1. Trigger Symbol & Logic of Strategy Cycles

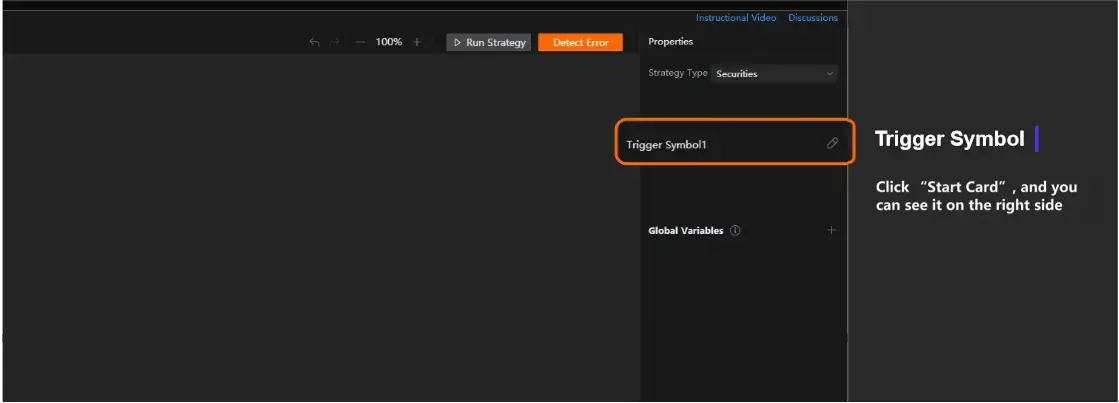

Every strategy has at least one trigger symbol. Click "Start Card”, and you’ll see it in the property bar on the right.

Note: The "Trigger Symbol 1” here is just used as a reference. A real trigger symbol will be chosen in live trading or backtesting later.

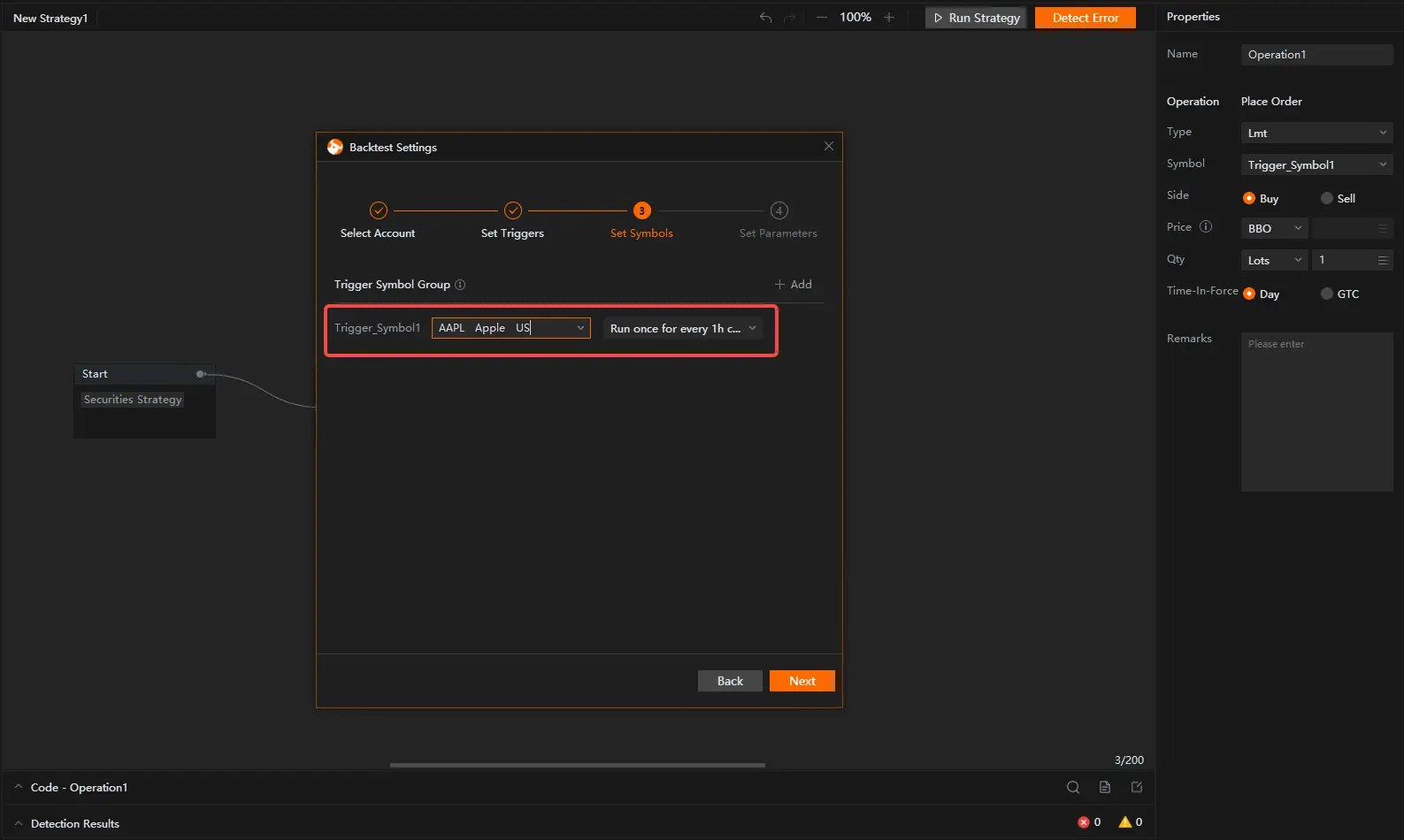

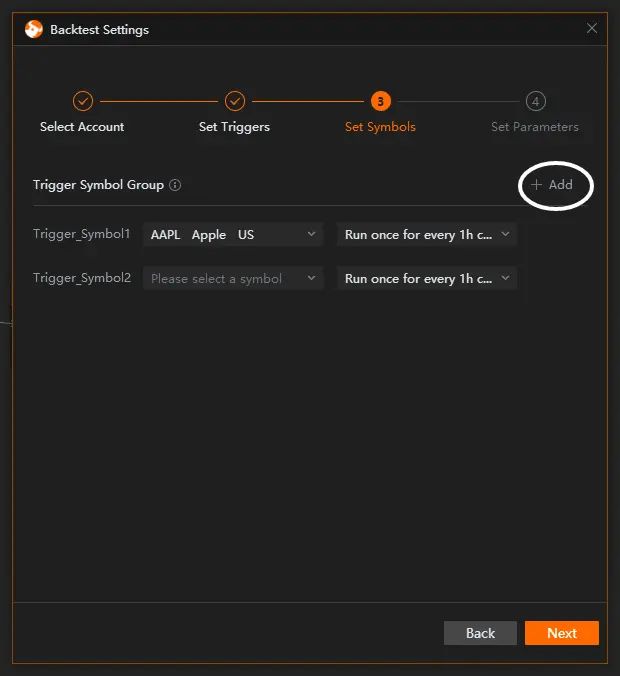

Click "Backtest" or "Live Trading", and then you can choose a real trigger symbol in the setting window as the "Trigger Symbol 1” above.

One important role of the trigger symbol is to drive the cyclical running of the strategy. Therefore, you also need to set the interval between two rounds of running.

For example, set the strategy as "Apple (AAPL.US) & Run once for every tick”. It means that the strategy runs once for every time Apple (AAPL.US) has one tick. When the strategy runs, an order of 5,000 board lots will be placed if a golden cross occurs in the MACD.

After the end of each round of running, the strategy will wait until Apple (AAPL.US) has another tick that will trigger another round of running.

2. Multiple Trigger Symbols & Multiple Trigger Symbol Groups

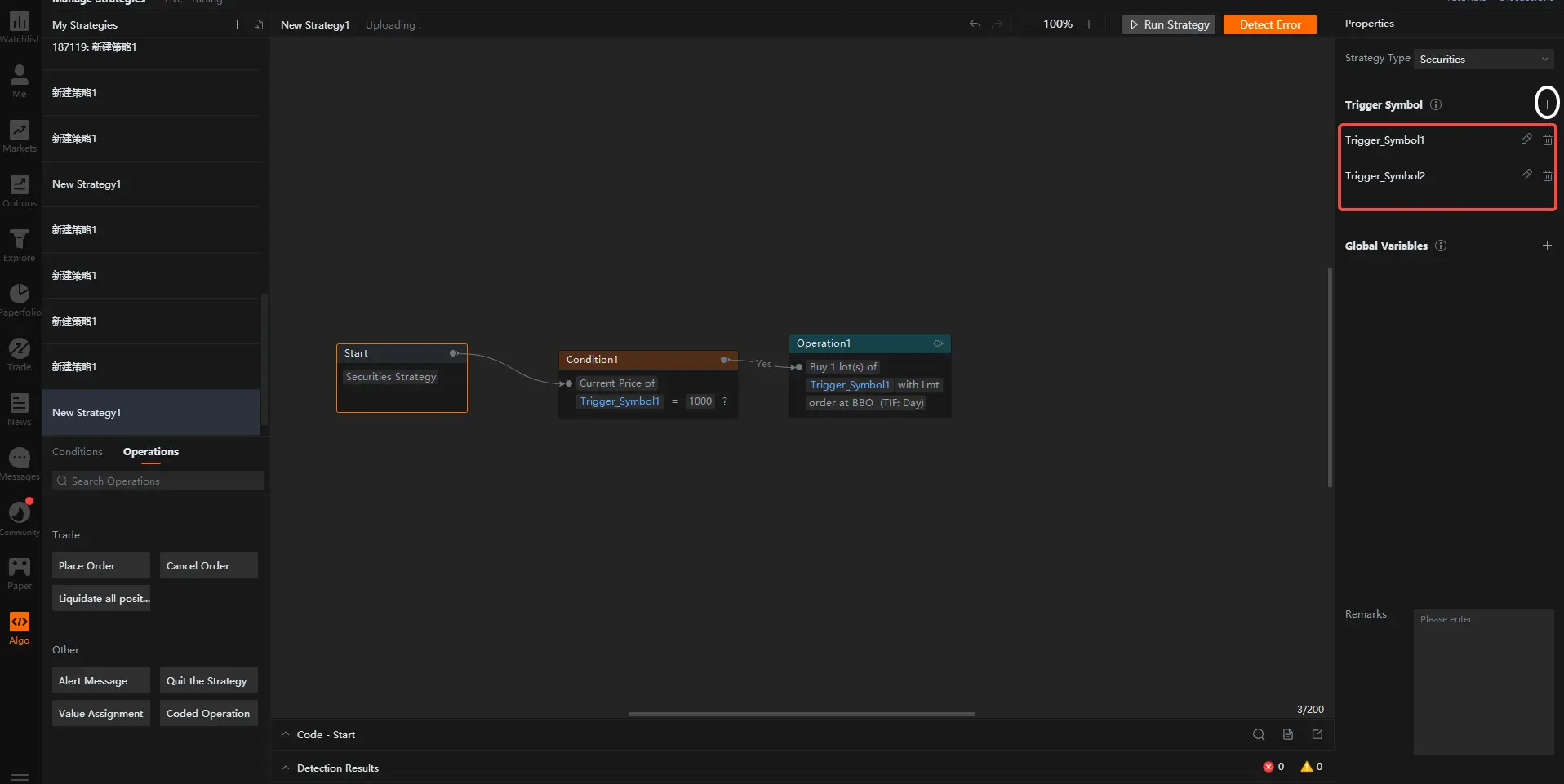

When building a strategy, we can set multiple trigger symbols on the canvas.

We can also add multiple trigger symbol groups in backtest or live trading.

So, what on earth is the difference between multiple trigger symbols and multiple trigger symbol groups?

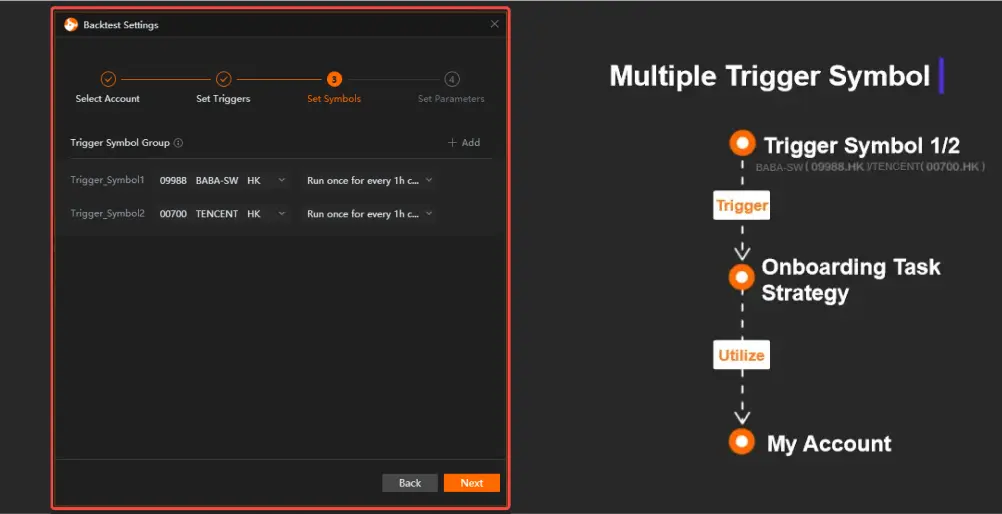

2.1 Multiple Trigger Symbols

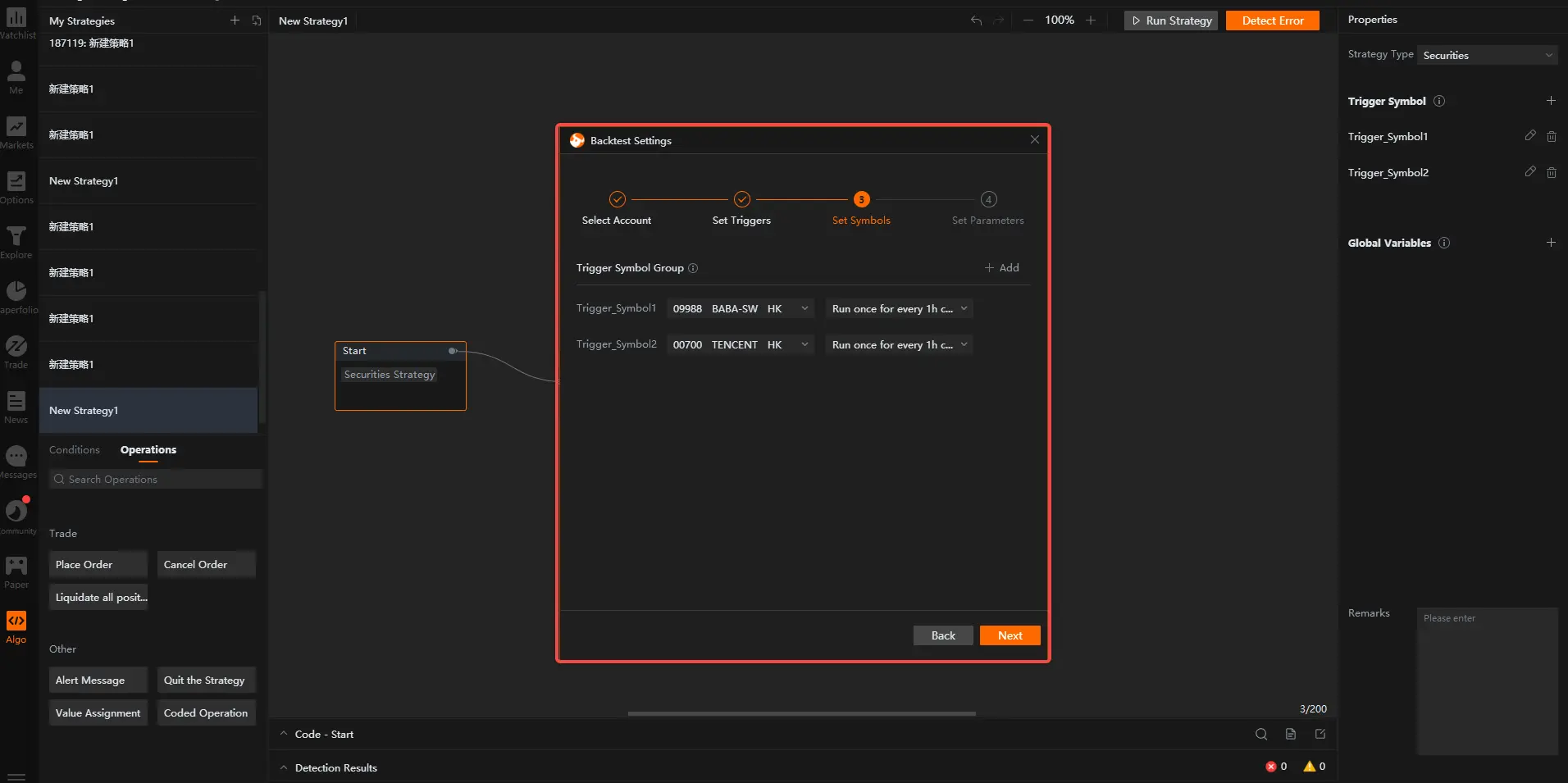

Taking the onboarding task strategy as an example, two trigger symbols are set in the "Start Card" on the canvas.

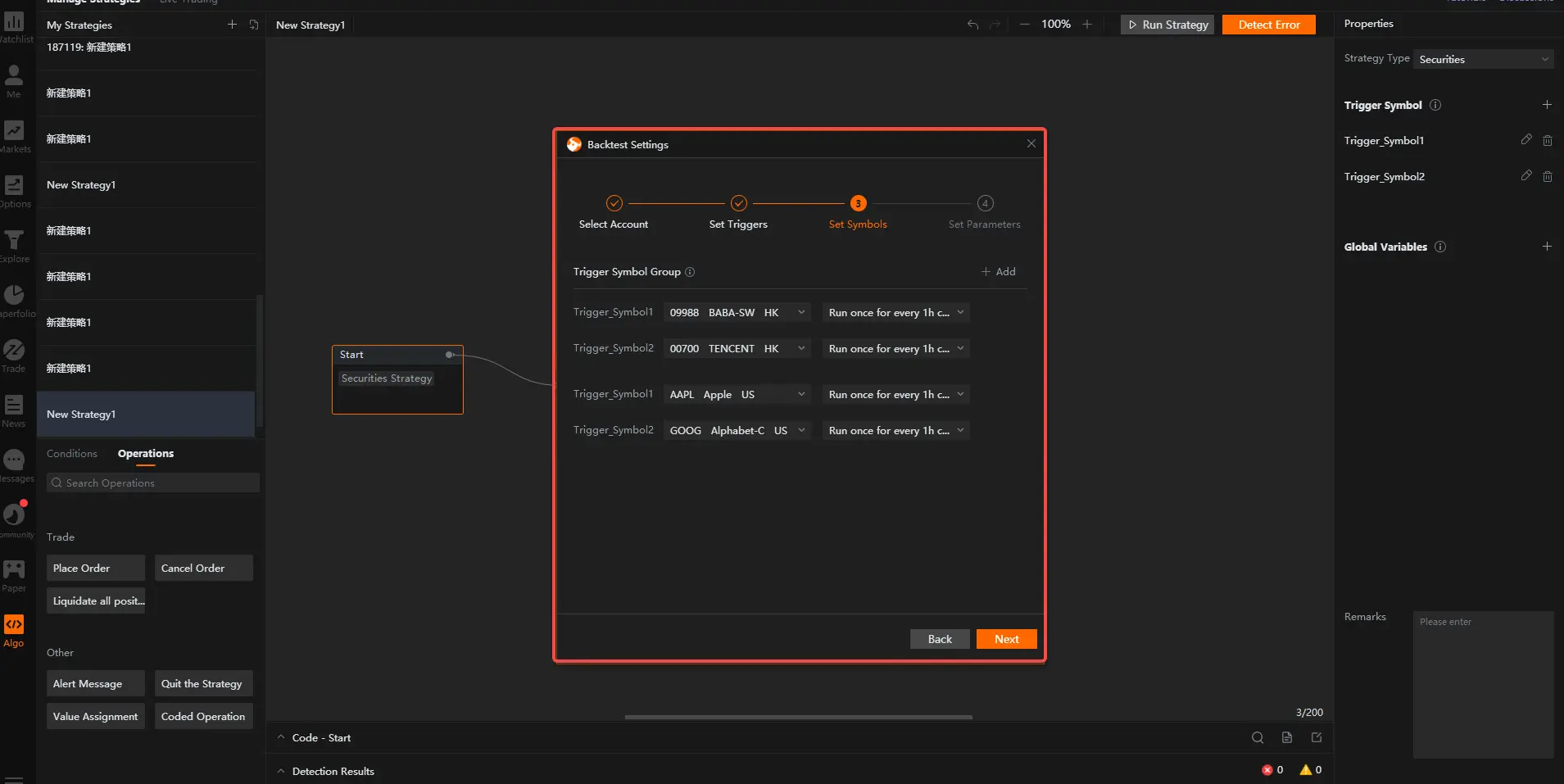

In the Backtest Setting window, assign the two trigger symbols as Alibaba (09988.HK) and Tencent Holdings (00700.HK) respectively.

It indicates that the ticker of both Alibaba (09988.HK) and Tencent Holdings (00700.HK) will trigger the running of the onboarding task strategy.

Moreover, it doesn't matter if the strategy is triggered by Alibaba (09988.HK) or Tencent Holdings (00700.HK). No matter which ticker of these two trigger symbols triggered the strategy, the determination logic is to place an order for Tencent Holdings (00700.HK) with the MACD of Alibaba (09988.HK) as a condition.

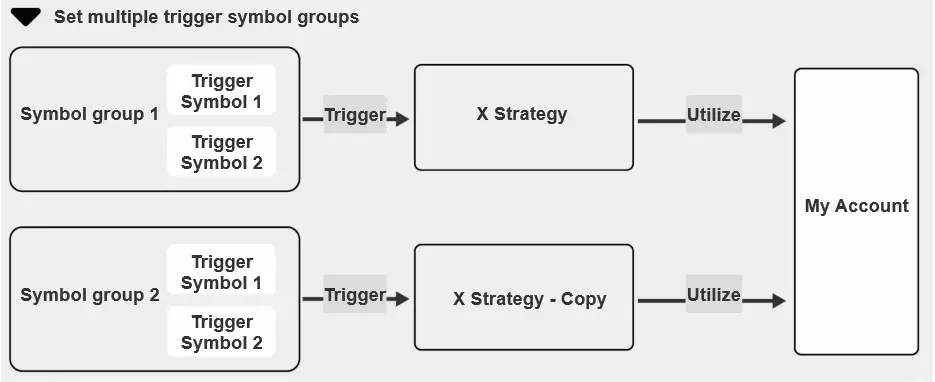

2.2 Multiple Trigger Symbol Groups

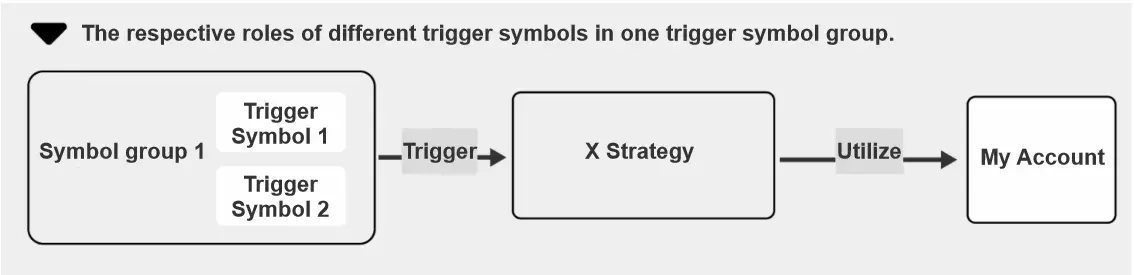

From the above example, we can see the respective roles of different trigger symbols in one trigger symbol group.

If you add another trigger symbol group to the onboarding task strategy and assign the two trigger symbols as Apple (AAPL.US) and Google (GOOG.US) respectively, what will happen?

By setting multiple trigger symbol groups, you made a copy of the onboarding task strategy.

The tickers of Alibaba (09988.HK) and Tencent Holdings (00700.HK) will only trigger the original onboarding task strategy; the tickers of Apple (AAPL.US) and Google (GOOG.US) will only trigger the copy.

The original onboarding task strategy and the copy run in a relatively independent way, but they use the money (cash) and assets (stocks) in the same account (real account or backtest account).

Therefore, if one strategy has taken up the buying power of the account, the other one may face a situation where the buying power is not sufficient to place an order.