Futu Research | ETF Investment Research

[Gold ETF] Gold Price Surges, Full Analysis of Hong Kong and US Equity Gold ETF Investments

Gold, as the world's recognized bellwether in financial storms, has increasingly strengthened its position in the global financial system as a hedge.

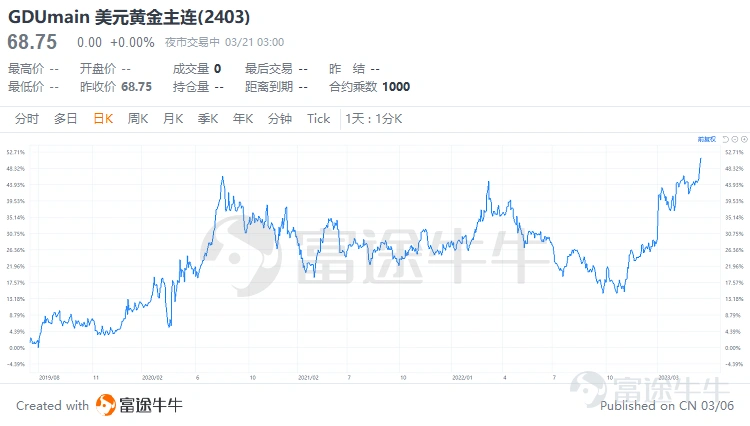

The historic surge in gold prices reflects not only increased market demand for traditional safe havens, but also the result of a deep interweaving of macroeconomic drivers: collective buying by global central banks, potential recession and stagnation risks, escalating trade disputes, and an escalating geopolitical crisis. Heavy pressure has collectively fueled a new round of gains in gold prices.

Gold ETFs, with their high transparency, liquidity and ease of operation, have become the core means for investors to allocate gold assets.

Gold ETFs in Hong Kong stocks and US equity markets closely follow gold price movements, providing an efficient investment path in the face of complex economic conditions and are important in global financial markets.

As the global economic landscape changes, in-depth analysis and close attention to the performance of gold ETFs in both markets and their strategic role are particularly important.

Why invest in gold?

As a key component of global financial markets, the gold market has unique fundamental features and functionalities — pricing, circulation, risk management and hedging.

Looking back at history, gold price movements show clear cyclical characteristics. Gold prices have fluctuated significantly since the 1970s, surging from a few hundred dollars an ounce to an all-time high of nearly two thousand dollars and then remaining high under the influence of economic cycles, monetary policy changes, and geopolitical events. Gold is often favored by investors, especially when global economic uncertainty intensifies or inflation is expected to rise. Gold is often favored by investors due to its traditional hedging properties and inflation values.

In the chess board of global investment banking, gold is equivalent to a special “insurance piece”. It is indispensable in asset allocations, as a shield to help investors hedge against the risk of volatility in financial markets, especially when common investment varieties such as stocks, bonds, are facing uncertainty. Gold can reduce the overall portfolio by reducing the risk of low relevance to these assets Insurance.

At the same time, gold is still an effective means of fighting inflation. In times of low or even negative interest rates, people have found that depositing money into banks may not only generate no interest, but may depreciate as prices rise, at which time gold appears particularly valuable because its value is relatively stable and is not eroded by inflation like banknotes.

So, if you want to invest in gold and don't want to own it directly, what gold ETF products are on the market right now?

ETFs give investors the opportunity to participate in the gold market without having to directly hold gold. Gold ETFs are becoming an important tool for investors to allocate gold assets with their high transparency, high liquidity and ease of operation.

Here are some gold ETFs in US stocks and Hong Kong stocks for everyone to choose from:

Gold ETF on US stocks:

1. $SPDR Gold ETF(GLD.US)$: It is the world's largest gold ETF, offering investors the opportunity to track gold spot prices.

2. $Gold Trust Ishares(IAU.US)$: It is also a large gold ETF that tracks the market value of gold.

3. $VanEck Gold Miners Equity ETF(GDX.US)$: This ETF invests in a range of gold mining companies around the world rather than investing directly in gold.

4th. $VanEck Junior Gold Miners ETF(GDXJ.US)$: Similar to GDX, GDXJ invests in small to medium-sized global gold mining companies.

Gold ETFs on Hong Kong stocks:

1. $SPDR Gold Trust(02840.HK)$: This is a gold ETF listed on the Hong Kong Stock Exchange and is a sister fund to GLD of US equities and aims to track gold prices.

2. $Value Gold ETF(03081.HK)$: This is another gold ETF listed on the HKEx, which tracks the price of gold on the London Gold Market.

How to Trade Gold ETFs with Futu?

Before investing (buying and selling) stocks, you first need to open a securities (stocks) account. Just like depositing money in a bank, you need to open a bank account first.

Securities (Stock) Account Opening Process

Step 1: Head over to the Futubull network and sign up for a new account.(Register now)

Step 2: Open a securities account on the basis of the Futu account.(Open account now)

Step 3: Fill in your personal and financial details (includingBank Code and Account Number), and then deposit funds via EdDA Quick Deposit, Fast Transfer (FPS), Bank Transfer.(Invest immediately)

Step 4: Download the Futubull Customer Portal and log in.(Download now)

How to Find All Gold ETFs Easily?

If you are interested in investing in gold ETFs, you can search for Gold ETF in the search box, or on the ETF page, open Topic ETF Find Gold ETF for your investment decisions.

>> Futu Securities offers 5x24 hours trading of US shares and free LV2 emotions, help you to open your wallet and enjoy new rewards instantly

What are the risks of investing in gold ETFs?

While gold ETFs provide investors with easy, low-cost access to the gold market, there are also risks involved. Here are some of the risks you may face when investing in gold ETFs:

Risk of Price Volatility: The price of gold is subject to significant volatility due to global economic conditions, interest rate changes, dollar exchange rates, inflation expectations, geopolitics, etc., which will directly affect the net value of the gold ETF.

Tracking Error Risk: Gold ETFs are typically designed to closely track the spot price of gold, but due to issues such as management fees, transaction costs, and physical gold delivery and custody, actual performance may be present with a deviation from the benchmark gold price, a so-called “tracking error”.

Credit Risk: Although the gold ETF itself is a securitised product of physical gold, if problems arise with the custodian bank or issuer, it may result in losses for ETF investors.

Policy and legal risks: Legal and regulatory changes in the relevant countries and territories, such as tax policy adjustments, changes in regulatory requirements, etc., may affect the investment value of a gold ETF.

Investors should be aware of and carefully assess the risks involved in gold ETFs. The price of gold fluctuates like the waves of the sea, tracking errors is like a horse that cannot be ridden, credit risk needs to be alert to changes in the reputation of custodians, and regulatory adjustments are like clouds, and have far-reaching effects on investments. Uncertainty in market operations tests insight and decision making, and long-term costs are also hidden risks. Therefore, before investing, be sure to combine your goals, risk tolerance and comprehensive analysis of the macroeconomic environment, and keep an eye on market dynamics and information to manage overall risk in a scientifically sound manner, ensuring informed decisions~