Analysis of exchange rate trends

【Latest Japanese Yen Exchange Rate】Analysis of the trend of the yen exchange rate+methods of investing in the Japanese stock market

Today's Latest Japanese Yen Exchange Rates

As one of the most traded currencies globally, the Japanese Yen (JPY) currency pair accounts for nearly 15% of global forex trading volume, second only to the US dollar and euro. It is important because it reflects Japan's economic status as the third largest national economy and its extensive global trading network. The yen rate is naturally of interest; and in the Hong Kong region, it is a common concern.JPY to Hong Kong DollarIt's all about traveling to Japan. Once the yen depreciates, $1 HKD can be exchanged for more yen, and it becomes more affordable. When shopping locally, things are like being discounted, stimulating consumption.

A Review of Past Yen Exchange Rate Trends

In the beginning of 2021,US Dollar vs Japanese Yen Exchange RateMaintain a level around 105 yen. Subsequently, as the US economy recovered, the Fed's monetary policy shifted and the yen gradually depreciated to a high of 122 yen/USD in March 2022.

Subsequently, the yen rallied, mainly due to the Bank of Japan maintaining ultra-loose monetary policy, while US rate hikes are expected to ease. In September 2022, the USD/JPY exchange rate rose once again to 143 yen.

However, the dollar index continued to strengthen in the second half of 2022, pushing the yen to depreciate again. As of early 2023, the USD/JPY exchange rate is around 138 yen.

Going into 2023, influenced by the slow pace of the US Federal Reserve's rate hike, the yen rebounded somewhat to around 130 yen.

At the beginning of 2024, the US dollar against the yen has fallen to 155 yen, a new low since the yen began to depreciate in June 1990! Some analysts believe that this is the mainstream trend of selling yen and buying USD as market investors are aware of the continued widening of the US dollar spread.

All in all, over the past three years, the USD/JPY exchange rate has been basically in the range of 105-143 yen, from rising to falling, to partially rebounding, and the future direction of the yen will depend on the monetary policy of each central bank. If you are interested in the Japanese yen or the Japanese stock market, pay close attention!

Factors for the change in the yen's trend

Tightening monetary policy is expected to slow down the pace of the Fed's rate hikes and monetary policy stance will directly affect the dollar's movements, thereby affecting the yen exchange rate. The Fed's monetary policy shift in 2021 pushed the dollar sharply higher and led to the depreciation of the yen.

The US spread widens When the US spreads widen, overseas funds tend to flow out of Japan, to the detriment of the yen.

Japanese economic growth weakened the strong US economic recovery, which also supported the dollar compared to the better performance of the Japanese economy. Japan's weak economic growth has intensified the yen's depreciation pressure.

However, the depreciation of the yen is often a favorable factor for corporate profits. So, which stocks are expected to benefit?

Content reference:Worth collecting! Japanese stocks are looking for investment opportunities

How to invest in the Japanese market in Hong Kong?

With Futu now open, you can't exchange or trade forex directly. The day trading feature offers the benefits of a Yield expansion rate of 2.8% and Gold as low as 80 yen, helping you to expand your investment path in Japan >>

How to buy Japanese stocks and ETFs in Hong Kong?

Futu Securities will be excluded from offering Hong Kong US share trading services, moreJapanese stocks,Japan ETF ProductsOptions trading services, andJapanese Stock Live Streaming QuotesClick here for the best deals. Currently, Futu will receive 0.08% gold on the day of trading, with a minimum trading gold of 80 yen per coin.

Following are the steps to buy Futubull shares:

Go toFutu Internet, and register a new account.(Register now)

Open a securities account with a Futu account, click below to open it instantly and enjoy the opening bonus of up to USD.(How to open an account)

Deposit funds via EdDA Quick Deposit, Fast Transfer (FPS), Bank Transfer.(How to deposit funds)

Download the Futubull App and log in.(Download now)

Click “Trade” in the lower left corner of the stock quotation page to activate the daily stock market function and start selling. (How to trade shares on Futubull)

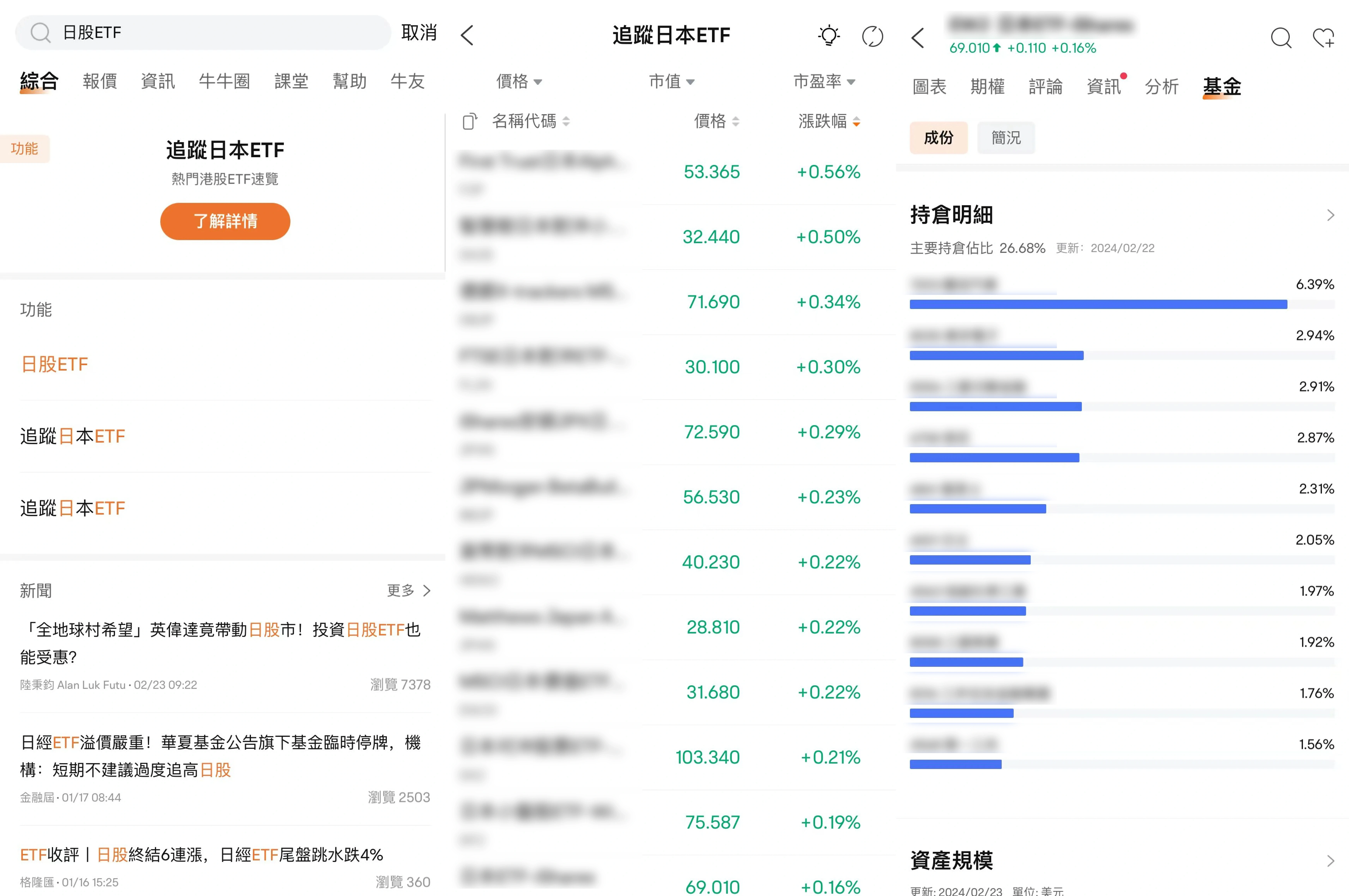

If you intend to invest in a day stock ETF, you can search for [Japanese Stock ETF] in the search box to track more ETFs, or on the ETF Funds page, you can learn about the leading positions held by each ETF for your investment decisions.

In addition, Futu supports bidirectional currency exchange (HKD and JPY to USD and JPY to RMB and JPY), so that transactions can be completed quickly without the need for an additional exchange and transfer process.

If you see the prospect of a good day's stock, do not miss the first step in Futu, try the football day stock market! Want to know more aboutIntroduction to Japanese Stock TradingandFutu Daily Share Fees ,Click to learn >>