- Account

- Fee Schedule

- Funding

- IPOs Subscription

- Stock Transfer

- Margin Trading

- Trading in HK Market

- Trading in US Market

- Trading in A-shares Market

- FUTU MONEY PLUS

- Futures / Futures Options

- Crypto

- Leveraged Foreign Exchange

- Trading in JP Market

- Trading in SG Market

- Position and P&L

- Regular Savings Plan

- Promotions

- Free Stocks & Coupons

- Corporate Action

- App Features

- Paper Trading

- Market Introduction

HK Stocks

About pre-opening

What is the P/E ratio and P/B ratio

Why isn't China Unicom an AH share

What is the market volatility regulation mechanism (VCM)

What is the closing auction trading period (CAS)

Quote card related

Rules for naming stock short names (HK stocks)

Why the latest price of Hong Kong stocks is not equal to the latest transaction price

Hong Kong stocks advanced overall market (SF) introduction

Whether the opening price is the first transaction of the stock-market rules

What is Hong Kong stock LV2 and the Hong Kong BMP

Market description of HK options

HKEX BMP description

US Stocks

ADRs

Options

Funds

Futures

Japanese Stocks

Singapore Stocks

Malaysian Stocks

Stock Connect

Index

- Getting started

- Technical analysis

- Algo Trading

- Open API

- Anti-Fraud

- Contact Us

What is Hong Kong stock LV2 and the Hong Kong BMP

The specific functional advantages of Lv2 include the following four points:

2. Transaction records one by one

3. Buy and sell ten quotations

For details, please see the following.

1. Instant price

In the basic quotation, latest prices of Hong Kong stocks need to be refreshed manually.

And LV2 pushes the price instantly, what you see is the latest, no need to refresh manually. However, this does not mean that you can buy or sell at the same price. The specific reason will be mentioned in the tenth position of the order.

2. Transaction records one by one

After LV2 is opened, real-time quotes will show transaction information, including three types of information.

The first column-transaction time;

The second column-transaction price;

The third column-trading volume (unit: share), such as 11k, which represents 11,000 shares.

In addition, there are some special symbols to understand.

↑——External disk, actively buy stocks at a price of one or higher;

↓——In the internal market, actively sell stocks at a price of one or lower;

◆——Neutral order, which is matched between the bid price and the sell price.

The meaning of other symbols can be understood by poking a question mark in Futu App.

Then you may have to ask what is the use of this information on a transaction by transaction?

How the main trading techniques can generally be expressed in trading volume:

The heavy volume at the bottom is a sign that the quotation is about to rise, and the heavy volume at the top indicates that the quotation is about to call back;

In the process of rising, heavy volume indicates that there is still room for growth, while falling volume indicates that it has not been adjusted in place;

Rising and shrinking volume indicates insufficient momentum, and there may be a callback at any time, and falling shrinking volume indicates insufficient falling momentum.

These can be easily observed from the daily trading volume, and the changes in the daily trading volume can better reveal the intention of the dealer!

In terms of trading volume, if it is a continuous ↑, it means that the willingness to buy is strong and the stock price is showing an upward trend; if it is a continuous ↓, it means that the willingness to sell is strong and the stock price is showing a downward trend.

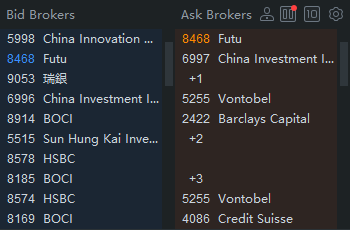

3. Buy and sell ten quotes

The first column-buy order number;

Column 2-bid price;

The third column-the amount of pending orders (unit: share);

Column 4-Number of brokers (the part in brackets)

The common basic quotation shows only the transaction price, and placing an order based on the transaction price may not necessarily succeed in the transaction. The reason is that the conclusion of the transaction is based on the order matching mechanism. When the price of one buy and one sell are the same, the matching is successful and the transaction price (current price) is formed.

At the same price, the first order is placed in the front row, and the order is executed in order. This is also the reason why sometimes the order will not be successful.

Therefore, according to the ten levels of the order, accurate bids can be made. If you want to buy or sell stocks as soon as possible, you need to increase or decrease the quotation based on ten price levels.

Through ten levels of the buying and selling order, you can see the quotations and pending orders of both buyers and sellers, and you can also judge the trend of future stock prices. The size of the pending order will play a role in resistance or support.

If there are a large number of pending orders on Sell 4, then Sell 4 is a resistance level, and the stock price will rise only if all the orders for Sell 4 are taken in. In addition, a large number of buying (selling) orders have appeared continuously, indicating a trend of ups (downs) in a short period of time.

4. Trading Broker

The proportion of the current pending order volume will also be displayed in the ten orders of the order. As shown in Figure 4, the current buying orders are more than selling orders, and the stock price has an upward trend.

Finally, talk about order brokers. Hong Kong stocks are special, not only showing the broker code, but also the name of the broker.

The brokers with a buy order of -1 or more are in the buy position; the brokers with a sell order of +1 or more are in the sell position, and so on.

Buy one: Credit Suisse

Buy two: Credit Suisse, Huixin

Sell one: Credit Suisse, Morgan Stanley, Futu Securities, Futu Securities, Tianhua, Credit Suisse, HSBC Securities

From the broker queue of the order, you can roughly judge the position of your pending order.

In addition, for some stocks or warrants, there are only one or two order brokers, and they are still in the same family, so they may encounter the situation of controlling orders and need to be extra careful.