Futu Research | ETF Investment Research

[S&P 500 ETF] Buffett's Persistent Belief to Invest in Preferred S&P 500 Index ETF

BUFFETT, THE MAGNATE, HAS EMPHASIZED SEVERAL TIMES AT PREVIOUS ANNUAL MEETINGS IN THE BAY AREA:

“I think the best way for most people is to have a S&P 500 index fund.”

“People spend a lot of money buying stock proposals, but they don't need to. If you bet on the United States and hold a position for decades, your rate of return will be much better than buying Treasuries, and much better than those who follow stock recommendations.”

Between 1993 and 2018, he made 14 S&P 500 recommendations and even explicitly planned in his will to invest 90% of his personal assets in the S&P 500, fully demonstrating his confidence in the long-term stable returns of the index.

So why has this simple index earned Buffett such firm and lasting recognition?

What is S&P 500

The S&P 500 index, like the “Big Plate Thermometer,” compiled by Standard & Poor's, tracks the performance of the 500 most influential listed companies in the United States. These companies cover the broad spectrum of industry peers whose market capitalization determines their impact in the index.

The World's WavesMagnificent 7Apple (AAPL.US), Amazon (AMZN.US), Google (GOOGL.US), Meta (META.US), Microsoft (MSFT.US), Tesla (TSLA.US) and Wanda (NVDA.US) are ahead of them, and these companies accounted for more than 20% of the S&P 500 index's 2023 increase 76% of them.

The rise of the S&P 500 index intuitively reflects the overall movement of the US stock market. In fact, investing in the S&P 500 implies that investors have invested in a portfolio that is deeply tied to the overall performance of the US economy, so it can be said that the S&P 500 is betting on the development potential and long-term prosperity of the US economy Glory.

>> S&P 500 Index and S&P 500 Futures

How is the S&P 500 Index investing?

“People would rather get a lottery ticket that could win the big prize next week, or grab a chance to get rich slowly,” Buffett once said.

Over the past 5 years, 10 years and 20 years, the S&P 500 has outperformed a wide range of asset classes across the globe, outpacing not only European and Asian equities, but also emerging market equities.

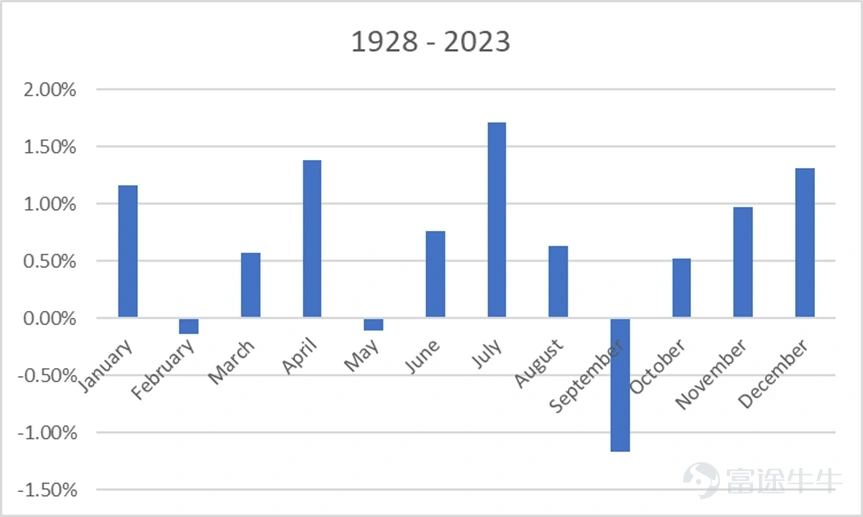

The S&P 500 has been profitable every 20 years in its history. It has a 20-year average minimum return of 5.62%, a 25-year average return of 9.07%, and the actual rate of return is closer to the average as investment time extends. There were a total of 1152 months from January 1928 to December 2023, with a positive return in 682 months.

In a real case scenario, if $1 was invested in the S&P 500 Index on January 1, 1970, and by the end of 2020, the final return, including dividends, would be about $191.89, and the annualized compound return would be 10.43%.

And on a month-by-month basis, the historical S&P 500 typically delivers positive returns in most months of the year. Although there is a consensus that summer will be low and sell off in May, in fact the S&P 500 maintains a good upward momentum during the summer.

On the other hand, the “September effect” is actually present, that is, the S&P 500 often shows significant falls in September. However, the following months are often accompanied by strong rebounds, which may benefit from factors such as holiday spending stimulating the market. Therefore, for investors, understanding this seasonal trend helps them make decisions in September, such as holding cash to buy stocks at low positions.

Which S&P 500ETF products can I choose?

The S&P 500-linked ETF equity fund (S&P 500 Index ETF) provides a one-stop, low-cost solution. For example, SPY charges of only 0.09%, far lower than stock handling fees or 1~ 2% for mutual funds, which seems very affordable.

Buffett believes that this passive investment model is ideal for general investors, saving not only time researching stocks but also earning opportunities. It is ideal for investors who intend to deploy US stocks on a long-term basis:

I often recommend low-cost S&P 500 index funds, but only a few humble friends would believe me. Hardly any of the extremely wealthy investors, fund managers, and pension funds actually followed my advice, and they politely thanked me. But the turnaround was persuaded by asset management managers who charged high management fees to choose another way of investing.

Well-known S&P 500 index ETFs on the US market:

1. $SPDR S&P 500 ETF(SPY.US)$: Often referred to as “Spider”, it is one of the first and most well-known S&P 500 index ETFs on the market. Managed by State Street Global Advisors, launched in 1993, it is not only one of the largest exchange-traded funds in the world, but has been a widely used US large-cap investment vehicle by investors. SPY has extremely high liquidity, huge daily trading volume, which makes it easy for investors to buy or sell, and the spread is often small, which is especially beneficial for big hand traders.

2. $iShares Core S&P 500 ETF(IVV.US)$: IVV is an ETF issued by iShares under BlackRock and also aims to track the performance of the S&P 500 index. IVV has a lower cost ratio compared to SPY, at around 0.03%. WHILE IVV'S LIQUIDITY IS NOT AS HIGH AS SPY'S, FOR MOST INVESTORS, ITS DAILY TRADING VOLUME IS STILL SUFFICIENT TO MEET NORMAL TRADING NEEDS.

3. $Vanguard S&P 500 ETF(VOO.US)$: VOO is an ETF managed by the well-known low-cost fund manager Vanguard Group, which also closely tracks the S&P 500 index. VOO's expense ratio is typically around 0.03%, which is also a reflection of Vanguard's low-cost investment strategy.

4th. In addition to the three ETFs that track the S&P 500 Index mentioned above, you can also note$Proshares Trust S&P 500 Divid Aristocrats Etf(NOBL.US)$: This is an ETF that picks “Dividend Nobles” (companies whose dividends have grown for 25 years in a row) as a constituent stock from the S&P 500 index.

summed

“In the short term, the stock market is a voting machine, but in the long run it looks more like a weight machine.” From a long-term investment perspective, the S&P 500 offers an attractive risk-return ratio that is almost impossible to find an asset class to match for investors looking to accumulate wealth.

Therefore, when building a portfolio, S&P 500 index related products can be one of the ideal choices for most investors, especially as a supplemental or basic configuration tool other than directly investing in individual stocks.

“Only when the tide recedes will you know who is swimming naked.” Regardless of how the market is changing, maintaining rational analysis and independent thinking, and sticking to value investing is the key to making a solid move forward in any market environment.

Want to know more about Buffett's investment passwords? Download the Futubull App now to see the Shareholders Store!

How to trade ETFs through Futu?

Before investing in ETFs, you first need to open a securities (stocks) account. Just like depositing money in a bank, you need to open a bank account first.

Securities (Stock) Account Opening Process

Step 1: Head over to the Futubull network and sign up for a new account.(Register now)

Step 2: Open a securities account on the basis of the Futu account.(Open account now)