What is Cryptocurrency? Learn how to trade Bitcoin, Ethereum ETF in Hong Kong

Virtual Asset has gained attention in the financial world in recent years because it is influencing the world's perception of money and transactions. Whether Bitcoin, Ethereum or other cryptocurrencies, they attract the eyes of countless investors due to their transparency, anonymity and efficient transfers. In Hong Kong, trading cryptocurrencies and virtual asset ETFs is not only a new investment option, but also a new trend in fintech. This article will detail the basics of cryptocurrencies and provide practical tutorials on how to trade crypto-related assets such as Crypto and Bitcoin Bitcoin ETF in Hong Kong.

What is Cryptocurrency?

cryptocurrencyIt is one of the virtual assets and is based on Blockchain technology to record all transactions and use encryption technology to secure transactions, control the generation of new units, and validate asset transfers. Unlike traditional currencies, cryptocurrencies are decentralized and not controlled by any government or financial institution. THIS MEANS THAT CRYPTOCURRENCY TRANSACTIONS ARE JOINTLY MAINTAINED BY GLOBALLY DISTRIBUTED NODES RATHER THAN MANAGED BY A CENTRAL AGENCY.

Difference between Cryptocurrencies and Legal Currencies

cryptocurrency | Legal Currency | |

definitions | Blockchain-based digital currencies using cryptography to secure transactions | Currency issued by the government and recognized by law |

Technology Basics | Completely decentralized, not controlled by any central body, jointly maintained by distributed networks | Centralized system controlled and managed by the Central Bank |

Practical Application | Decentralized finance (DeFi), non-denominated tokens (NFTs), cross-border payments, online transactions, and more. | Daily transactions, pay wages, pay taxes, save, invest, etc. |

Scope of use | There are no borders and can be used by anyone with a network and a digital wallet. | Usually limited to use within the issuing country or region, but can be exchanged via the foreign exchange market. |

Representative Examples | Bitcoin (Bitcoin), Ethereum, etc. | Renminbi (CNY), Hong Kong Dollar (HKD), US Dollar (USD), etc |

Principle of operation behind cryptocurrency technology

Blockchain Technology

Cryptocurrencies rely on blockchain technology to operate. Blockchain is a distributed ledger technology (DLT) that is jointly owned and maintained by the network. FEATURES INCLUDE DECENTRALIZATION, TAMPERABILITY, TRANSPARENCY, AND ANONYMITY. Decentralization reduces costs and increases efficiency, non-tampering ensures data integrity, transparency increases transaction openness, anonymity protects user privacy.

Encryption technology

Encryption technology is key to ensuring transaction security and data integrity. Each transaction is encrypted and recorded in blocks, which are linked together in chronological order to form an immutable chain. Any attempt to tamper with a single block is detected and rejected by other nodes, ensuring the integrity of the data and the security of user privacy.

Mining Mechanism

Mining, a process of validating blockchain transactions and adding new coins, is an important part of the cryptocurrency ecosystem that ensures the security and decentralization of cryptocurrencies such as Bitcoin based on Proof of Work, PoW) consensus mechanisms. Mining refers to using computational power to solve complex mathematical problems in order to validate and add new transactions to the blockchain. Miners who successfully solve problems receive newly generated cryptocurrencies as a reward, which not only motivates miners to participate in network maintenance, but also ensures the effectiveness and security of transactions.

Characteristics of Cryptocurrencies

DECENTRALIZATION: CRYPTOCURRENCIES DO NOT DEPEND ON CENTRAL INSTITUTIONS TO OPERATE, AVOIDING THE CONTROL OF GOVERNMENTS OR FINANCIAL INSTITUTIONS.

Open Transparency: All transaction information is publicly recorded on the blockchain and anyone can inquire at any time, increasing the transparency of transactions.

Anonymous Identity: Powerful encryption technology protects the security and anonymity of transactions, showing only a public address, making it difficult to track the identity.

NON-TAMPERABLE: ONCE THE TRANSACTION IS COMPLETE, IT IS NOT REVERSIBLE, UNLIKE A LEGAL CURRENCY TRANSACTION, CANNOT BE CANCELED THROUGH THE BANK.

Globalization: Cryptocurrencies are borderless, with Internet access to trade globally, without the intervention of traditional financial institutions.

High Efficiency Low Cost: Cryptocurrency transfers are fast, low cost, and 24/7 service, improving transfer efficiency and convenience.

Popular Cryptocurrencies

As of June 2024, there are currently more than 10,000 cryptocurrencies. If you are starting to venture into the world of virtual currencies because of the high risk of newly listed currencies, consider starting with cryptocurrencies that rank ahead of the market and seize the time to invest. The following are the 3 cryptocurrencies with the highest market capitalization as of June 2024:

Bitcoin (Bitcoin)

$ Bitcoin (BTC.CC) $ The world's first issued cryptocurrency, founded in 2008, has a total cap of 21 million units, and its market value and acceptance is far higher than other cryptocurrencies.

Ethereum

$ Ether (ETH.CC) $ ETH, which is traded second only to Bitcoin, is the second highest cryptocurrency in the world by circulation and market capitalization. Since there is no upper limit to the issue volume of Ethereum, its price is low relative to Bitcoin.

Tether (USDT)

A digital asset linked to the dollar, its issued cryptocurrencies have corresponding dollar reserve support and are stored in specific bank accounts to reduce the price volatility of the cryptocurrency, also known as stablecoins.

Bitcoin Bitcoin Spot ETF

Cryptocurrency futures, such as Bitcoin are directly buying and holding virtual assets, can affect gains or losses in their asset price. As of June 19, 2024, Bitcoin's price peaked at $65,069*, while the Bitcoin Spot ETF (exchange-traded fund) tracks the price performance of Bitcoin or indices, where investors can buy at relatively low prices, hold fund shares, and do not directly hold virtual assets. As of July 11, 2024, the largest asset-sized Bitcoin spot ETFs in the Hong Kong and US equity markets were Chinatown Bitcoin (03042) and Grayscale Bitcoin Trust (GBTC) *.

*GBTC is only available for professional investors

Other Cryptocurrency ETFs

In addition to the Bitcoin Spot ETF, the Hong Kong and US equity markets haveBitcoin, Ethereum Futures ETFThis ETF tracks cash-settled cryptocurrency futures contracts that are traded on the market, and currently the largest cryptocurrency futures ETF is the ProShares Bitcoin Strategy ETF (BITO) on the U.S. stock market, reaching $2.315 billion. As for the US equity market, on 23 July 2024, the US Securities Exchange (SEC) approved the listing of an Ethereum spot ETF, which requires a “Professional Investor” certification.

Cryptocurrency Trading Hours

The cryptocurrency spot market currently supports 7x24 hours of trading and selling with no closing hours.

Cryptocurrency “Burst” Meaning

You may have heard of a “cryptocurrency boom,” which refers to an investor's margin account not having enough funds to sustain the trades they hold, resulting in the market forcing a closure, causing investors to suffer significant losses. This is often the case when investors trade using leverage because leverage magnifies risk.

To reduce this risk, investors can choose to directly hold spot assets in cash, such as Bitcoin (BTC) and Ethereum (ETH), these mainstream cryptocurrencies are relatively secure, without worrying about the risk of a blowout.

Investing in the cryptocurrency market can be more stable as long as you adopt the right investment strategy and risk management.

How to invest in cryptocurrencies?

1. HOLD CRYPTOCURRENCIES DIRECTLY

Run to win huge assets around the world! Bitcoin is up nearly 55% this year, how will the post-market play out?

2. Bitcoin, Ethereum, Spot or Futures ETF in the Hong Kong and US Market

The US election is in the final countdown! Can Bitcoin return to historical highs and what other opportunities do the Hong Kong and US equity markets have?

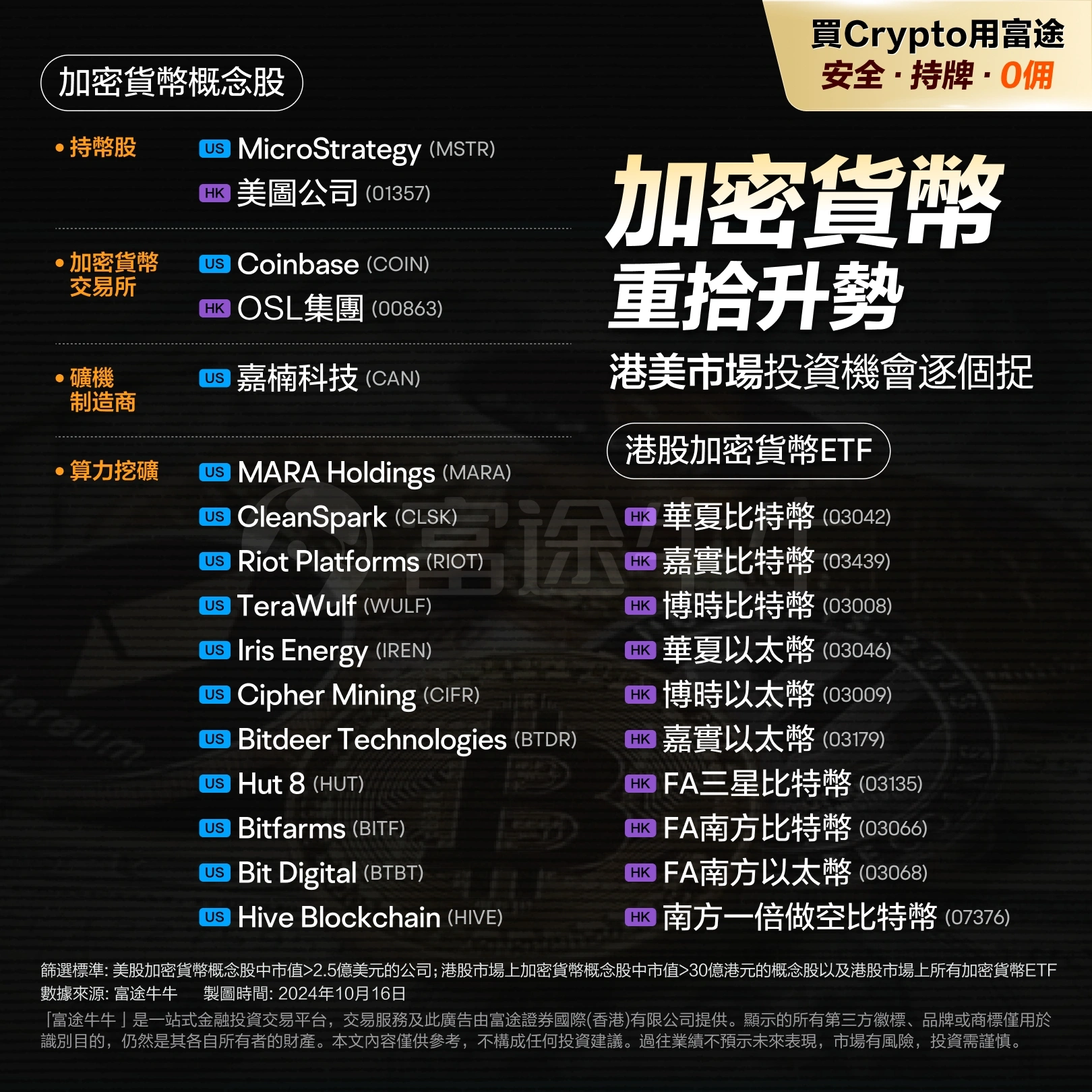

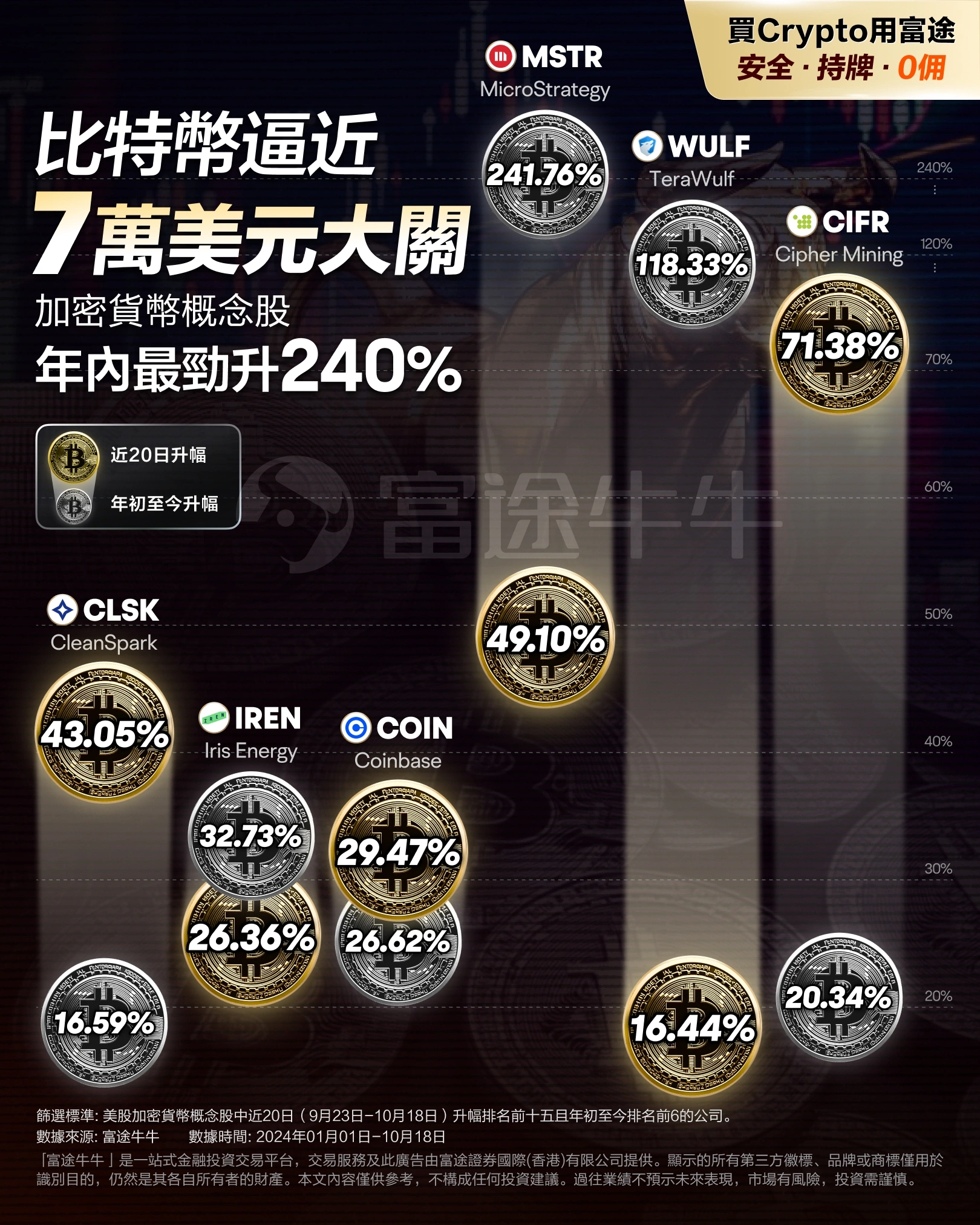

3. Crypto Concept Stocks

Multiple interests resonate, Bitcoin nears the $0.07 million mark! MicroStrategy Soars 240% Year-to-Date to Record High

How to Trade Cryptocurrencies in Hong Kong?

Futu Securities provides virtual asset trading services for Hong Kong certificated institutions to trade cryptocurrencies, cryptocurrency futures ETFs, futures ETFs and related securities in one place. When trading, Futu offers CFD transactions, users need to enter USDT and can directly purchase Bitcoin and BTC futures using HKD or USD.

If you know that you have no prospects for cryptocurrency, do not miss the first step in Futu, explore the world of cryptocurrencies and trade virtual currencies! Let's start now,Find out more about potential investment opportunities in the virtual currency market >>

^Offer subject to terms and conditions

How to Trade Cryptocurrencies with Futu?

Here's how to follow the steps of Futubull Crypto:

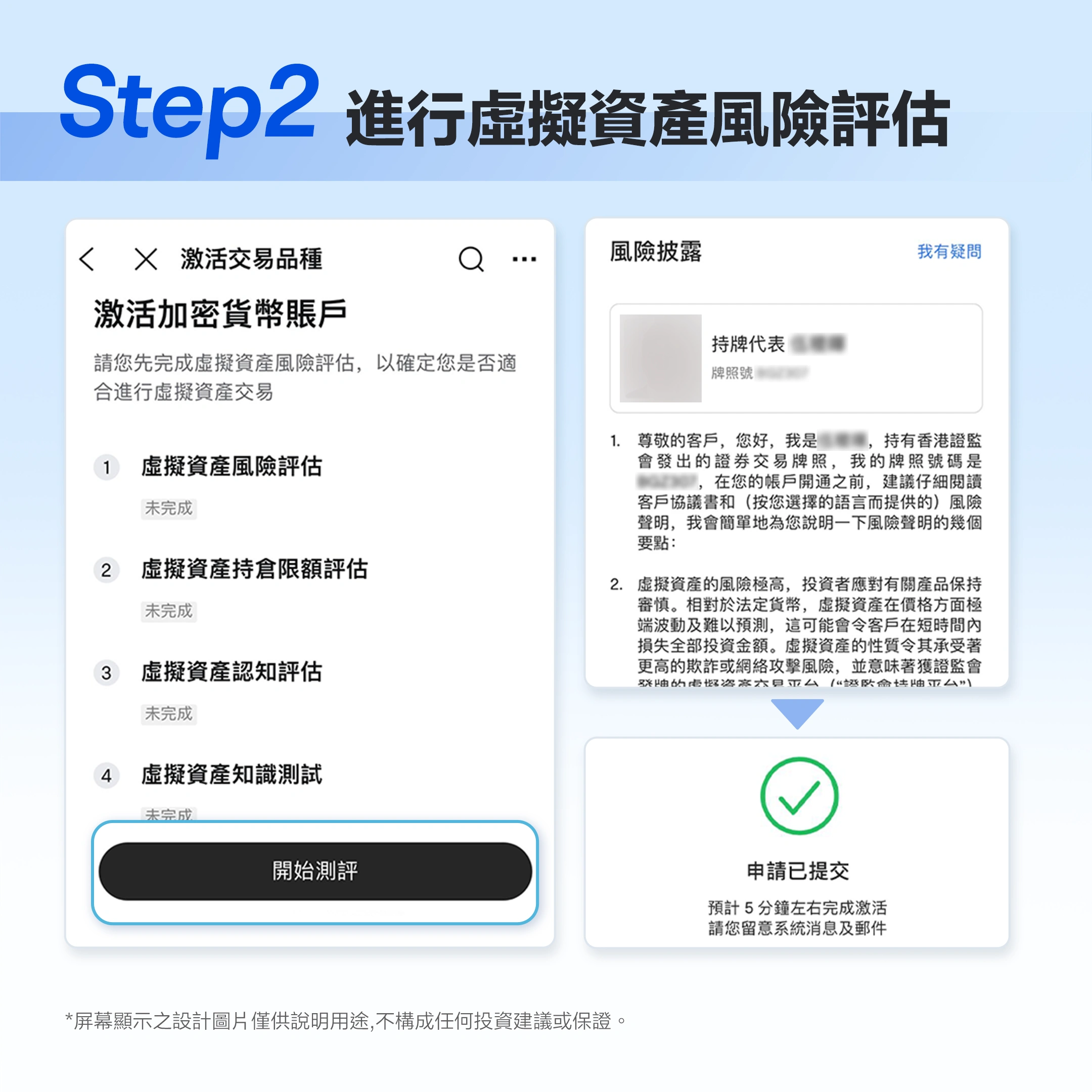

After opening an account, activate the Crypto trading function, go to the [Accounts] page, click on [Cash Comprehensive Account], and open [Account Management] in [More], [Activate Trade Varieties] in [More], and select [Cryptocurrencies] in [Unactivated].

Before starting a cryptocurrency account, a “virtual asset risk assessment, virtual asset holding limit assessment, virtual asset knowledge test”, and identity verification are required. After submitting the application, start up in about 5 minutes and a successful launch will receive a system message and message.

Before trading cryptocurrency, please allow time to deposit funds into your cryptocurrency account. Go to the [Accounts] page, click on [Cash Integrated Account - Cryptocurrency], select [Funds Transfer] or [Deposit Funds], then select the settlement currency type and enter the amount to trade after your account.

Enter the market for crypto currency, select the currency that offers the trade, click on the lower left corner to trade, and you can start selling. (How to trade cryptocurrencies on Futubull)

If you intend to invest in a cryptocurrency ETF, you can search for [Cryptocurrency ETF] in the search box to track more cryptocurrency ETFs. You can also learn about the size of each ETF's assets and basic information such as management fees, dividend policies, etc., on the ETF Funds page to guide your investment decisions.