Futu Research | ETF Investment Research

[Hedge Assets] Seizing Gold Opportunities in Interest Rate Reduction Cycles Through ETFs

“Gold and silver is not currency, natural currency is gold silver”. Economic common sense tells us that gold and other precious metals have one very important attribute — the value of conservation. From ancient times, gold and other precious metals have been safe havens in times of turmoil.

Looking at the length of the timeline, the Fed's rate cut is basically in order. Gold prices moved higher after the Dragon Spring Festival, breaking above $2400 in May and reaching a new all-time high. What kind of investment logic does this imply?

Pricing logic of precious metals

When looking for speculative opportunities for falling interest rates to the precious metals market, we first need to figure out how precious metals are priced and what factors affect the price of precious metals in order to further analyze in which ways a fall in interest rates can benefit precious metals prices. For example, gold has only two factors that affect its pricing: the true value of gold and the opportunity cost of holding it.

True Value

True value, which is the bonus of holding gold, is reflected mainly in three dimensions: the scale of value, the supply relationship, and public safety.

Value scale: Gold is generally opposed to the value of a major currency, such as the US dollar. When the value of a currency falls, gold's function as a store of value is enhanced, and the price rises accordingly.

Demand relationship: Gold as a commodity, its value is fundamentally affected by supply: supply and demand rises in value, and vice versa.

Public safe haven: “Buy gold in the world's most precious antiques.” When events such as falling interest rates cause the roots of the modern monetary system to shake, gold's hedging attributes appear, driving its price up.

Opportunity Cost

The opportunity cost is the “loss” of holding gold. Two main aspects are reflected: the natural weakness of zero-yield assets and the liquidity of weak general merchandise.

Zero Interest Assets: Gold cannot survive after holding gold, so the opportunity cost of holding gold is the interest income that can be generated by investing in interest-bearing assets (stocks, bonds, etc.). To some extent, gold prices are a shadow of actual interest rates, and the medium-term volatility of gold is largely due to market expectations for bond yields.

Volatility: Although gold has grandfatherly monetary properties, it is not the mainstream of the time. When a liquidity crisis occurs, various trading and investing behaviors drive the demand for cash higher, gold loses its liquidity comparison, and the price of gold takes its toll.

Taken together, we can also draw from these factors when assessing investment opportunities for gold and other precious metals.

Impact of falling interest rates on hedged assets such as gold

As mentioned above, “the gold price is a shadow of the actual interest rate”. Once the Fed cuts interest rates, the Italian interest rate will fall for the first time, accompanied by the high level of inflation in the United States, a drop in real interest rates will be decisive.

Therefore, in this case, the attractiveness of life assets such as bonds stocks compared to gold will drop significantly, and investors will be more inclined to hold various types of hedged assets — the price of precious metals such as gold will go higher along the way; meanwhile, various assets in the market and banks in the country will be more likely to buy precious gold, etc. The metal stabilized, and the market experienced a shortage of demand, which further pushed its price higher.

Illustration: The relationship of gold price with the real US interest rate (2022-2023)

After clarifying the speculative opportunities for precious metals such as gold, below we present investment products related to precious metals in the US equity market, where investors can choose as needed.

Gold Related Hedge Asset Products

In a previous article, we talked about how, for a broad range of investors, an ETF is a safe and diversified investment product compared to investing directly in stocks and futures. Next, we will introduce you to the top silver ETF in the US stock market by market capitalization as a safe haven asset for your reference.

GLD SPDR Gold ETF

$SPDR Gold ETF(GLD.US)$: It is the world's largest physical gold ETF, tracking the gold price of the London Gold and Silver Market Association (LBMA). Buying this ETF is equivalent to holding gold indirectly and directly enjoying the benefits of rising gold prices, giving investors the opportunity to track the spot price of gold.

As of May 27, GLD's assets have reached $65.238 billion, a year-to-date increase of nearly 13% and its trading rate is 0.4%.

Advantages: Direct link to gold prices, large asset size, high liquidity, suitable for high frequency big hand trading.

Disadvantages: Higher transaction fees (0.4%) and medium-term investment returns may be affected.

IAU Gold Trust ETF

$Gold Trust Ishares(IAU.US)$: It is also a large gold ETF for the US equity market that tracks the LBMA's gold price, offering investors the opportunity to trade gold futures directly. Its current asset size is $29.721 billion, below GLD. At the beginning of the year to date, the IAU has increased by more than 13%.

Advantage: IAU costs are lower than GLD (trading rate of only 0.25%), suitable for investors with medium-term asset allocations.

Disadvantages: Although the visibility is high, it is still not like GLD, and the circulation is relatively weak.

GLDM SPDR Gold MiniShares Trust

$Spdr Gold Minishares Trust(GLDM.US)$ : It is also a US equity ETF that invests in physical gold. Unlike the two physical gold ETFs above, GLDM's asset size is only $7.584 billion, making it more suitable for small investors. At the same time, its trading rate is very low at just 0.18%, up 12.9% year-to-date.

Advantages: Very low trading rates (0.18%), suitable for long-term investors.

Disadvantages: The fund is undersized by 1/3 of the IAU and 1/5 of the GLD, and the liquidity is far from the previous two ETFs.

GDX Gold Mining ETF

$VanEck Gold Miners Equity ETF(GDX.US)$: This ETF invests in a range of gold mining companies around the world rather than investing directly in gold. In addition to indirectly enjoying the benefits of rising gold prices, the purchase of such ETFs may also benefit from the performance growth of gold industry companies.

Advantage: Benefit from two ways to increase gold prices and improve the performance of gold industry chain companies

Disadvantages: Higher trading rates (0.51%), unfavorable for medium-term investment returns.

As of May 27, it had assets of $14.518 billion and a trading rate of 0.51%. The year-to-date increase is 13.71%. The product's holdings include well-known mining companies such as Newman Mining, AEM.

GDXJ Small Gold Mining ETF

$VanEck Junior Gold Miners ETF(GDXJ.US)$GDX is also a global gold mining company, but GDXJ focuses more on small to medium-sized gold mining companies.

Advantages: Similar to GDX, there are two ways to benefit from gold price gains and corporate performance.

Disadvantages: Investment in small and medium-sized mining companies whose assets are less than half GDX and the rates are not low (0.5%).

As of May 27, it had assets of $5.462 billion and a trading rate of 0.5%. The year-to-date increase is 17.65%. The product's holdings include small and medium-sized mining companies such as AGI, Harmonie Gold.

Silver-Related Hedge Asset Products

Since there are relatively few silver ETF products on the U.S. stock market, we have selected the top three silver ETF products by market capitalization for your reference.

SLV Silver ETF

$iShares Silver Trust(SLV.US)$SLV is the world's largest silver physical ETF that directly holds silver and tracks spot silver price movements. As of May 29, SLV's assets were approximately US$13.42 billion at a trading rate of 0.50%, and an increase of 35.25% year-to-date.

Advantage: The largest silver ETF in existence provides investors with good liquidity.

Disadvantages: The management fee is higher (0.50%), and there may be some cost accumulation over the long term.

SIL Global X Silver Mining ETF

$Global X Funds Global X Silver Miners Etf (Post Rev Spl(SIL.US)$ SIL does not track silver prices directly, but tracks the Solactive Global Silver Miners Total Return Index, which includes listed companies involved in silver exploration, mining and refining. As of May 29, SIL's assets were approximately $1.214 billion at a trading rate of 0.65%, an increase of 28.2% year-to-date.

Advantages: Components cover well-known silver mining companies in several countries such as Canada, Russia, the United States, including Whitton Precious Metals (WPM), Standard American Silver Corporation (PAAS), etc.

Downside: The trading rate is 0.65%, the highest of the three ETFs, and the performance of the shares is affected by the performance of silver mining companies.

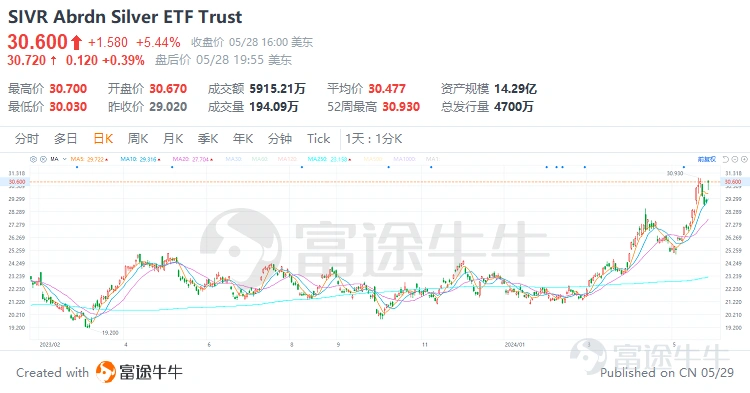

SIVR Abrdn Silver ETF Trust

$Abrdn Silver ETF Trust(SIVR.US)$: SIVR also directly tracks the price of physical silver, the ETF's silver bars are stored in vaults and checked regularly, not participating in futures contracts. As of May 29, SIVR's assets were approximately $1.429 billion at a trading rate of 0.30%, and an increase of 35.16% year-to-date.

Advantage: Lower fee rate (0.30%) compared to SLV, which saves transaction costs.

Disadvantages: Smaller asset size and low liquidity.

Copper Market Related Hedge Asset Products

Similar to the silver market, here are the top three copper ETFs on the U.S. stock market by market capitalization that everyone can use as an investment reference.

CPER USA Copper Index

$United Sts Commodity Index Fd Com Unit Repstg U S Copper Index Fd(CPER.US)$: Tracks the SummerHaven Copper Index Total Return Index, which tracks the performance of copper futures contracts, providing investments directly related to copper prices. As of May 29, CPER's assets were approximately $0.232 billion at a trading rate of 0.65%, an increase of 23.86% year-to-date.

Advantage: Direct tracking of copper prices is ideal for investors with a clear view of the copper market.

Disadvantages: Small market capitalization, liquidity may be limited, and higher rates (0.65%).

CPOX Copper Mining ETF

$Global X Copper Miners ETF(COPX.US)$: Track the Solactive Global Copper Miners Index. The index covers copper exploration companies, developers and producers, providing a comprehensive exposure to the copper mining industry. As of May 29, COPX has an asset size of approximately $2.7 billion at a trading rate of 0.65%, an increase of 34.56% year-to-date.

Advantage: Provides a broad portfolio of global copper mining companies, whose constituent stocks include Polish Mining Group (KGHM), First Quantum Mining (FM), etc.

Disadvantages: relatively high cost rate (0.65%) and product performance is affected by the operating condition of copper mining companies.

ICOP ISHARES COPPER AND METALS MINING ETF

$ISHARES COPPER AND METALS MINING ETF(ICOP.US)$: Copper ETF, newly listed in June 2023, tracks the STOXX Global Copper and Metals Mining Index. The index focuses on global copper mining companies, providing investment opportunities in this particular industry.

As of May 29, CPER's asset size was approximately $22.5 million with a transaction rate of just 0.47%, an increase of 30.67% year-to-date.

Advantage: Holding shares cover well-known companies such as Southern Copper, McMoreland Copper and Copper; low fee rate (0.47%), suitable for long terms.

Disadvantages: With less than one year to market, smaller market capitalization and low liquidity compared to legacy ETFs such as COPX.