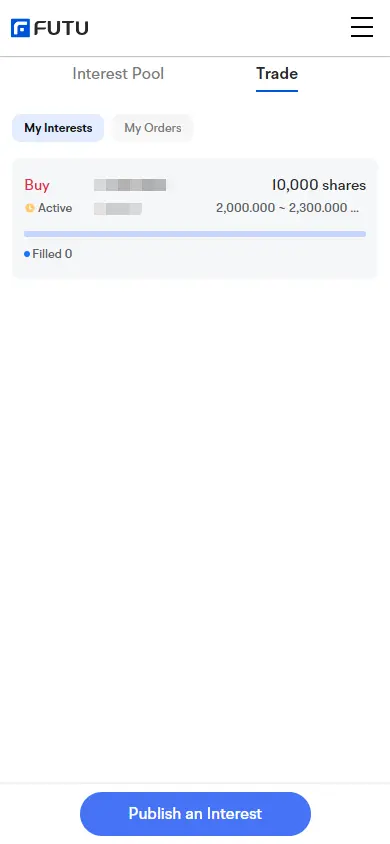

Path: Trade > My Interests

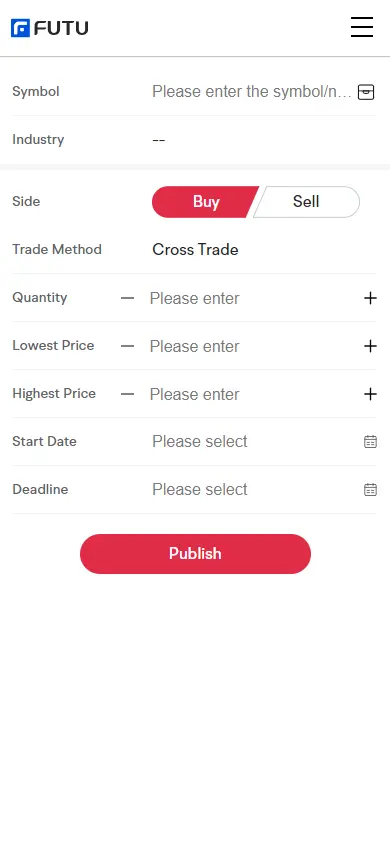

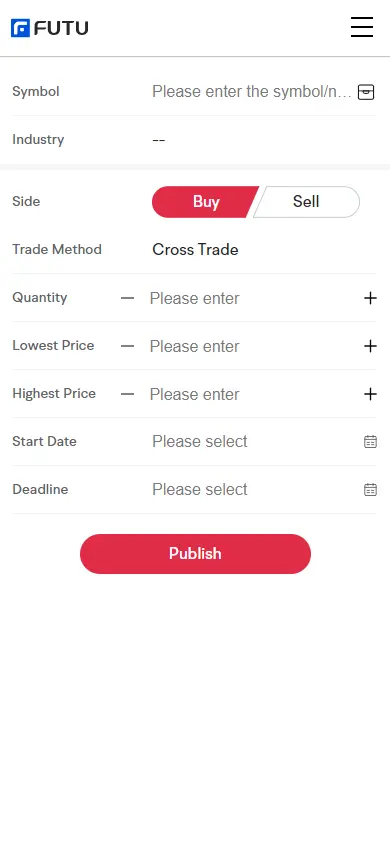

Click "Publish an Interest" to fill in the interest information page:

① Select the stock for this transaction;

② Fill in the trading information.

Click "Publish", and the interest will be published. The published interests will be displayed in the interest pool.

2.1.4 Order confirmation

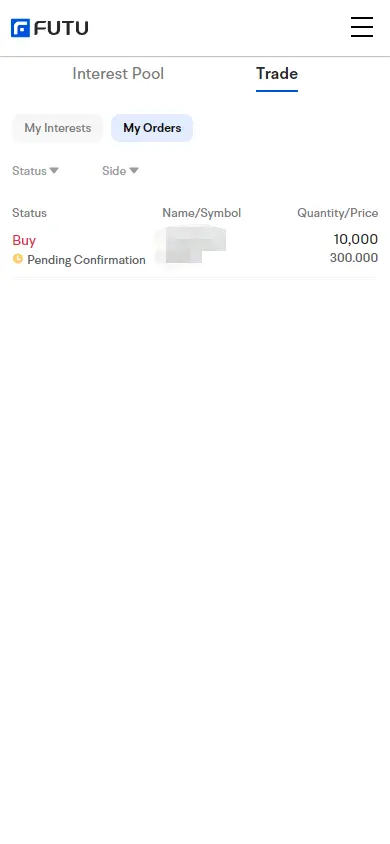

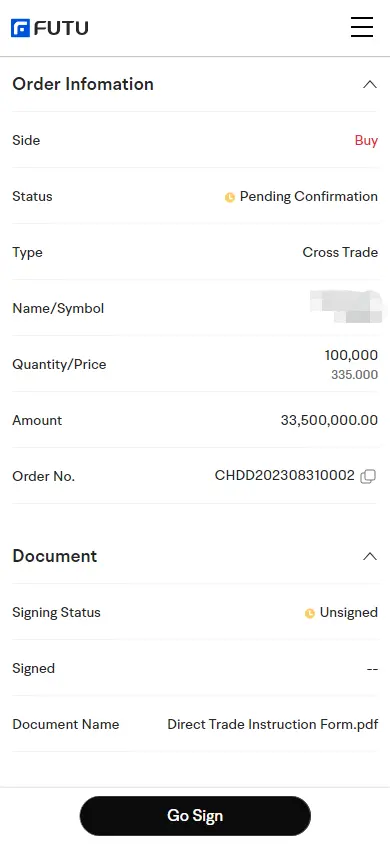

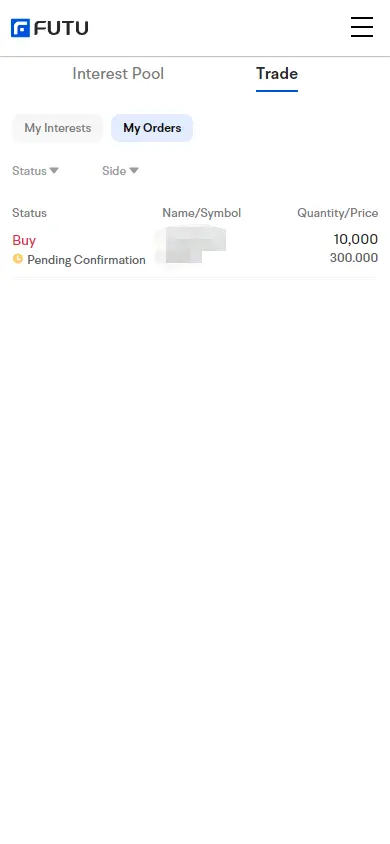

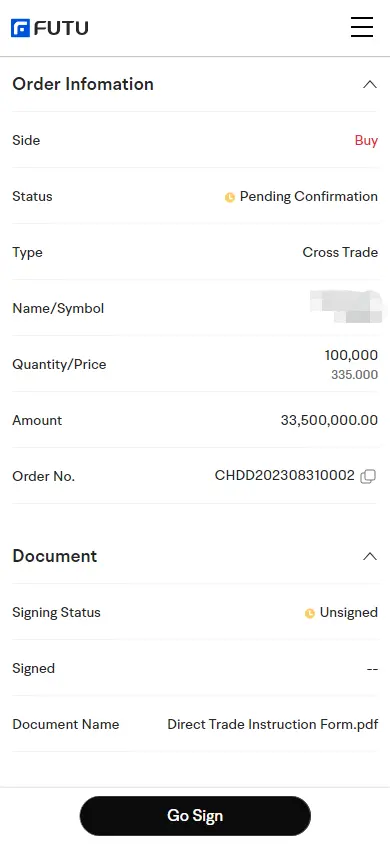

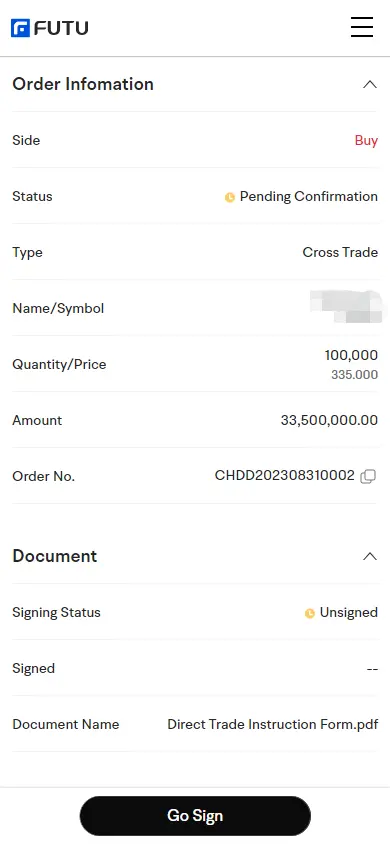

A block trade order will be created after Futu matches your order. You can view the order in Trade > My Orders. The details of orders are displayed on the order details page.

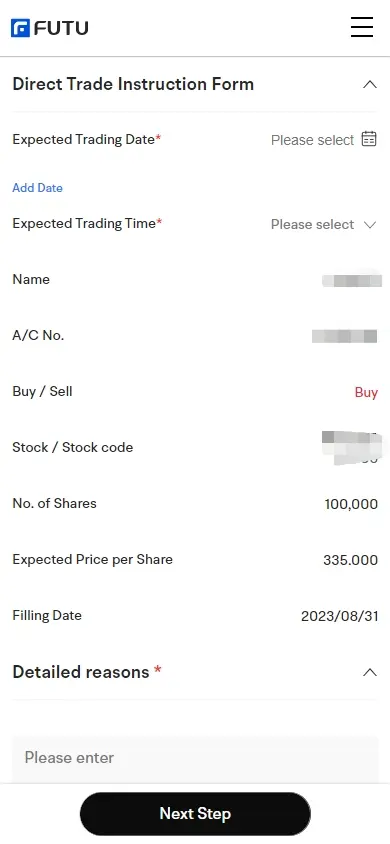

Please sign the Cross Order Instruction Form when your order is in pending confirmation status.

Path: Trade > My Orders > Pending Confirmation

Click "Sign Now" to sign the form online.

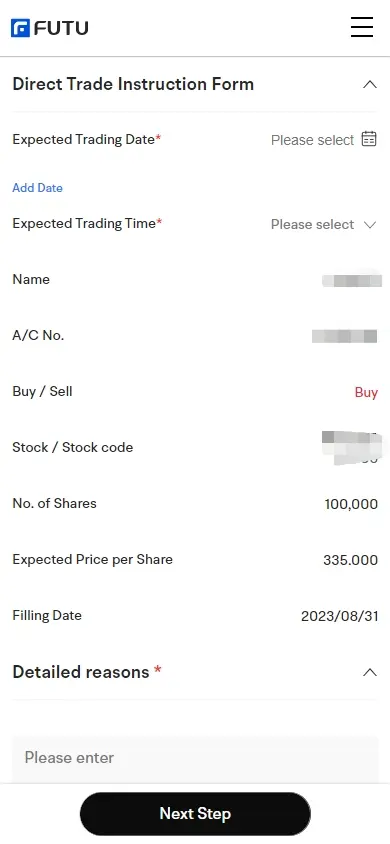

① Select "Expected Trading Date" and "Expected Trading Time." Fill in the reason for the transaction and double-check the information.

② Confirm the terms and conditions.

③ Complete the SMS verification and sign.

After signing, the order status will change to "pending execution." Futu will verify the order with you by phone and execute the transaction.

2.2 Offline operation process

1. Both buyer and seller sign the Cross Order Form. Scan or take a picture of the signed Cross Order Form and send it to Futu by email.

1) Email subject: Cross Order Trading Instructions

2) Email address: dealing@futuhk.com

2. After receiving the instruction, our trader will call the buyer and seller to confirm the transaction content, the expected trading date and time, the running time, the target stock, and the order price and quantity.

3. The positions and funds of the buyer and seller will be updated after the operation is completed.

2.3 Business consulting

If you have any interests or questions about online/offline block trade process, please send email to blocktrade@futuhk.com.