Futu Research | ETF Investment Research

[Reverse ETF] Leveraged and Reverse ETF Investment Guide: Can I Hold for the Long Term? Under what circumstances is it suitable for investment?

LEVERAGED ETF AND REVERSE ETF, AN ETF WITH LEVERAGED ATTRIBUTES, IS AN ETF (EXCHANGE-TRADED FUND) THAT HAS LOW THRESHOLDS TO INVEST IN A BASKET OF ASSETS AND IS HIGHLY SOUGHT AFTER BY MARKETS WITHOUT THE NEED TO BE FINANCED AND OFTEN USED AS A SHORT-LINE SPECULATION OR HEDGING TOOL.

However, many investors do not yet understand what leveraged and reverse ETFs are. Next, we will discuss the concepts and principles of leveraged and reverse ETFs, investment advantages and risks, the popular leverage and reverse ETFs in Hong Kong and reverse ETFs, and more specifically how to invest in these ETFs.

What is a Leveraged ETF?

As I said at the beginning,Leveraged ETFThis means that you do not need to use financing, and ETFs that allow you to do many times more for related indices or assets.

Currently, the leveraged ETF on the market is divided into three types of leverage multipliers of 1.5x /2 times /3x. For example, if you invest in an ETF that is 3 times the leverage of the Nasdaq 100, if the index closes up 1% on the day, the ETF will rise by 3%; but if the index falls 1% on the day, the index will fall by 3%.

What is a reverse ETF?

When the market is feeling bad or you are already in a downtrend,Reverse ETFIt will come in handy. It is generally used for two purposes: combination risk hedging and short-term speculative trading.

Reverse ETFs, like regular ETFs, track the performance of related indices, but the difference is that reverse ETFs attempt to build a movement opposite to the related index. In addition to the 1x reverse ETF, there are 1.5/2/3 times leveraged reverse ETFs in the market. For example, if you invest in a reverse ETF with 3x the leverage of the Nasdaq 100, if the index closes up 1% on the day, the ETF will fall 3%; but if the index falls 1% on the day, the index will rise 3%.

Like a leveraged ETF, a reverse ETF is also based on the performance of the relevant index or asset on the day and has the same benefits and risks as a leveraged ETF.

Characteristics of Leveraged and Reverse ETFs

A leveraged ETF is a double-edged sword that can magnify gains with good, and worse losses. What occasion and what type of investor is it suitable for compared to other leveraged and void related assets? What are the advantages and disadvantages?

Which ones are suitable for investing in leveraged ETFs?

Investors with a certain investment experience and a higher risk preference. Conversely, reverse ETFs are more difficult to invest in than positively leveraged ETFs.

What types of markets are Leveraged and Inverted ETFs applicable to?

LEVERAGED ETF: SUITABLE FOR UNILATERAL BULLISH TRADING WITH A CLEAR TREND, SUCH AS FOR A WIN CHASE IN A BULL MARKET, OR WHEN AN INDEX OR STOCK IS SUBJECTED TO A REBOUND.

Reverse ETF: For one-sided bearish actions with a clear trend, such as for taking profits in a bear market, or when an index or a stock is retracting from its peak.

What are the advantages of leveraged and reverse ETFs?

No Borrowing: Buying a leveraged ETF requires no borrowing and no financing interest.

Don't worry about a blowout: No margin trading is involved. Don't worry about a blowout if the stock price fluctuates sharply.

Simple operation: You can buy with a stock account, and there is a professional body to manage the underlying assets for you.

Easy to understand: Reverse ETF prices are only related to the corresponding asset price and are not affected by maturity dates, pullback fluctuations, etc., and are relatively easy to get started.

What are the disadvantages of leveraged and reverse ETFs?

More suitable for single side markets: there will be additional losses in turbulent markets and ETF performance will not match the performance of related assets.

Higher rates: Leveraged ETFs are also often added to the portfolio of futures or swaps. To avoid large deviations from the tracking criteria, fund managers need to trade these contracts frequently, which may incur losses in the process, which are also deducted from the ETF's net asset value.

Relatively low leverage ratios: up to 3x leverage and reverse ETF leverage multipliers, and futures, options, and derivatives, such as options, are more small-scale, with potentially large potential gains in investing less capital, and leverage multipliers of up to 10x or even more.

How Leveraged and Reverse ETFs Work

Both leveraged and reverse ETFs operate on the basis of a “rebalance” mechanism. Simply put, ETF leverage is based on the performance of the relevant index or asset on the day.

The following is a simple explanation with two examples that you can skip without wanting to look:

Case 1: Assume the initial value of index A is 100. The index is up 10% every day for 3 days in a row and 33.1% for 3 days. If there is an ETF that does 2 times more index A and starts at 100, what would be the result three days later? Due to the rebalancing mechanism of the leveraged ETF, the ETF is up 20% daily for a 3-day gain of 72.8%.

Scenario 2: Assume the initial value of index B is 100. The index maintained a 10% gain the day before and 10% the following day; after 6 days, it fell 2.97%. There is also a 2x multi-index B ETF with a starting value of 100 with a drop of 11.53% 6 days later.

In short, a leveraged ETF can help magnify potential gains and losses when an index or asset is in extreme strength.

However, those who have actually invested know that this is rare, market trends are not always so obvious and in most cases the future is difficult to predict. In the event of market volatility, long-term leveraged and inverted ETFs are unlikely to outperform the relevant assets, and even sideways movements of the benchmark asset may occur, but leverage and reverse ETFs decline.

Are Leveraged and Reverse ETFs Suitable for Long Term Holds?

Based on the above operating principles of leveraged and reverse ETFs, in theory, leveraged and reverse ETFs are not suitable for long-term holding, and all ETF issuers emphasize this risk.

But under certain conditions, medium-long line leveraged and inverted ETFs also have the potential for hefty potential returns.

For example, from January 3, 2023 to October 24, 2024, the Nasdaq 100 Index increased 86.26%, and the TQQQ, 3x the Dona index, increased 346.78%.

Even if the long-term trend is on the rise, it is difficult to avoid varying degrees of pullback in the middle. From July 11, 2024 to August 5, 2024, the index experienced a large continuous decline of 13.45%, and TQQQ also experienced its largest pullback since 2023, with a total decline of 36.87% during the period.

Therefore, if you want to hold a leveraged or inverted ETF for a long time, you need to take greater risks, while meeting the following two prerequisites:

Accurate selection of associated assets: choose a medium-long line that is in an uptrend or downtrend, a target asset with less volatility (the index is more suitable for individual stocks), and hold a leveraged ETF in the main up/down cycle;

Investors are more demanding on their own investment capacity: investors have sufficient investment experience to gather adequate market information in a timely manner and know how to combine analysis of the current macroeconomic environment to determine medium-term target asset trends and have a clear and clear investment strategy.

Top US Stock Leveraged & Reverse ETFs

The US equity market has many leveraged and reverse ETFs to choose from and track a wide range of assets. Popular ETF trades are active to meet investors' diverse investment goals and investment strategies. Based on the different asset types involved, we will introduce relatively large, more actively traded leveraged and inverted ETFs in the same types of US equity markets.

Track the Big Dial Index

Preferred Tech Stocks: Nasdaq 100 Index

3X Leverage: TQQQ $ProShares UltraPro QQQ ETF(TQQQ.US)$

3X Reverse: SQQQ $ProShares UltraPro Short QQQ ETF(SQQQ.US)$

2x Leverage: QLD $Proshares Ultra QQQ ETF(QLD.US)$

2x Reverse: QID $ProShares UltraShort QQQ(QID.US)$

1X Reverse: PSQ $ProShares Short QQQ(PSQ.US)$

Composite US Stock Market: S&P 500

3X Leverage: SPXL $Direxion Daily S&P 500 Bull 3X Shares ETF(SPXL.US)$

3x Reverse: SPXS $Direxion Daily S&P 500 Bear 3X Shares ETF(SPXS.US)$

2x Leverage: SSO $Proshares Ultra S&P500(SSO.US)$

2x Reverse: SDS $Proshares Ultrashort S&P500(SDS.US)$

1X Reverse: SH $Short S&P 500 Proshares(SH.US)$

Preferred Blue Chip Stocks: Dow Jones Industrial Average

3x Leverage: UDOW $ProShares UltraPro Dow30 ETF(UDOW.US)$

3x Reverse: SDOW $ProShares UltraPro Short Dow30 ETF(SDOW.US)$

2x Leverage: DDM $Proshares Ultra Dow30(DDM.US)$

2x Reverse: DXD $ProShares UltraShort Dow30(DXD.US)$

1X Reverse: DOG $Proshares Short Dow30(DOG.US)$

Preferred small-cap stocks: Russell 2000 Index

3x Leverage: TNA $Direxion Daily Small Cap Bull 3X ETF(TNA.US)$

3x Reverse: TZA $Direxion Daily Small Cap Bear 3X Shares ETF(TZA.US)$

2x Leverage: UWM $Proshares Trust Pshs Ultruss2000(UWM.US)$

1X Reverse: RWM $Short Russell 2000 Proshares(RWM.US)$

OTHER TYPES OF INDICES: PANIC INDEX (VIX INDEX)

2x Leverage: UVIX $2x Long VIX Futures ETF(UVIX.US)$

1.5x Leverage: UVXY $ProShares Ultra VIX Short-Term Futures ETF(UVXY.US)$

1X Reverse: SVIX $-1X SHORT VIX FUTURES ETF(SVIX.US)$

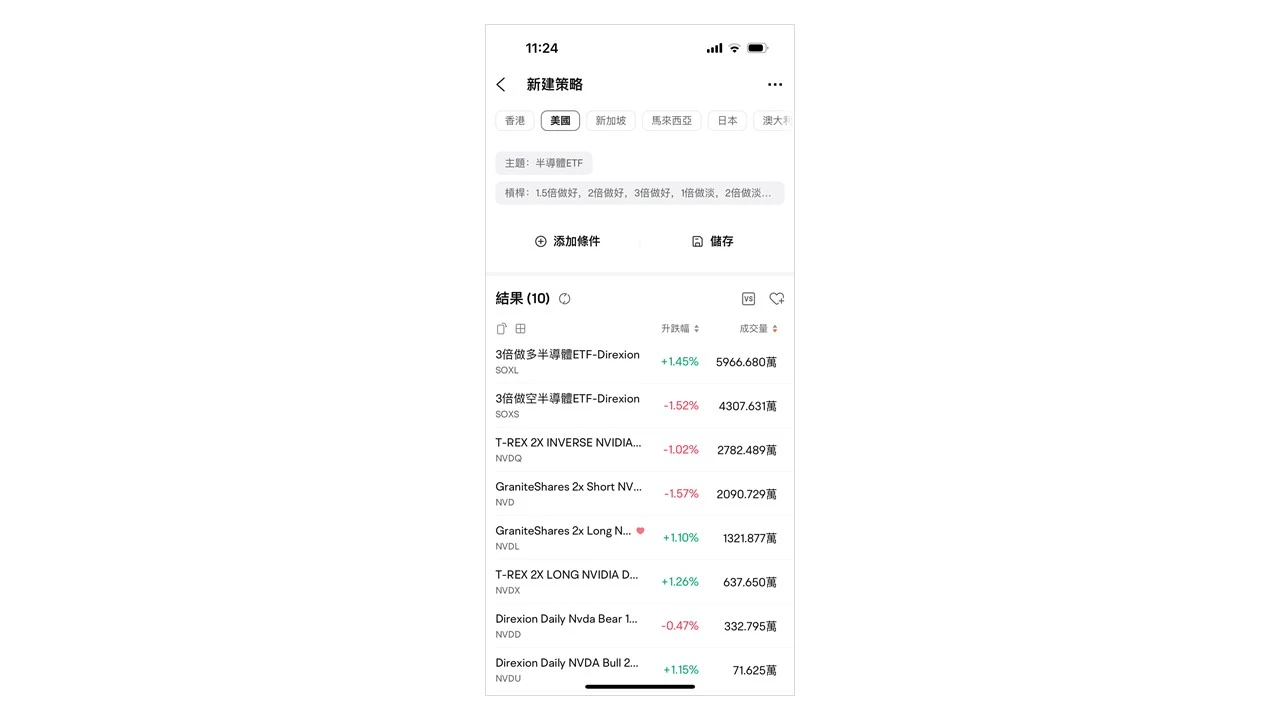

Track a hot topic or industry

semiconductors

3X Leverage: SOXL $Direxion Daily Semiconductor Bull 3x Shares ETF(SOXL.US)$

3x Reverse: SOXS $Direxion Daily Semiconductor Bear 3x Shares ETF(SOXS.US)$

2x Leverage: USD $Proshares Trust Pshs Ult Semicdt(USD.US)$

2x Reverse: SSG $Proshares Trust Ultrashort Semiconductors New 2020(R/S)(SSG.US)$

biotech

3X Leverage: LABU $Direxion Daily S&P Biotech Bull 3x Shares ETF(LABU.US)$

3X Reverse: LABD $Direxion Daily S&P Biotech Bear 3x Shares ETF(LABD.US)$

Chinese concept

3X Leverage: YINN $Direxion Daily FTSE China Bull 3X Shares ETF(YINN.US)$

3x Reverse: YANG $Direxion Daily FTSE China Bear 3X Shares ETF(YANG.US)$

2x Leverage (Shanghai Deep 300 Index): CHAU $Direxion Daily CSI 300 China A Share Bull 2X Shares(CHAU.US)$

2x Leverage (China Internet Stocks): CWEB $Direxion Daily CSI China Internet Index Bull 2x Shares ETF(CWEB.US)$

Sci-network shares

3X Leverage: WEBL $Direxion Daily Dow Jones Internet Bull 3X Shares(WEBL.US)$

3X Reverse: WEBS $Direxion Daily Dow Jones Internet Bear 3X Shares ETF(WEBS.US)$

Track a Single Star Stock

Nvidia

2x Leverage: NVDL $GraniteShares 2x Long NVDA Daily ETF(NVDL.US)$

2x Reverse: NVD $GraniteShares 2x Short NVDA Daily ETF(NVD.US)$

Tesla

2x Leverage: TSLL $Direxion Daily TSLA Bull 2X Shares(TSLL.US)$

2x Reverse: TSLQ $Tradr 2X Short TSLA Daily ETF(TSLQ.US)$

Coinbase

2x Leverage: CONL $GraniteShares 2x Long COIN Daily ETF(CONL.US)$

Apple

2x Leverage: AAPU $Direxion Daily AAPL Bull 2X Shares(AAPU.US)$

1X Reverse: AAPD $Direxion Daily AAPL Bear 1X Shares(AAPD.US)$

Microsoft

2x Leverage: MSFU $Direxion Daily MSFT Bull 2X Shares(MSFU.US)$

Google

2x Leverage: GGLL $Direxion Daily GOOGL Bull 2X Shares(GGLL.US)$

Amazon

2x Leverage: AMZU $Direxion Daily AMZN Bull 2X Shares(AMZU.US)$

MicroStrategy

1.75x Leverage: MSTX $TIDAL TRUST II DEFIANCE DAILY TARGET 1.75X LNG MSTR ETF(MSTX.US)$

【Learn More】Want to know what a single stock ETF is? Click here for more tutorial content.

Track assets other than stocks

US Debt

3x Leverage: TMF $Direxion Daily 20+ Year Treasury Bull 3X Shares ETF(TMF.US)$

3x Reverse: TMV $Direxion Daily 20+ Year Treasury Bear 3x Shares ETF(TMV.US)$

2x Leverage: TBT $ProShares UltraShort 20+ Year Treasury(TBT.US)$

2x Reverse: TBF $ProShares Short 20+ Yr Treasury(TBF.US)$

gold

2x Leverage: UGL $ProShares Ultra Gold(UGL.US)$

2x Leverage: BITU $ProShares Ultra Bitcoin ETF(BITU.US)$

2x Reverse: SBIT $ProShares UltraShort Bitcoin ETF(SBIT.US)$

1X Reverse: BITI $ProShares Short Bitcoin ETF(BITI.US)$

crude

2x Leverage: UCO $ProShares Ultra Bloomberg Crude Oil ETF(UCO.US)$

2x Reverse: SCO $ProShares UltraShort Bloomberg Crude Oil ETF(SCO.US)$

Data source: Futubull. Data are based on October 24, 2024, to track the trend of the same asset class and the reversal of the largest and most actively traded ETFs in the ETF asset model.

Popular Hong Kong Stock Leveraged & Reverse ETFs

Leveraged and inverted ETFs are relatively scarce in the Hong Kong market. Among them, ETFs that track major indices (Hang Seng Index, Hang Seng Technology Index) have a larger asset size and are more actively traded, and are loved by Hong Kong investors.

Track Hong Kong Stock Index

Hang Seng Indices

2x Leverage: 7200 $CSOP Hang Seng Index Daily (2x) Leveraged Product(07200.HK)$

2x Reverse: 7500 $CSOP Hang Seng Index Daily (-2x) Inverse Product(07500.HK)$

Hang Seng Technology Indices

2x Leverage: 7226 $CSOP Hang Seng TECH Index Daily (2X) Leveraged Product(07226.HK)$

2x Reverse: 7552 $CSOP Hang Seng TECH Index Daily (-2x) Inverse Product(07552.HK)$

National Enterprise Indices

2x Leverage: 7288 $CSOP HANG SENG CHINA ENTERPRISES INDEX DAILY(07288.HK)$

2x Reverse: 7588 $FI2 CSOP HSCEI(07588.HK)$

Track Mainland A-share indices

Shanghai Deep 300 Index

2x Leverage: 7233 $CSOP CSI 300 Index Daily (2x) Leveraged Product(07233.HK)$

China Startup Index

2x Leverage: 7234 $Bosera SZSE Chinext Daily (2x) Leveraged Product(07234.HK)$

* ETFs that track Mainland A shares in the current Hong Kong stock market are mostly ordinary ETFs without leverage, and there are currently no reverse ETFs

Other Assets

gold

2x Leverage: 7299 $CSOP Gold Futures Daily(07299.HK)$

Crypto

1 double idle time: 7376 $CSOP Bitcoin Futures Daily (-1x) Inverse Product(07376.HK)$

* ETFs that track cryptocurrency assets in the current Hong Kong stock market are mostly unleveraged ordinary ETFs

Data source: Futubull. Data are based on October 24, 2024, to track the trend of the same asset class and the reversal of the largest and most actively traded ETFs in the ETF asset model.

How to invest in leveraged and reverse ETFs?

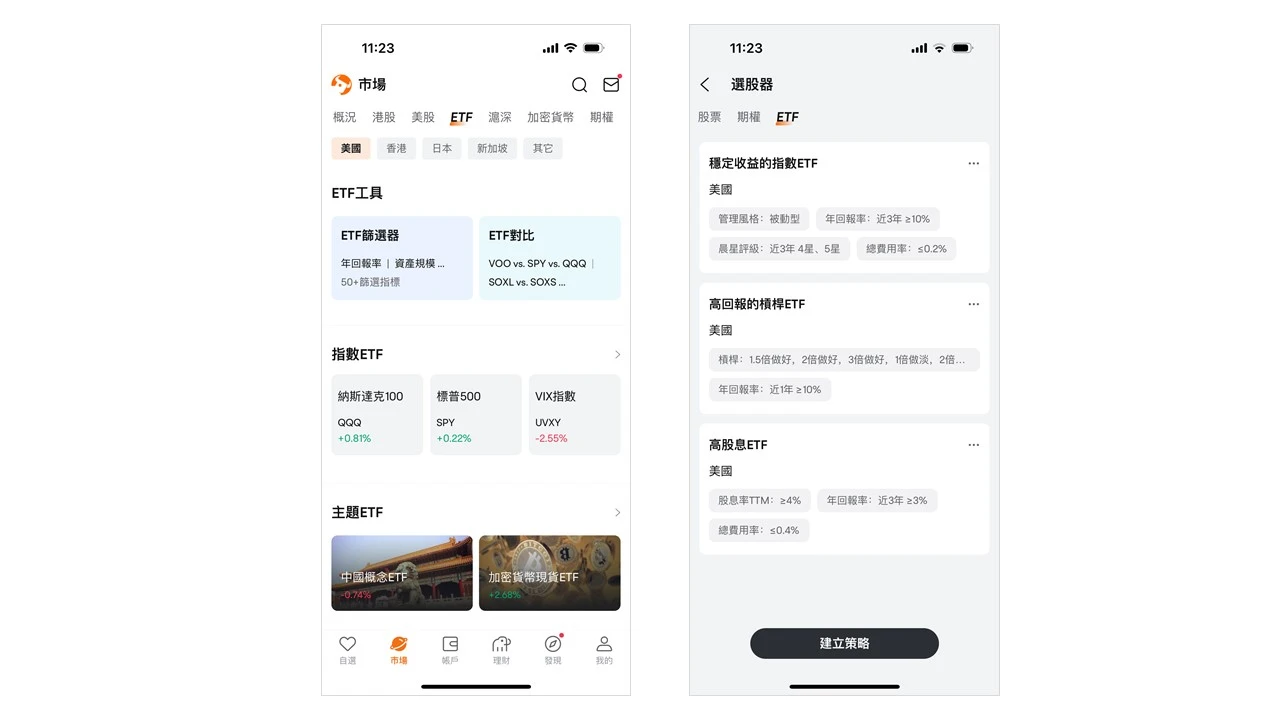

With the ETF filter selector in Futubull App, you can find the leading and reverse ETFs in just 3 steps.

Step 1: Find the ETF Filter

Open the Futubull App, select “Market” in the navigation section at the bottom of the page, click “ETF” at the top of the page;

In the “ETF Tools” column, select “ETF Filter”

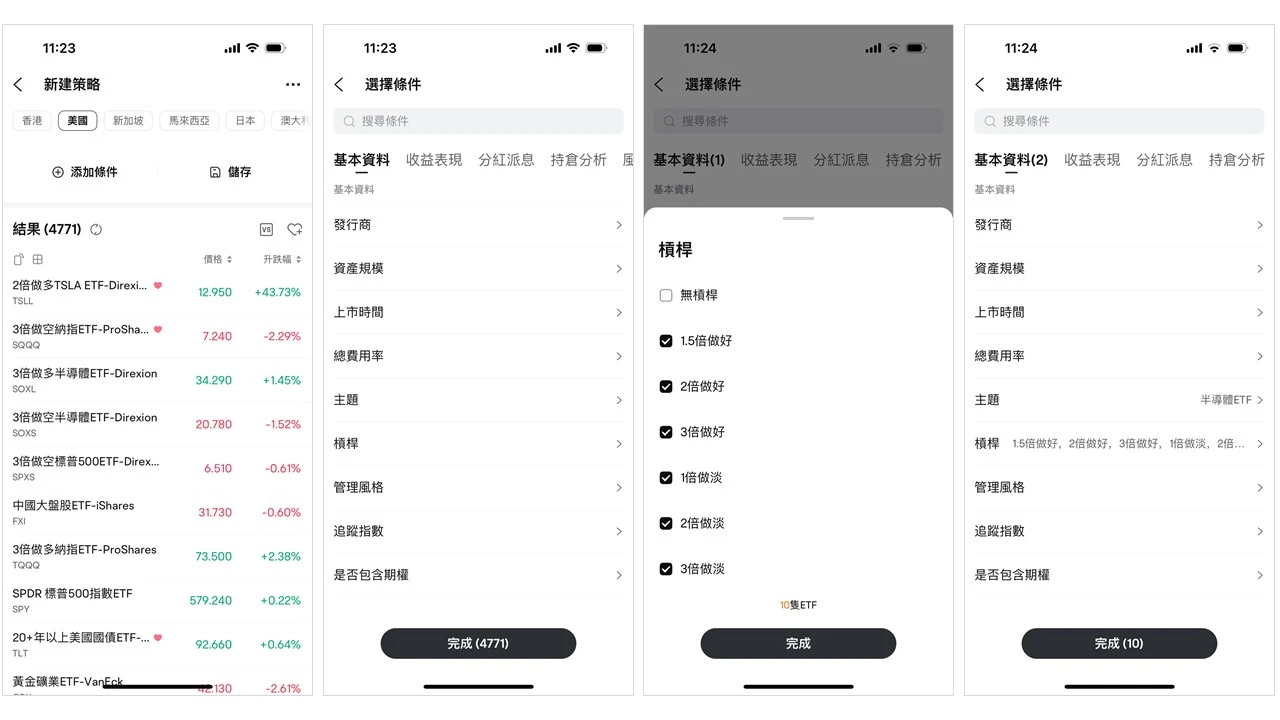

Step 2: Set ETF Filtering Criteria

Open the “ETF Filter” and click “Create Strategy”;

Select a country or region at the top of the page, for example: If you want to find a US equity ETF, select “United States”;

Click Add Criteria, choose Topic or Track Index. For example, if you want to invest in an ETF related to the Nasdaq 100 Index, check “Nasdaq 100” in Tracking Indices; if you want to invest in a Semiconductor ETF, check Semiconductor ETF in Topics;

Select “Leverage”, tick the desired leverage multiplier, click “Finish” to get the filtered result

Step 3: Contrast the Filter Results

Swipe the list left and right to further compare the trading volume and leverage multiplier of the ETF;

If you have more than one ETF with the same direction and leverage multiplier, it is recommended to choose a higher volume ETF.

Want more ETF hands-on tutorials? You can click on the following link:

LEVERAGED ETF | CHASE OR BOTTOM: TEACH YOU HOW TO CHOOSE A LEVERAGED ETF

Reverse ETF | Bear Market Doesn't Surprise! Accidental Reverse ETF Crisis