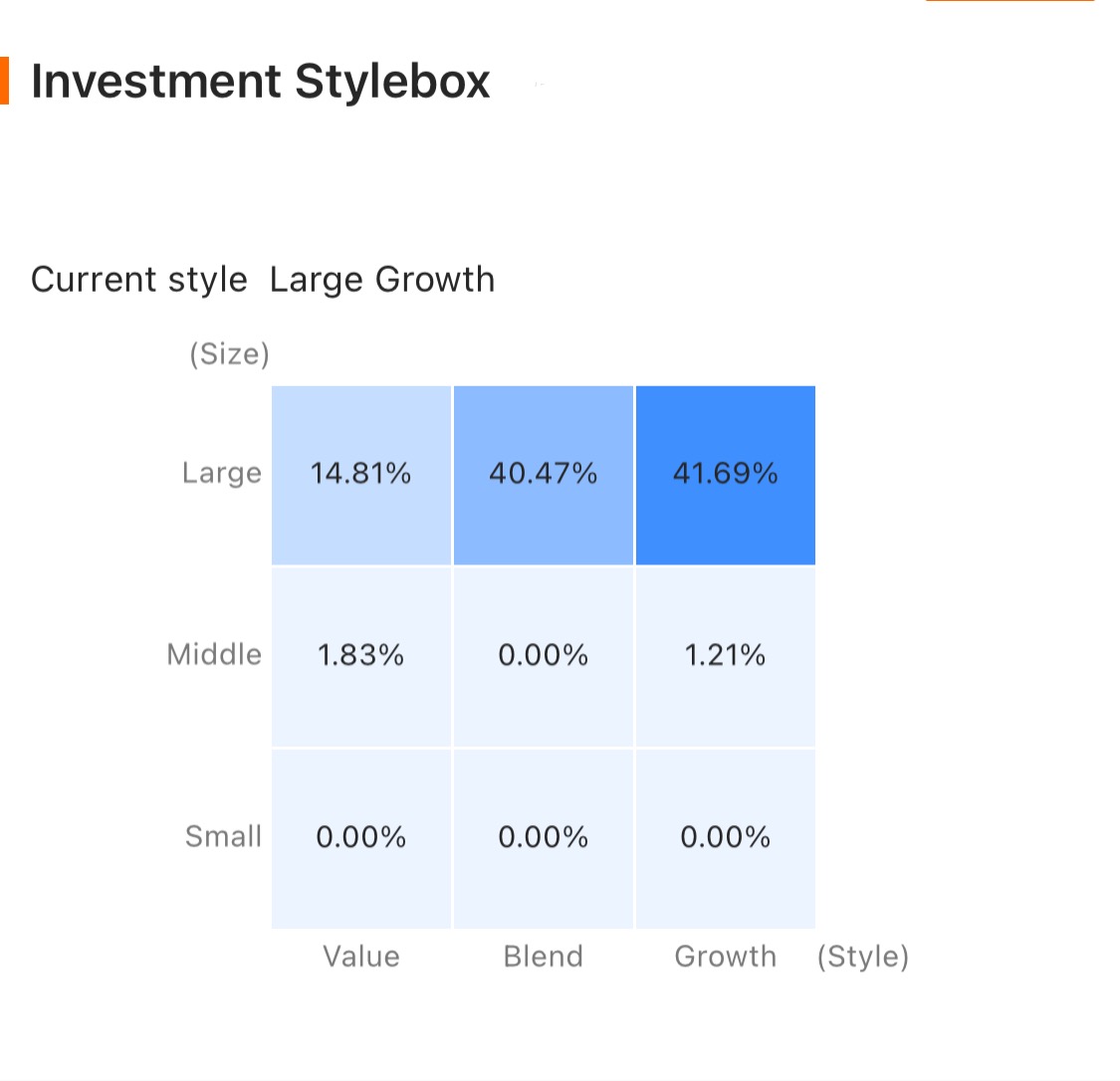

Investment style box description

1. Overview

Morningstar investment style box method (Morningstar Style Box) was founded in 1992 to help investors analyze the investment style of the fund, which is quickly recognized by institutional investors and individual investors. Different investment styles often form different levels of risk and return, so it is very important for investors to understand and examine the investment style of their assets. Under this premise, the Morningstar investment style box arises at the historic moment, which provides an intuitive and simple analysis tool to help investors optimize the investment group and monitor the portfolio.

In this method, two factors that affect the performance of the fund are listed separately: the scale and style of the stocks invested by the fund. Based on the market value of the stocks held by the fund, Morningstar defines the scale style of the fund to invest in stocks as large, medium and small, and based on the value-growth characteristics of the stocks held by the fund. the value-growth style of fund investment stocks is defined as value type, balance type and growth type.

As shown in the picture, the Morningstar investment style box is a square, divided into nine grids. The vertical axis depicts the size of the market capitalization of stocks, which is divided into large, medium and small stocks. The horizontal axis describes the value-growth orientation of stocks, which can be divided into value type, balance type and growth type. The fund investment style shown in the chart is "market value type". The investment style box simply and intuitively shows the asset allocation style of the fund, and for the first time, investors can evaluate the fund according to the investment portfolio of the fund rather than according to the name of the fund or the description of the marketer. This method is the basis of Morningstar's style classification of funds, and provides an industry standard for fund classification and tracking of fund portfolios.

In March 2002, Morning Star improved the original investment style box method and launched a new Morning Star investment style box (New Morningstar Style Box). The old method uses the median market value of the basic stock to analyze the size of the fund shareholding, while the positioning of the value-growth coordinate is based on the ratio of return to price and the ratio of net asset to price. The new method uses the "10 factor analysis" method to measure the value-growth orientation of the stock, including 5 factor analysis value scores and 5 factor analysis growth scores. When measuring the scale of stock market value, a more flexible division method is adopted to replace the median market value to define the large, medium and small market. Among them, the value score of the stock reflects the comprehensive consideration of the expected income, net assets, income, cash flow and dividends of the listed company, and is willing to pay the price per share. The growth score reflects the growth of listed companies, including income, net assets, income and cash flow. The weight distribution is detailed in Table 1.

2. Pre-requisite

Premise 1: the size of the stock, that is, the dividing point of the large, medium and small market stocks, varies with the change of the market value of the stock. It should be emphasized that there may be two reasons for the change in the style of the stock: one is that the fundamentals of the stock have changed. Second, because the market value of the stock will change every month, the "scoring set" of the stock will also change.

3. Stock scale classification

For domestic A-share listed companies, we divide their shares into three categories according to the total market value: large market, middle market and small market. The specific classification criteria are as follows: the stocks are arranged in descending order according to their total market value, and the corresponding cumulative market value of each stock is calculated as a percentage of the total market value of all stocks Cum-Ratio, and 0 < Cum-Ratio ≤ 100%.

3.1 large-cap stocks: stocks whose cumulative market capitalization percentage is less than or equal to 70 per cent, that is, Cum-Ratio ≤ 70 per cent.

3.2 medium stock: stocks whose cumulative market value percentage is between 70% and 90%, that is, 70% < Cum-Ratio ≤ 90%.

3.3 small-cap stocks: stocks with a cumulative market value of more than 90 per cent, that is, to meet Cum-Ratio > 90 per cent. On the basis of completing the scale classification, the large market, the middle market and the small market are regarded as a "scoring set" respectively, and the value score and growth score of the stock are measured.

4. Measure the score of stock value

The value score of the stock reflects the comprehensive consideration of the expected income, net assets, income, cash flow and dividends of the listed company and the price situation that investors are willing to pay for each share of the stock. The value score mainly takes into account five factors: the expected earnings per share, the expected net assets per share, the expected main business income per share, the expected net cash flow per share and the expected cash dividend per share. For a specific scale classification, that is, large market, middle market, small market stocks, Morning Star calculates the value scores of each stock.

4.1 for each stock, five expected indicators (E1 / p, b1 / p, R1 / p, C1 / p and D1 / p),) are calculated as shown in Table 2.

4.2 each index is scored by ranking.

4.3 the value score OVS (Overall Value Score) of each stock is obtained by synthesizing the above five expected index scores.

5. Measure the score of stock growth

The growth score of stocks mainly reflects the growth of listed companies, taking into account the growth rate of earnings per share, the growth rate of net assets per share, the growth rate of income per share of the main business, and the growth rate of net cash flow per share. Compared with the value score, no dividend per share factor is taken into account. For a specific scale classification, that is, large market, middle market, small market stocks, Morning Star calculates the growth scores of each stock.

5.1 for each stock, the growth rates of its four indicators (G '( e), G '( b), G '( r) and G '( c)),) are calculated as shown in Table III.

5.2 each of the above indicators is scored by ranking.

5.3 the growth score OGS (Overall Growth Score) of each stock is obtained by synthesizing the four index scores.

6. Determine the value-mix-growth score and threshold value of the stock

The value-mixed-growth score VCG (Value-Core-Growth) of the stock is obtained by subtracted the value score OGS from the value score OVS, that is, the value-growth orientation of the stock. When the VCG of a stock is less than or equal to the value threshold, Morning Star defines it as a value type. When the VCG of a stock is between the above two threshold values, Morning Star defines it as a hybrid.

7. The position of stocks in the Wind Box

Morning Star positions a stock in a style box through a two-dimensional coordinate system, the X axis and the Y axis, and uses a similar method to determine the location of the fund in the wind box. Among them, the X axis reflects the value-growth score, and the Y axis reflects the scale score.

7.1 X-axis scale conversion

Of which: VCG: indicates the comprehensive score of stock value growth VT (Flag): represents the value threshold of Flag stocks GT (Flag): represents the growth threshold for Flag stocks Flag: represents the class of large, medium and small stocks to which the stock belongs; Flag = 1 is the large market, Flag = 2 is the middle market, and Flag = 3 is the small market.

7.2 Y-Axis scale conversion

Of which: Cap: indicates the total market value of the stock MST: represents the threshold value of a small plate LMT: represents the threshold value of the large and medium plateFinally, the style of the stock is defined according to the raw X and raw Y scores of each stock.

8. The location of the Fund in the Wind Box

The positioning of the fund in the investment climate box is based on the portfolio of the fund and the style of the stocks held by the fund. Morning Star finally defines the investment style of the fund by calculating the value of the fund's holdings-growth score X and the stock size score Y. At this stage, Morning Star only analyzes the stock investment of stock fund, allocation fund, capital preservation fund and closed-end fund. Although most bond funds also hold a certain proportion of stocks (typically no more than 20 per cent of net worth), they are not the focus of our study.

8.1 calculate the X and Y scores.

8.2 determine the threshold for the value-balance-growth of the investment style of the Fund.

Here we take gamma = 0.5. - 8.3 the fund is positioned in the investment style box, and the classification criteria are shown in the table below.