First Half 2024 Review: Is the Hong Kong Stock Bull Market Over? 3 key factors to expect positive results in the second half of the year

The first half of 2024 is almost over, and writers have recently begun to make some revisions and outlooks. Avoiding longer frames, this review series will separate Hong Kong and US stocks. After all, the investment logic, operation and focus of the two markets are not the same at the moment (although the conclusions are good, the authors never use the results to analyze and give advice). Today we will discuss Hong Kong stocks that are more complex and difficult to understand. In this review article, the authors will revisit some of their thoughts from this year, and in addition to seeing the right things, they will share some of their thoughts. After all, learning from mistakes is always one of the most effective ways to improve your experience.

Also, I wonder if you are still interested in the Japanese stock market? $Nikkei 225(.N225.JP)$Recently, the preparation for the challenge has been 4 million, but it seems that not many people are paying attention. If interested bulls welcome comments in the message area, the writer will consider the reaction to determine whether to discuss the overall outlook for Japanese stocks as well.

Performance of Hong Kong stocks in the first half of 2024

$Hang Seng Index(800000.HK)$At the beginning of the year under the influence of liquidity stress, which hit a year-on-year low of 14794 points on 22 January, some other policies that hoped to save the city, including rapid downsizing, national consolidation, state enterprise reform (CPI), etc. Although some of the above policies fell flat, as the news came, Hong Kong stocks Liquidity risk is also beginning to improve, which is the first signal that the market is seeing a bottom. The author also posted at the beginning of February“What about Hong Kong stocks? How to deploy next”In his view, although there is no 100% way to judge the market situation, it also suggests the time for a rebound in high value stocks.

Then, as the market sentiment slowly improved, another was published in mid-March“Is Hong Kong stocks coming to spring?”。 Although, from the point of view of the results, the option strategy proposed at the time was a failure![]() , but $Hang Seng TECH Index(800700.HK)$Indeed, close to the 4162 point mark, the subscription option at that time also entered the off-price price in May, was not a completely failed strategy.

, but $Hang Seng TECH Index(800700.HK)$Indeed, close to the 4162 point mark, the subscription option at that time also entered the off-price price in May, was not a completely failed strategy.![]() 。 More importantly, the author has mentioned it in other articles. $TENCENT(00700.HK)$、 $XIAOMI-W(01810.HK)$und $MEITUAN-W(03690.HK)$Technology stocks are stronger, the performance is stronger in comparison with the scientific indicators, and the performance of performance is no one to lose. Related article Interested cow friends, please tell me the history of the Futubull breed

。 More importantly, the author has mentioned it in other articles. $TENCENT(00700.HK)$、 $XIAOMI-W(01810.HK)$und $MEITUAN-W(03690.HK)$Technology stocks are stronger, the performance is stronger in comparison with the scientific indicators, and the performance of performance is no one to lose. Related article Interested cow friends, please tell me the history of the Futubull breed![]() .

.

The Hang Seng Index also entered a technical bull market as technology stocks performed well, and the authors subsequently published two articles”When entering a technical bull market, how should investors choose stocks?” and” Hong Kong stocks rise in a row, how should investors respond to the bull market?”, the index also continued its rise in May, reaching an initial peak after peaking at 19706 on May 24. The subsequent index showed a rapid decline, but in terms of the gold ratio, it was only a sharp upward adjustment. What's more, the index still hasn't fallen past the market's famed bull bear cutoff line 250 antennas, suggesting that the bullish 1 market sentiment seen by writers has not yet been beaten.![]() .

.

Performance of blue chip stocks

Based on the Futubull PC version, the following two trading days in June 2024 will now be slightly different from the entire six months of 2024, but relative analysis and market analysis will not make a big picture.

It can be seen clearly from the above-mentioned Blu-node stock performance, which showed a good performance this year, which is not open to high yield stocks and technology stocks, and these two blocks are the ones that we will be looking forward to this year. In addition to the results of direct monitoring, people missed the opportunity to increase their investment in May and higher dividends.How should investors look for treasure in high-yield stocks?”, among them $PETROCHINA(00857.HK)$、 $CHINA COAL(01898.HK)$、 $CHINA RES POWER(00836.HK)$、 $CCB(00939.HK)$、 $CHINA MOBILE(00941.HK)$All performed well, and these high-yield stocks continued to outperform the market even as the majors came back from their highs.

As for the weaker blue-chip stocks, either policy-affected, consumer or locally-related stocks, are fundamentally weaker stocks.![]() 。 This is the same as what the authors mentioned in the last year's lectures on technology trends; if we are to choose a downside estimation, more good fundamentals are needed to support the turn, and the performance of the above bluechips reflects what our classroom has mentioned.

。 This is the same as what the authors mentioned in the last year's lectures on technology trends; if we are to choose a downside estimation, more good fundamentals are needed to support the turn, and the performance of the above bluechips reflects what our classroom has mentioned.![]() .

.

First Half of 2024 Review

Overall, bettors felt good about their outlook on Hong Kong stocks in the first half of 2024, after all, high-yield stocks and tech stocks (Tencent, Merit and Xiaomi, which are seen only by technology buyers) were outperforming the market. Even if the authors say that the market situation has changed from bear to bull, they also emphasize that the market is bull 1, which means that the market situation will be very repetitive, as long as it is necessary to pursue some fundamentally stronger stocks and make some more medium-long deployments.

Biggest Mistakes of the Year - Consumer Markets

The authors agree with the view from the Bank's report in April that China's macroeconomic improvement is slowly turning positive, and there is no problem in this regard. However, the underestimation of the impact of writers in industry volumes and individual consumer markets is indisputable. The best example is $Kweichow Moutai(600519.SH)$。 While the stock is unrelated to Hong Kong stocks, it is definitely inspiring for the consumer sector.

First of all, the following comments do not mean that the author is currently looking at Tammautai, but what the author wants to share is that they underestimated the impact of the event. Since the beginning of May, the news has indicated that the price of moonshine has been trending downward in different distribution channels (this refers to the market, not the factory price). The authors initially thought that the fall in the price of the yellow bull was a healthy and marketable thing, but also underestimated the fact that the market's consumer spending power is still weak. Then, on the back of concerns about consumer weakness, the consumer goods and non-essential consumer stocks led sharply lower after May. Fundamentally, or if these concerns were overstated, the share price damage could not be seen. Whether the fundamentals of the consumer sector will change, it may take until the performance of the interim results to reflect, which is currently a very awkward one, whether in the A-share or Hong Kong stock markets.

With this in mind, the authors believe that even if the market atmosphere changes, it is better not to speculate wildly and recklessly judge the impact of certain events. In practice, strict curbs and discipline are needed.

Outlook for the second half of 2024

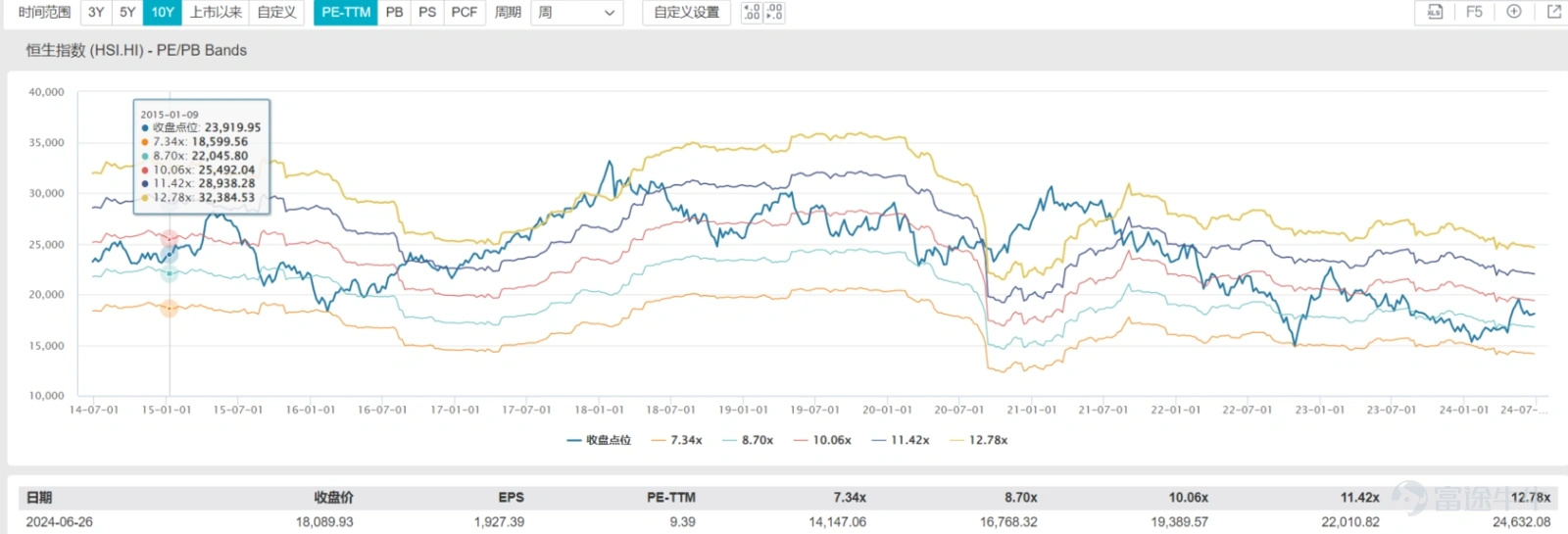

We can first judge the outlook for the second half of the year from the current valuation of the following Hong Kong stocks. Here are the market earnings channels for the Hang Seng Index provided by WIND:

The data shows that this year the index has recovered from levels below the two standard deviations at the bottom of the market earnings channel to a high of 19706 points on May 20 this year. The index has rebounded once to a 10-year average level. This means that the index is basically on the way to a valuation correction. If the index is to move further upwards (above the average level), the increase in corporate profits will be an important element.

Considering that the last six months, there have been a lot of heavy blue chips that have delivered outstanding results, such as $HSBC HOLDINGS(00005.HK)$China Mobile, Tencent, Meithun, Xiaomi and others have also seen their expectations of rising profits without foundation. However, after the negative effects of the half year ended (liquidity was tight before the half year, and the recent hibor also reflected the above factors), Hong Kong stocks may not perform badly in the short term.

Here are a few turning points to look out for next season:

July ~ Whether U.S. interest rate cuts are expected to be further confirmed (watch for stronger non-farm data) /Third Congress related stimulus policies.

August ~ Blue-chip results: Keep an eye on the dividend ability of some companies, and falling costs for some of the leading companies boosted earnings performance.

September~ Whether the US Federal Reserve will conduct an interest rate cut cycle. After the start of the rate cut cycle, the spread between the RMB and the US dollar is expected to narrow.

If the above-mentioned advantages are successful, the Hang Seng Index is expected to continue on the path of valuation correction. Based on the market earnings channel, the more optimistic valuation level is expected to reach 22,000 pips (the current 10-year average is above one standard deviation).

In terms of technical trends, the high of 22700 on January 27, 2023 will be the most critical resistance level in the entire Bull1 city. Breaking through the current economic environment is not an easy task.![]() It may take further improvement across the macroeconomy to break through this resistance.

It may take further improvement across the macroeconomy to break through this resistance.![]() 。 Perhaps, as some investment reports say, we will wait until real estate improves slowly in 2025.

。 Perhaps, as some investment reports say, we will wait until real estate improves slowly in 2025.

Chief Analyst of Futu Securities Liang

(The author is a license holder of the Securities Regulatory Commission, and its contacts do not have financial interests in the issuer of the proposed shares mentioned above)