See what is a bull bear card in one article | Latest bull bear card games

You may often see people on the web earning multiples or even tens of times more with bull tokens. This also means that the potential risk for bulls is very high relative to stocks, so it is important to understand the concepts and rules before trading.

Below are the differences between the bull and the nest wheel, the gameplay and the trading precautions.

Cow Wheel vs Bull Bear Card

WBO WAGON IS A POPULAR FINANCIAL DERIVATIVE IN HONG KONG FOR INVESTORS. The two tools have a lot of similarities, for example, the Cow Wheel and the Bull Bear token can help investors make it easy to make small leveraged investments. As a result, many investors mix the two together. But in fact, there are a lot of differences between the Cow Wheel and the Bull Bear Card, and ignoring them can lead to unnecessary losses.

What is a bull bear certificate?

Like the Cow Wheel, Callable Bull/Bear Contracts, also known as Turbo, are leveraged derivatives for short term investments.

The bull bear card is divided into bull card and bear card. When the price of the related asset rises, the price of the bull bond rises, the price of the bear notes falls; conversely, when the price of the related asset falls, the price of the bulls falls and the price of the bear notes rises. Taking the example of the Hang Seng Index bull certificate, suppose an investor who is bullish on the Hang Seng index, can buy the corresponding bull bond, the bearish Hang Seng index, can buy the corresponding bear bond.

What is a flywheel?

Warrants are also called warrants. If you are familiar with options, you will find that the reel is very similar to options.

An investor buys a flywheel, which is equivalent to buying a right that allows an investor to buy or sell a specified asset (stocks, commodities, foreign exchange, etc.) at a specified price (exercise price) within a specified time (maturity date).

There are two types of Call rounds and Put rounds, which correspond to the rights to buy and sell specified assets in the future. In general, you can buy the corresponding Call Round if you think that a stock is going to move forward. If the stock price rises afterwards, the Call round price will rise, and if the share price falls, the Call Round will also fall. Conversely, if you believe that the share price will fall in the future, you can buy the corresponding Put round; if the subsequent share price falls, the Put round price rises, and if the share price rises, the Put round price decreases.

The difference between the bull pass and the wagtail wheel

Coop wheels are similar to bull tokens in terms of buying and selling channels, cost costs, maximum loss, opening mechanism, and so on.

The main difference between the two is the forced recycling mechanism. The bull bear token has a recycling mechanism, and once the price of the relevant asset hits the recovery price, the bull bear token will be forcibly withdrawn to stop trading. And the coop wheel is not equipped with a forced recycling mechanism.

If you are interested in the Cow Wheel and the Bull Bear Card, but are not clear about the specifics of the two, you can refer to the following figure.

Extended reading: https://www.instagram.com/p/C7BpkApSPLN/

Bull Bear Card Gameplay

A bull bear token is a tool suitable for short line trading, and many professional investors use it for intraday trading, magnifying the potential gains of indices or stock ranges.

In the process of actual trading, choosing a bull token is the first and most important step.

How can I choose a suitable bull bear card? Investors need to pay special attention to these factors: recovery price, swap ratio, trade spread, premium, street price ratio, last trading day.

Bull Bear Card Name

A bull bear certificate can be distinguished from the listing number. Currently on the market are uniformly assigned a listing number beginning with “5” and “6”.

At the same time, its Chinese and English names also convey a lot of product information.

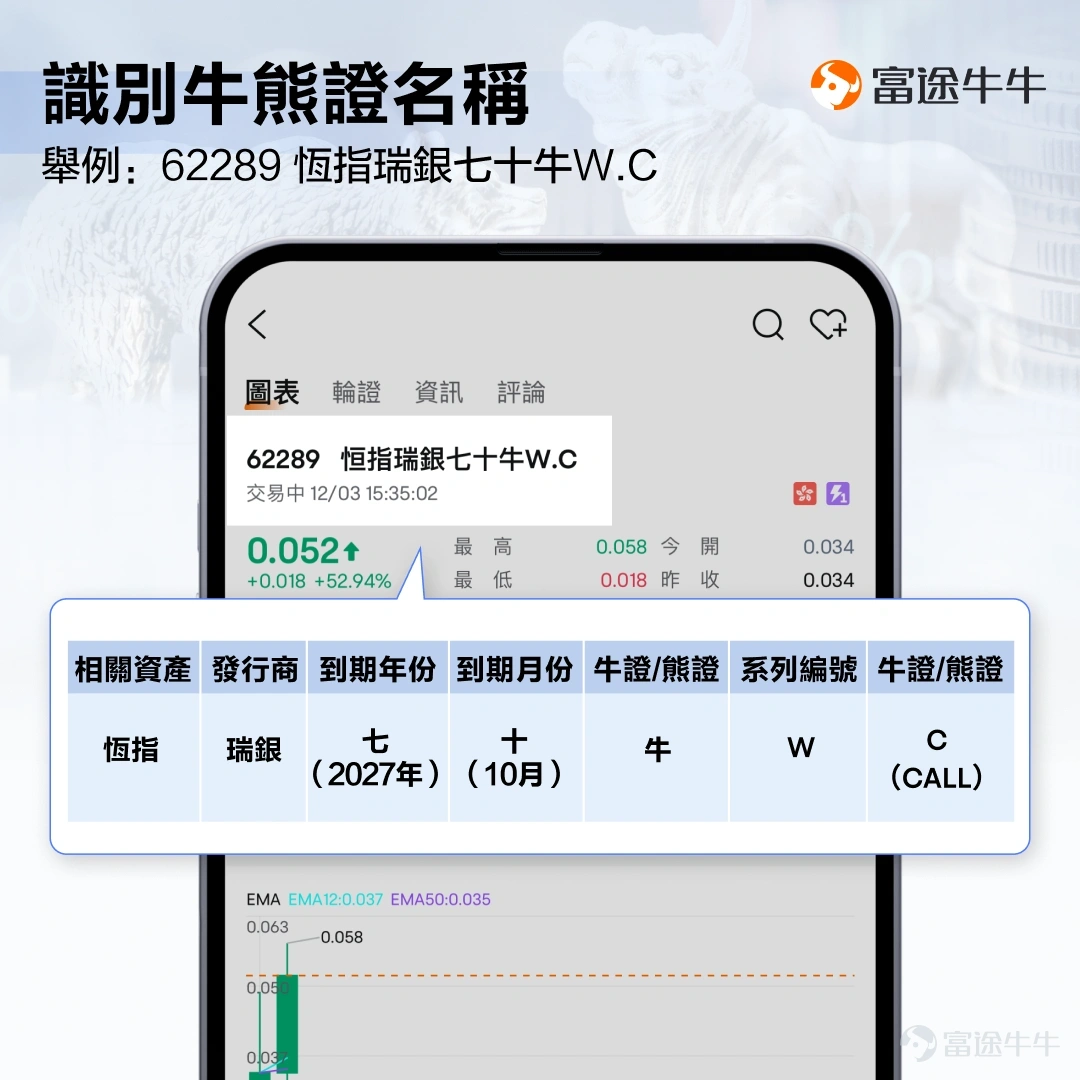

Example: 62289 Hang Seng Swiss Silver Seventy Bulls W.C

The first two words are the name of the linked asset. For example, a constant finger indicates that the bull bear is tracking the movement of the constant finger.

The third and fourth word is the shorthand name of the issuer of the Bull Bear Card. For example, UBS, the issuer on behalf of this bull bear is UBS.

The fifth and sixth words are the year/month of maturity. For example, 70 represents October 2027; there are also special cases, such as 7A or 7B, where A represents November, B represents December, so 7A is November 2027 and 7B represents December 2027.

The last word, bull or bear, stands for bull or bear certificate.

The first letter at the end, such as ABCDE... , which means that the issuer has issued multiple bulls for the asset at the same time, but with different exercise conditions (e.g. different strike price), so distinguish by letters.

The last letter, C or P, is an abbreviation for call and put, representing bull and bear cards, respectively.

In summary, based on the information in the picture, we learned: this is a tracking bull certificate issued by UBS, with a strike date of October 2027.

Recycling Price

DUE TO THE LEVERAGE EFFECT OF BULLBEAR BONDS, POSITIVE STOCK PRICE VOLATILITY IS INCREASED. When the stock price moves sharply, it may occur that the recovery price has not yet been reached, but the issuer has stopped the quotation, causing investors to be unable to sell due to the lack of a counter disk. Therefore, when choosing a bull pass, it is relatively less risky to recycle a bull bear card with a higher price.

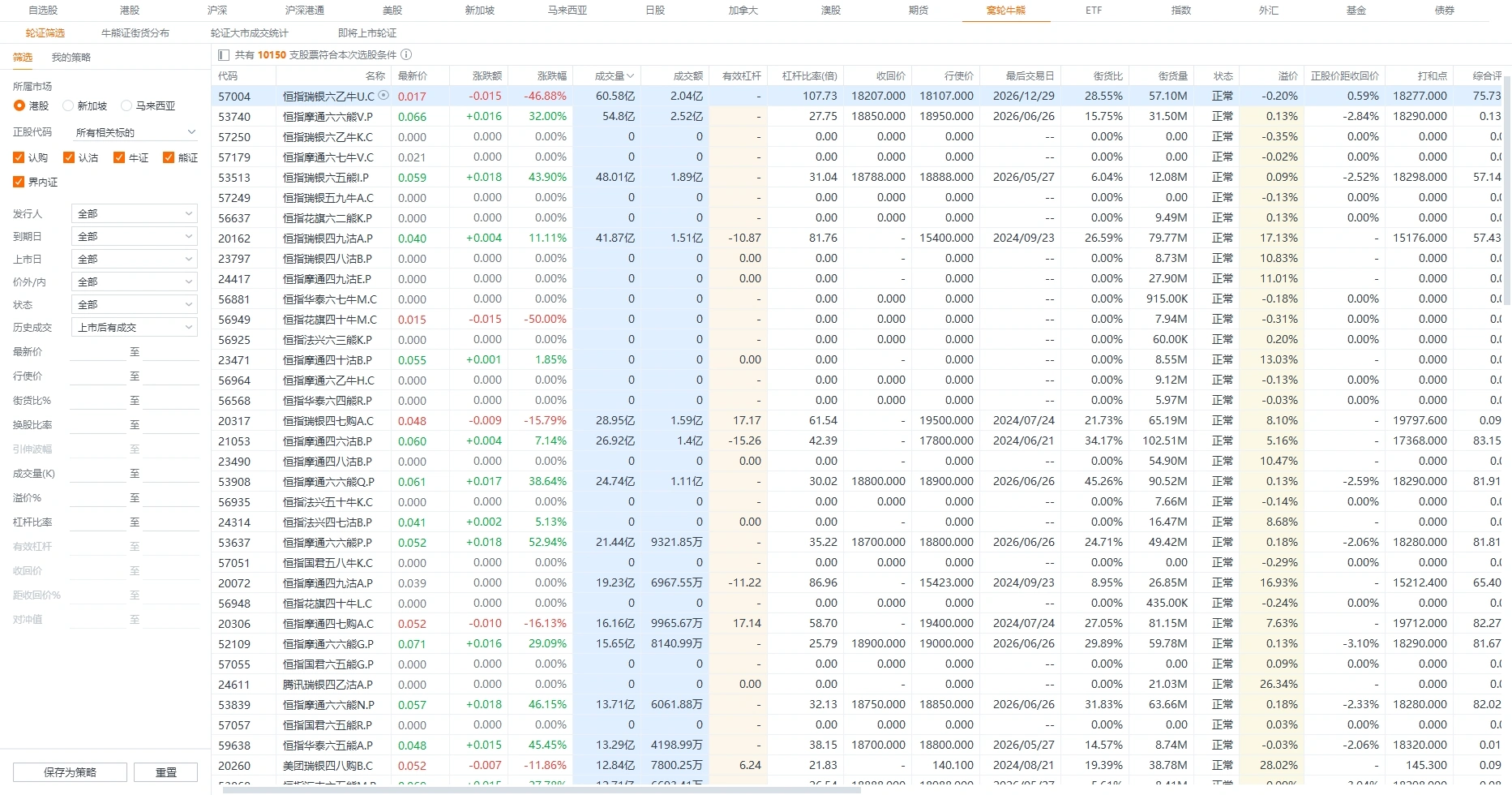

When using Futubull Stuffing, a percentage of the price of the related asset can be recovered through the bull certificate, helping the owners quickly identify the lower-risk cow certificates.

(The page is divided into a selection page for the Futubull desktop version and mobile app. PC Version: Features->Clockwork BumbleMobile App: Market Market->Hong Kong Stockholder->Snorkeling Bumblebee. (The design images displayed on the screen are for illustrative purposes only and do not constitute any investment advice or guarantee)

Exchange Ratio

The exchange rate refers to the number of bull securities required to exchange 1 share of common stock. For example, one USF bond with a swap ratio of 100. At maturity, each 100 warrants can be exchanged for the right to purchase 1 share of the common stock at the exchange price.

In actual operation, the swap ratio can also be used to simply estimate the sensitivity of the bulls to changes in the price of the main stock. Under the same conditions, the share price of the main stock moves at HK$1 per share. The lower the exchange rate, the greater the price of the bulls, the more sensitive to the share price movement. The estimation method can refer to the following formula:

Bull Bear Theory Price Change = Value of Change in Common Stock Price ÷ Exchange Rate

Change in price of related assets = Exchange Ratio x 0.001

(* The minimum price variation of the Bull Bear Card is HK$0.001)

For example, if a stock price rose by HK$1, the exchange rate of 500 bonds increased by HK$0.002 and the exchange ratio of 100 increased by HK$0.01. USING THE VARIATION OF THE FORMULA, WE CAN ALSO DEDUCE THAT IF THE PRICE OF A BOND WITH A SWAP RATIO OF 500 ROSE BY HK$0.001, THE PRICE OF A COMMON STOCK WOULD RISE BY HK$0.5; BY CONTRAST, THE PRICE OF A POSITIVE STOCK WOULD NEED TO RISE BY JUST HK$0.01, AND THE PRICE OF A BULLS WITH A SWAP RATIO OF 100 WOULD RISE BY HK$0.001.

Trading Spreads

Since a bull bear certificate needs to rely on the issuer's (“bookmaker”) quotation, even if it is associated with the same stock, but bears issued by different issuers may have different trading spreads, this factor is also a factor that we need to consider when screening a bull bear. Especially for high-frequency traders, the focus needs to be on buying and selling spreads.

Premium

Bull Bear Premium refers to the ratio of the amount paid by an investor who has a maturity to buy or sell a stock at the exercise price when an investor buys a bull-bear certificate compared to a directly traded preferred stock. It can also be understood how much the upside and fall of the stock price can be achieved by investors to achieve a profit and loss balance.

Generally speaking, the same recycling price, close expiration date, and different issuers of bull bear cards, the lower the premium the better.

In addition, if the premium is too high, the issuer also adjusts the premium, which can lead to a decrease in the price of the bulls. Therefore, choosing bulls with a lower premium can also avoid such risks when holding a position as much as possible.

Street goods ratio

The number of bulls held in the market by other investors in addition to the issuer, is known as street commodities. The proportion of street goods as a proportion of total issuance is the street goods ratio. If the bulls have a high street price ratio, the issuer's pricing ability may be affected, resulting in a greater impact of supply factors on the price movements of the bull bond, which may also result in a larger bid spread.

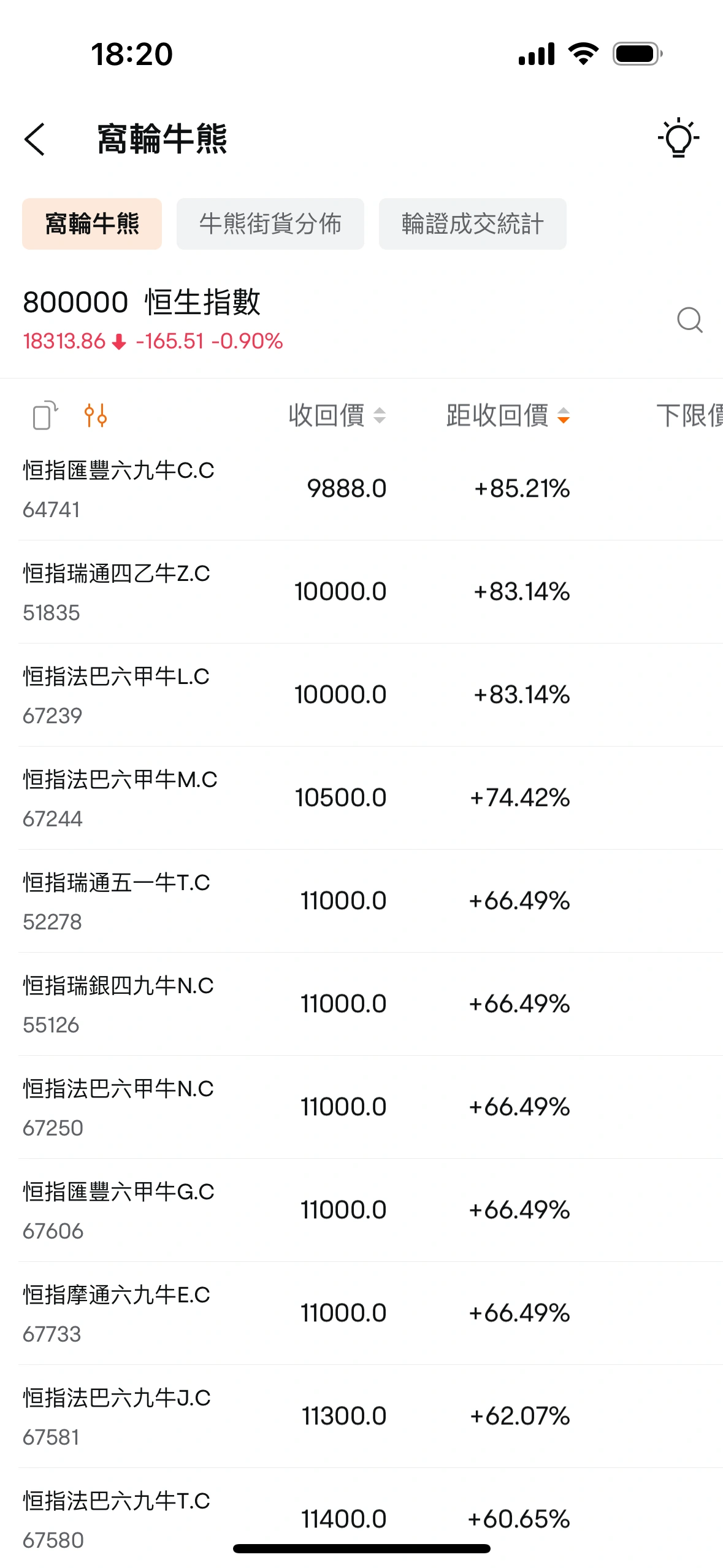

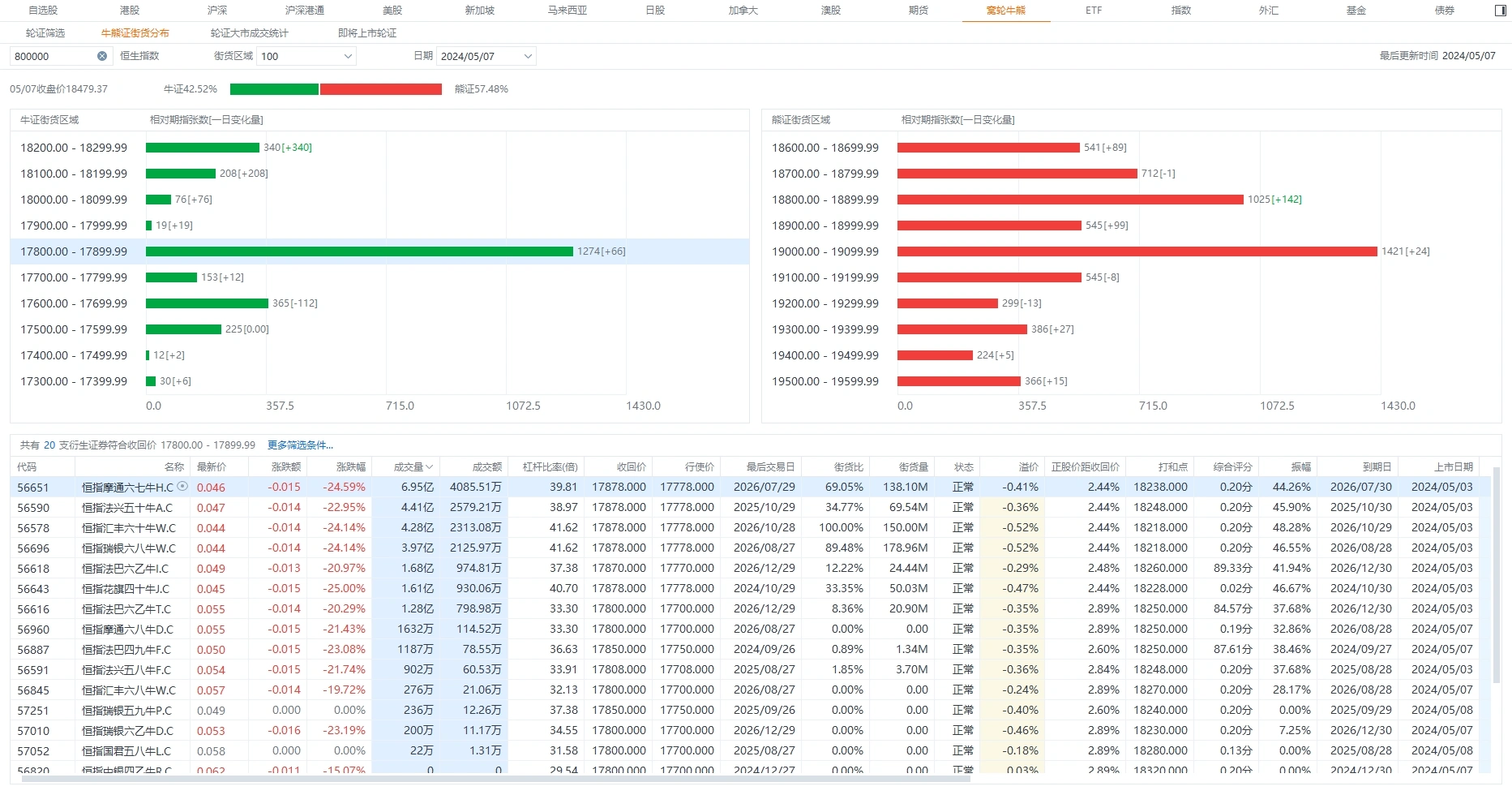

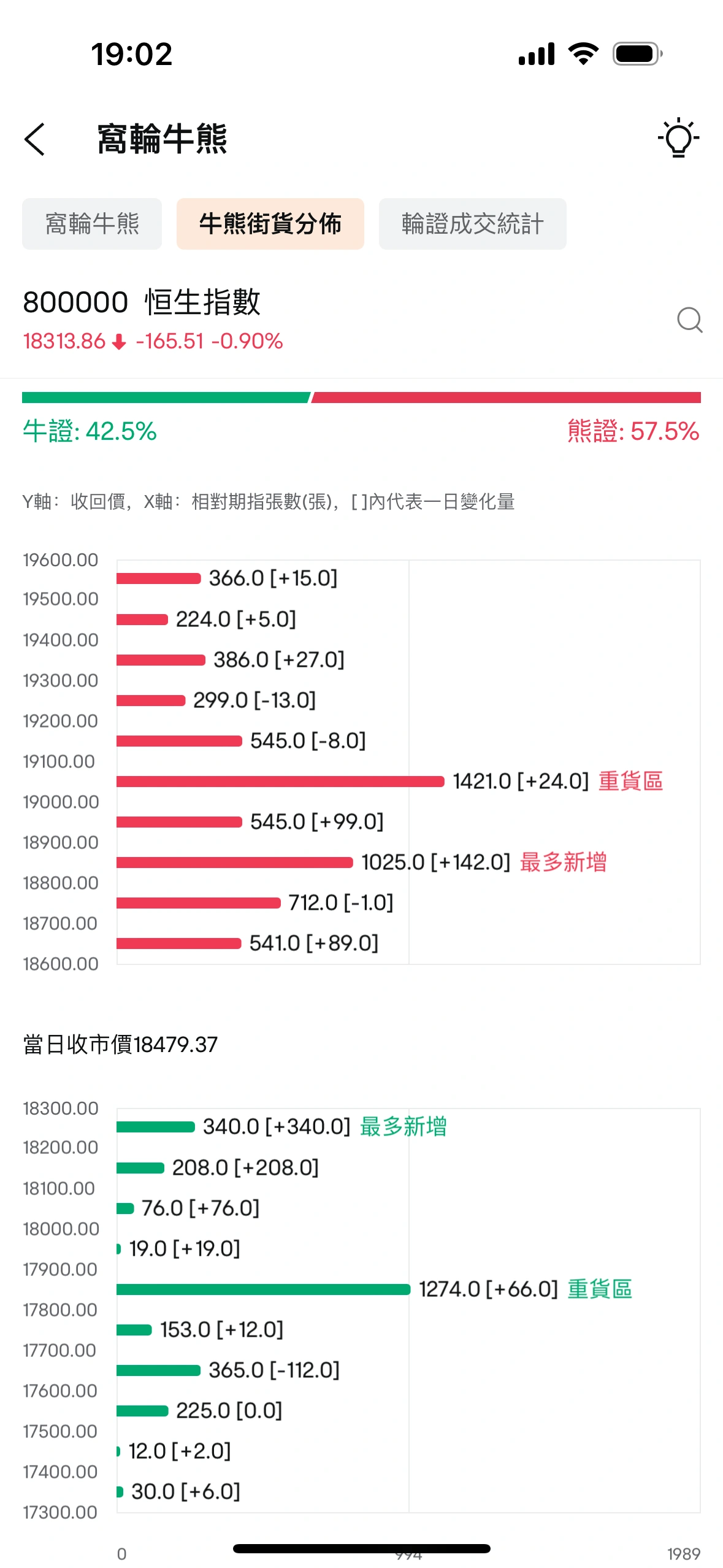

When trading bulls using the Futubull computer version or mobile app, refer to the Bumblebee Street Distribution feature.

(Separate features for Futubull PC and mobile app. computer version: mobile phone app: “market market” ->stock market “stock market” ->stock market ->wheel cow bums->bull street store distribution. (The design images displayed on the screen are for illustrative purposes only and do not constitute any investment advice or guarantee)

When using this feature, you can keep an eye on the “Overload Zone”. For example, as can be seen from the information above, in the screenshot below, in all tradable Hang Seng Index bull bonds, the bulls with a price between 17800-17899.99 are recovered, and the most marketable positions of bear securities with a recovery price between 19000-19100 are recovered.

Last Trading Day

EACH BULL CARD HAS A SCHEDULED EXPIRATION DATE. IF THE BULL CARD IS NOT FORCIBLY WITHDRAWN BEFORE EXPIRATION, IT IS TRADED ON THE MARKET UNTIL THE LAST TRADING DAY, AND THE LAST TRADING DAY OF THE BULL BEAR CARD IS THE ONE TRADING DAY BEFORE THE BULL CARD'S EXPIRATION DATE.

If you do not want to hold the bull card until maturity, be sure to keep an eye on this date to avoid losing money due to missing the last trading time.

Settlement Procedures

In general, when the Bull Bear Card expires, the issuer calculates the cash settlement amount for the Bull Bear Card. The bulls currently on the market are settled in cash and do not involve stock settlement. The relevant settlement amount is automatically credited to the holder's securities account, and the cattlemen do not need any further action.

The following is the calculation method for settlement after the expiration of the Bull Bear Card:

— Debt Settlement Value = (Settlement Price - Exercise Price) /Conversion Rate

— Bear Card Settlement Value = (Exercise Price - Settlement Price) /Conversion Rate

The remaining value of the Bull Bear Pass

Bull Bear Card Classification and Differences

The bull bear card is divided into two types of class N and class R, with class N having no residual value, and type R leaving a residual value depending on the case. Currently, the Hong Kong market is mainly represented by R bull certificates.

Calculation of the remaining value of the bull bear certificate

When a Bull Bear Token triggers a withdrawal price before expiration, the Bull Bear Token is immediately withdrawn, at this point we care most about: Does the account have any remaining value? Or hematopoiesis?

Debt Remaining Value = (Settlement Price - Exercise Price) /Exchange Rate

If the price of the relevant asset hits or falls below the strike price during the observation period, the remaining value is zero.

Note: The settlement price is the lowest level of the relevant asset price during the observation period.

Bear Notes Remaining Value = (Exercise Price - Settlement Price) /Exchange Rate

If the price of the relevant asset hits or exceeds the strike price during the observation period, the remaining value is 0.

Note: The settlement price is the highest of the relevant asset price during the observation period.

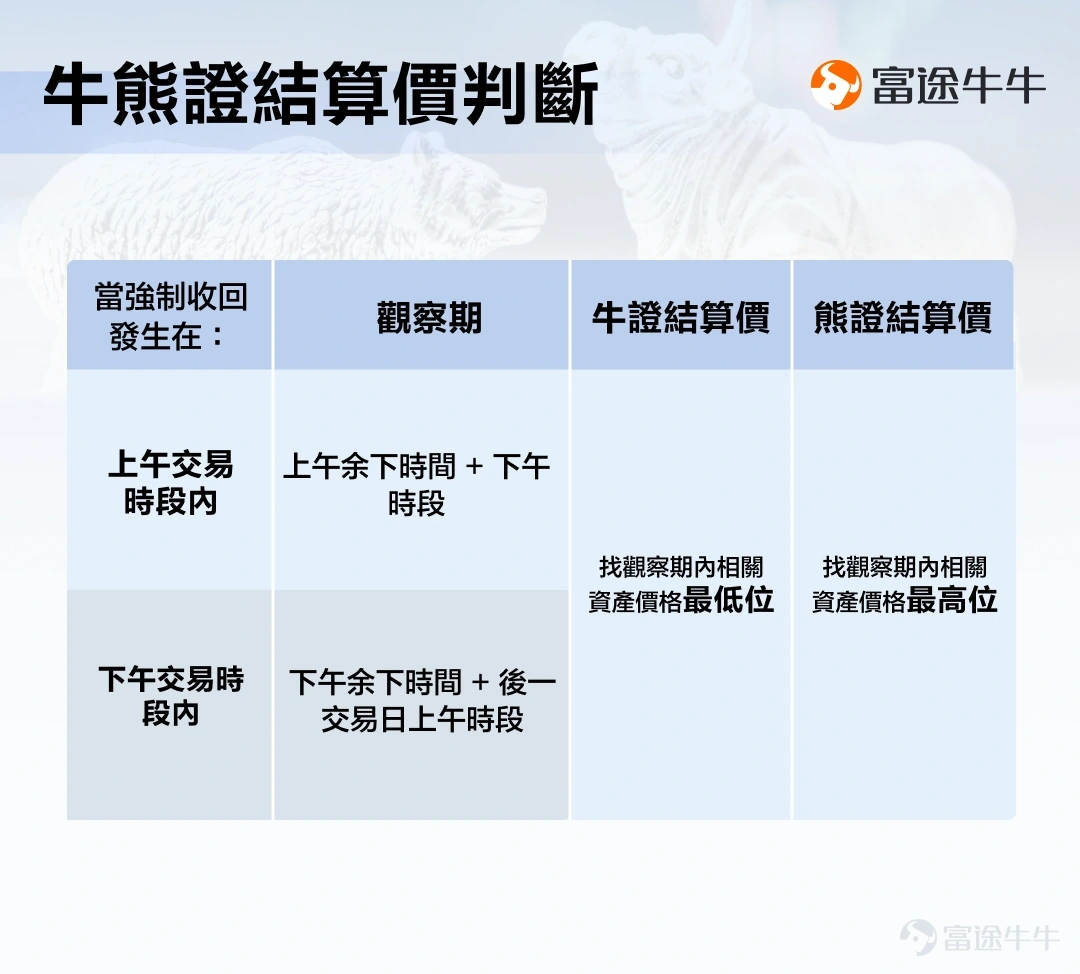

Bull Bear Card Settlement Price Judgment

The settlement price of the Bull Bear Card needs to be defined based on the actual value of the price of the relevant asset during the observation period. The settlement price of the bulls is the lowest level of the relevant asset price during the observation period, and the settlement price of the bear bond is the highest of the relevant asset price during the observation period.

What is the observation period?

The remaining value observation period includes the remaining time of the trading session when the bulls are forced to be withdrawn and the next full trading session immediately following.

Is it easier to remember this picture below?

Bull Bear Card Residual Value Enquiry

Futubull operation:

In general, within a week of being recovered, any remaining value will be automatically credited to the Cattle Friend's securities account without further action. The corresponding bull bear certificate is expected to disappear in the holding position. You can then check the details of the next day's statement.

Futubull Features:

If you want to know the residual value of the bull bull bear, you can first inquire about the warrant issuer through the “App - Bullbear Quote Detail Page - Information - Announcements”, and then check the remaining value through the issuer's website.

Risk Disclosure:

This content is for reference only and should not be construed as a basis for the solicitation, solicitation, solicitation, recommendation to buy and sell any investment product or investment decision, nor should it be construed as professional opinion. Certificates and bull notes are derivatives and are not suitable for all investors. Investments involve risk. The value of warrants and bull certificates can rise or fall sharply, and the holder's investment may suffer a full loss. Past performance does not predict future performance. Certificates and bull certificates are unsecured structured products. If the issuer is insolvent or in default, you may not be able to recover some or all of the monies receivable. The bookmaker may be the only bidder. The Bull Bear Card has a mandatory redemption mechanism. If the price of the relevant asset hits the redemption price before maturity, the Bull Bear Certificate will be withdrawn immediately. N Bull Card investors will lose all of their investment in the Bull Bear and the remaining value of the R Bull Card may be zero. You should ensure that you are familiar with the nature of the Certificates or Bulldog Notes prior to purchasing the Certificates or Bulldog Notes, read the terms and risk factors of the Certificates and Bull Notes as set out in the Listing Documents, and seek professional advice.