2025 Latest Investment Package

Beginner's Investing Tutorial | The Latest Investment Lazy Kit for 2024

In Hong Kong, single-row savings are lagging behind the trend. In order to add value to savings, many people are allowed to choose to invest. Realizing financial freedom in the morning is certainly the goal of most of the jobs. Today, Futui brings you to the world of investment with the knowledge you need to enter the world of investment.

Why invest?

Investing is one of the ways to achieve asset value, and investment can provide higher potential returns than simply saving. At the same time, with a diversified portfolio, you can effectively reduce risk and improve the overall stability of your assets. Whether it's for retirement savings, a child's education fund, or for personal financial goals, investing can help you accelerate those goals.

Getting Started with Stock Investing

The first step for many people to enter the financial market is to invest in stocks. By purchasing company shares, you become a partial owner of the company and have the opportunity to share in the company's growth and profits. Before you start investing in stocks, it is essential to understand fundamental and technical analysis, market trends and company performance. In addition, you need to master stop loss setting and risk management strategies to ensure investment safety.

【Stock Introduction】Getting Started with Stock Investing

【Net Days Subtract】Is it profitable to sell stocks? One article answers what is divisible and frequently asked questions!

【Monthly Stock Offering】Monthly Stock Highlights 2024 | What are the Benefits of Monthly Yields in Hong Kong and US Stocks

[Margin]Necessity Margin Trading Concept

【Yin Yang Candle】20 Must-Learn Candle Shapes to Start Investing

[Dividend tax]Is it possible to reduce the dividend tax on Hong Kong stocks? Mainland Investors Attention!

【Crab delivery point deployment】Using the example of Eniveda, understand the investment strategy behind stocks

Getting Started with Investing in Hong Kong Stocks

As an international financial centre, Hong Kong attracts many well-known global companies to go public and offers a wide range of investment options. Investors need to be familiar with the trading rules, trading times and common indices such as the Hang Seng Index. Understanding factors such as Hong Kong's economic situation, policy changes and Sino-American relations is particularly important for investors in Hong Kong stocks. In addition, understanding how to use Hong Kong stocks and related tax policies can help you engage more in the market.

【Hong Kong Stock Dividend Shares】Dividend Stocks 2024|How to Use High-Yield Hong Kong Stocks to Support Retirement?

[IPO Subscription]Latest IPO IPO IPO Tutorial (with 0 Interest 0 Handling Fees)

【AI Stock】The Latest AI Investment Guide in Hong Kong

Getting Started with Investing in US Stocks

The United States is the world's largest stock market with industry-leading technology, financial, and consumer companies. Investors need to understand the trading rules of the New York Stock Exchange and Nasdaq, as well as the composition of major indices such as the Dow Jones Industrial Average, the S&P 500 Index. Familiarity with U.S. economic indicators, interest rate policy, and performance seasons is key to successfully investing in U.S. stocks. In addition, learning about leveraged products and options trading in the US equity market can give you more investment opportunities.

【Introduction to US Stocks】How to Start Buying US Stocks | Full Explanation of Opening Times, Basic Rules

【U.S. Stock Dividends】High Yield US Stock Pick Strategies! Pick 10 Stable High-Yield Stock Portfolios

【US Stock Technology Stock】The latest market capitalization/results overview of the seven giants of US stocks!

Getting Started with Investing in Japanese Stocks

The Tokyo Stock Exchange is the main exchange in Japan with a rich selection of stock categories and industries. Investors need to understand the composition of the Nikkei 225 index and the TOKEN index and its implications. Familiarity with Japan's economic environment, monetary policy and corporate culture is essential for successful investment in Japanese stocks. In addition, considering the impact of yen exchange rate fluctuations on investment returns is also the part that needs to be paid attention to when starting out in Japanese equities.

【Investing in Japanese stocks】How to invest in the Japanese stock market in Hong Kong? List of Annexed Stock ETFs

Getting Started in A Shares

The A-share market, which includes the Shanghai Stock Exchange and Shenzhen Stock Exchange, is mainly aimed at local Chinese investors, but with the opening of Shanghai Hongkong and Hongkong Tok, a growing number of international investors are also able to participate. Before entering the market, remember to understand the trading rules of A-shares, the bearing-and-stop system and the T+1 delivery system. Also, keep a close eye on China's economic policies, industry trends, and government regulatory measures, all of which affect the direction of the A-share market.

[A Stock Index]Learn about the top 6 A-share indices and investment directions!

【A-shares ETF】An A-share ETF that tracks Chinese indices on the Hong Kong stock market

Stock Account Options

It is important to choose the right stock account for stock trading. To effectively filter out which stock account is best for you, you can compare trading fees, platform features, and customer service quality across different brokers, and consider the research tools and educational resources they offer to support your investment decisions.

[Good margin for securities markets]Is it good to invest in a hedge fund? Compare Stock Accounts with Banks and Securities Banks!

Getting Started with Options Investing

Options are generally considered to be flexible investment tools that can be used to hedge risks and speculate. Before you want to start Playing Options, you first need to understand the basics of options, such as subscription and put options, and how to price. Want to successfully profit from options? Learn to use options strategies such as buy subscription options, sell put options, and combination strategies to achieve different investment goals.

【Option Introduction】Options Tutorial: From Beginner to Practical (Fundamentals, Trading Strategies, Hands-On Skills)

Index Futures Investing in Indices

Index futures allow investors to invest in overall market performance rather than a single stock. LEARNING HOW TO ANALYZE MARKET INDICES, UNDERSTAND FUTURES CONTRACT SPECIFICATIONS AND LEVERAGE EFFECTS CAN HELP YOU SEIZE OPPORTUNITIES IN MARKET VOLATILITY. Index futures are especially suitable for those investors who want to trade short-term or hedge overall market risks.

[US Stock Futures]Big Review of the 3 Major US Stock Indices! How to trade the top three US index futures?

[Futures Indices]【Getting Started】Get a quick look at how to play and note the HKD Futures Index

Getting Started with ETF Investing

ETFs (exchange-traded funds) are financial products that combine the advantages of stocks and funds. They offer a diverse portfolio, often characterized by low costs and high liquidity. ETFs can be divided into different types, such as stocks, bonds and commodities, so be sure to understand before entering to choose an ETF that suits your investment goals.

【What is ETF】A MUST-SEE ETF INVESTMENT GUIDE FOR HONG KONG INVESTORS

[ETF Tax Refund]ETF Tax Refund Guide: Know Your Investment Returns

[Bitcoin ETF]COIN CIRCLE BULL MARKET IN PROGRESS? Don't Miss These Bitcoin ETFs

【Japanese Stock ETF】What are Japan ETFs? How to Invest in the Japanese Market in Hong Kong

[Gold ETF]Gold Prices Soar, Full Analysis of Hong Kong and US Equity Gold ETF Investments

【India ETF】Indian Stock Market Soars, India ETF Investment Recommendation for US Stocks

[S&P 500 ETF]Buffett's Persistent Belief to Invest in Preferred S&P 500 Index ETF

[S&P Leveraged ETF]Expect the Federal Reserve to cut interest rates, and buy the S&P index! Leveraged ETF Introduction

[Commodity ETF]Energy, Silver, Crude Oil ETF Investment Advice

[Index ETF]U.S. STOCKS HIT A HIGH, WHICH U.S. STOCK ETFS TO INVEST IN

[Bond ETF]Interest Rate Reduction Expected to Keep an Eye on These US Bond ETFs

【Japan ETF】Which Japanese Stock Market ETFs do you want to invest directly in the Japanese stock market?

[US Stock High Yield ETF]5 HIGH YIELD ETFS FOR YOU TO CHOOSE FROM

【Hong Kong High Yield ETF】What are the High Dividend ETFs for Hong Kong Stocks? Learn more in one article!

[Emerging Markets ETF]A Guide to Investing in Emerging Markets ETFs Under U.S. Stocks

【High Dividend ETF】A good investment is not only about high dividends, but also growth

[US Bond ETF]Measuring the expected change in interest rates, which US bond ETFs are worth watching?

[Hedge Asset ETF]Seizing Gold Opportunities in an Interest Rate Reduction Cycle

[Asset Allocation]How to Diversify Diversified Investments through Asset Allocation

Getting Started with Fund Investing

An investment fund is a better choice for investors who want to add value to their assets through investment but lack the time or expertise. Funds are pools of funds managed by professional managers, which include equity funds, bond funds, and hybrid funds. If you are looking to invest in a fund, you can evaluate the fund manager's management skills or help you choose the right fund product for you.

[Fund investment]How Beginners Buy Funds: Start Your First Fund Investment

[Dividend Fund]Dividend Funds (Bond Funds) Investment Guide

[Trust Fund]Trust Fund Investment Guide

[Monetary Fund]What is a currency fund? How to Buy a Currency Fund in Hong Kong

【REITAS】Real Estate Trust Fund Investment Guide

Getting Started with Bond Investing

If you are an investor looking for stable returns, investing in bonds is a relatively low risk option. But before you start investing, it's important to understand the fundamentals of bonds, such as check rates, maturity yields and credit ratings; and understanding market rates and adjusting your portfolio according to the economic situation will not only help you identify quality bonds and increase your chances of earning.

【Bonds Investment】【Bond Investment Guide】How to buy bonds conveniently in Hong Kong?

[US Treasury]How to Buy US Debt in Hong Kong with Futu?

【Green Bonds】READ MORE ABOUT HOW GREEN BONDS CAN SUBSCRIBE TO GREEN BONDS CITYWIDE FOR UP TO 13 FREE STABLE YIELDS OF 4.75CM

【Agency Bonds】IEA Bonds Up to 12 Free | Annual Rate 4.25pc

[Infrastructure Bonds]Guaranteed return 3.5 cm! How to get up to “11 free” subscription?

Getting Started with Cryptocurrency Investing

Cryptocurrencies are an emerging class of virtual assets with high risk and high returns. The cryptocurrency market is changing rapidly, so you want to invest in cryptocurrencies, as well as a basic understanding of blockchain technology, the characteristics of major cryptocurrencies, and how to securely store and trade crypto assets, but also have a sensitive market feel to keep an eye on market dynamics.

[Cryptocurrencies]What is Cryptocurrency? Learn how to trade Bitcoin, Ethereum ETF in Hong Kong

【Bitcoin Gameplay】How to play Bitcoin? Learn what Bitcoin is in 5 minutes!

[Bitcoin Analysis]Bitcoin Analysis | Bitcoin Sword Indicates 0.1 million, How to Trade Better

[Cryptocurrency Exchange]Which cryptocurrency exchange is better? 2024 Latest Cryptocurrency Trading Guide

Futu Securities provides trading services for virtual assets and related products only to specific groups of clients, including regulatory jurisdictions that prohibit virtual asset transactions from being restricted, and as a basis for high risk underwriting clients, the tool displays and audits results on the APP page as required.

Getting Started with Alternative Investments

Introduction to Bull Bear Securities Investing

Bull Bear Securities is a structured product for those investors who want to take advantage of market volatility in the short term. The price of a bull bond follows the price movements of the relevant asset, such as stocks or indices, and has a leverage effect, meaning that potential gains and risks are magnified. To get started with bull trading, remember to understand how a bull bond works, including expiration dates, exercise prices, and leverage ratios, and learn how to navigate market movements and technical analysis to help you find the best time to trade.

【Bull Bear Card Gameplay】Read more: Bull Bear Card Gameplay and Trading Precautions

Getting Started with Forex Investment

Forex investment is one of the most liquid markets in the global financial markets. Getting started with forex investment requires familiarity with trading currency pairs such as EUR/USD and GBP/USD, as well as the major factors that influence forex markets such as interest rate policy, economic data and geopolitical events. Technical analysis and fundamental analysis can help you make more accurate trading decisions, and better understand risk management strategies and leverage techniques to reduce trading risk.

【Japanese Yen Investment】【Latest yen exchange rate trend analysis】How to invest in Japanese yen?

Getting Started with Macro Investing

Introduction to Macro Investing involves analysis of the global economy, commodity prices, interest rate movements, and geopolitical events. This investment strategy focuses on understanding how macroeconomic factors affect the performance of different asset classes. Investors need to master the analysis of economic indicators, such as GDP growth, unemployment, and inflation data, to make investment decisions that meet macroeconomic trends.

[US interest rate increase]How do I deploy investments during the interest rate hike cycle?

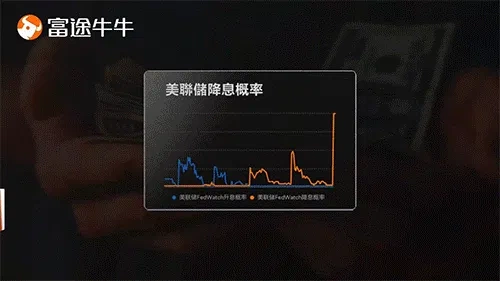

[US interest rate reduction]How will the US interest rate cut affect the market? With US meeting schedule

【Non-agricultural employment data】What do you see in the non-farm employment data? Analysis and Deployment Strategy Guidelines

More Tips for Getting Started with Investing

To achieve asset value, you need to choose the right product for your investment, as well as a sound investment plan and goals. In addition, maintaining a diversified portfolio, regularly reviewing and adjusting asset allocations, and constantly learning and updating investment knowledge are important factors in improving investment success. Also, don't just look at short-term results, spending patience and discipline can lead to longer term and lasting gains!

【Investment Immigration】Hong Kong Investment Immigration Solutions - New Capital Investor Immigration Scheme

【Regular Deposit】Latest Bank HKD Fixed Deposit Rate Comparison

[Passive income]Ways to earn passive income in Hong Kong

How to invest in all of the above products

Open a combined account with Futu and trade the above investment products immediately. Click here to open a live account and enjoy the opening reward of up to USD.(Open an account now)