Financial Crisis | Historical Insights on Global Markets

Global Markets Financial Crisis Insights | From Liquidity Crisis to Market Recovery

1. Background of the financial crisis

In a volatile financial market, liquidity crises flow like a dark tide, and at times they send shockwaves. When panic spreads, investors sell assets, and the market is subject to severe volatility. This Monday, global markets experienced a sudden Black Monday, with equity markets, digital currencies, and other asset classes suffering from heavy losses. During this storm, we witnessed the fragility of the market while also seeing hope for a recovery.

While the liquidity crisis presents challenges, it also reveals the inner laws of the market. Today, we take a deep look at the impact of the past several liquidity crises on the US, Nikkei and Singapore markets, and analyze how these markets have recovered from the crisis and continue to move forward. By studying historical scenarios, we can gain a better understanding of the nature of how markets work and provide valuable insights into future investment decisions.

Next, follow in our footsteps and explore together how these markets find their way forward in turbulence.

Second, historical financial crisis case analysis

US Stock Markets Financial Crisis

CASE 1:2008 FINANCIAL CRISIS

BACKGROUND OF EVENTS: ON SEPTEMBER 15, 2008, THE BANKRUPTCY OF LEHMAN BROTHERS TRIGGERED A GLOBAL LIQUIDITY CRISIS, AND MARKET PANIC WAS HIGH. U.S. STOCKS FELL SHARPLY IN THE SHORT TERM AS LIQUIDITY TIGHTENED SHARPLY.

Follow-up: U.S. stocks experienced sharp swings in the short term, but began to gradually recover in early 2009 and returned to pre-crisis levels in 2013.

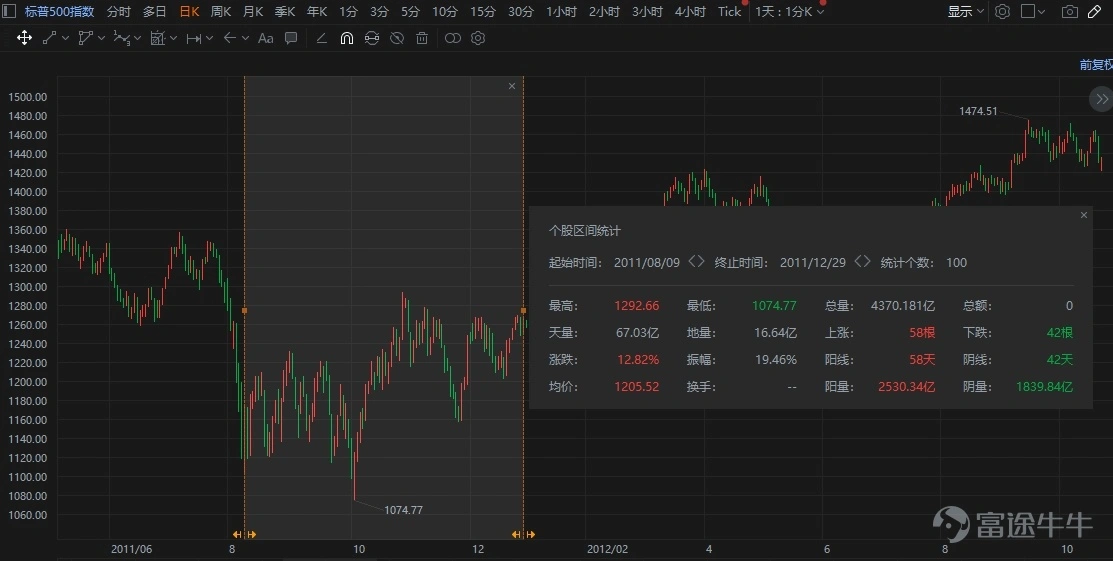

Case 2: Euro Debt Crisis and US Credit Rating Downgrades in August 2011

BACKGROUND OF EVENTS: EUROZONE DEBT CRISIS AND S&P DOWNGRADE OF US CREDIT RATING LEAD TO MARKET PANIC. The Nasdaq index fell by about 20% in late July to early August 2011. On August 8th, the Nasdaq index fell by about 6.9%.

Follow-up: The market is highly volatile, experiencing multiple falls and rebounds

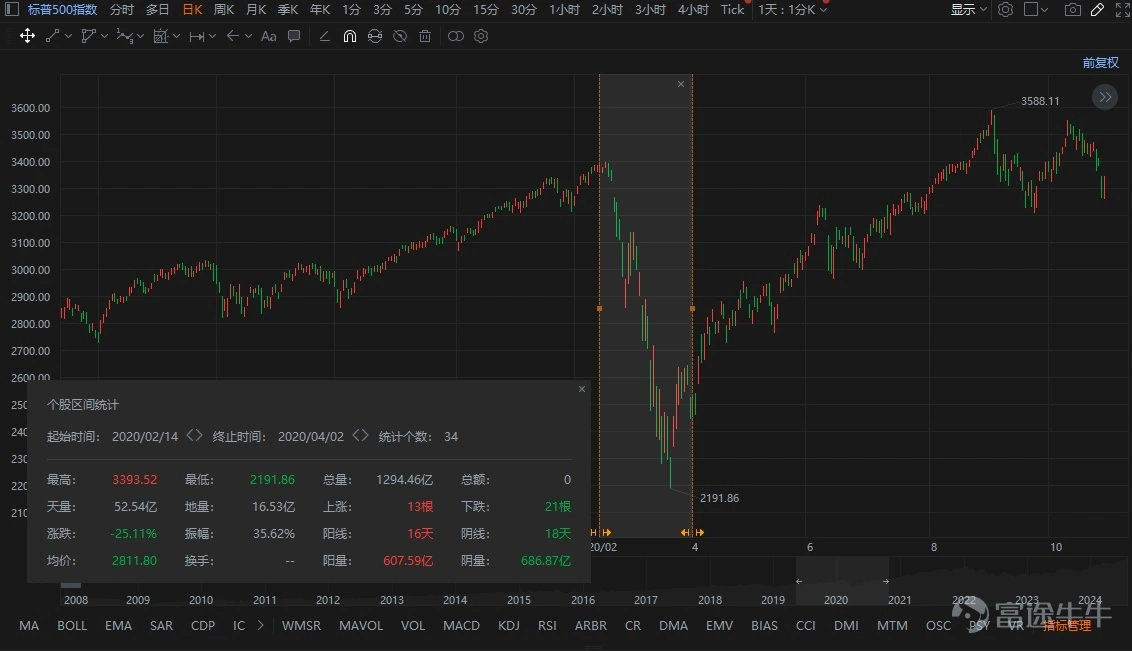

CASE 3: COVID-19 PANDEMIC IN MARCH 2020

BACKGROUND OF EVENTS: REDUCED GLOBAL ECONOMIC ACTIVITY AND MARKET PANIC TRIGGERED BY THE PANDEMIC. The Nasdaq index fell by about 30% in the month of mid-February to mid-March 2020.

Follow-up: The market continued to fluctuate strongly, but began to rebound after the close on March 23.

If the rapid decline in the short term is not due to the economic collapse, but only the short-term liquidity depletion of the market, which will continue to rise higher after the end of the period of turbulence, US stocks are expected to continue to suffer losses in the future.

Tradable products related to US stocks:

Corporate Bond ETF: $Ishares Iboxx $ Investment Grade Corporate Bond Etf(LQD.US)$

Japanese Stock Market Financial Crisis

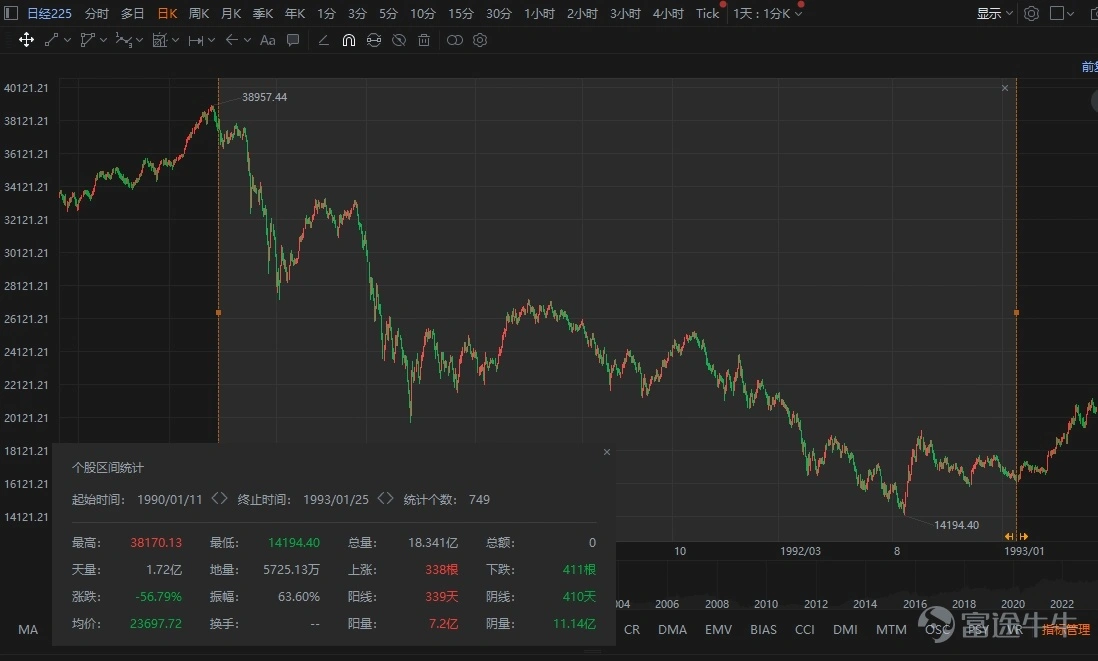

Case 1: The Japanese bubble burst in 1990

BACKGROUND OF EVENTS: IN EARLY 1990, THE JAPANESE STOCK MARKET BUBBLE BURST, CAUSING MARKET LIQUIDITY DEPLETION, AND THE JAPANESE BENCHMARK FELL IN THE SHORT TERM.

Follow-up: After that, Japanese stocks experienced a long bear market until they began to recover steadily until 2003.

CASE 2:2008 FINANCIAL CRISIS

BACKGROUND: GLOBAL FINANCIAL CRISIS TRIGGERED BY THE BANKRUPTCY OF LEHMAN BROTHERS LEADS TO MARKET PANIC AND GLOBAL STOCK MARKETS TUMBLE. From September 2008 to March 2009, the JPI fell by about 50%.

Follow-up: Starting in March 2009, the JPI gradually recovered to around 12000 pips in early 2013. During this time, the market has experienced several fluctuations, but the overall trend is gradually upward.

CASE 3:2011 FUKUSHIMA NUCLEAR ACCIDENT

BACKGROUND: ON MARCH 11, 2011, THE FUKUSHIMA NUCLEAR ACCIDENT TRIGGERED MARKET PANIC, A SHARP TIGHTENING OF LIQUIDITY, AND THE JAPANESE YEN INDEX FELL SHARPLY.

Follow-up: Over the next few months, the market gradually recovered, and by the end of 2011, the JPY rose to a range of circa 8500 to 9000 pips.

The same logic applies to Japanese stocks. Unless there is a severe economic downturn, the market will remain stable under the support of liquidity and higher if liquidity improves.

Tradable products related to Japanese stocks

Singapore Markets Financial Crisis

Case 1:1997 Asian Financial Crisis

BACKGROUND: IN 1997, THE SINGAPORE MARKET WAS HIT BY THE ASIAN FINANCIAL CRISIS, AND THE LIQUIDITY CRISIS CAUSED THE STOCK MARKET TO FALL SHARPLY.

Follow-up: After experiencing a brief period of panic selling, the Singapore stock market has regained stability over the year.

Case 2: The bursting of the Internet bubble in 2000

BACKGROUND OF EVENTS: THE INTERNET BUBBLE FORMED IN THE LATE 1990S, AND THE BUBBLE BURST IN EARLY 2000 LED TO A SHARP DECLINE IN TECHNOLOGY STOCKS AND THE OVERALL STOCK MARKET. The STI fell from a high of about 2582 points in March 2000 to a low of about 1200 in September 2002, a drop of more than 50%.

Follow-up: The market has experienced multiple rebounds and falls again, but the overall trend is to continue downwards. After reaching a low point in September 2002, the STI began to gradually recover.

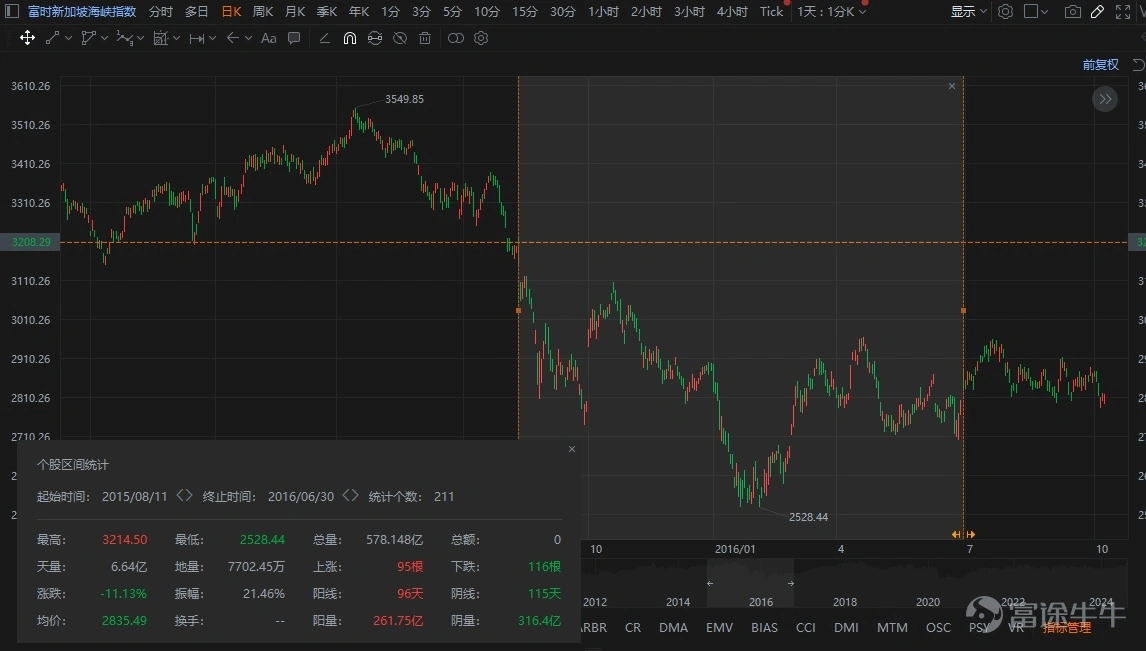

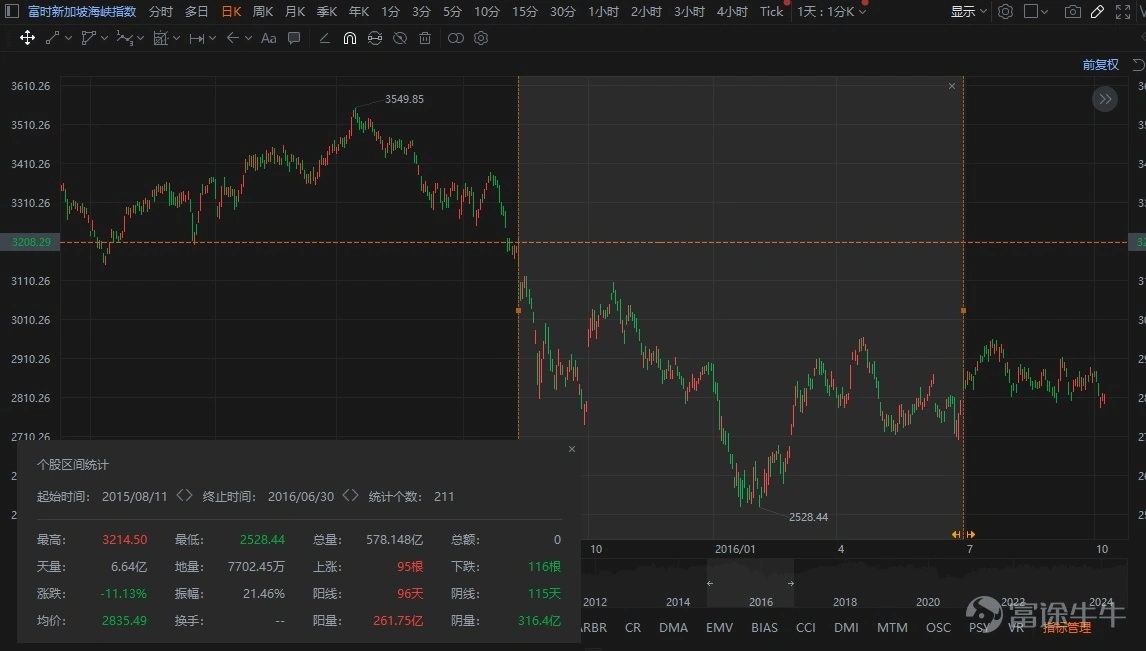

CASE 3: AUGUST 2015 CHINESE STOCK MARKET CRASH AND GLOBAL MARKET PANIC

Background of the event: The Chinese stock market crash and the depreciation of the RMB sparked global market concerns, leading to widespread market panic. STIs decreased by about 20% between August 2015 and early 2016.

Follow-up: The market continued to fluctuate between August 2015 and early 2016, with several attempts to bounce back but not for long. Starting in February 2016, the STI gradually stabilized and rebounded, and the market recovered steadily after June 2016.

In addition to the continued collapse caused by the Asian financial storm, the Singapore market will continue to rise higher after suffering the shock of the global liquidity slump.

Tradable products related to the Singapore market

ETF: $STI ETF(ES3.SG)$

Digital Currency Markets Financial Crisis

Scenario 1:2018 Crypto Market Crash

BACKGROUND OF EVENTS: IN LATE 2017 TO EARLY 2018, THE PRICE OF MAJOR CRYPTOCURRENCIES SUCH AS BITCOIN FELL SHARPLY, TRIGGERING A LIQUIDITY CRISIS.

Follow-up: Although the market was pessimistic in the short term, the cryptocurrency market gradually recovered in 2019 and welcomed a new round of bull markets in 2020.

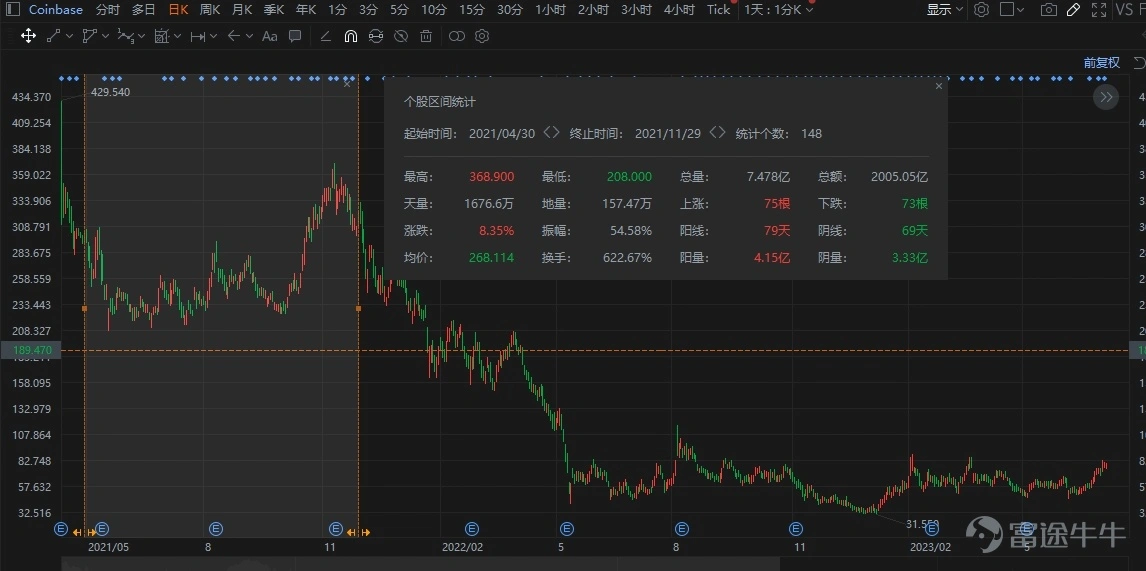

CASE 2: CHINA CRACKS DOWN ON CRYPTOCURRENCY MINING AND TRADING IN 2021

BACKGROUND OF EVENTS: FROM MAY TO JULY 2021, THE CHINESE GOVERNMENT STEPPED UP ITS CRACKDOWN ON CRYPTOCURRENCY MINING AND TRADING, WITH SEVERAL PROVINCES SHUTTING DOWN MINING SITES AND BANNING FINANCIAL INSTITUTIONS FROM PROVIDING CRYPTOCURRENCY-RELATED SERVICES.

Follow-up: The market gradually rebounded from August to November, but gains and adjustments began at the end of the year.

Scenario 3: FTX Exchange Crash in November 2022

BACKGROUND OF THE EVENT: THE LIQUIDITY CRISIS AND BANKRUPTCY OF THE FTX EXCHANGE, SPARKED WIDESPREAD MARKET CONCERNS ABOUT THE SECURITY AND LIQUIDITY OF CRYPTOCURRENCY EXCHANGES. Bitcoin fell by about 30%.

Follow-up: Although market sentiment remained subdued in the short term, the market recovered gradually in the first quarter of 2023 and continued to warm in the second quarter of 2023.

The elasticity of digital currencies will increase as digital currencies have a minimal relationship with the physical economy, accompanied by increased liquidity

Transactional products related to digital currencies:

Digital Currency: $ Bitcoin (BTC.CC) $

By reviewing the performance of the market after several liquidity crises in history, we can draw some important conclusions. First, while short-term liquidity crises can cause significant market volatility, whether in the US, Japanese equities or Singapore markets, markets are often able to recover and continue to rise for a period of time unless accompanied by severe economic downturns. In addition, central bank policy measures, changes in the macroeconomic environment, and the sentiment of market participants will have a significant impact on the speed and extent of market recovery.

In the face of liquidity crises, it is essential for investors to remain calm and rationally analyze the situation. Understanding different types of market reactions and the drivers behind them can help investors make smarter investment decisions. At the same time, using a variety of financial instruments such as ETFs, options and futures can effectively manage risk and prepare for a market recovery.

In summary, while the market may experience volatility in the short term, in the long run, investors still have the opportunity to earn good returns based on sound risk management strategies and an understanding of market fundamentals. Finding certainty in uncertainty is the charm of investing art.