Futu Research | Long-term joint savings information, won't I buy? Good buying standards!

AT 2:00 A.M. ON MARCH 21, BEIJING TIME, THE FED ANNOUNCED IT WOULD CONTINUE TO KEEP THE FED FUNDS RATE UNCHANGED IN THE RANGE OF 5.25% TO 5.5%, THE FIFTH CONSECUTIVE TIME SINCE SEPTEMBER LAST YEAR, A DECISION THAT WAS IN LINE WITH MARKET EXPECTATIONS. At the news conference that followed, Fed Chairman Powell released a mild signal, hinting that current interest rates may already be near cyclical highs and that it is appropriate to initiate a rate cut at some point in the year, despite current levels of inflation remaining high.

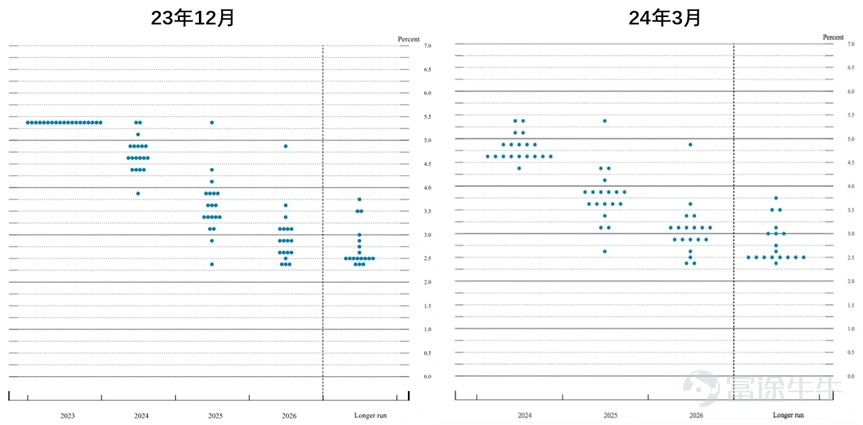

According to its latest published economic forecast bitmap forecast, the Fed plans to cut interest rates by 75 pips in total this year, which means a possible reduction of 25 pips each time in order to gradually ease monetary policy.

Figure: Interest Rate Bitmap Comparison

Source: US Federal Open Market Committee (FOMC)

In historical data, in the 11 Fed rate hike and fall cycles since 1982, the S&P 500 and Nasdaq have typically shown strong average returns of close to 10% during the six months after the first rate cut. This means that markets tend to react positively to monetary policy easing.

Faced with the potential market advantages of falling interest rates, investors may ask: How to choose the right portfolio among the many options?

To this question, Buffett has already given an answer:

“I think the best way for most people is to have a S&P 500 index fund.”

“People spend a lot of money buying stock proposals, but they don't need to. If you bet on the United States and hold a position for decades, your returns will be much better than buying Treasuries, and much better than those who follow stock recommendations.”

Between 1993 and 2018, he made 14 S&P 500 recommendations and even explicitly planned in his will to invest 90% of his personal assets in the S&P 500, fully demonstrating his confidence in the long-term stable returns of the index.

First, the S&P 500 Index is one of the most important benchmarks for the U.S. stock market, covering the market performance of large listed companies in the United States, whose constituents include leading companies in various industries with extremely high market representation. When macroeconomic policy shifts in favor of stock markets, the S&P 500 tends to more fully reflect this macro trend, providing investors with an effective tool to capture the overall market rally.

Second, investing in the S&P 500 is equivalent to a diversified investment in 500 premium companies. Risk is more diversified than investing in a single stock, reducing the impact of fluctuations in a single company's operating conditions. Moreover, because the S&P 500 index contains the taps of multiple sectors, there is often some hedging effect between the sectors, to a certain extent to hedge against specific industry risks, even at different stages of the economic cycle.

Finally, by purchasing ETFs or other indexed investment products that track the S&P 500 index, investors can easily and cheaply participate in the performance of the entire stack without picking stocks or trading frequently, especially when high market uncertainty or lower yield expectations lead to complex market sentiment. Investment strategy is more stable.

What products can I choose?

ETF index equity funds linked to the S&P 500 offer a one-stop, low-cost solution. For example, SPY charges of only 0.09%, far lower than stock handling fees or 1~ 2% for mutual funds, which seems very affordable.

Buffett believes that this passive investing model is ideal for general investors, saving not only time researching stocks but also earning opportunities. It is ideal for investors who intend to lay out US stocks on a long line:

“I often recommend low-cost S&P 500 index funds, but only a few humble friends would believe me. Hardly any of the extremely wealthy investors, fund managers, and pension funds actually followed my advice, and they politely thanked me. But the turnaround was persuaded by asset management managers who charged high management fees to choose another way of investing.”

Well-known S&P 500 ETFs on the US market include:

1. $SPDR S&P 500 ETF(SPY.US)$: Often referred to as “Spider”, it is one of the first and most well-known S&P 500 index ETFs on the market. Managed by State Street Global Advisors, launched in 1993, it is not only one of the largest exchange-traded funds in the world, but has been a widely used U.S. stock investment vehicle by investors. SPY has extremely high liquidity, huge daily trading volume, which makes it easy for investors to buy or sell, and the spread is often small, which is especially beneficial for big hand traders.

2. $iShares Core S&P 500 ETF(IVV.US)$: IVV is an ETF issued by iShares under BlackRock and also aims to track the performance of the S&P 500 index. IVV has a lower cost ratio compared to SPY, at around 0.03%. WHILE IVV'S LIQUIDITY IS NOT AS HIGH AS SPY'S, FOR MOST INVESTORS, ITS DAILY TRADING VOLUME IS STILL SUFFICIENT TO MEET NORMAL TRADING NEEDS.

3. $Vanguard S&P 500 ETF(VOO.US)$: VOO is an ETF managed by the well-known low-cost fund manager Vanguard Group, which also closely tracks the S&P 500 index. VOO's expense ratio is typically around 0.03%, which is also a reflection of Vanguard's low-cost investment strategy.

4th. In addition to the three ETFs that track the S&P 500 Index mentioned above, you can also note $Proshares Trust S&P 500 Divid Aristocrats Etf(NOBL.US)$: This is an ETF that picks “Dividend Nobles” (companies whose dividends have grown for 25 years in a row) as a constituent stock from the S&P 500 index.

What do you need to look out for in leveraged ETFs?

Leveraged ETFs (Leveraged Exchange-Traded Funds) are ETFs that use financial derivatives, such as options and swap agreements, to magnify the daily returns of the benchmarks they track, which typically offer 2x or 3x daily returns, but at the same time carry extremely high risks and are not suitable for long-term positions.

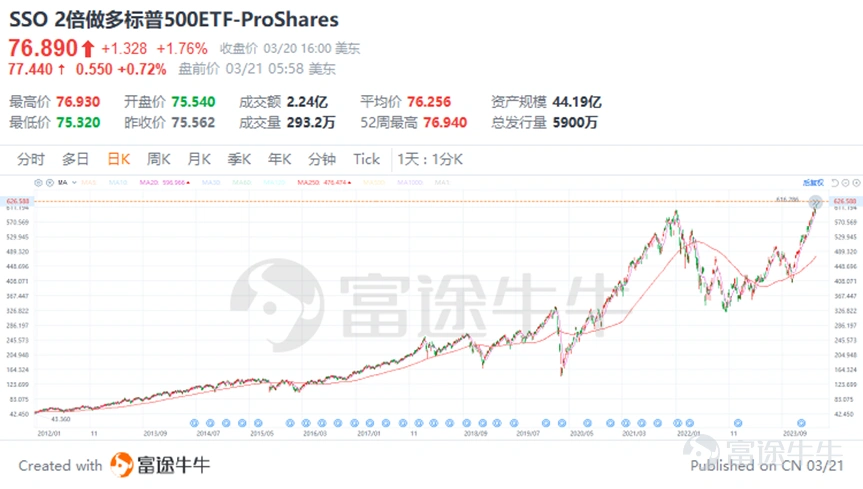

1. $Proshares Ultra S&P500(SSO.US)$: The SSO is designed for those investors who expect the S&P 500 index to rise in the coming day and want to magnify the return on investment. If the S&P 500 rises 1% on the day, in theory the SSO will try to achieve a daily yield of about 2%.

2. $ProShares UltraPro S&P500 ETF(UPRO.US)$: UPRO ALSO OFFERS 3X LEVERAGE ON THE DAILY MOVEMENTS OF THE S&P 500 INDEX, I.E. THE ETF TARGETS A 3% DAILY RETURN WHEN THE S&P 500 RISES 1%.

3. $Proshares Ultrashort S&P500(SDS.US)$: SDS is a bearish ETF that tries to provide twice the return of the index's daily decline when the S&P 500 index falls.

4th. $Direxion Daily S&P 500 Bear 3X Shares ETF(SPXS.US)$: SPXS is also a bearish ETF that aims to provide a threefold return on the days when the S&P 500 index falls.

However, because of their structure and the way they operate, leveraged ETFs experience a loss of performance when they are long lived, which is often referred to as “depletion” or “loss”. This loss is mainly caused by the following factors:

① Composite effect:

The goal of a leveraged ETF is to provide a multiple of the benchmark index return on a daily basis. Because they are readjusted daily, time compositing effects lead to deviations in long-term performance from multiple expected returns. In volatile markets, this effect is particularly pronounced because leveraged ETFs need to rise continuously to compensate for previous losses and stay connected to the index.

② Reset/Rebalance Costs:

Leveraged ETFs readjust their leverage ratios at the end of each day to maintain their intended leverage levels. This daily readjustment requires buying and selling derivatives and can incur trading costs, especially in times of high market volatility. These costs accumulate over time and can lead to a decline in long-term performance.

③ Cost of borrowing money:

Leveraged ETFs need to borrow money or use derivatives to achieve leverage. These operations generate borrowing costs or derivative holding costs. These fees reduce the ETF's net asset value (NAV), thus impacting long-term returns.

④ Volatility Loss:

In volatile markets, the losses of leveraged ETFs are particularly significant. Because they provide a multiple of daily returns, negative returns have a disproportionate impact on the value of the ETF in volatile markets. For example, if the market rises and falls by the same percentage for two consecutive days, the value of a leveraged ETF will fall as losses are magnified.

⑤ Management Fee:

While management fees are a part of all ETFs, in leveraged ETFs they also affect long-term performance, as investors not only have to pay the fund's management fees but also need to consider the additional costs associated with the above leveraged operations.

Leveraged ETFs are often not suitable for long-term investments due to the above factors. They are more suitable for experienced investors for short-term trading or hedging strategies.

Let's give a simple example:

Suppose we have a target of a leveraged ETF that tracks a benchmark index with 2x daily returns. Here is a simplified example that shows that in a volatile market, the value of a leveraged ETF can drop even if the benchmark index has a total return of zero.

Assumption:

(1) The initial value of the benchmark index is 100 pips.

(2) The initial price of a leveraged ETF is $100.

(3) The goal of the ETF is to provide a daily return of 2x the benchmark index.

Scenario:

On the first day, the benchmark index rose 10%. The index rose from 100 to 110.

The return on a leveraged ETF is 20% (2x 10%).

The new value of the ETF is $120 (starting price of $100 + 20%).

The next day, the benchmark index fell 9.09% (which would take the index back to 100 points, as the 9.09% drop of 110 points was just 10 points).

The return on the leveraged ETF is -18.18% (2x -9.09%).

The new value of the ETF is $98.18 ($120 - 18.18%).

Results:

(1) At the end of the two days, the benchmark index returned to its initial value of 100 pips, with a total return of 0%.

(2) However, the price of the leveraged ETF dropped from $100 to $98.18 with a total loss of 1.82%.

This example illustrates the losses caused by a leveraged ETF due to daily resets even if the performance of the benchmark index returns to its original point in the event of market volatility. In practice, leveraged ETFs are also affected by management fees, borrowing costs, and resetting costs, which further reduce the long-term value of the ETF.

Therefore, leveraged ETFs are more suitable for those investors who aim to invest in the short term and are able to closely monitor market movements. For investors looking for a long-term investment strategy, the loss-making characteristics of these products may result in unanticipated returns. Inexperienced investors advise far from paying tribute to them.

summed

Buffett once said that it is easy for investors to find themselves “affected by market failures because they are leveraged or because psychological factors cannot absorb bad news.” When we invest in global markets, if we are not familiar with a country's market, there are doubts about stock research, but taking a look at the country's assets, the best investment strategy is to learn Buffett's “Index Investing Law” while paying more attention to some of the basics and risks will help us invest more successfully.