Technical Analysis - From Getting Started to Trading

RSI Indicator: Evaluate Multi-Empty Strength, Predict Price Reversal

What does RSI mean?

The RSI indicator, also known as the Relative Weakness Index, is a highly useful technical analysis indicator primarily used to assess overbought and oversold.

The RSI indicator calculates the ratio of the cumulative rise and fall in the price of a security over a period of time to measure the relative weakness of price movements.

The RSI indicator fluctuates between 0~100 up and down. Generally, RSI>70, the market is overbought; RSI<30, the market is oversold.

Investors can judge market trends and identify potential reversal times by observing the relationship between RSI indicators and price movements.

Parameters and calculation methods of the RSI indicator

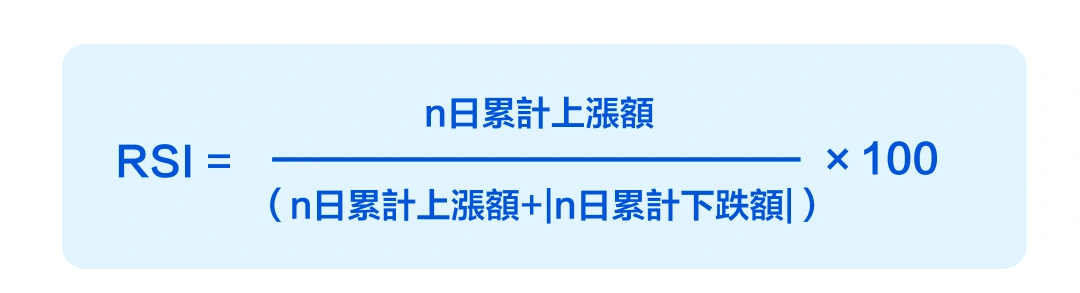

The RSI indicator has many different calculation methods, for ease of understanding, we can refer to this formula below.

RSI = n day cumulative increase/(n day cumulative increase +|n day cumulative decrease |) ×100

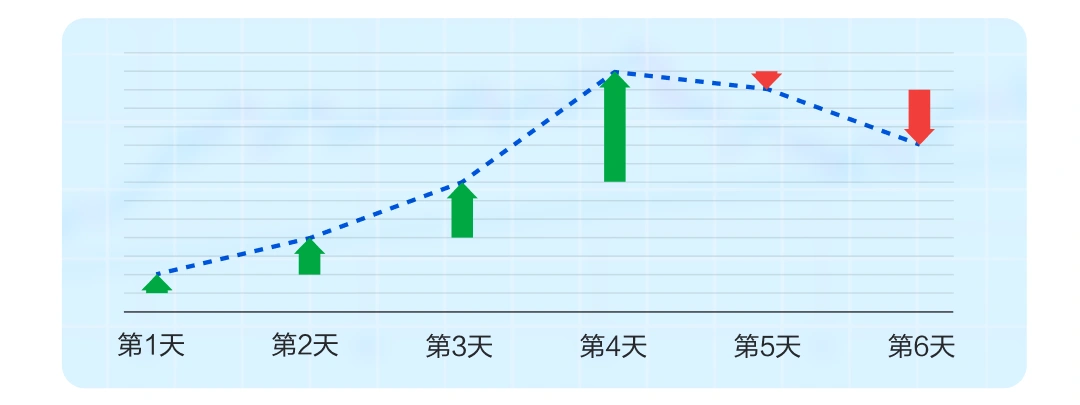

For example, let's say stock A rose $1, $2, $3, and $6 on the previous 4 days, and fell by $1 and $3 on days 5 and 6, respectively.

Based on the above data, the cumulative increase is 1+2+3+6=12 (USD) and the cumulative decrease is 1+3=4 (USD), so RSI=12÷ (12+4) ×100=75.

Simply put, RSI=75 means that the cumulative increase in share price over a period of time accounts for 75% of the total increase and fall (absolute value).

The parameter of the RSI indicator is usually set to 14 days.

Key Points of the RSI Indicator

Buy and sell points

If the RSI is overbought (>70), the potential sell point appears when it returns to the 70 overbought breakline; if the RSI is oversold (<30), the potential buy point appears when it returns to the 30 oversold boundary line.

Resistance and Support

In an uptrend, the RSI mainly stays above 40, the 40-50 zone can serve as a potential support level; in a downtrend, the RSI mainly stays below 60, and the 50-60 zone can serve as a potential resistance level.

Turn off the signal

Backwardation means that when the price makes a new high or new low, the RSI indicator does not move up or down synchronously, indicating that price movements may reverse and investors may seek buying and selling opportunities.

Failed swing

“Failure Fluctuation” is a special form of RSI indicator that can be used to predict market reversals. Failure swings are divided into bullish and bearish forms, with four steps.

Bullish Failure Fluctuation

RSI falls below 30 (oversold);

RSI rebounds to above 30;

The RSI has bounced back but remains above 30;

The RSI rises above the previous high.

Bearish Failure Swinging

RSI rises above 70 (overbought);

The RSI fell to below 70;

RSI rebounds but remains below 70;

The RSI fell below the previous low.

What does RSI look like?

RSI Case 1

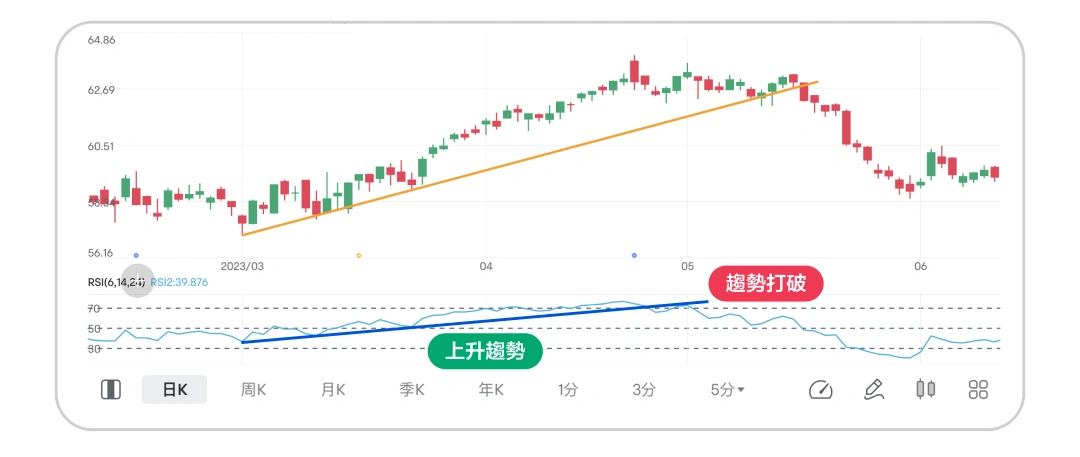

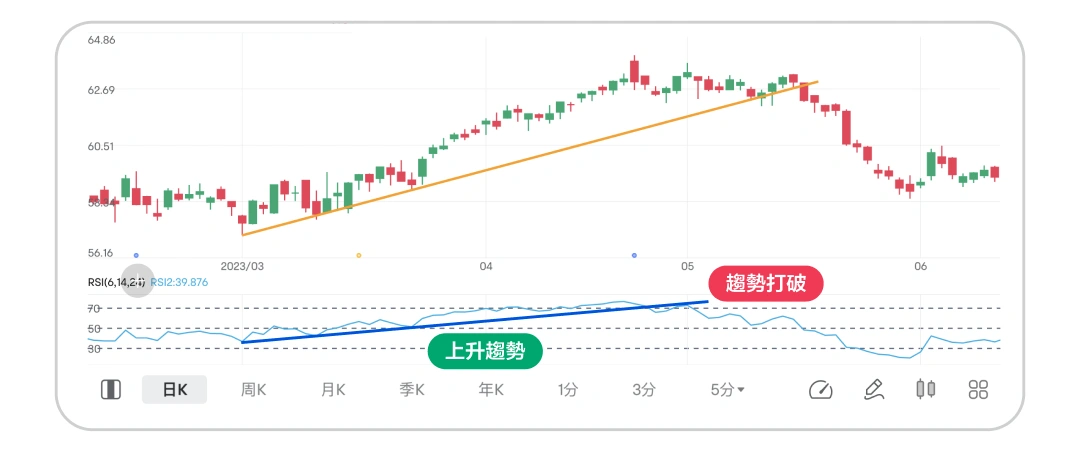

Use RSI indicators to confirm market trends and predict market reversals.

Since the RSI is calculated based on the closing price, it can be analyzed using trend lines.

Figure 1 shows that when the stock price shows an uptrend at the same time as the RSI indicator, investors may judge that the upside is sustainable. However, when the rise of the RSI indicator is broken, it may indicate that the stock price will face an adjustment, which is a potential stock reversal signal.

RSI Case 2

Use the backwardness of the RSI indicator to determine potential trade reversals.

Figure 2 shows that the RSI indicator is lagging behind the stock price movement.

When the stock price breaks new lows, the RSI indicator shows an upward momentum, which is a common bottom-back signal indicating that the stock price may reverse upward in the short term.

RSI Case 3

Capture potential trading opportunities with the “Failure Fluctuation” feature of the RSI indicator.

“Failure Fluctuation” is a special form of RSI indicator that can be used to predict the timing of potential market reversals. It should be noted that the failed swing only focuses on the movement of the RSI itself and is not affected by price movements.

Figure 3 shows the bullish failure swing of the RSI, which consists of four steps: 1. RSI falls below 30 (oversold); 2. RSI rebounds to above 30; 3. The RSI has bounced back but remains above 30; 4. The RSI breaks through the previous high, unleashing a potential buy signal.

RSI Overview

The RSI indicator is a very useful momentum swing indicator primarily used to assess overbought and oversold.

Similar to other momentum swing indicators, overbought and oversold signals released by RSI indicators tend to be more effective in turbulent markets.

In general, the overbought and oversold threshold of the RSI indicator is 70 and 30, respectively. However, for some assets with relatively low volatility, the reference range can be appropriately shrunk.

It should be noted that overbuying and overselling is a warning signal and does not mean that price reversals are bound to occur. In real combat, RSI indicators should be used in conjunction with other technical analysis tools to achieve better results.

This content discusses technical analysis, and other approaches, including fundamental analysis, may provide different perspectives. The examples provided are for illustrative purposes only and do not reflect the expected results. All investments involve risk, including the potential loss of principal, which cannot guarantee the success of any investment strategy.