1. Option Strategy View

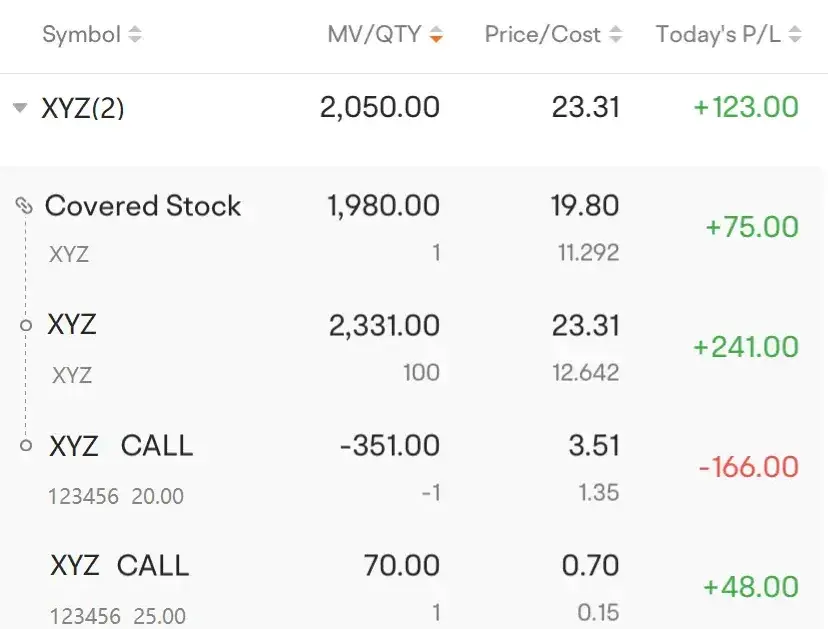

In the Option Strategy View, each component of an option strategy will be listed under the respective strategy.

Once you turn on the Option Strategy View, your P/L will be calculated based on the terms of the entire strategy.

Example

Say you hold a covered call on stock XYZ, the current price, cost per share, and P/L for the covered call position will be displayed as follows:

Symbol | Quantity | Current Price | Cost Per Share | P/L |

Covered Stock | 1 | 11 | 8 | 300 |

XYZ | 100 | 14 | 10 | 400 |

XYZ CALL 20 | -1 | 3 | 2 | -100 |

Then you continue to establish a vertical spread on stock XYZ by selling one XYZ call 20 at $4 and buying one XYZ CALL 16 at $4.5, and your covered call position and vertical spread position will be displayed separately as follows:

Symbol | Quantity | Current Price | Cost Per Share | P/L |

Covered Stock | 1 | 10 | 7 | 300 |

XYZ | 100 | 15 | 10 | 500 |

XYZ CALL 20 | -1 | 5 | 3 | -200 |

Vertical | 1 | 2 | 1.5 | 50 |

XYZ CALL 16 | 1 | 7 | 4.5 | 250 |

XYZ CALL 20 | -1 | 5 | 3 | -200 |

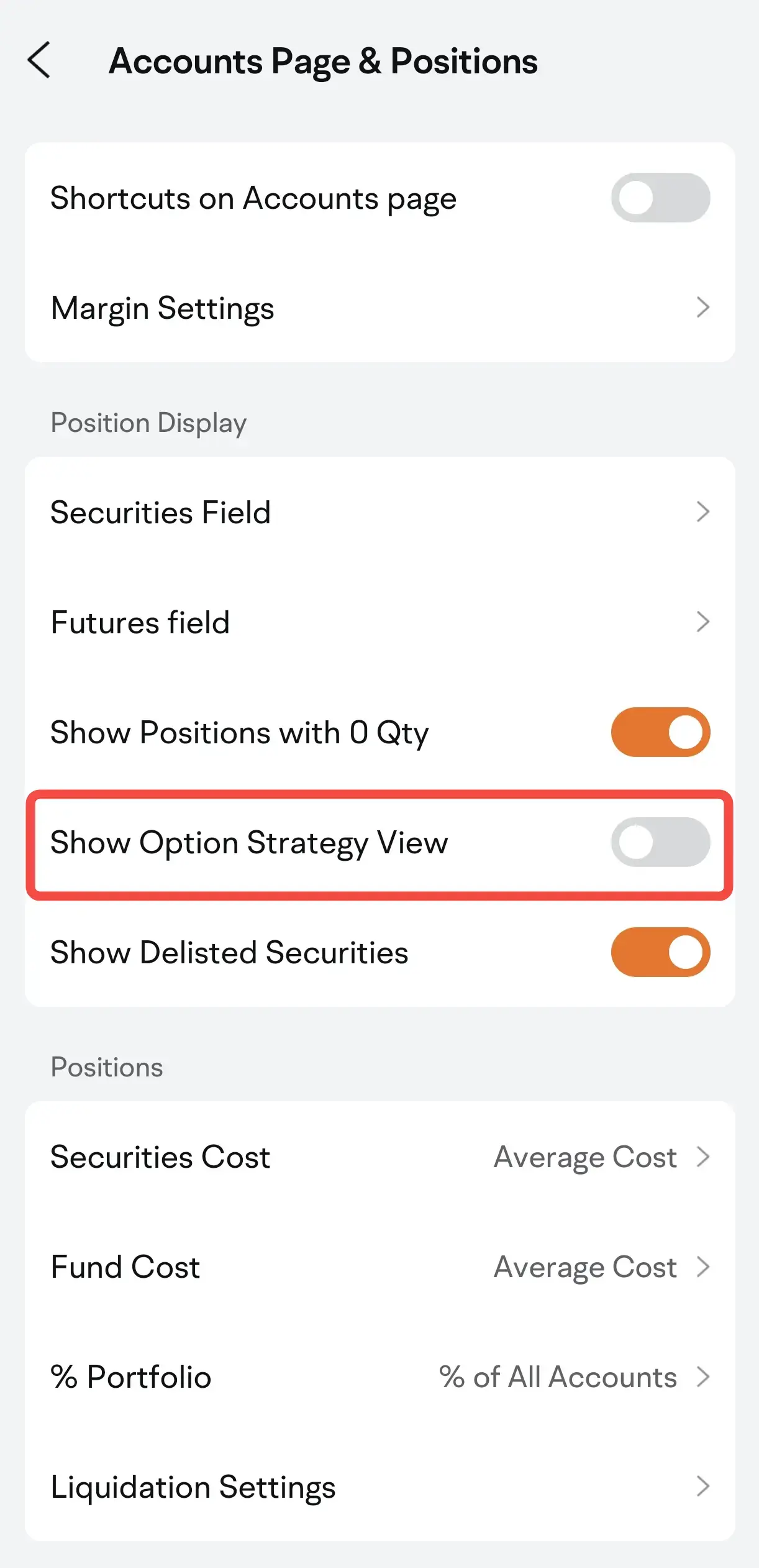

2. How to turn off the Option Strategy View

The Option Strategy View is turned on by default. To turn off the Option Strategy View, please go to: