ADR Fees

1. What is an ADR

ADR (American Depository Receipt) is a negotiable security issued by an American depositary bank that represents a specific number of shares in a non-US company. ADRs can trade on the US stock market.

2. What are ADR fees

ADRs have custody fees that are levied on a regular basis. In addition, some ADRs may be subject to dividend distribution fees, ratio change fees, etc. These fees differ by ADR. For specific information, please refer to your ADR prospectus or search through SEC EDGAR.

|

Fee Type |

Description |

Amount |

Payment Frequency |

|

Custody fee |

ADR issuers charge custody fees to brokerages or clearing firms, who then pass these fees to ADR holders.

|

$0.02 to $0.05 per share on average |

Unfixed. Maybe multiple times per year |

|

Dividend distribution/stock split fee |

Dividend distribution/share split fees may be incurred in the event of dividend distributions or stock splits |

Unfixed |

In accordance with the occurrence of dividend distributions or stock splits |

|

Cancellation fee |

Cancellation fees may be incurred in the event of ADR delisting or cancellation |

$0.02 to $0.05 per share on average |

In accordance with the occurrence of ADR delisting or cancellation |

|

Ratio change fee |

Ratio change fees are charged by the depository bank in the event of changes in the ratio of ADRs to underlying shares |

$0.02 to $0.05 per share on average |

In accordance with the occurrence of ratio changes |

Please note: The above fees are for reference only. Specific amounts, as well as payment frequency and timing, vary by ADR.

3. How ADR fees are collected

Generally speaking, ADR fees are deducted from the cash in your account on the payable date. When ADR fees are incurred, the custodian bank will regularly update the record date, payable date, etc. The brokerage will freeze the receivable amount on the record date, and then deduct it according to the date on which it is actually deducted by the depositary bank.

Record date: Fees will be charged for ADRs you buy before the market closes one trading day before the record date, which will have settled by the record date. You will still be charged ADR fees if you sell ADRs on or after the record date.

Payable date: the date on which ADR fees are deducted by the bank. It may be different from the date of deduction by the brokerage due to reasons such as funds settlement.

Please note: When ADR fees are frozen or deducted, you will receive system messages and email notifications.

4. Where to find information on ADR fees

Most ADRs are under the custody of four major banks, i.e. BNY Mellon, Deutsche Bank, Citi Bank, and J.P. Morgan.

Some ADRs are under the custody of one of these banks. If you can not find the relevant information on that bank’s official website, please try the websites of the other three banks.

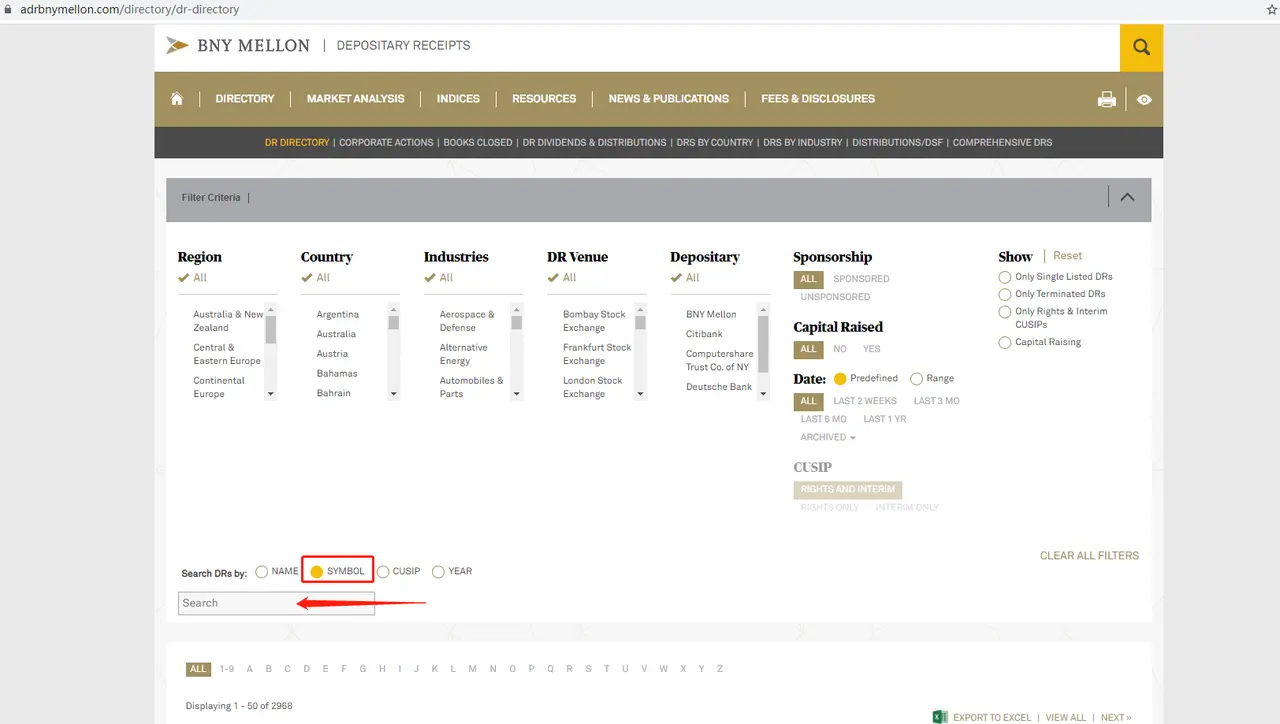

4.1 BNY Mellon

Go to the website of BNY Mellon, select Symbol, enter the stock symbol, and a page showing the ADR details will pop up.

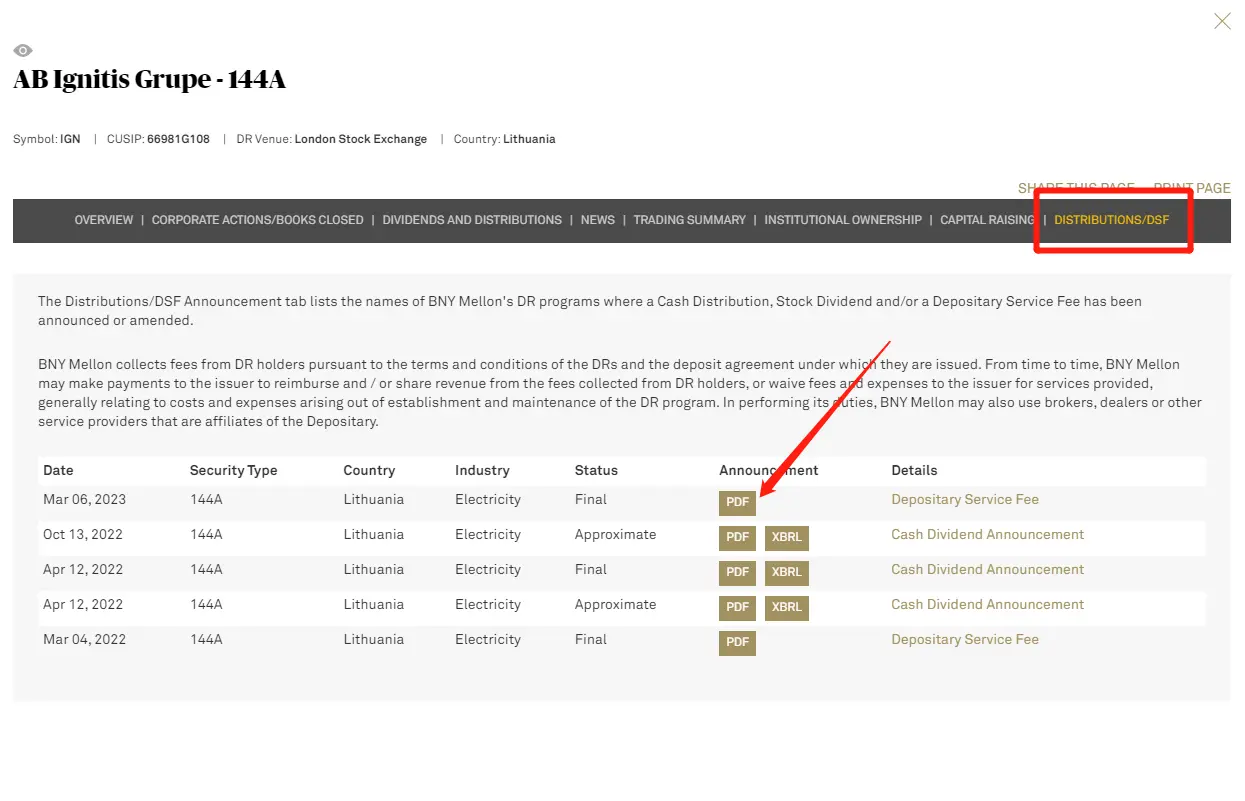

Click Distribution/DSF on the page to view the details of ADR fees, and click the PDF icon to view or download the bank notice.

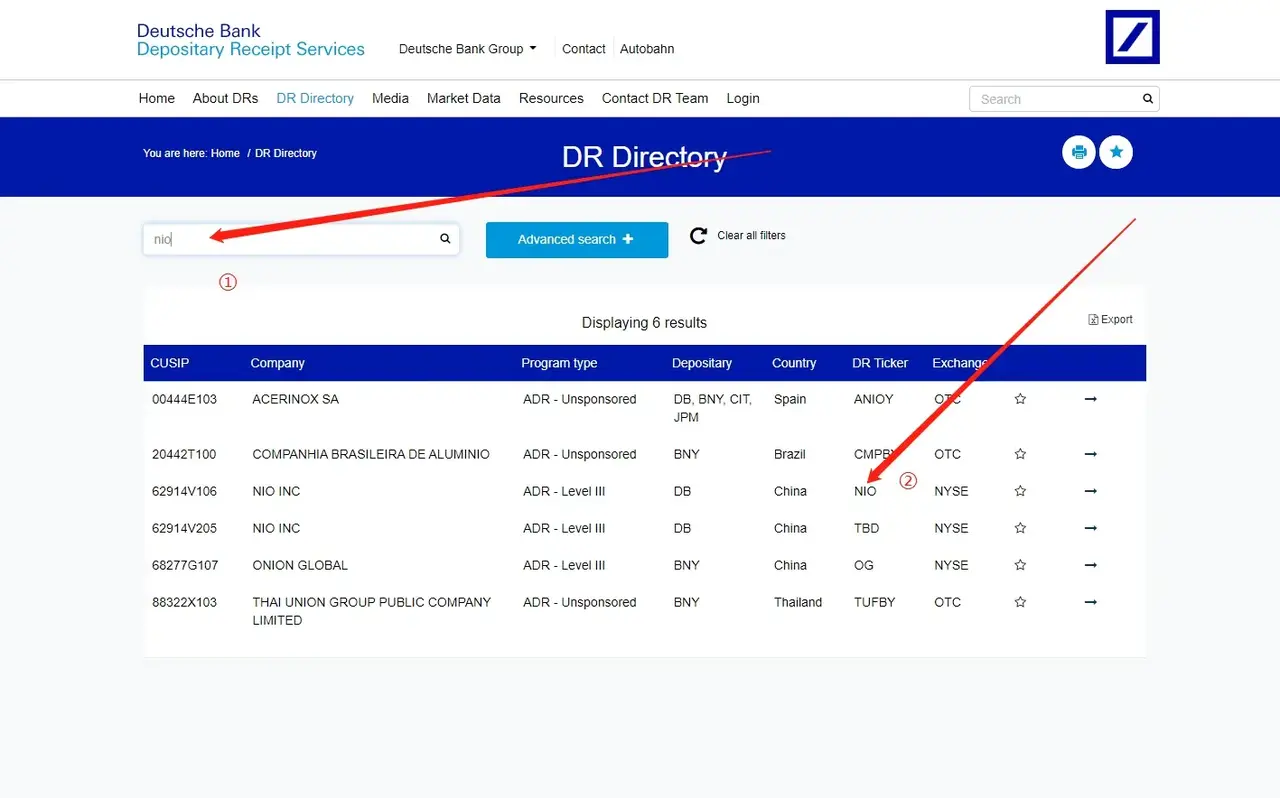

4.2 Deutsche Bank

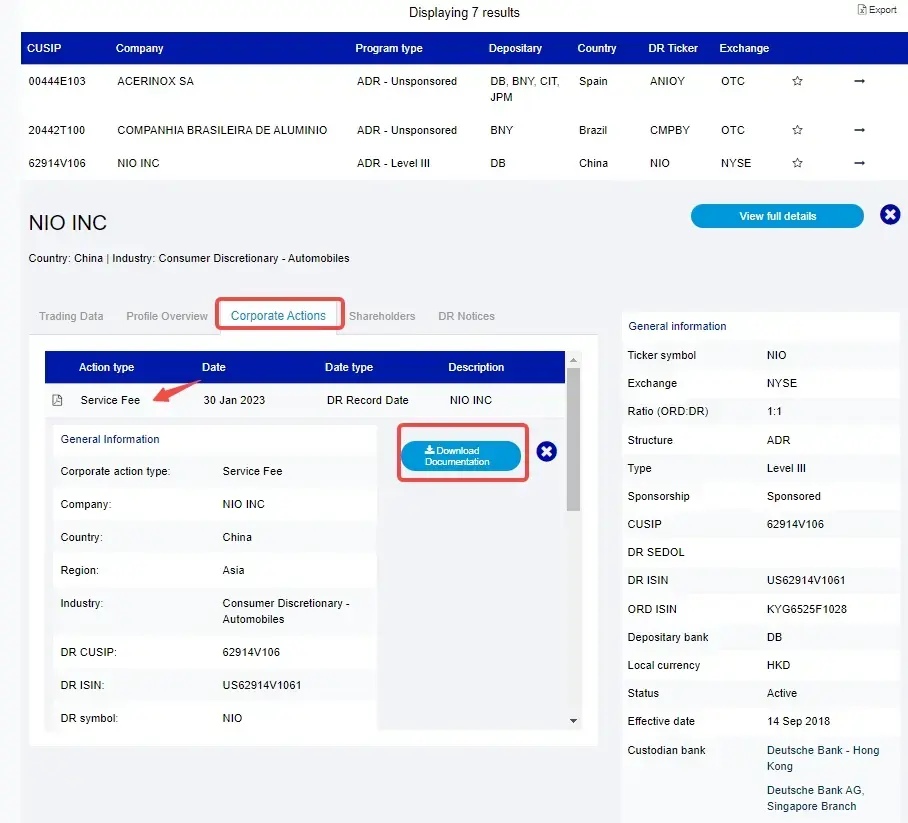

Go to the website of Deutsche Bank, enter the stock symbol in the search bar, click the corresponding DR Ticker, and the ADR details page will appear.

Click Corporate Actions on the page to view the details of ADR fees, and click the link on the right to download the bank notice.

4.3 Citibank

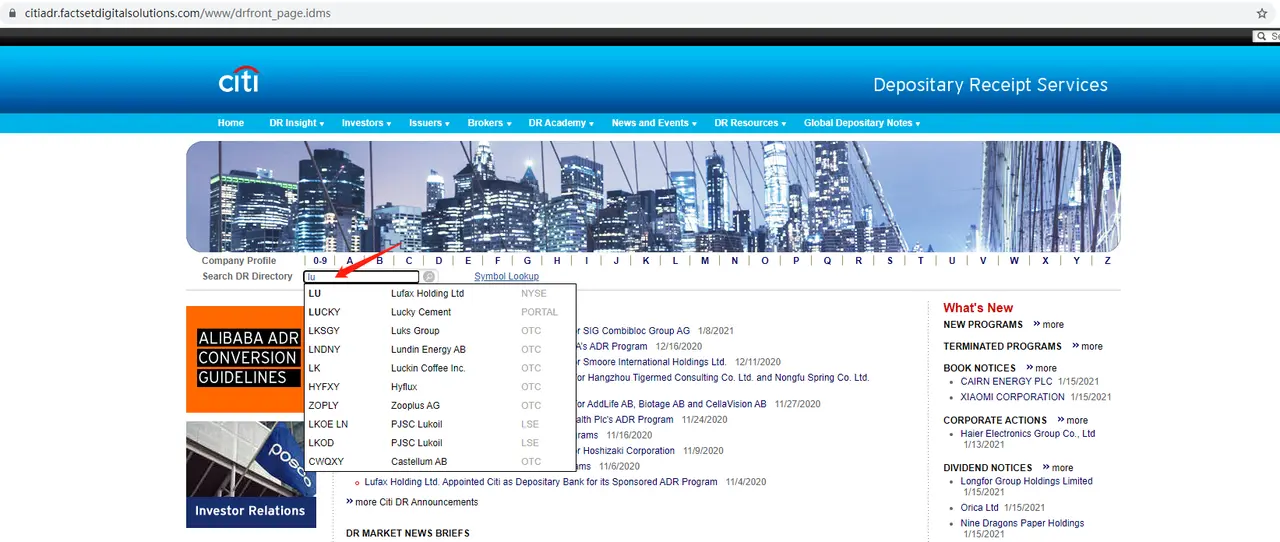

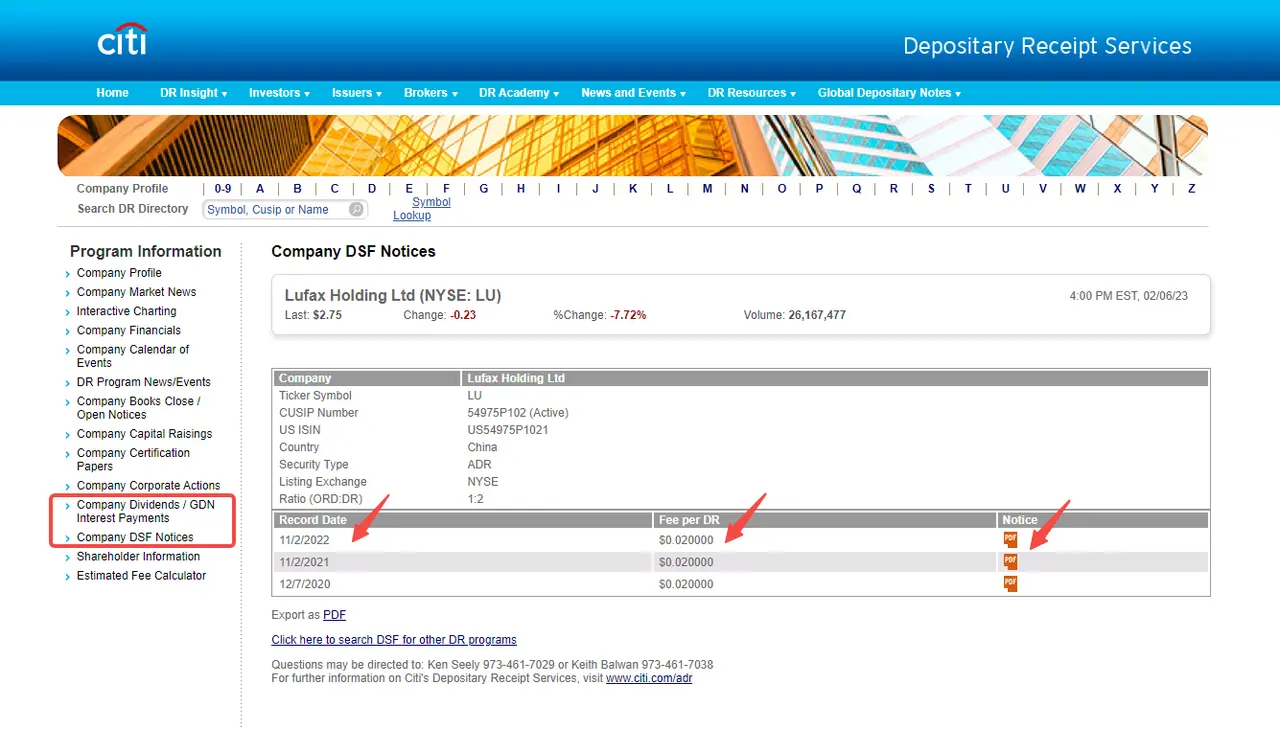

Go to the website of Citibank, enter the stock symbol in the search bar, click Search, and the ADR details page will appear.

Click Company Dividends/GDN Interest Payments or Company DSF Notices on the right navigation bar of the page to view the details of ADR fees, and click the PDF icon to download the bank notice.

4.4 J.P. Morgan

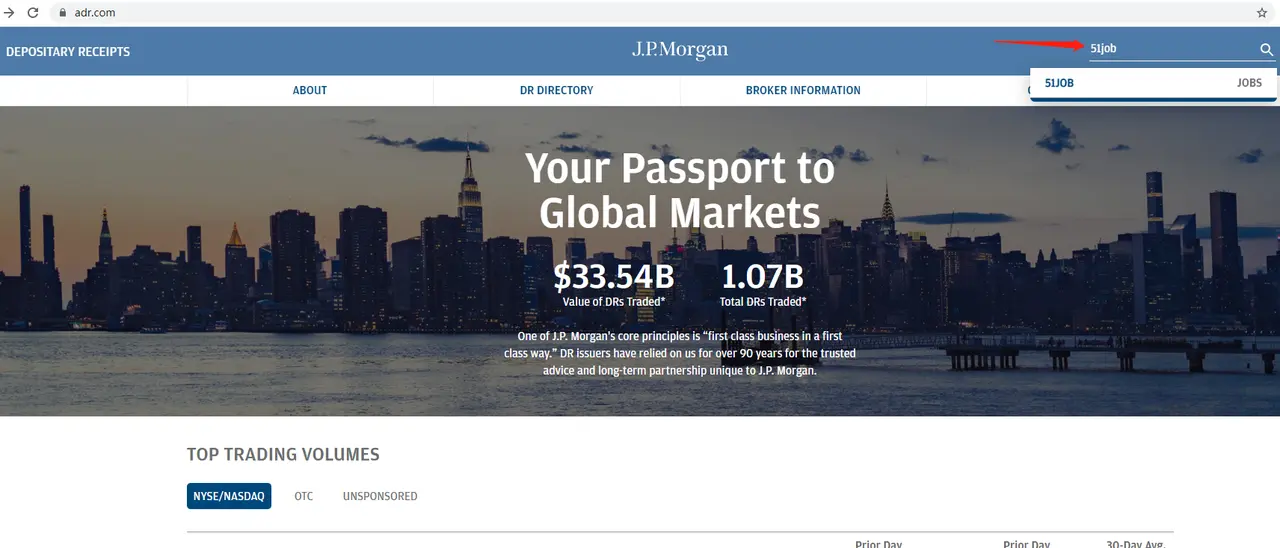

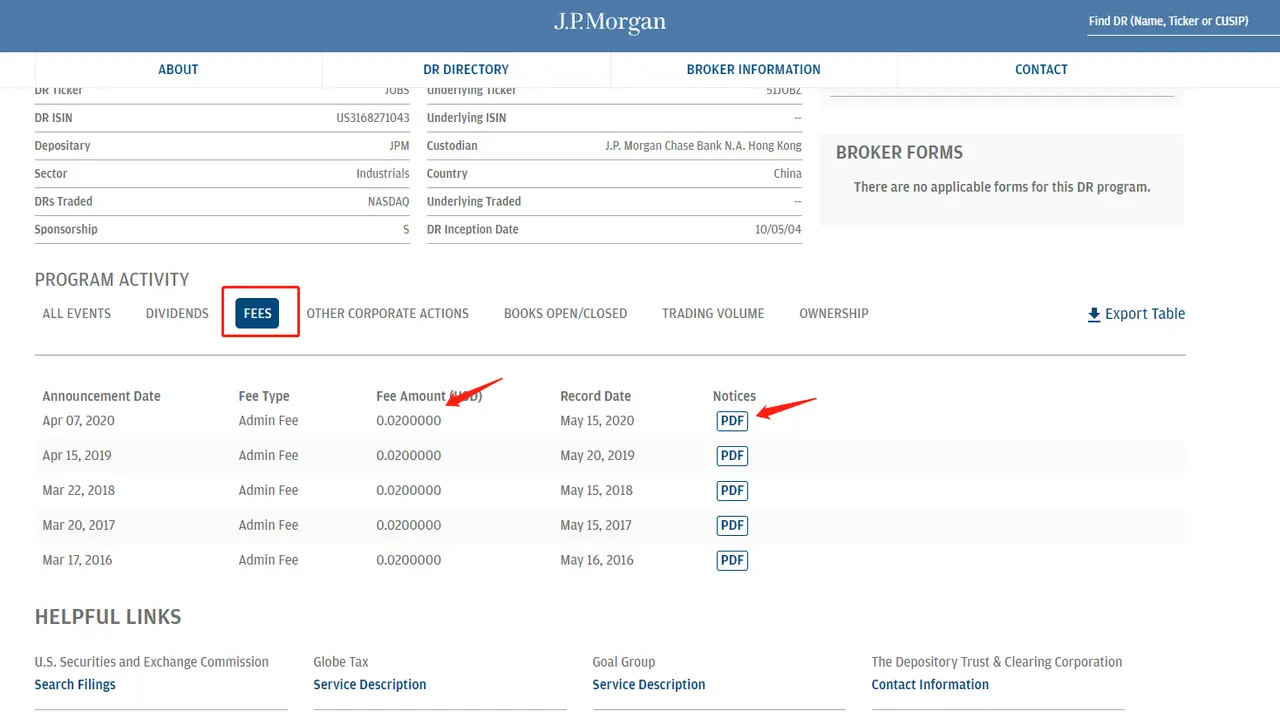

Go to the website of J.P. Morgan, enter the stock symbol in the search bar, click Search, and the ADR details page will appear.

Click Fees under Program Activity on the page to view the details of ADR fees, and click the PDF icon to download the bank notice.

5. Where to check my ADR fees

In your daily statement, find items with an ADR Fee description in the Comment field. You can also view your ADR fees via Accounts > Any Account > More > Funds Details in the app.