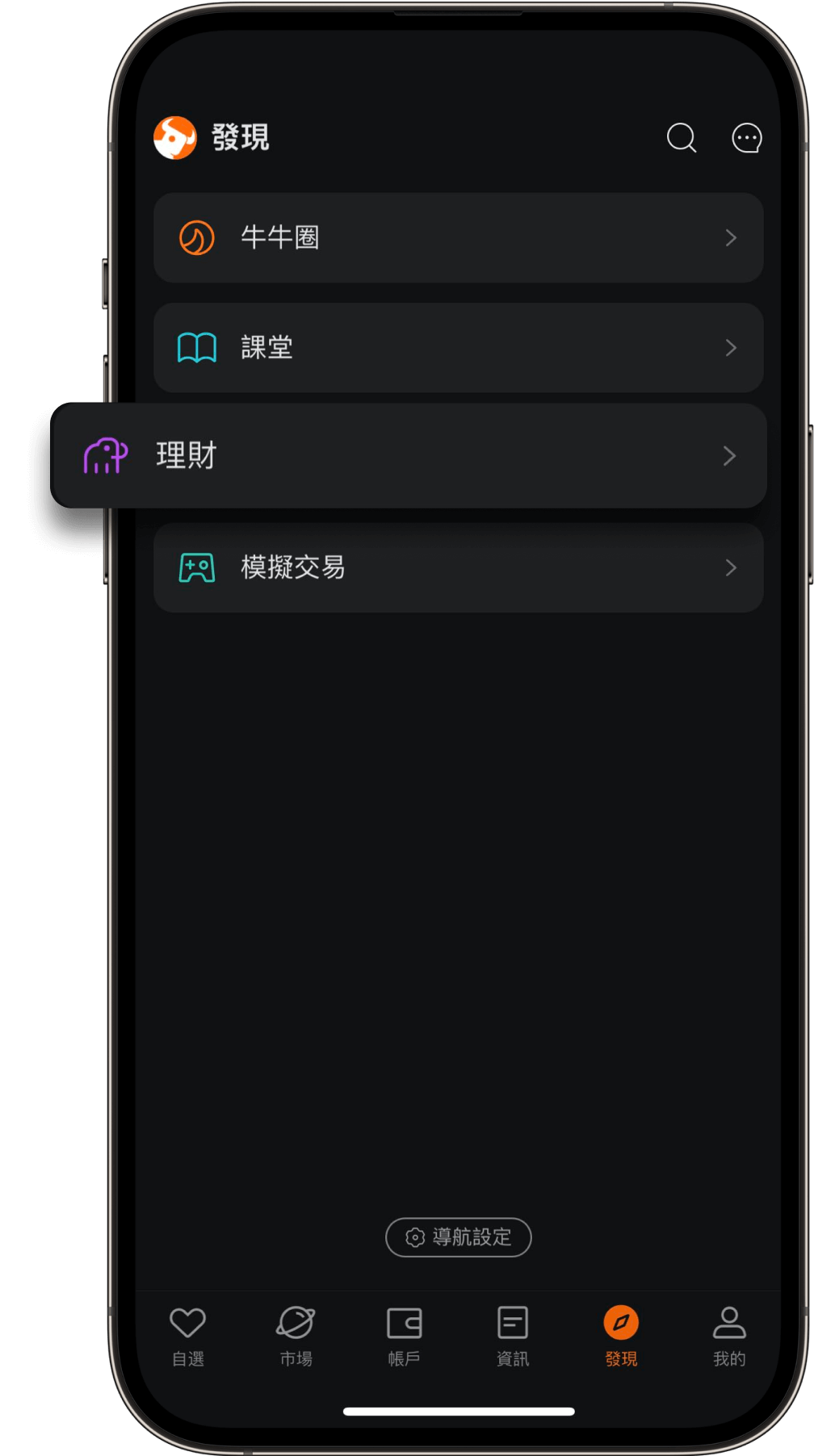

Futu developed a systematic fund

rating model.

Only funds with a

passing score and which rank

high

can appear on the platform.

Clear

All

Quotes

News

Learn

Help

All

HK

US

CN

SG

AU

JP

All

News

Announcements

Reports

No matches yet

Operations too frequent. Please try again later.

Please check network settings and try again Refresh

Refresh

Loading

History record

Latest News

Quotes

More

News

More

Learn

More

Help

More

Loading

News

More

Announcements

More

Reports

More