1. Impact of stock company actions on option contracts

2. Typical scenarios of option contract adjustments under US stock company actions

2.1 Scenario 1: Change of underlying code

2.2 Scenario 2: No change in underlying code, change in strike price and the number of contracts

3. Why is there an option with the same exercise price after corporate action?

When the underlying stock undergoes a corporate action, the underlying security of the option contract will change accordingly. Options contracts already issued prior to the corporate action will be adjusted to accommodate the stock after the corporate action, keeping the total contract value unchanged.

Adjustments to options contracts after a corporate action will be posted on the OCC website. You can visit OCC website to view the latest adjustment notices or search for historical notices.

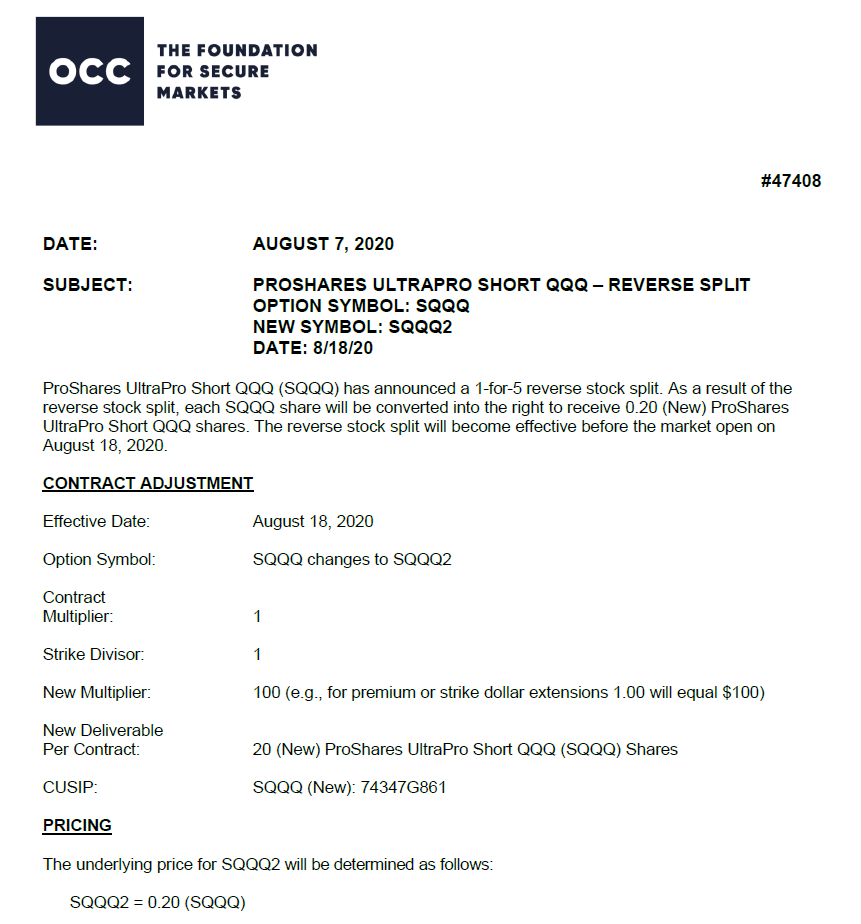

This is one of the most common methods of adjustment. As an example, SQQQ made a 1-for-5 reserve stock split on August 18, 2020, which the OCC announced as follows.

This adjustment can be interpreted as follows.

● Effective Date: August 18, 2020, i.e. option contracts opened before this date will be adjusted

● Option Symbol: The underlying code of the above-affected contracts will be changed from SQQQ to SQQQ2

● Contract Multiplier: Unchanged, the number of contracts already held will not be changed

● Strike Divisor: Keeping 1 unchanged, but the underlying is SQQQ2 instead of SQQQ

● New Multiplier: Keeping 100 unchanged, but the underlying is SQQQ2 instead of SQQQ

● New Deliverable Per Contract: 20-share SQQQ, which is the original 100-share SQQQ2

● Pricing: SQQQ2 (original SQQQ) = 0.2 * SQQQ (new)

Based on the above adjustment, assuming you hold an option with the adjusted code SQQQ2201218C5000, if exercised, it would be equivalent to you purchasing 20 shares of new SQQQ (i.e. 100 shares of SQQQ2) at a price of 100 * $5 = $500.

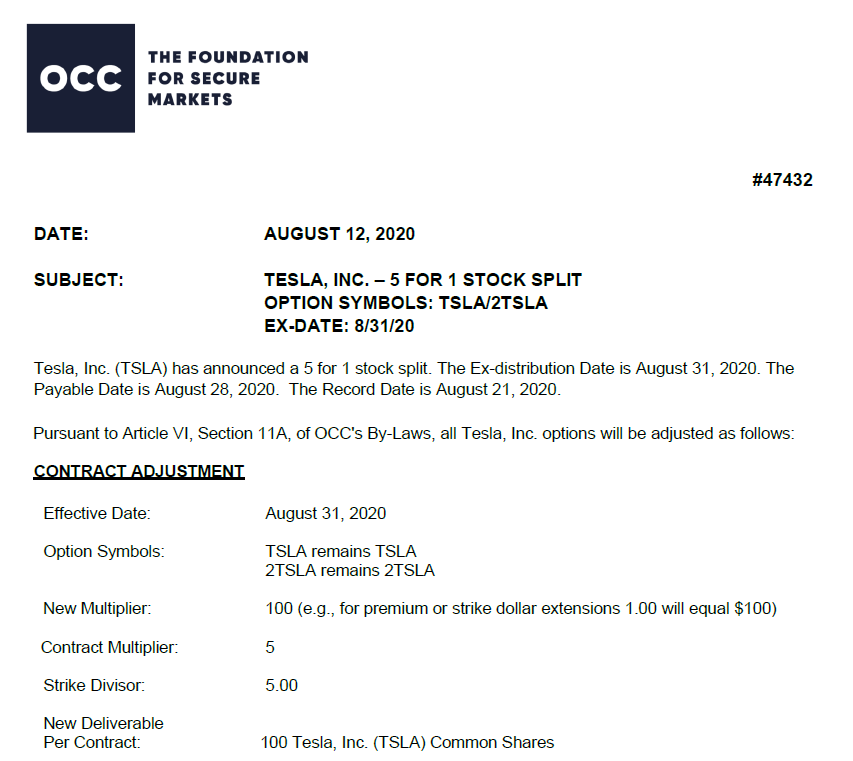

This is a relatively rare occurrence. As an example, TSLA conducted a 5 for 1 stock split on August 31, 2020, as announced by the OCC as follows.

This adjustment can be interpreted as follows.

● Effective Date: August 31, 2020, i.e. option contracts opened before this date will be adjusted

● Option Symbol: Keep the code as TSLA unchanged

● New Multiplier: Keeping 100 unchanged

● Contract Multiplier: Multiply by 5, i.e. the number of contracts held becomes 5 times the original number

● Strike Divisor: Divided by 5, i.e. the adjusted contract strike price is 1/5 of the original price

● New Deliverable Per Contract: 100 shares of TSLA after stock split

Based on the above adjustments, assume you hold an option with the adjusted code TSLA201218C392000, if exercised, it is equivalent to you purchasing 100 shares of the split TSLA for 100 * $392 = $39,200.

In the case of FFIE , for example, after the corporate action, there are call options with the same strike price on the same expiration date, but with a large price difference.

In fact, the two option contracts are FFIE241115C3000 and FFIE3241115C3000.

FFIE3241115C3000 is an FFIE contract adjusted after the corporate action, the underlying of which is FFIE3.

Although the strike price is $3, it is equivalent to the price of the new FFIE going up to $100 to reach in-the-money (FFIE3 = 0.03 * FFIE).

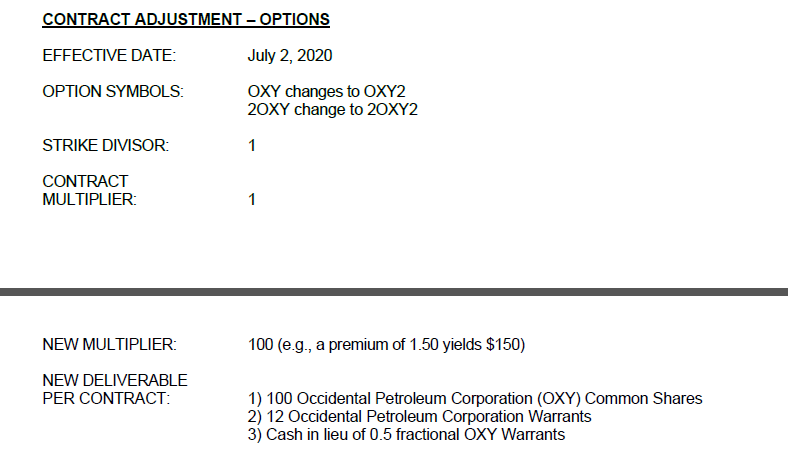

An option contract is considered a basket contract if the underlying of the option contract is adjusted to a combination of securities + cash as a result of corporate action. Upstream brokers usually refuse to open positions in such contracts.

For example, OXY distributes call warrants to holders in July 2020, so the OXY options contract makes a corresponding adjustment on July 2.

The underlying code of the adjusted contract is changed to OXY2, which corresponds to 100 shares of OXY + 12 warrants + cash in lieu of 0.5 warrants considered as a combination of a series of securities/derivatives + cash. Therefore, all option contracts with the underlying OXY2 will be rejected by the upstream brokerage firm to open positions.

- No more -