How to recover the original strategies that have been modified multiple times? Here is the answer.

Method 1: Using the Undo button

If you made only a few modifications to a strategy, you can recover it by using the Undo button.

Go to the "Algo" tab > "My Strategies", and you will find the Undo button in the upper right corner of the canvas (the keyboard shortcut is Ctrl + Z).

Note: You can undo up to 10 modifications; therefore, strategies being modified too many times may not be recovered.

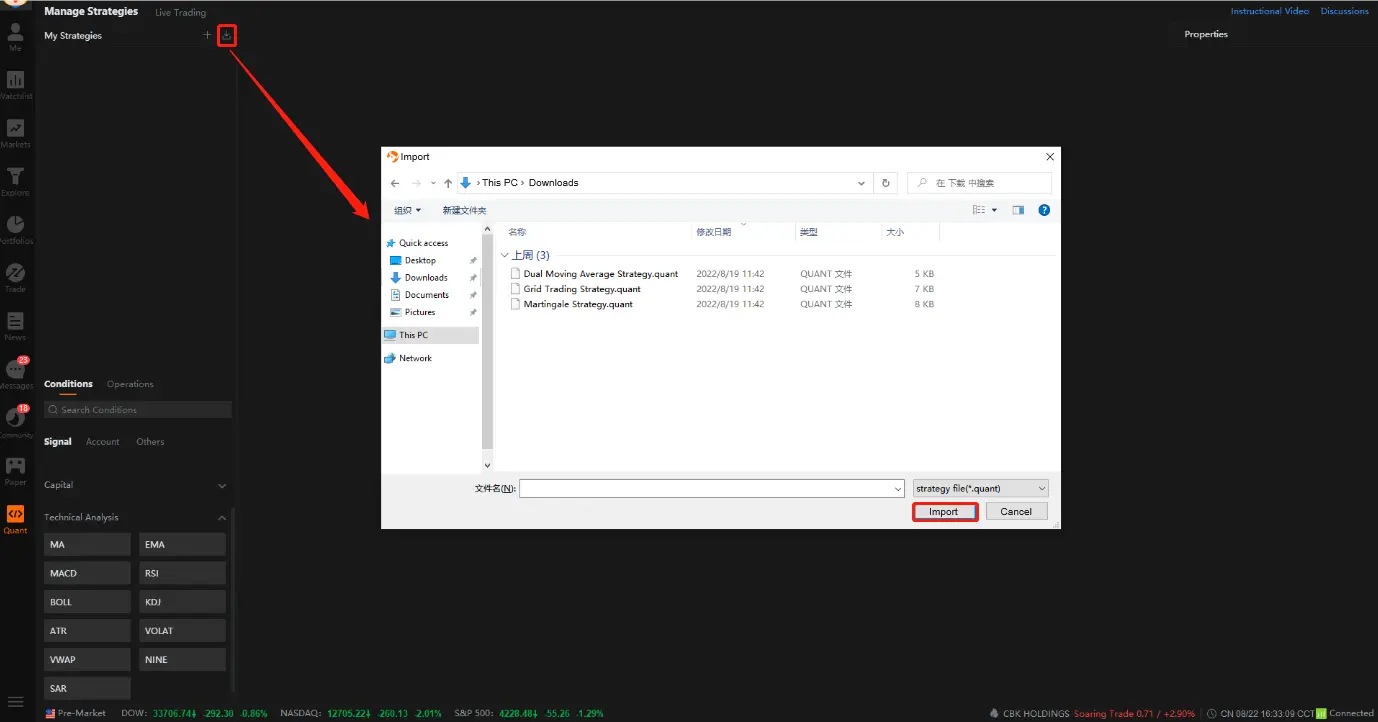

Method 2: Importing the original strategies

If the original strategies have been deleted, you can recover them by importing them.

Go to the "Algo" tab > "My Strategies", click on the "+" button, and select the strategy(ies) to be imported.

(Any images provided are not current and any securities shown are for illustrative purposes only and are not recommendations. )

You can download the original strategies via the following links: (Minimum version requirement:13.19.12528)

Dual Moving Average Strategy: Dual Moving Average Strategy.quant

Grid Trading Strategy: Grid Trading Strategy.quant

Grid Trading Strategy (pro): Grid_Trading(pro).quant

Martingale Strategy: Martingale Strategy.quant

Options Near Expiration Strategy: Options Near Expiration Strategy.quant

Bracket Order (Buy): Bracket Order(Buy).quant

Bracket Order (Sell): Bracket Order(Sell).quant

MACD Strategy:MACD Strategy.quant

Bollinger Bands Mean Reversion Strategy:Bollinger Bands Mean Reversion Strategy.quant

TTM Squeeze Strategy:TTM Squeeze Strategy.quant

RSI Trend Strategy: RSI Trend Strategy.quant

ATR Breakout Strategy:ATR Breakout Strategy.quant

Donchian Channel Breakout Strategy:Donchian Channel Breakout Strategy.quant

Bull Call Spread Strategy:Bull Call Spread Strategy.quant

Trend-following Strategy for Intraday Trading:Trend-following Strategy for Intraday Trading.quant

Gamma Scalping Strategy:Gamma Scalping Strategy.quant

Risk Reversal Strategy:Risk Reversal Strategy.quant

(To download the strategy on the mobile app, copy its link and paste it into a web browser.)

Losses can happen more quickly with quant and algorithmic trading compared to other forms of trading. Trading in financial markets carries inherent risks, making effective risk management a crucial aspect of quantitative trading systems. These risks encompass various factors that can disrupt the performance of such systems, including market volatility leading to losses.

Moreover, quants face additional risks such as capital allocation, technology, and broker-related uncertainties. It's important to note that automated investment strategies do not guarantee profits or protect against losses.

The responsiveness of the trading system or app may vary due to market conditions, system performance, and other factors. Account access, real-time data, and trade execution may be affected by factors such as market volatility.