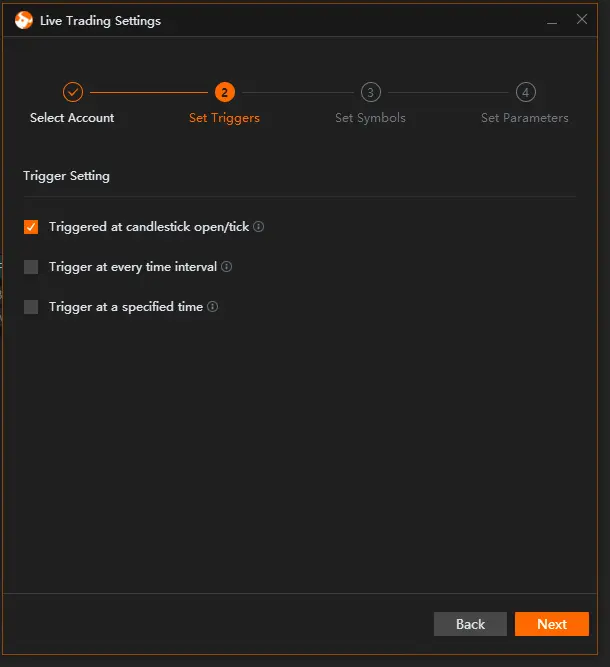

Trigger conditions are essential for running strategies during backtesting and live trading. The following are some of the trigger conditions provided in Algo trading:

1. Real-time quotes

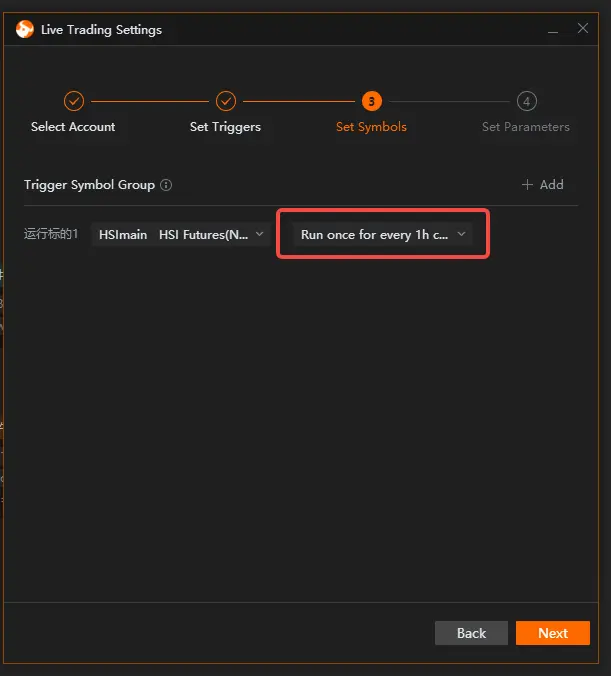

1.1 Run once per candle

If you select "Run once for every 1h candle," the strategy will start at the beginning of each hour's candle instead of its end. This means the strategy will always run at the start of the trading day, coinciding with the first 1-hour candle. But it won't run at the end of the trading day. Please note that at the beginning of each candle, it's still incomplete, so only one price is available. Thus, the highest, lowest, opening, and closing prices of the latest candle will all equal the opening price.

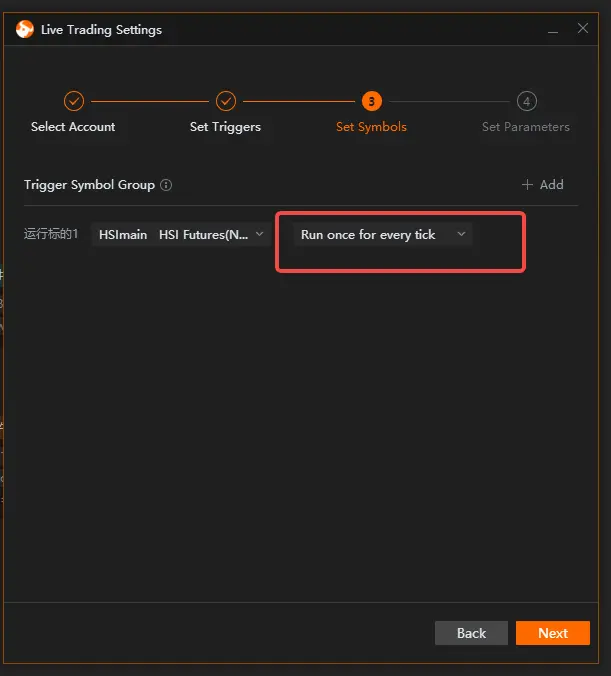

1.2 Run once for every tick

A tick shows the details of a trade.

By selecting this option, the strategy will run once for every tick.

The frequency of the trigger depends on the underlying security's trading activity. If the security is highly active, the strategy will run more frequently. This trigger condition is ideal for real-time monitoring of a specific security to avoid missing any quotes.

Note: The tick data in backtesting is simulated based on 1-minute candles (with four trades per minute) and not actual past tick data.

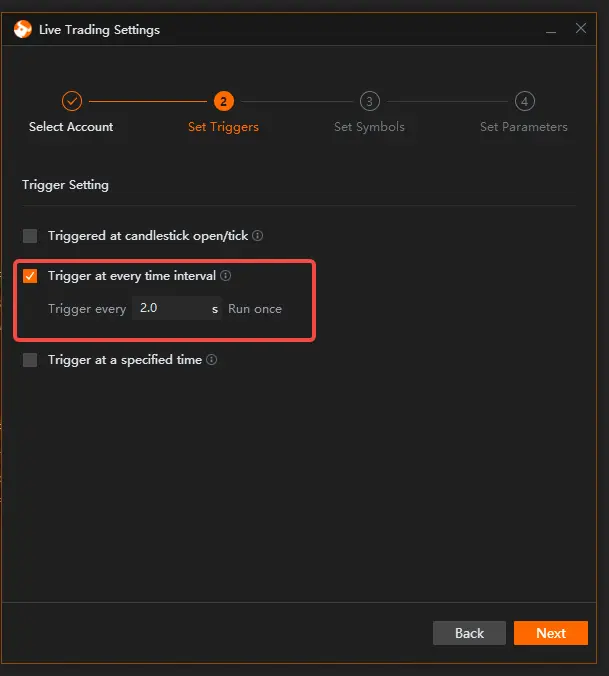

2. Time intervals

If you set it to run once every 2 seconds, for example, the strategy will execute every 2 seconds, regardless of the underlying security's trading status.

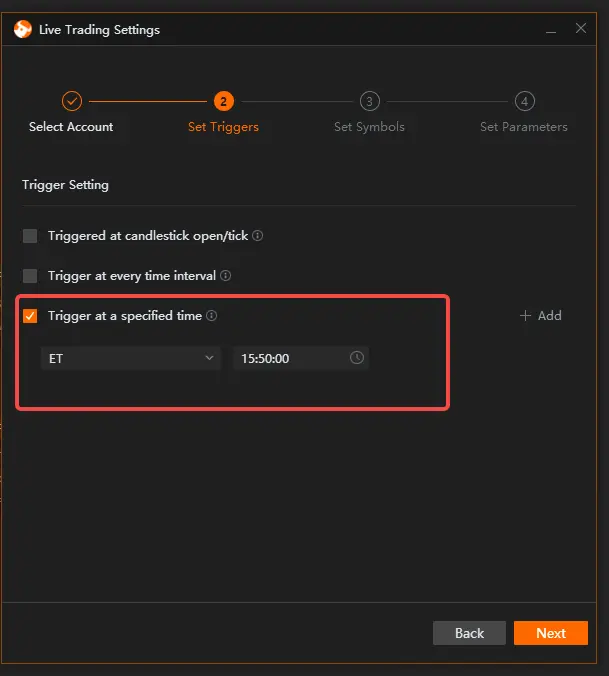

3. Specific time

If you set it to run at a specific time, such as 15:50:00 ET, the strategy will run once daily at that specified time, regardless of the underlying security's trading status. This trigger condition is typically used for scenarios like "performing operations before market close each day" or "rebalancing portfolio each day".