U.S. General Election 2024

US Election 2024 | A Guide to Investing Under Trump

On the morning of November 6, US local time, Republican presidential candidate Trump declared victory in the 2024 presidential election. Under the influence of the election, the Trump trade overtook major assets, the S&P 500 index futures rose 2%, the US dollar and US bond yields rose, and Bitcoin rose to a record high of $75,000!

Trump Speeches

Trump's policy proposals vividly embody a conservative stance, emphasizing “America First,” implementing trade protectionism, strict immigration restrictions, tax cuts and loosening industry regulation, advocating a massive expansion of traditional energy, and decrying climate change as a “hoax.”

While Trump returns to the White House, infrastructure, traditional energy, finance, pharmaceuticals and other industries may benefit, his policies may also cause inflation to rise again, dragging down market performance.

The impact of the US election on US stocks

Pledging to cut corporate taxes and reduce regulation, Trump may appoint a dovish Fed chairman. His win is expected to benefit the financial industry, including banks and asset management companies, and help lift the U.S. stock market in the short term.

From the historical record, the US presidential election has had some impact on the monthly performance of US stocks. Near the day of the US election, market volatility usually increases, leading to weaker stock market performance; and after the US election results are released, market uncertainty disappears, volatility gradually recedes, and US stocks have the opportunity to bounce back.

According to the Bank of America statistics, US stocks generally fell in the months leading up to the US elections in 9-October, followed by a rebound in the 11-December period after the US general election. In fact, many analysts have long predicted that the rise of US stocks will continue until the end of 2024, regardless of who wins the US presidential election. The S&P 500 fell 1.4% in the week before the vote, which could be a signal for the stock market to move higher in the next month. If the S&P 500 is weak before Election Day, it will perform well after Election Day, with an average gain of around 4% by year-end, according to Jeffery's analysis.

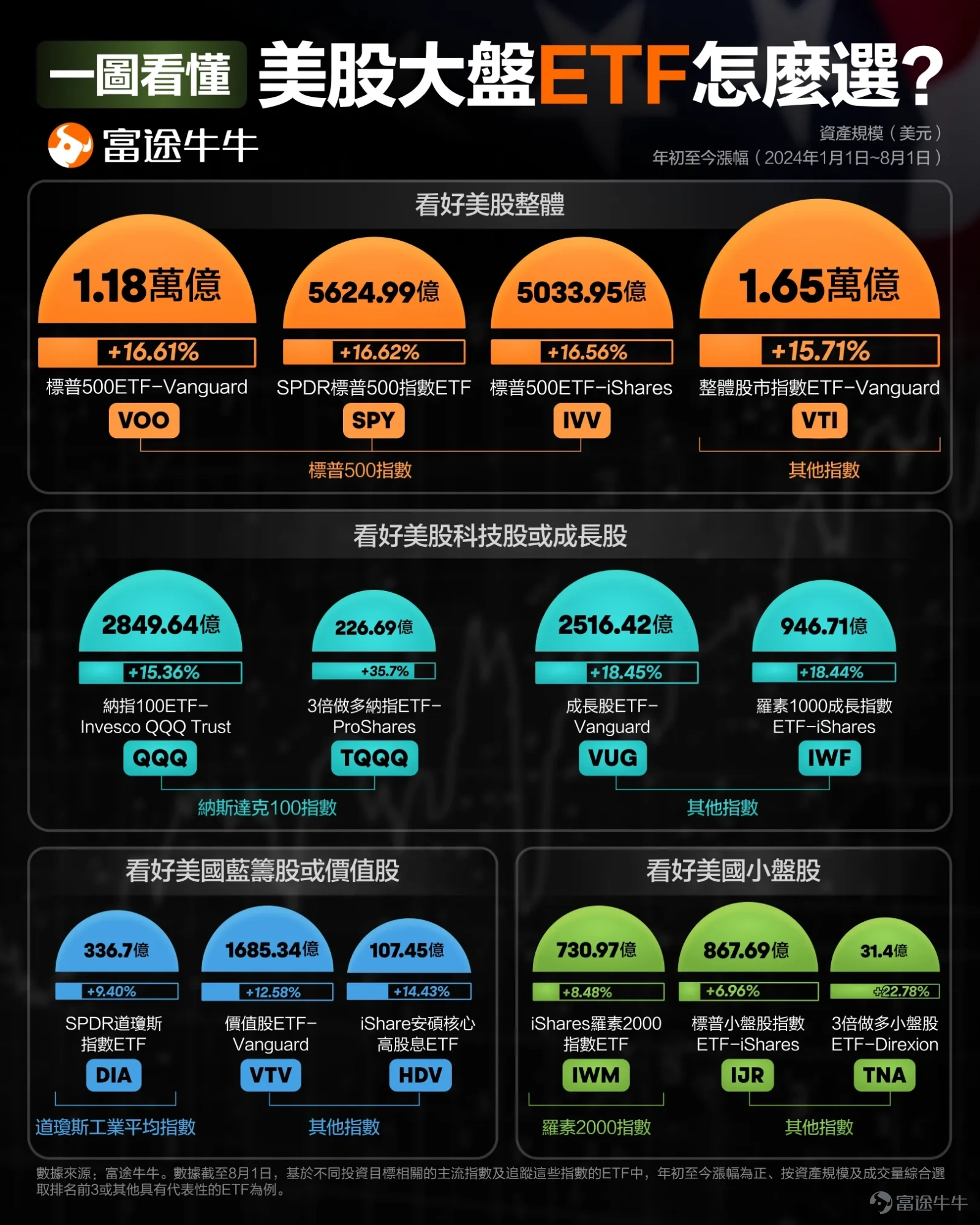

If you look at the US stock market, investing in the S&P 500 can effectively disperse individual and industry risks, and in the long run it is also a tool to beat inflation. Tracking the S&P 500 index, large ETFs with good liquidity and lower rates have $Vanguard S&P 500 ETF(VOO.US)$ 、 $SPDR S&P 500 ETF(SPY.US)$ 、 $iShares Core S&P 500 ETF(IVV.US)$ etc.

Effects of the US Election on Bitcoin

Trump is undoubtedly a supporter of cryptocurrencies, and Bitcoin's rise is seen as one of the key directions of “Trump trading.” Trump vowed that if he returned to the White House, he would make the United States the global cryptocurrency capital, build strategic Bitcoin reserves, and appoint regulators who love digital assets, indicating that he is the most industry-friendly candidate.

Influenced by the election, the price of Bitcoin broke above $75,000 on the day of the US election, rising more than 8% to hit an all-time high.

In the US equity market, cryptocurrency-related concept stocks mainly consist of three companies: the world's largest cryptocurrency trading platform $Coinbase(COIN.US)$ , the largest mining company in the world $MARA Holdings(MARA.US)$ and one of the listed companies holding the most Bitcoin $MicroStrategy(MSTR.US)$ 。

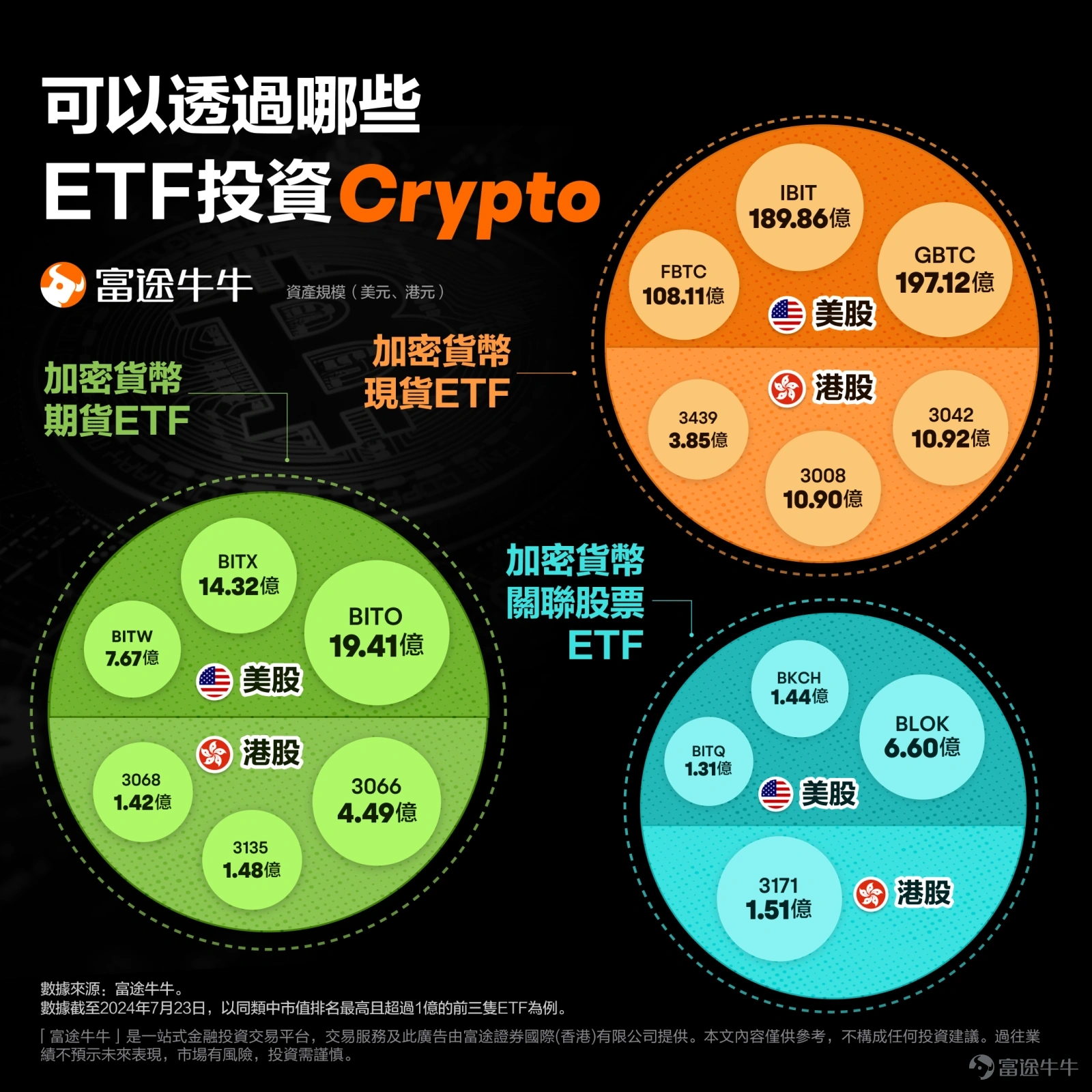

In addition, investors can also track the price movements of cryptocurrency assets such as Bitcoin ETFs, such as Bitcoin ETFs, which can be divided into cryptocurrency spot ETFs, cryptocurrency futures ETFs, and ETFs for cryptocurrency-related stocks.

Effects of US Elections on the US Dollar and US Debt

Trump winning the US election could mean that the market will be in for a “strong dollar storm”. As traders in the forex market expect Trump to implement trade protectionist policies, including raising tariffs on imports to support US manufacturing. In addition, Trump's repeated emphasis on tax cuts will stimulate inflation and reduce the Fed's room for interest rate reductions, pushing the U.S. dollar and U.S. bond yields higher.

Morgan Stanley expects that the dollar will strengthen after the Republican victory, and the dollar will rise against the euro, the renminbi, other currencies that may be affected by tariffs, such as the euro, the renminbi.

Bond traders say the Republican victory poses a “clear threat” to bond buyers. With Republicans united with Congress, Trump will advance tax cuts and tariff plans, widen the fiscal deficit, and restart the era of inflation. This will push up yields on 10-year US bonds, and bond prices may fall further.

Larger in the US Bond ETF $Vanguard Total Bond Market ETF(BND.US)$ 、 $iShares Core US Aggregate Bond ETF(AGG.US)$ and $iShares 20+ Year Treasury Bond ETF(TLT.US)$ Both have fallen to three-month lows, while the dollar index has breached 105 again in four months.

TRUMP WINS ETFS WORTH WATCHING

Tax Reduction Policy

Beneficiary Segment: Enterprise as a whole, especially large multinational companies, small enterprises, consumer segments

Good logic: Tax reduction policies directly reduce companies' tax burden, increase their profits and cash flow, leaving them with more capital to invest, buy back shares or distribute dividends, and increase shareholder returns. At the same time, the personal income tax exemption will increase consumers' disposable income and promote consumption growth.

Related ETFs

Enterprise as a whole, especially large multinational companies: $SPDR S&P 500 ETF(SPY.US)$, $Invesco QQQ Trust(QQQ.US)$

Small Business: $iShares Russell 2000 ETF(IWM.US)$ $Vanguard Small-Cap ETF(VB.US)$

Infrastructure construction

Beneficial Sectors: Building Materials, Construction Engineering Companies, Heavy Machinery Manufacturers

Good logic: Promoting large-scale infrastructure planning, including the construction of roads, bridges, airports, etc., will directly increase the demand for building materials and engineering services, driving the growth of related industries.

Related ETFs

Building Material: $Materials Select Sector SPDR ETF(XLB.US)$ , $iShares US Basic Materials ETF(IYM.US)$

Architectural Engineering Company: $Ishares U.S. Infrastructure Etf(IFRA.US)$ , $Global X Funds Global X U.S. Infrastructure Development Etf(PAVE.US)$

Heavy Machinery Manufacturer: $Industrial Select Sector SPDR Fund(XLI.US)$ , $Vanguard Industrials ETF(VIS.US)$

Energy Policy (Supporting Traditional Energy)

Beneficial Sectors: Petroleum, Natural Gas, Coal, Slate Oil

Good logic: The Trump administration tends to relax regulation of the traditional energy industry, supporting the development and use of fossil fuels. This will lower energy companies' operating costs, increase their profitability, and promote U.S. energy self-sufficiency and export growth.

Related ETFs

Trade Policy (Protectionism)

Beneficial Sectors: Domestic Manufacturing, Steel, Aluminum

Good logic: By imposing tariffs and trade barriers, the Trump administration is trying to protect U.S. domestic manufacturing from foreign competition. This policy may benefit domestic manufacturing enterprises, since their products will be relatively more competitive in the domestic market.

Related ETFs

Domestic manufacturing industry: $Ishares U.S. Industrials Etf(IYJ.US)$ , $Vanguard Industrials ETF(VIS.US)$

This time Trump is elected President of the United States again, his policy changes will bring a series of new investment opportunities.

We can both effectively capture these opportunities by laying out relevant ETFs, dispersing risk, and capture investment opportunities for genuine stocks with concept stocks.

Trump Concept Stocks

“Trump concept stocks” have been one of the topics of hype in the market this year, and there is a chance for a new round of hype about related labels when Trump is elected.

In which, $Trump Media & Technology(DJT.US)$ Widely considered to be the most pure “Trump concept stock”. DJT is the parent company of the famous Truth Social, in which Trump owns nearly 60% of the shares. DJT tends to rise strongly whenever the odds of Trump winning increase. Since the end of September, DJT has rebounded strongly, with the share price rising from less than $12 to near $55, to a peak of more than 360%.

In the “Seven Giants” of US stocks, $Tesla(TSLA.US)$ They are the potential beneficiaries of the Trump deal. Tesla's CEO Musk is one of Trump's biggest supporters, donating nearly $75 million in campaign funds to him. Trump also promised that if elected, he would appoint Musk as chairman of the Commission on Government Efficiency. TESLA'S STOCK PRICE SOARED 12% IN OVERNIGHT TRADING AS THE ELECTION TILTS TO TRUMP!

In addition, stocks with close ties to Trump include $Rumble(RUM.US)$ und $Phunware(PHUN.US)$ 。 Similar in nature to DJT, Rumble is a social platform where conservatives gather and provides video hosting and streaming services for DJT. In addition, Trump's running mate, Vice President Vance, is also a shareholder in RUM. PHUN, IN TURN, PROVIDES SERVICES SUCH AS MOBILE APP DEVELOPMENT AND DATA ANALYTICS FOR THE TRUMP 2020 PRESIDENTIAL CAMPAIGN.

We have launched” $Donald Trump(BK22962)$ ”, for investors to follow and trade. Here are the main conceptual blocks that benefited from Trump's election and their logic:

1. Financial companies

Logic: The Trump administration implemented tax reduction policies and loosened financial regulation to benefit banks and financial institutions.

Beneficiary companies: Banks, asset management companies.

2. Natural Gas Production Company

Logic: The Trump administration supports the traditional energy industry, relaxes regulation, encourages the extraction and use of natural gas.

Beneficiaries: Natural gas production companies and related equipment manufacturers.

3. insurers

Logic: The Trump administration's adjustments in financial regulation and healthcare policy could benefit the insurance industry.

Beneficiary companies: various types of insurance companies.

4th. Biopharmaceuticals

Logic: The Trump administration's policy adjustments to the pharmaceutical market, including lowering drug prices and reforming the health care system.

Beneficiary companies: Pharmaceutical companies, medical device manufacturers.

5. Cryptocurrency Mining Company

Logic: Some policies of the Trump administration may have an impact on the cryptocurrency market, especially in the area of financial regulation.

Beneficiary companies: Cryptocurrency mining companies and related technology companies.

6. Trade Protection Beneficiary Company

Logic: Trump introduced trade protectionism to protect domestic manufacturing by imposing tariffs.

Beneficiary companies: Trade protected manufacturing enterprises in steel, aluminum, etc.

7. Agricultural equipment company

Logic: The Trump administration's agriculture and trade policies may affect the demand for farm equipment.

Beneficiary Company: Agricultural equipment manufacturer.