Futu Research | With more business performance than expected, there is less room for investment?

Last time $TENCENT(00700.HK)$After the results were published, we quickly made judgments on the investment value of Tencent and concluded that Tencent had a higher investment value and produced content《Futu Research | Report 2023Q4 Results: Good Results, Report to Shareholders》and Tencent currently announces its quarterly results for 31 March 2024, which show:

Revenue of 155.01 billion yuan (RMB, below), an increase of 6% year-on-year;

Net profit was R$418.89 million, up 62% year-on-year;

Adjusted net profit of $502.65 billion, up 54% year-on-year;

Earnings per share were $4.479, up 64% year-on-year;

Non-International Financial Reporting Criteria Earnings Per Share of $5.375, Up 57% YoY

In the quarter before the results,Tencent Stock PriceOn the back of the upside, the share price is on a good upward trend. When Tencent delivers these results, although shareholders are more satisfied, how much investment is worth next, should be the focus of our analysis for this performance.

The market's past investment interest in Internet companies has been light in the business model, but the concern is that long-term barriers are being challenged, including growth in the China region, so our results will focus attention on their business model and business situation to analyze the value of the investment.

1. Tencent's performance reflects the reliability of the business model

Based on the data presented in the results, revenue in Q1 2024 grew by $95.15 billion, but actually decreased by $61.73 billion, resulting in a gross profit of $156.88 billion. This is evidenced by Tencent's investment research that its business model has a higher value, and Tencent has a very lightweight business model. Relying mainly on gaming, advertising, fintech and other businesses, lower fixed asset investment requirements and large operating leverage overall, which is what we mentioned in our last results

“Overall, Tencent's fundamentals are solid and will save money to expand new businesses (such as video accounts, etc.) and expand overseas development opportunities. This business model works well and leads the way for Tencent's management team to grow the business. The line plan is very clear”

From the results of 2024Q1, we were able to see that Tencent continues to operate its business model with such a light asset that, once the economy warms up, will cause Tencent's business revenue to grow far more than its costs. In fact, what is reflected in the profit table is that “Tencent can not only increase revenues but also compress costs”. This is also the value of investing in Tencent's “lightweight business model”.

After compressing operating costs, we find that revenues grew 6% year-on-year ($1595 billion), overall sales expenses grew by 7% ($75 billion), and general and administrative expenses (usually wage-driven) rose by only 1%, which also indicates that Tencent, supported by this business model, is overlaying continued internal corruption, without Spending large amounts of money on sales can support continued business growth, while efficiently adjusting human resources can also compress overall general and administrative expenses.

Our conclusion is that Tencent's business model, which reflects this performance, is still very light and highly profitable, so we should focus more on long-term competitiveness and business performance.

Second, what is the business situation of Tencent?

We believe that Tencent is good at leveraging its social traffic advantage to generate cash flow by matching its gaming business traffic advantage, so Tencent's gaming business accounts for the largest share of its revenue and short video business as a focus for future growth.

So what we need to consider is:

1. Will Tencent's traffic advantage wane?

2. Is Tencent's gaming business falling under the influence of competition?

3. How is the business development of short films?

1. Will Tencent's traffic advantage wane?

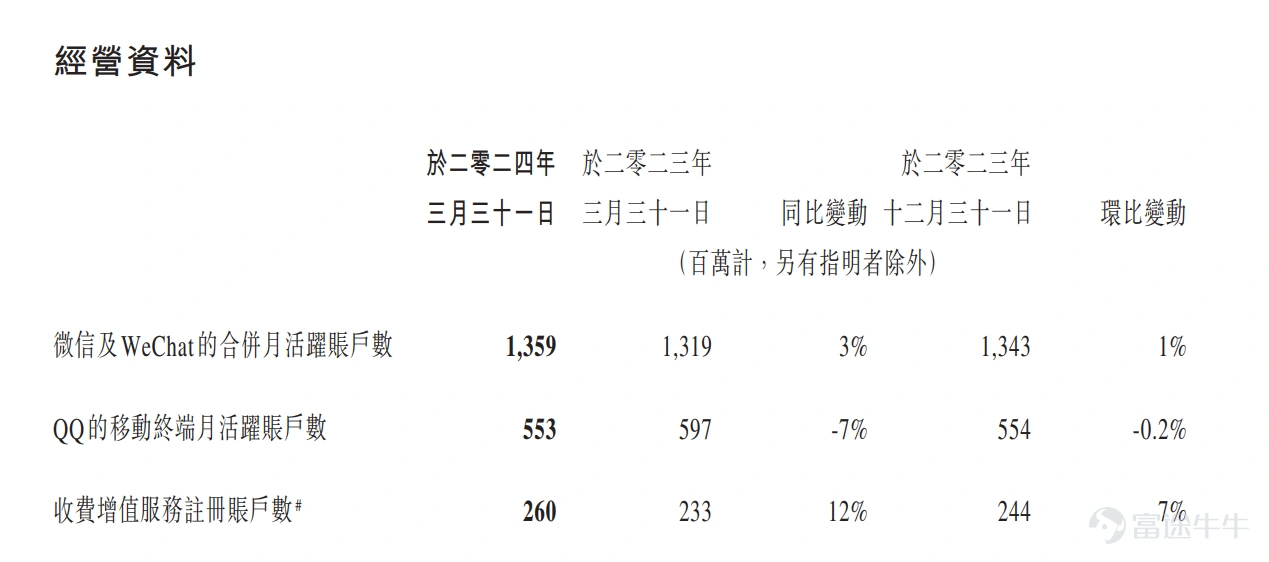

WeChat is growing well against a background of multi-user, peer-to-peer or peer-to-peer, with a combined monthly active user base of 13.59 million people. QQ as a legacy product, despite weak growth, has shown negative growth, but currently maintains 5.53 million monthly active users. It's not easy.

In addition, other highlights revealed in the results are worth noting: (1) Total user usage of video accounts grew by more than 80% year-on-year. We've enhanced the live delivery ecosystem for accounts by expanding product categories and encouraging more content creators to participate in live delivery.

(2) Total user usage of the widget grew by more than 20% year-on-year. Among them, the daily use of non-game widgets increased by a double-digit percentage, and the total paid for small games increased by 30% year-on-year.

So the progress of video accounts, especially the increased competitiveness of video accounts in e-commerce, is bound to bring Tencent investors another “business segment that has not been completed for years — e-commerce”. Video accounts carry Tencent's new e-commerce dream, although the old dream has been flooded several times in history The decline, but now relying on video accounts, should the e-commerce business grow, it will also give Tencent new scope for business growth.

NEXT IS WIDGETS, WHICH HAVE SEEN A DECLINE IN PEOPLE'S WILLINGNESS TO DOWNLOAD APPS DIRECTLY AFTER THEIR CURRENT INTERNET REACH PEAK, AND THE GROWTH IN OVERALL WIDGET USAGE HAS ALSO GIVEN WECHAT A NEW SPACE FOR IMAGINATION.

So, taken together, we find that Tencent's current advantage of relying on social for traffic has not disappeared, but rather, in line with the new era, competitiveness is intensifying.

2. Is Tencent's gaming business falling under the influence of competition?

How is Tencent's game going to sea

Total paid games in the international market grew 34% year-on-year, driven by the resurgence in popularity of Supercell's games, especially Wilderness Brawl, and growth in total users and payers for PUBG MOBILE. International gaming revenue grew by 3% year-on-year to RMB136 billion (constant year-on-year) as Supercell's games confirm revenue cycle.

The total paid for games in the domestic market resumed year-on-year growth, up 3%, and the domestic game revenue fell 2% year-on-year to RMB345 billion, due to longer confirmation of revenue.

Needless to say, there is a reason for market concerns. Tencent's gaming business is indeed peaking in China, which is also more dependent on Tencent's past practice of leveraging traffic and data advantages to discover and collaborate on explosive games, which will make it easy for Tencent's gaming business to make money, but the gaming industry With continued development, the demand for content has increased, which also requires Tencent's ability to develop games themselves, which may take time if you want to make a breakthrough overall.

(2) Tencent's game of aces relies on its portfolio to be stable

Capital Markets has been concerned about Tencent's two legacy titles, King's Glory and Peace Elite, as we can see from the results disclosure: the two native flagship titles, King's Glory and Peace Elite, are beginning to benefit from a new pace of commercialization and an improvement in game content design. Total payments grew year-on-year in 2024Q1.

In addition to the two older games, Tencent's pay-per-view totals for several local-market games, including Battle of the Shovel, Walkthrough of Fire, and Crossroads of the Dark Zone, hit all-time highs this quarter.

Supercell's games achieved growth in user volume and total paid; Wilderness Brawl has more than doubled the number of daily active accounts in the international market compared to the same period last year, and the total paid is more than four times the same period last year.

For a single game, King's Glory was impacted by overuse during last year's New Year period, with revenue declining year-on-year, while Peace Elite revenue declined year-over-year due to weaker commercialization in 2023H2. This was largely offset by revenue from Tencent's recently released games, including Intrepid Contract and Destiny's Ark, as well as strong growth in The Battle of the Shovel.

3. How is the development of the short film business?

Based on the Disclosure of Results:

(1) Over 80% year-on-year growth in total users of video accounts;

(2) Account live service revenue is growing;

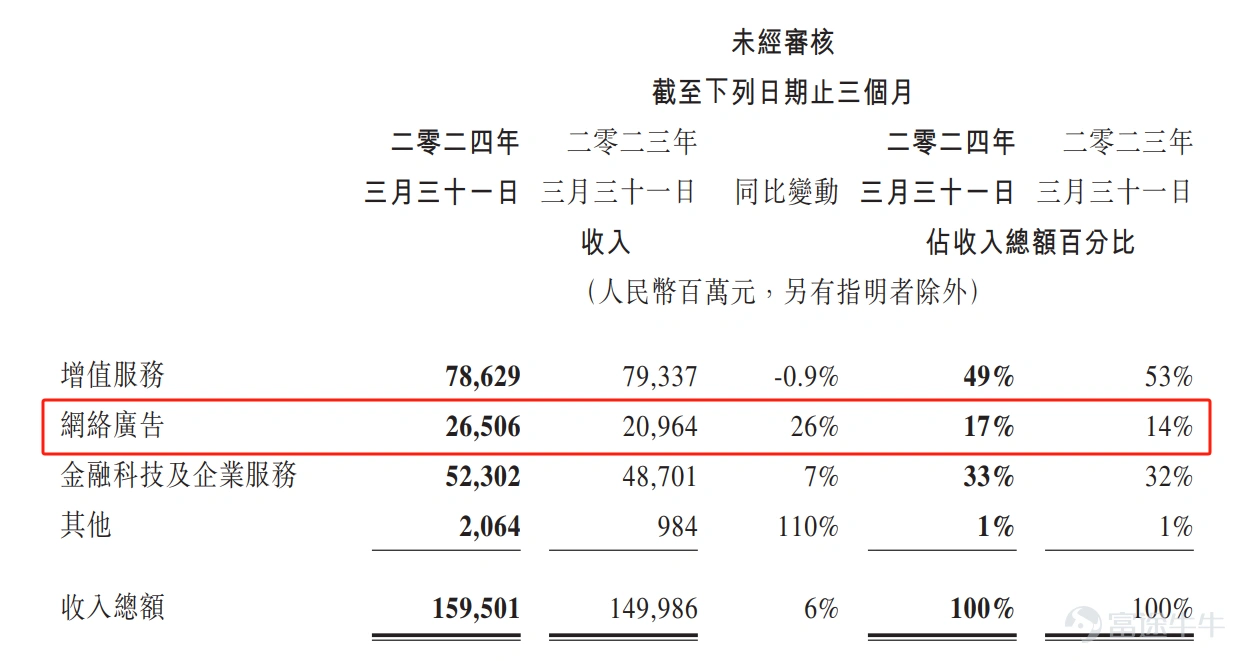

(3) VIDEO ACCOUNTS BOOST ADVERTISING BUSINESS GROWTH: REVENUE FROM THE ONLINE ADVERTISING BUSINESS GREW 26% YEAR-ON-YEAR TO RMB265 BILLION IN 2024Q1, DRIVEN BY GROWTH IN WECHAT VIDEO ACCOUNTS, WIDGETS, PUBLIC NUMBERS AND SEARCH QUOTAS;

(4) The increase in video account merchant technical service fees contributes to cloud business revenue growth;

We can see the games business declining as advertising revenue from the video business grows (in terms of value-added services, 49.29% revenue in 2024Q1 and 52.90% in 2023Q1 revenue by weight), so the growth of video accounts is equally helpful for improving Tencent's business structure.

However, there is little business data disclosed in the video account in these results, and we believe that Tencent has not yet turned short videos into a tool for mass transformation and is still increasing product capabilities and activity.

Taken together, we find that Tencent's legacy business capabilities are significant and competitive advantage, but the games business is clearly weak domestically, relying on the game portfolio to maintain its current position, while there are still more opportunities overseas, while short videos are a springboard for new growth, from a lightweight business model to legacy businesses. Looking at the business and new business combination, we speculate that once the economy warms up, Tencent's performance flexibility will be significant.

So here comes the new question, Tencent, which has risen significantly in the past, how is the investment value?

Third, we give the valuation of Tencent

In the foregoing research content of Futu Research, we have mentioned many times that long-term investment income is derived from =EPS increase* valuation change+shareholder feedback.

Therefore, a significant increase in shareholder returns will help improve Tencent's valuation. In the previous article, we also called on listed companies to focus on shareholder returns that will help raise their valuation levels, but some market participants believe that “buybacks are not dividends, only dividends are real dividends. Newspaper”. Here, we have a different opinion.

Since the general requirement to repurchase Hong Kong shares is required to be written off (although a consultation paper proposing amendments to the Listing Rules for Stock Shares was published on 27 October 2023 by the Exchange on 27 October 2023, it is proposed to amend the Listing Rules, introduce a stock exchange mechanism and seek market comments), the Company has completed the repurchase after completion of the repurchase, which actually causes the total share capital to fall, which favors EPS (earnings per share) increases and also avoids dividend tax costs due to cash dividends. (Of course, this rule is being adjusted, but we believe Tencent's repurchase write-offs will continue at most)

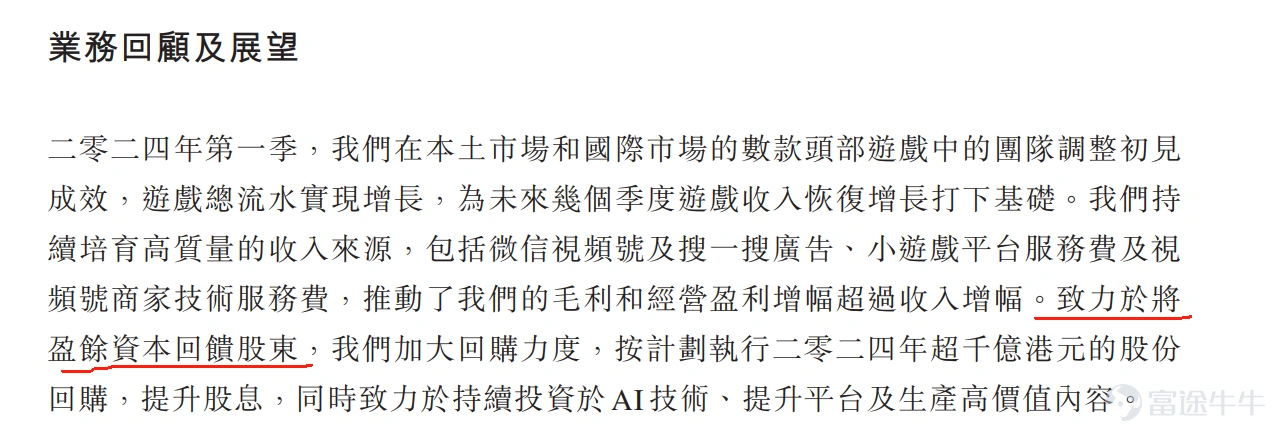

The repurchase of Tencent in 2024 will amount to HK$1 trillion, a cash dividend of HK$3.4/share, and a current market value of HK$3.6 trillion. We estimate that if the repurchase is carried out at the current valuation of HK$1 trillion, a shareholder return (HK$1,000/HK$3.6 trillion) = a share write-off of 2.77% and a cash dividend of HK$3.4 When a pre-tax dividend of HK$381.8 per share at the current closing price is 0.89%, the return on aggregate shareholders is: 2.77% +0.89% = 3.66%

This shareholder return is not high, but not low, is a moderate level, and Tencent's statement in its results is “committed to returning surplus capital to shareholders”.

So if we determine that Tencent's free cash flow will continue to grow at a higher rate in the future, in particular the free cash flow of $1745 billion in 2023, and we are expected to exceed $2,000 billion in 2024. If such a large free cash flow is fed back to shareholders, the shareholder return will be a significant improvement, so we estimate that for now we are assuming Comprehensive judgment under constant conditions (long-term investment income derived from =EPS increase* valuation change+shareholder return):

Tencent's long-term investment return=EPS growth+shareholder return. Tencent's future share price space will be highly correlated with “EPS growth+free cash flow growth”. Based on the data presented in these results, Tencent is far from peaking, and investors can actively enjoy the company's business development and shareholder returns Increase the dividend.

How to Buy Stocks

Before investing (buying and selling) stocks, you first need to open a securities (stocks) account. Just like depositing money in a bank, you need to open a bank account first.

Securities (Stock) Account Opening Process

Step 1: Head over to the Futubull network and sign up for a new account.(Register now)

Step 2: Open a securities account on the basis of the Futu account.(Open account now)

Step 3: Fill in your personal and financial details (includingBank Code and Account Number), and then deposit funds via EdDA Quick Deposit, Fast Transfer (FPS), Bank Transfer.(Invest immediately)

Step 4: Download the Futubull Customer Portal and log in.(Download now)