Technical Analysis - From Getting Started to Trading

ATR Indicator: Check price movements, set stop profit and loss

What is the ATR indicator?

The ATR indicator, also called the Average True Range, is a technical analysis indicator used to assess market volatility.

When a bullish gap appears, it causes a “distortion” of the traditional diameter calculation of the volatility, but the ATR indicator is able to overcome this flaw and more truthfully reflect price volatility.

Simply put, the ATR indicator measures volatility in absolute values. For example, showing ATR=$2 on the daily chart represents an average daily fluctuation of $2 per day over the past time.

With ATR indicators, investors can roughly understand the potential range of price volatility on a daily basis, helping to better formulate a stop-loss strategy.

Parameters and calculation methods of ATR indicators

The calculation method for ATR indicators is simple, and the key is to understand the important concept of “true volatility”. True volatility requires a comparison of three prices, which is the maximum of the following three:

Highest prices in Japan - Lowest prices in Japan

| Highest price in Japan - Yesterday's closing price |

| LOWEST PRICE IN JAPAN - YESTERDAY'S CLOSING PRICE |

(Note: The latter two formulas take absolute values because the ATR indicator does not take into account the upward and downward direction of the price.)

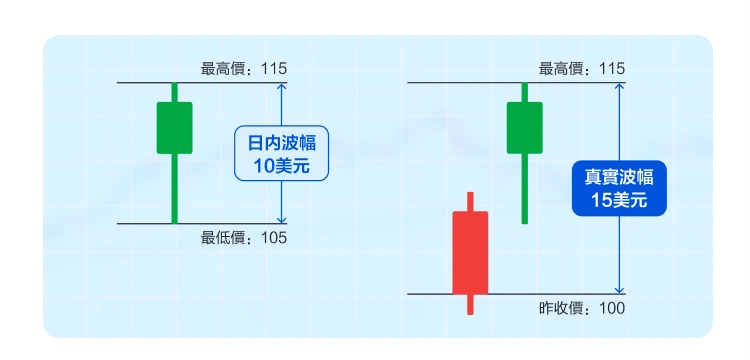

For example, let's say A stock closed yesterday at $100, the next day the stock price jumped high, opening at $110, and the daily highs and lows were $115 and $105, respectively. Based on the above data, the daily volatility on the A stock's traditional mouthpiece is $115-105=$10, but considering that there is a gaping gap, the real volatility should be calculated based on yesterday's closing price, i.e. $115-100=$15.

Once the definition of true volatility is clarified, the ATR indicator is easy to calculate. The ATR indicator is actually the moving average of the real volatility data, the time parameter is generally set to 14 days.

Key Points of ATR Indicator

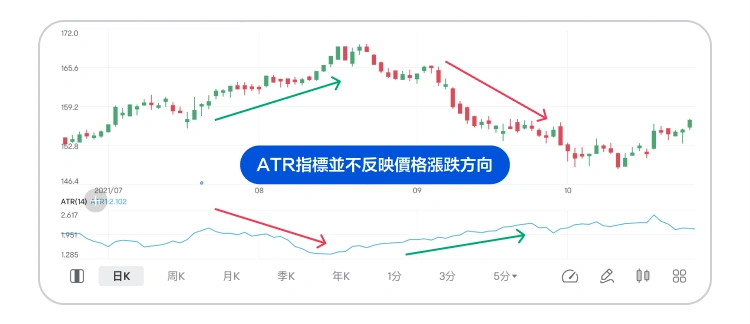

Unlike many mainstream technical analysis indicators, the ATR indicator does not reflect the upward and downward direction of the stock price. The ATR indicator is simply used to measure volatility and is calculated using absolute values.

A rise in the ATR indicator indicates that the volatility of recent transactions is greater, the potential for price increases and losses, and the range of stop and loss can be widened appropriately. On the contrary, the ATR indicator is falling, indicating that the volatility of recent transactions has been reduced, the potential for price gains is smaller, and the range for profit and loss can be appropriately narrowed.

Higher ATR

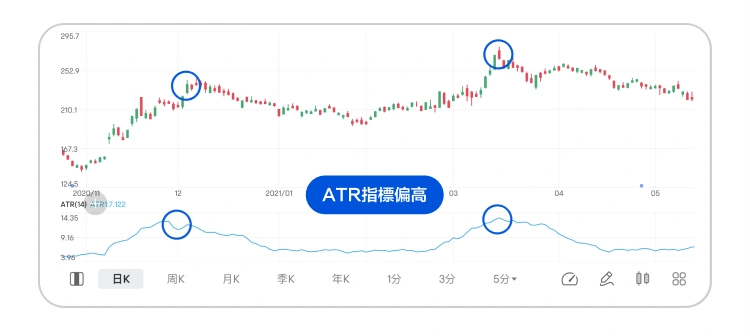

The ATR indicator is high, usually due to a sharp rise in the stock, but this sharp fluctuation often does not last very long and can therefore be a potential signal for a reversal of the market.

ATR indicator is lower

The ATR indicator is lower and usually occurs during the cross settlement phase with lower volatility in the market, in which case investors may have the opportunity to trade in a range.

ATR case analysis

Set up potential offsite locations

Simply put, the ATR indicator represents the potential range of daily volatility in asset prices.

Based on the nature of the ATR indicator, some short line traders, such as intraday traders in the forex market, may use the ATR indicator to set the appropriate stop and stop loss position.

Assume the intraday ATR value of a currency pair is 80 basis points (1 basis point equals 0.01 percentage point). In other words, its exchange rate has fluctuated 80 basis points per day on average over the past 14 days.

With this in mind, traders may consider setting their target profit at around 80 basis points, i.e. 1x ATR value, as trading volatility of 1x ATR value is relatively easy to achieve.

On the other hand, traders may also consider setting the stop loss range to 80 basis points as well.

Develop a stop-loss strategy

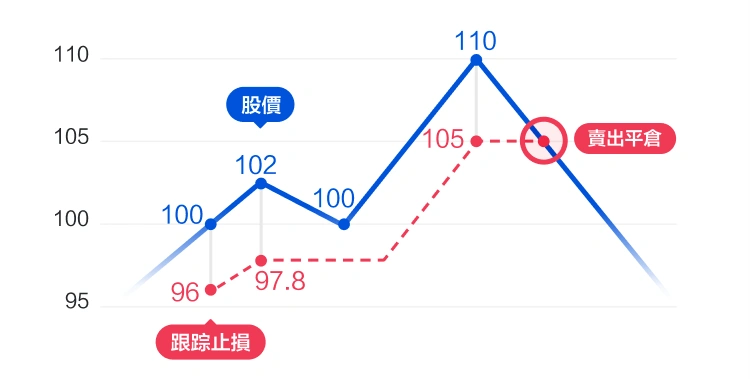

Tracking stop loss is a risk management strategy that adjusts the closing price according to market changes and helps investors to target some of the potential gains.

Tracking stop loss strategies set by ATR indicators are more flexible than tracking stop losses at fixed amounts or fixed percentages because they take market volatility into account.

Investors can multiply the ATR indicator by a numeric value (for example, multiplied by 2) to track the stop-loss price.

For example, suppose an investor buys a stock at $100, and the intraday ATR indicator is $2 at the time of purchase. So, the initial stop loss price for this trade can be set at 100 - 2×2 = 96 (USD).

If the share price rises to $102 and the ATR indicator also rises to $2.1, the tracking stop loss position will rise accordingly to 102 - 2.1×2 = 97.8 (USD).

If the share price rises further to $110 and the ATR indicator becomes $2.5, the stop loss position is tracked to 110 - 2.5×2 = 105 (USD).

If the stock price continues to rise, the tracking stop loss position will also rise accordingly, and the investor can continue to hold the position; the trade will close until the stock price falls below the tracking stop loss point.

ATR Overview

The ATR indicator is a very useful technical analysis indicator that helps investors keep a close eye on price volatility and thus develop a more rational trading strategy.

It should be noted that the ATR indicator does not reflect the upward and downward direction of the price, nor can it release potential trading signals separately.

In addition, the ATR indicator is a lagging indicator, which may not be able to reflect the potential range of movements in a timely manner due to sharp market movements.

In real life, investors should combine ATR indicators with other technical analysis tools to achieve better trading results.

This content discusses technical analysis, and other approaches, including fundamental analysis, may provide different perspectives. The examples provided are for illustrative purposes only and do not reflect the expected results. All investments involve risk, including the potential loss of principal, which cannot guarantee the success of any investment strategy.