- Account

- Fee Schedule

- Funding

- IPOs Subscription

- Stock Transfer

- Margin Trading

- Trading in HK Market

- Trading in US Market

- Trading in A-shares Market

- FUTU MONEY PLUS

- Futures / Futures Options

- Crypto

- Leveraged Foreign Exchange

- Trading in JP Market

- Trading in SG Market

- Position and P&L

- Regular Savings Plan

- Promotions

- Free Stocks & Coupons

- Corporate Action

- App Features

- Paper Trading

- Market Introduction

- Getting started

- Technical analysis

- Algo Trading

- Open API

- Anti-Fraud

- Contact Us

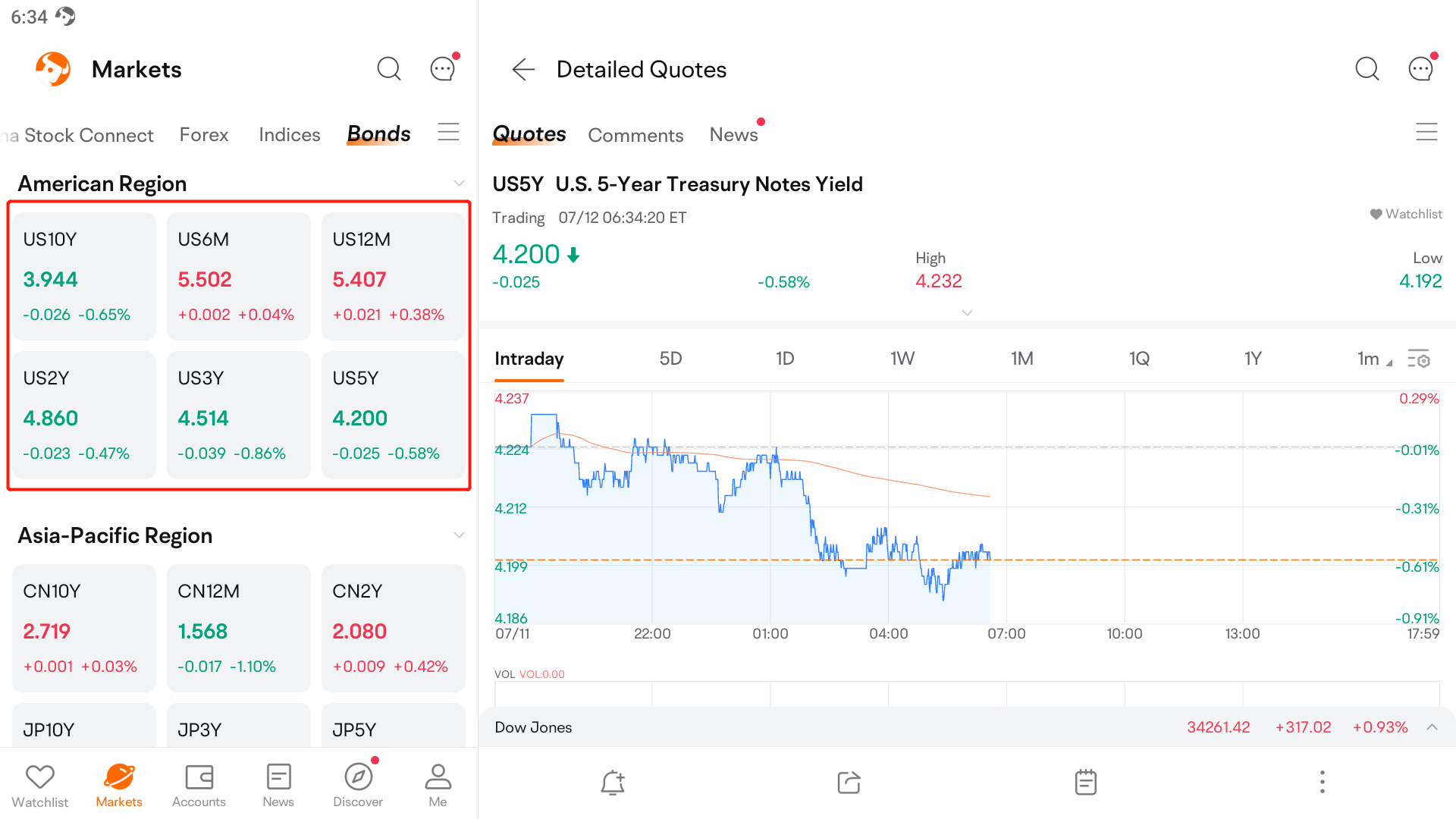

U.S. treasury futures quotes

In U.S. Treasury futures, the basis is the price spread, usually quoted in units of 1/32, between the futures contract and one of its eligible delivery securities.

In Futubull, the U.S. Treasury futures are quoted in units of 1/10.

What is Basis?

Basis can be defined as the difference between the clean price of the cash security minus the converted futures price.

Basis = Cash Price – (Futures Price x Conversion Factor)

For example, consider a cash 5-year note, the 1.75% of November 30, 2021 versus the March 2017 5-year U.S. Treasury futures contract (FVH7).

Assume the price of the cash security to be 99-10+ (1/32), the price of FVH7 to be 117-18+ (1/32), and the conversion factor (CF) of the cash security versus March 2017 5-year futures to be 0.8292. Because U.S. Treasury cash and futures products trade in full points and fractions of a 1/32 we must first convert our futures and cash prices to decimal then perform the math, then convert back to 1/32 form.

Step One: Convert prices from 1/32 to decimal

Pfutures = 117-18+ (1/32s) = 117.578125

CF = 0.8292, Pfutures = (117.578125 x 0.8292) = 97.49578125

Pcash = 99.10+ (1/32s) = 99.328125

Step Two: Perform the math in decimal

Basis = 99.328125 – 97.49578125 = 1.83234375

Step Three: Convert back to 1/32s

1.83234375 = 58.64 (1/32s)

Once this is done with all the securities eligible for delivery, traders can either trade the basis outright or use the gross basis as a starting point for deeper relative value analysis like calculating the cheapest-to-deliver (CTD) security of a given futures contract.

Trading of the U.S. Treasury basis is active part of the U.S. Treasury securities market. Basis trades can be executed and submitted for clearing at CME Group via an exchange-for-physical (EFP) transaction under Rule 538 of the exchange.