Help Center Market Introduction US Stocks Why stock prices in the pre-market different from other platforms

- Account

- Fee Schedule

- Funding

- IPOs Subscription

- Stock Transfer

- Margin Trading

- Trading in HK Market

- Trading in US Market

- Trading in A-shares Market

- FUTU MONEY PLUS

- Futures / Futures Options

- Crypto

- Leveraged Foreign Exchange

- Trading in JP Market

- Trading in SG Market

- Position and P&L

- Regular Savings Plan

- Promotions

- Free Stocks & Coupons

- Corporate Action

- App Features

- Paper Trading

- Market Introduction

- Getting started

- Technical analysis

- Algo Trading

- Open API

- Anti-Fraud

- Contact Us

Why stock prices in the pre-market different from other platforms

1. Data sources: The pre-market prices of free users based on Nasdaq Basic LV1 data. Users can get complete extended market data by paying to upgrade to National LV1 data.

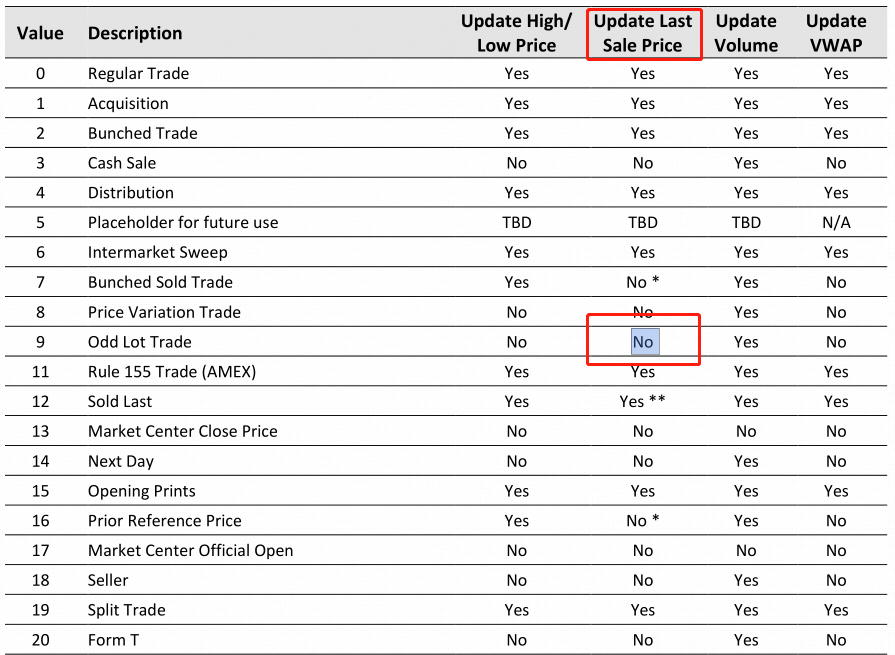

2. Odd lots: Round lots are defined by the exchanges and generally refer to quotes to buy or sell 100 shares of a given security or a larger number of shares divisible by 100. Odd lots, or orders for fewer than 100 shares, are not included in the NBBO and are not currently distributed by the SIPs.

Investment Course

Choose stocks based on financial reports

Quickly master financial season learning guidelines

When the financial season comes, company stock prices are the most likely to rise and fall, and many excellent investors will see the financial season as a good

In 【2024.11】, surged more than 0.04 million times, achieving the title of stock god Buffett! How do you view Berkshire's performance?

When it comes to legendary figures in the investment world, the name of Warren Buffett, the helm of Berkshire Hathaway, is definitely unavoidable. $Berkshire Ha

【November 2024】Has disney's predicament turned around? Pay attention to these 3 performance signals.

As the entertainment kingdom for nearly a century, Disney's status in Hollywood has gained prominence. Over 60 years of listing on the U.S. stock market, Disney