【What is ETF】Hong Kong Investors Must See ETF Investment Guide

ETFs have been respected by many institutions and well-known investors since their inception. Among them, the most active and diverse portfolio of US equity ETFs are traded. If you are interested in ETF investing, what information do you need to know before trading?

What is an ETF?

Most investors may be more familiar with stocks and think ETFs are relatively complex and unfamiliar with no idea what an ETF is. Let's get a quick look at the concept first.

ETFs are known as Exchange Traded Funds. As the name implies, it is a fund that, like stocks, can be traded on exchanges. With ETFs, investors can easily invest in different markets, different industry segments, different assets, and more.

What is the difference between investing in single stocks vs investing in ETFs?

What are the advantages of ETFs

In fact, ETFs have many advantages compared to investing in a single stock:

Dispersion risk

DIVERSIFIED RISK IS DIVERSIFIED INVESTING, WHICH MEANS NOT PUTTING ALL YOUR FUNDS “STASH” IN THE SAME STOCK OR IN THE SAME BLOCK TO REDUCE THE RISK OF SIGNIFICANT WITHDRAWAL OR LOSS OF ACCOUNT INCOME. The essence of an ETF is a fund, buying and holding an ETF, which is equivalent to indirectly holding a basket of ETF-related assets. For investors, trading is easy and saves the effort and time needed to choose stocks, making it the best diversified investment strategy for lazy people.

Low Admission Fee

How much equity do I need if you want to buy all US equity star stocks? Just look at one Inveida (NVDA), and the share price before the split is already in the thousands of dollars.

Relatively speaking, ETFs are a way to help you hold a basket of US equity stocks at low cost.

Wide variety

The asset classes that ETFs track are very rich. In addition to stocks, you can also find ETFs on the market that track bonds, commodities, forex, digital currencies, market volatility.

For example, if you think it's a good time to invest in gold recently, you don't need to buy gold futures or real gold, just have a securities account, and you can take advantage of the potential opportunity to flexibly seize gold price gains through gold ETFs.

What are the disadvantages of ETFs

Of course, there are also some relative disadvantages of ETF investing that need to be paid special attention to before investing. It is mainly the following two points:

Tracking errors

In practice, it is not difficult for us to find that the movement of ETFs is not 100% the same as that of the benchmark index. Why does this happen? Because there is a tracking error in any ETF. The greater the tracking error, the further the performance of ETF and benchmark indices or assets is lagging.

There are many reasons for tracking errors, including trading rules, ETF rates, financing vouchers, and more. In most cases, the higher the ETF tracking error may also be higher.

There is a management fee

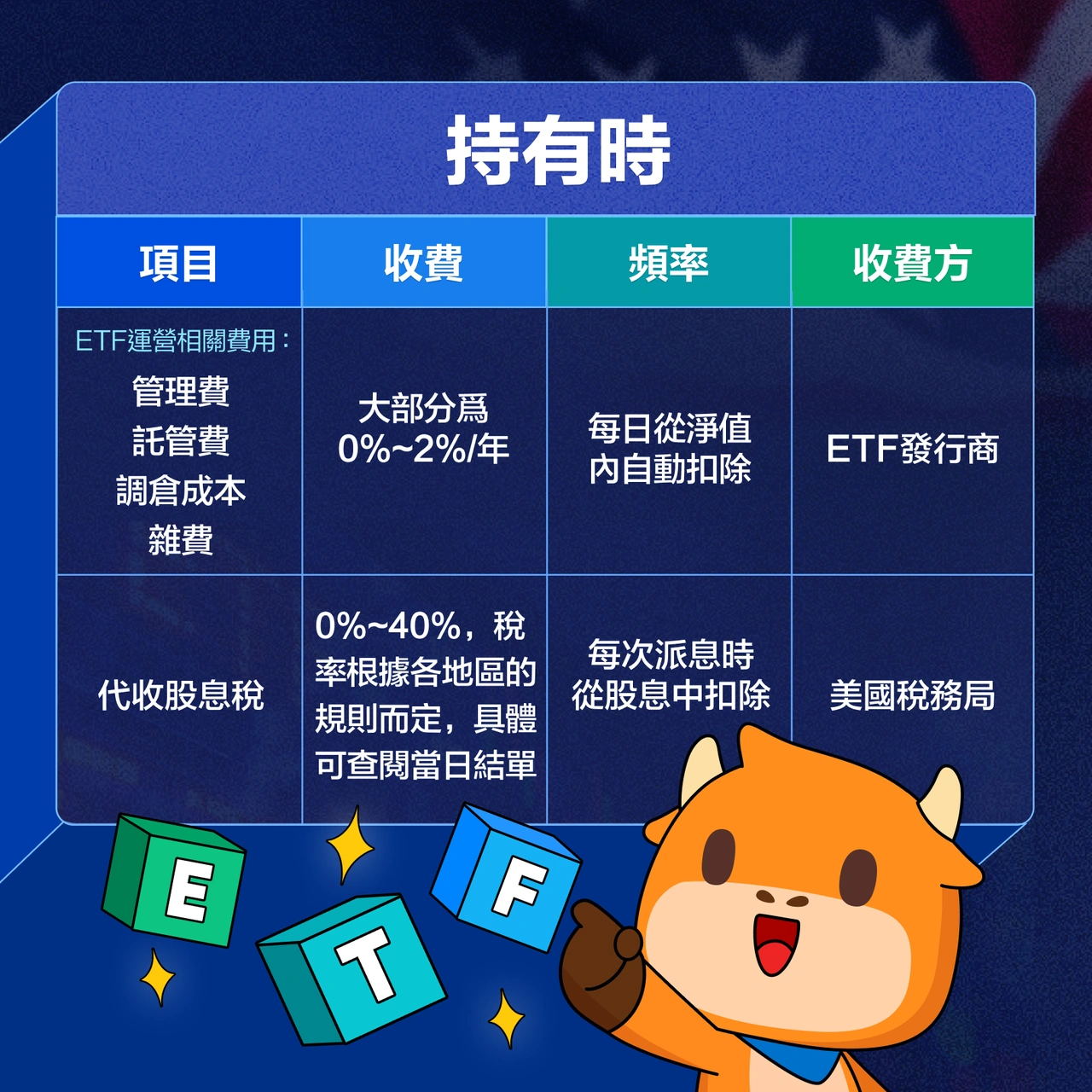

Trading fees for ETFs are basically the same as stocks, but they charge more than one management fee. For example, let's say you hold a $10,000 ETF with an ETF management rate of 0.1%, then you'll need to pay a $10 management fee per year. This fee is not deducted at the end of the year, but is deducted from the fund's net assets for each day you hold the ETF.

The longer the investment period, the more you need to pay attention to the rate, as this fee will have a complex effect over time like rolling a snowball, and a little bit of a gap can lead to a far difference in the final return.

What are the different types of ETFs?

There are many ways in which ETFs are classified now. Common classifications are:

According to the asset class, it can be divided into: stock ETF,Bond ETF,COMMODITY ETF, Forex ETF, etc.;

According to the investment style, it can be divided into: active type, passive type;

ACCORDING TO LEVERAGE MULTIPLIER, IT CAN BE DIVIDED INTO: LEVERAGED ETF, REVERSE ETF, ORDINARY ETF

Which ETF investment is best for you?

How do I decide which type of ETF to invest in? You need to be clear about two questions:

What is the purpose of investing in ETFs?

What are your risk preferences?

Based on your investment goals and risk preferences, we can roughly determine which type of ETF to choose. Here are some common types of investors for your reference:

1. Lower risk preference

Lower Risk Preference, Looking to Hold ETFs for Long Term for “Stable” Returns

Stock Indices ETFs

Stock god Warren Buffett has repeatedly recommended ETFs that track the S&P 500 index to the public, because investing in such ETFs is equivalent to indirectly investing in the US stock market, so there is essentially no “run on the big plate”.

U.S. Treasury ETF

Bonds are divided into different risk classes depending on the issuer and default risk. Of all the bonds, U.S. Treasury bonds are rated as “almost risk-free” assets that are “absolutely non-defaulting”. As a result, many experienced investors also put US Treasury bonds or related ETFs in their portfolios, thereby risking a fall in hedge stocks.

High Dividend ETF

There are many styles of investors who prefer conservative investors to invest in high yields for a steady cash flow on a regular basis. Among all stock ETFs, there is a class of ETFs that primarily invest in high-yield stocks. Such ETFs also distribute dividends to investors at a quarterly or monthly frequency. But for Hong Kong investors, investing in such ETFs needs to focus on dividend withholding tax. We'll go into more detail in the fees section later.

Those who have low risk preferences or expect to hold ETFs for a long time, be careful to avoid leveraged and inverted ETFs

Please note that leveraged and reverse ETFs are not suitable for investors with lower risk preferences or who wish to hold ETFs for a long time. Since leverage and reverse ETFs track the one-day performance of the relevant indices, such ETFs magnify potential losses when the market is in an up-and-down or crossbar situation.

2. Higher risk preference

Risk preference is higher, likes to speculate, wants to capture the opportunity of a blockchain short line through ETF

Bitcoin Related ETF

Bitcoin is the largest and most actively traded digital currency on the market today, with high price volatility and relatively high risks. The relatively high thresholds for participation in investing in Bitcoin have led many investors to falter in the past due to insufficient regulation. Investing Bitcoin with an ETF is less risky than investing in Bitcoin directly.

Emerging Markets ETF

Emerging markets refer to markets that are lagging behind mature markets but are growing rapidly. In contrast, these markets are immature and risk high, but there is also more room for development. Ordinary investors may not have a full understanding of emerging markets, find it harder to get timely market information, or find the right channel to invest in emerging market stocks. ETFs provide a very convenient investment channel to help investors grasp investment opportunities in the market in a timely manner.

Leveraged or Reverse Single Stock ETF

In addition to tracking a basket of assets, there are ETFs that track individual star stocks in the U.S. stock market. These ETFs allow investors to leverage more or less individual star stocks without the need for financing. It should be noted that these ETFs do not have the ability to diversify investments because they only track a single stock. At the same time, leveraged and inverted ETFs are also not suitable for long-term holding.

3. Capture Industry or Block Opportunities with an ETF

HOWEVER, YOU CAN CHOOSE A DIFFERENT ETF THEME BASED ON RECENT INVESTMENT OPPORTUNITIES. Open Futubull, select “Market” in the navigation bar below, click on “ETF” on this page to help you find more ETF investment opportunities. FIND THE TOP TOPIC ETF COLUMN, CLICK THE RIGHT ARROW TO SEE A LIST OF ETFS RELATED TO THE TOP TOPICS.

For example, suppose you want to see a list of semiconductor-related ETFs, you can do this:

Trading Costs and Fees of U.S. Equity ETFs

Investors in Hong KongTrading Costs and Fees of Trading U.S. Stock ETFsThe main one is as follows. If you would like to learn more about the detailed fee solution for Futu Securities, please click on this leaflet:

An important factor that can easily be overlooked but directly affects the ultimate benefit. Too large a spread can result in a hold order that cannot be traded, or a discount is sold. The spread amounts for each ETF are different, and those with lower trading volumes tend to be larger.

How to Trade US Stock ETFs?

UseFUTU-TRADING ETF, a wealth of free analysis tools are available to help you easily grasp ETF-related investment opportunities!

* The design images displayed on the screen are for illustrative purposes only and do not constitute any investment proposal or guarantee.