Futu Research | When will Alibaba's share price surge?

Alibaba ( $Alibaba(BABA.US)$& $BABA-SW(09988.HK)$) Announcing FY24Q4 (natural quarter 24Q1) results on May 15, the company's revenue grew 7% year-on-year, operating profit decreased 3% year-on-year, net profit decreased 96% year-on-year, and adjusted net profit decreased 11% year-on-year, short of market expectations. After the release of company results, US stocksAlibaba Stock PriceIt was the first to react, closing down more than 6%.

Directory:

1. Why has Alibaba's profit dropped so noticeably?

2. How are the core business and other businesses performing competitively?

3. Alibaba has been outpacing other internet companies in this round of Hong Kong stocks, so when will Alibaba's share price rise?

1. Why did Alibaba's profits fall so noticeably?

Out-of-day profitability slipped and losses widened sharply in the international business and poultry business, a major reason for the company's adjusted net profit falling 11% year-on-year.

Let's take a look at Ali's business structure first.

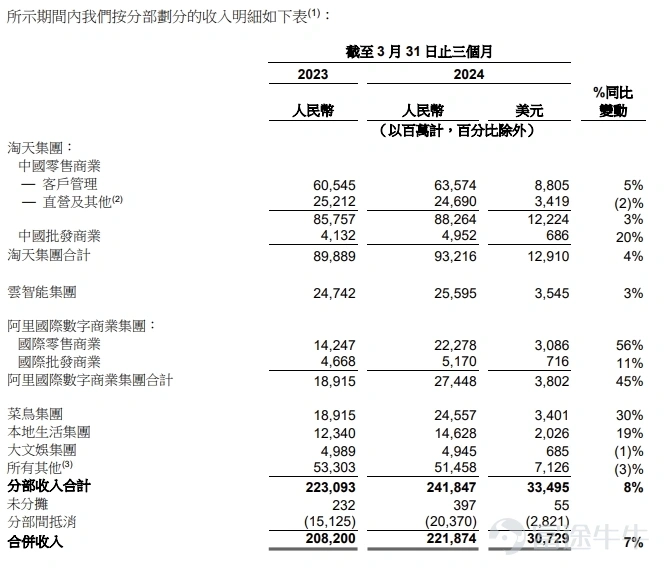

At the core of the Natutian Group, Ali's revenue is the primary source of revenue and profit, with revenue growth of 4% year-on-year in the quarter. Cloud Intelligence Group, Cannibal Group and International Business Group are at a mid-level revenue contribution, with revenue growth of 3%, 30% and 45% in the quarter, respectively. Finally, local life and entertainment groups, which contribute relatively little revenue. Driven by the rapid growth of its international business and its poultry business, the company's total revenue grew by 7% year-on-year.

Chart: Corporate Segment Revenue

Source: Company's official website

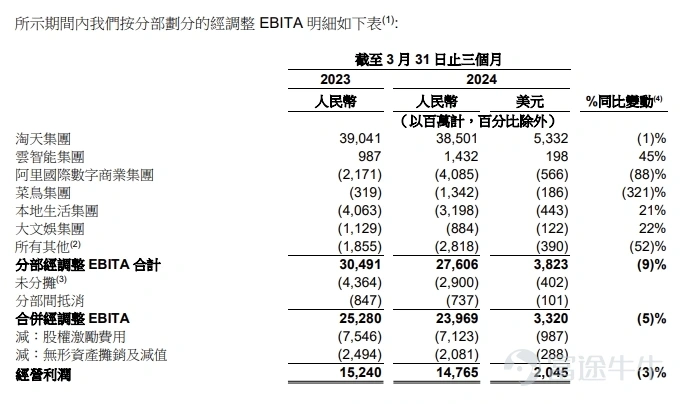

For a long time, the company's model has been based on profit taking profits and donating blood to other businesses. HOWEVER, JUDGING BY THE RESULTS FOR THE QUARTER, TAOTIAN GROUP, WHICH HAS BEEN “MAKING BLOOD”, ADJUSTED EBITA SLIPPED 1% YEAR-ON-YEAR. Among the other “transfused” businesses, only the cloud intelligence business achieved positive operating profit growth, the Bird Group and the International Business Group grew slightly, with losses widening further by 321% and 88%, respectively, and local life and entertainment losses narrowed.

Chart: Adjusted EBITA for Company Divisions

Source: Futu Research

In other words, the core business of Ali showed no improvement in its bloodmaking capacity in 2024Q1, and other businesses in addition to the cloud intelligence business are experiencing losses or even widening losses, which is the main reason for the company's profitability.

In addition, FY24Q4, the company's investment income was a loss of RMB57.02 billion and a net income of RMB104.96 billion for the same period in the year 23, mainly due to a significant net loss due to the change in market capitalization of the shares of listed companies held by the company in the quarter. The significant increase in these investment losses resulted in a 96% year-on-year decline in the company's net profit.

So, does the decline in company profitability indicate that the company's various businesses no longer have a competitive advantage? Let's take a look at Ali's specific business performance.

2. How is the core business and other business performance competitive?

1. Natutian Group's GMV grew in double digits, but currency rate slipped markedly

FY24Q4 Natutian Group and order volume achieved double-digit year-on-year growth, mainly benefiting from the company's increased promotions and incentives, increased price advantage, and a marked increase in the number of buyers and frequency of purchases. Of these, 88VIP membership grew by more than 3 million year-on-year in the quarter.

But the high growth of GMV did not generate the same high growth in customer management revenue. The Company's Customer Management Revenue (CMR) grew by only 5% year on year, indicating a marked decline in the monetization rate, which is expected mainly to be an increase in Taobao GMV, which has a low currency rate. The company swapped in price, causing Natutian Group's adjusted EBITA to decline by 1% year-on-year.

Due to the fact that the Chinese e-commerce market is basically at the top, major e-commerce companies compete fiercely, almost all of them in a “price war” manner. The “price war” may be effective for GMV growth, but once the company fails to break out of the vortex of the “price war”, it does enormous damage to profits.

Given that competition in China's e-commerce sector is difficult to ease in the short term, it is expected that Natutian Group's profitability will continue to be under pressure and will need to continue to focus on improving its performance. A double increase in GMV and monetization rates can achieve high-quality growth.

2. Cloud intelligence business is experiencing significant AI-driven growth, and other businesses such as international business still need to wait for a profitable corner

FY24Q4 Cloud Intelligence business revenue grew 3% year-on-year to $25.95 billion, with adjusted EBITA up 45% year-on-year, leading all business units. THE RAPID INCREASE IN CLOUD INTELLIGENCE BUSINESS PROFITABILITY IS MAINLY DUE TO: 1) HIGH-QUALITY REVENUE GROWTH IN CORE PUBLIC CLOUD PRODUCTS (INCLUDING FLEXIBLE COMPUTING, DATABASES, AI PRODUCTS, ETC.), AND AI-RELATED REVENUES ACHIEVED THREE-DIGIT YEAR-ON-YEAR GROWTH IN THE QUARTER. 2) At the same time, the company gradually reduces the income from project-type contracts with lower margins. 3) The effect of scale brings cost advantages, and companies have the ability to reduce the price of public cloud products, thereby increasing market competitiveness.

IT IS EXPECTED THAT AS AI DEMAND CONTINUES TO GROW, THE COMPANY'S CLOUD INTELLIGENCE BUSINESS IS EXPECTED TO BECOME MORE CIRCULAR AND PROFITABILITY IS EXPECTED TO BE FURTHER RELEASED. It is worth noting that the domestic cloud computing business is relatively competitive, and at present, Alibaba still retains the first market share, but has not trailed much later. Stabilizing the market position and increasing profitability are challenges that companies need to continuously address.

Both the international business and the poultry business continue to grow and are expected to be difficult to make a profit in the short term. The International Business Group and the Bird Group both achieved rapid growth, but losses in both businesses widened significantly as the company continued to expand its infrastructure, including supply chain and distribution capabilities, as well as its competitive advantage in terms of price. At present, the company continues to increase its investment in its international business and its poultry (including express) business, and earnings growth is expected to be driven by revenue growth in the short term, and profit margins have not yet been seen.

In addition to the Natutian Group, other segments of the group need to reduce losses and achieve profitability as much as possible in order to help the company continue to increase profitability. The complex corporate business structure tests the performance of the management. If the management is underperforming and the low-value business cannot be eliminated, the profitability of the company remains a huge drag on the company's profitability.

3. When exactly can Alibaba's share price rise?

We repeatedly mentioned in a previous article that the value of a company's investment depends on EPS growth and shareholder returns.

ALI'S SHAREHOLDER RETURNS ARE VERY ATTRACTIVE AT CURRENT MARKET CAPITALIZATION LEVELS. ALI REPURCHASED A TOTAL OF US$125 BILLION IN FY24, WHILE ALI ANNOUNCED A ONE-TIME SPECIAL CASH DIVIDEND, A DIVIDEND OF US$40 BILLION IN FY24, RETURNING $165 BILLION TO SHAREHOLDERS FOR THE YEAR. Based on the current U.S. stock market capitalization of $1935 billion, shareholder returns of 8.5% in FY24 are very attractive.

In addition, the company still has $290 billion in repurchases left unused to safeguard future shareholder returns.

But the problem now is that Ali's EPS growth uncertainty is high, mainly for the following reasons:

1) THE E-COMMERCE COMPETITION WORSENS, ALI FACES NOT ONLY TRADITIONAL ECOMMERCE RIVALS IN KYOTO AND MANY OTHERS, BUT ALSO THE IMPACT OF SHORT VIDEO E-COMMERCE SUCH AS JITONG, THE INDUSTRY ENTERS A PRICE WAR, AND THE PROFITABILITY OF ITS CORE BUSINESS HAS SLIPPED, AND THE TREND HAS NOT YET SEEN IMPROVEMENT.

2) The cloud intelligence business is not yet in the climate, and other businesses are also facing losses, and the profit corner is not visible in the short term.

Overall, we can make different case assumptions about Ali to determine investment strategies:

Case 1: The competitive landscape is stable, the GMV and the monetization rate of the outturn business have increased twice, other business segments are excluded from low-value businesses, significant losses, and the company's profitability is improved. At this time, the company's share price is undervalued and there will be more room for growth. Investors are advised to buy a call or a positive stock.

Situation 2: Competition continues to be intense, profits will not fall and be able to maintain current levels. Backed by 8.5% shareholder returns, the company's share price is in the current price shock. Investors are advised to adopt a sell put strategy and investors holding positive shares adopt a covercall strategy.

Case 3: Worsening competition, prolonged price battles significantly erode company profits, and failure to strip out low-value businesses, leading to further widening losses and a marked decline in company profitability. Then the company's share price will also fall, so investors are advised to buy a put.

How to Buy Stocks

Before investing (buying and selling) stocks, you first need to open a securities (stocks) account. Just like depositing money in a bank, you need to open a bank account first.

>> Futu Securities Hong Kong Stock Exchange is free for one day! GET FREE LV1 EXPERIENCE, OPEN IT NOW AND ENJOY IT WITH YOUR WALLETMosquitoesWelcome Rewards

Securities (Stock) Account Opening Process

Step 1: Head over to the Futubull network and sign up for a new account.(Register now)

Step 2: Open a securities account on the basis of the Futu account.(Open account now)

Step 3: Fill in your personal and financial details (includingBank Code and Account Number), and then deposit funds via EdDA Quick Deposit, Fast Transfer (FPS), Bank Transfer.(Invest immediately)

Step 4: Download the Futubull Customer Portal and log in.(Download now)