It's said that Trump is a walking drama machine, raising tariffs today and praising China tomorrow, making stock investors feel like they are on a roller coaster every day. But if you have seen hisThe Art of Trade, and then take another look at hisGemini horoscope—Wow! This guy's approach is simply the business version of "Empresses in the Palace", with every step marked by the four big characters "I want to make money".

The main core strategy in the book "The Art of Trade" is the combination of business thinking and the art of gaming.

Its core logic can be summarized into the following five dimensions:

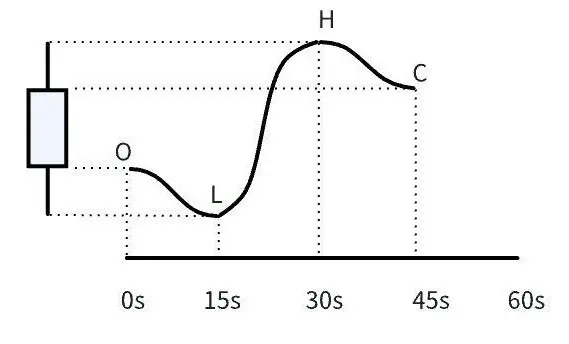

1. The underlying logic of "creating momentum" and "the combination of reality and illusion".

The book emphasizes "always let the other party make the first offer" and "exaggerate demand to gain leverage."

![]()

This strategy is often seen in tariff policies and trade negotiations.

[Example]

By imposing tariffs on various countries to create pressure, opponents are forced to the negotiation table, and then an agreement is reached through phased concessions.

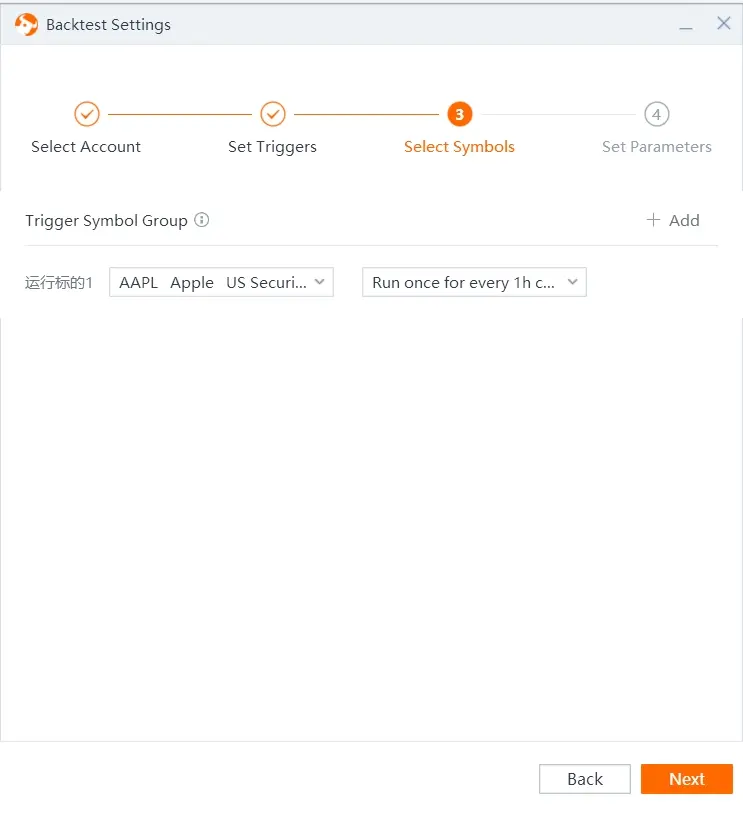

II. Practical Application of the "Big Negotiation" Strategy

![]()

First, he scared everyone quite a bit, and then he gave a little reward.Imagine you are bargaining in a vegetable market, and Trump's approach is to first raise a loudspeaker and shout: "This pile of cabbage must be sold to me for 100 yuan today!" When the vendor is stunned, he suddenly rubs his hands and says: "But seeing that you are not having an easy time, let's settle for 80 yuan~"

![]()

[Example]

1. In 2018, tariffs were imposed on CN commodities, turning the global stock market into a green wilderness. Just when everyone was about to collapse, he suddenly signed a first-phase agreement and triumphantly tweeted: "No one understands deals better than I do!"

![]()

2. On April 2, 2025, ...