Hong Kong investors rated their financial security level 6.43/10 on average, while the perceived economic uncertainty in 2025 is relatively high at 7.18/10.

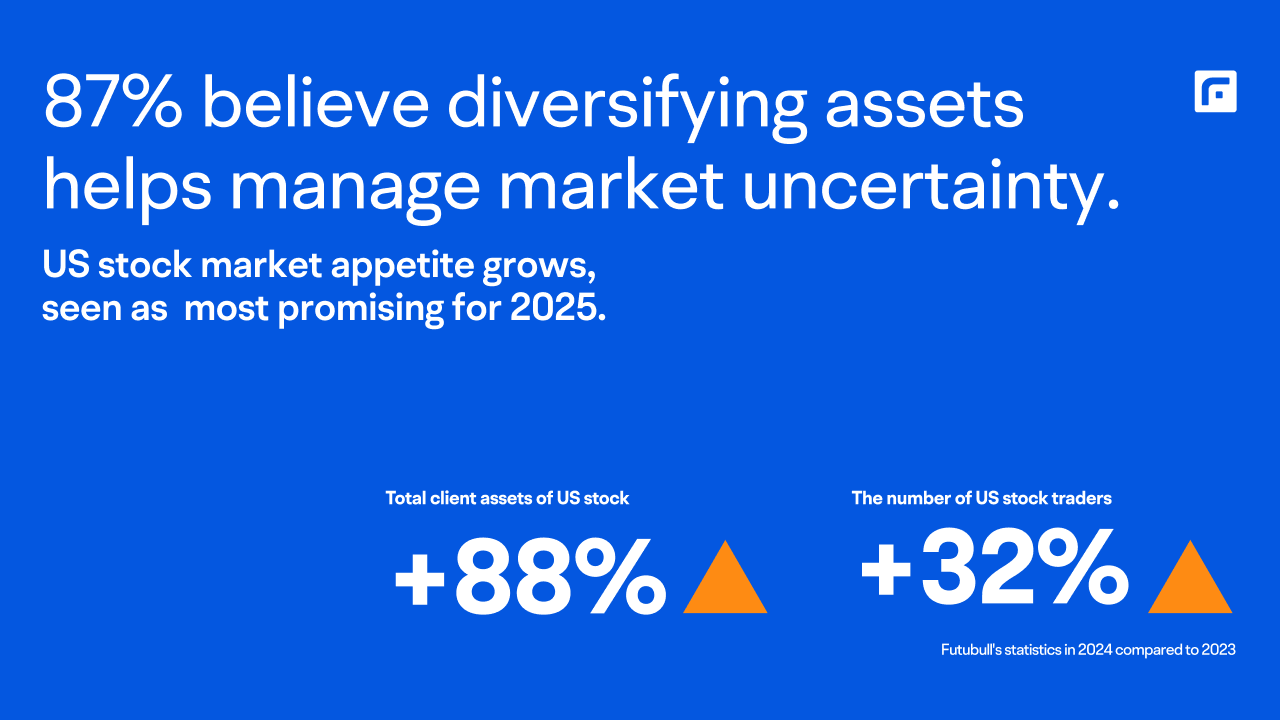

87% of Hong Kong investors believe a diversified investment portfolio can help them navigate economic uncertainties, and over 50% are increasing investments to generate passive income amid challenges.

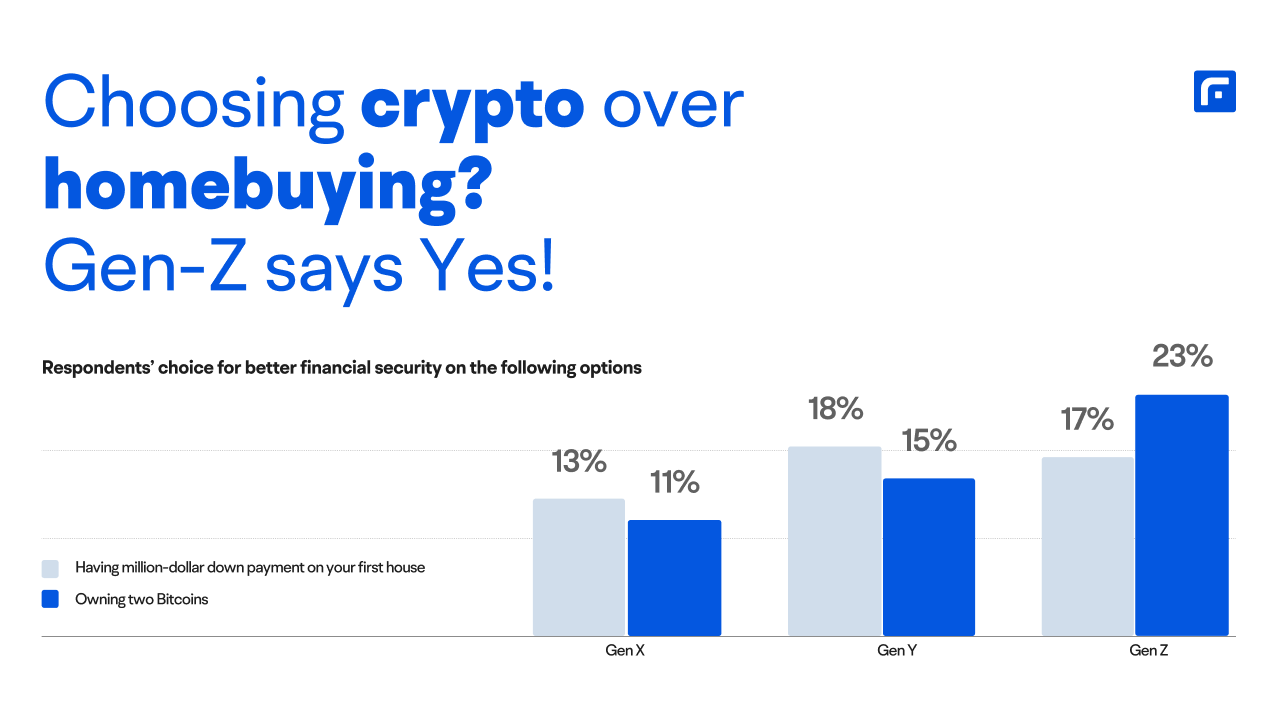

Cryptocurrency has become a new investment favorite, with Gen-Zs feeling greater financial security owning two bitcoins than having a down payment on a house.

Nearly 90% of million-dollar earners plan to maintain or increase investment allocation in 2025, focusing on stocks, cryptocurrency, and funds.

(Hong Kong, January 14, 2025) Futu Securities International (Hong Kong) Limited ("Futu") has released its "2025 Hong Kong Retail Investor Report" which collected responses from over 2,000 Hong Kong users on the Futu platform. The report examined respondents' income structure and investment preferences, revealing that Hong Kong investors' financial security level scores only 6.43 out of 10, with high economic uncertainty perceived. Nearly 90% of respondents opted for diversified investment strategies in response to this uncertainty and driven by the trend of global asset allocation, US stocks and cryptocurrencies emerged as the most promising assets for 2025.

Over 50% of Hong Kong Investors Increase Investments to Combat Uncertainty

Futu's latest survey indicates Hong Kong investors rate economic uncertainty at 7.18 out of 10, reflecting widespread concerns about current economic challenges. From a financial perspective, rather than reducing consumption, developing side businesses, or career transitions, Hong Kong investors prefer increasing investments for passive income, with 55% of respondents stating this makes them feel more secure. Diversifying asset allocation to mitigate risk was also popular with 41% of respondents reportedly choosing to employ this strategy.

Regarding investment preferences, Futu's data shows that 87% of respondents agreed that diversified investment strategies help manage economic downside risks. Rather than adopting more conservative risk appetites (30%), more respondents preferred diversifying their investment portfolios (43%), with a higher level of diversification observed among those with higher incomes and more investment experience.

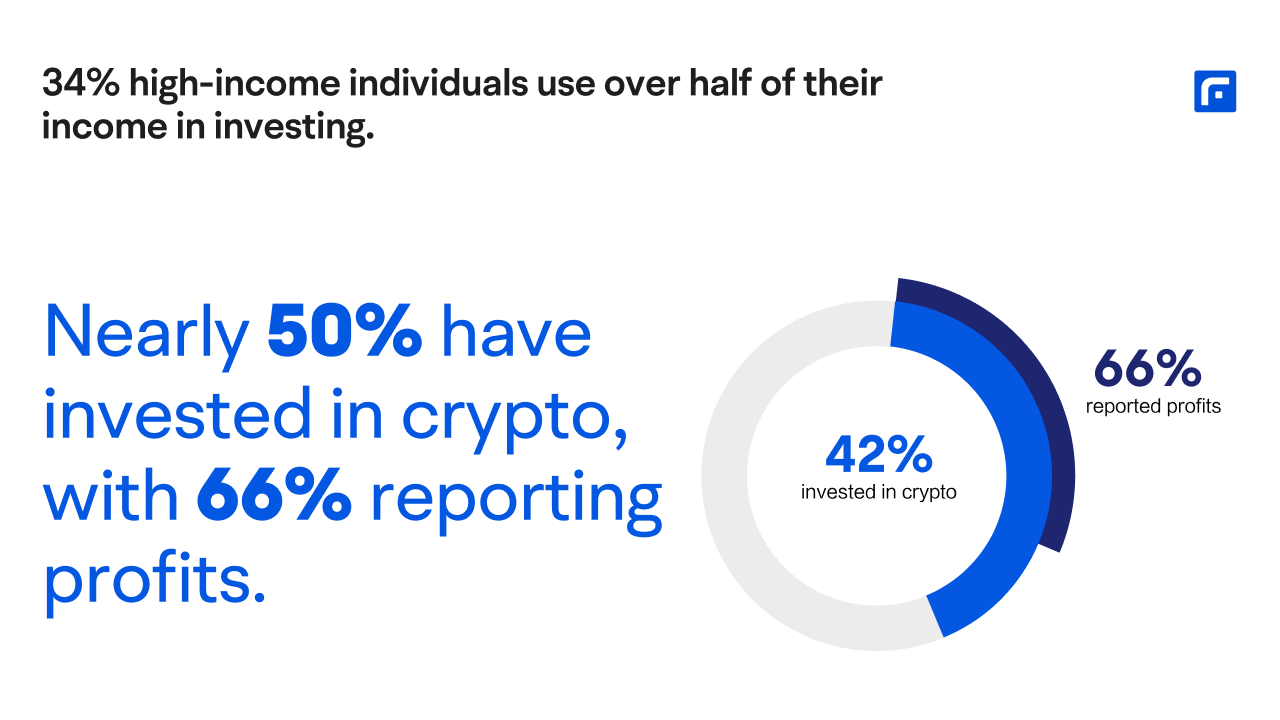

High-Income Earners Embrace Diversification Strategies; Nearly Half Invest in Cryptocurrency with over 60% Making Profit

The survey revealed that million-dollar annual income earners demonstrate diverse and aggressive characteristics when managing assets and investing, with a quarter of high-income respondents having more than five income sources and 34% investing over half their income. High-income investors prefer high-volatility assets such as futures, options, forex, and cryptocurrency. Data indicates that over 42% of them have invested in cryptocurrency, with 66% reporting profits. Furthermore, high-income earners continue to focus on diversified asset allocation, with 87% planning to maintain or increase investment allocation in 2025, prioritizing stocks, cryptocurrency, and funds as their top three assets for increased holdings.

Gen-X Optimistic about Cryptocurrency; Gen-Z Favors Bitcoin over "Getting on the Property Ladder"

As cryptocurrency attention rises, investment perspectives across generations have significantly shifted, with cryptocurrency gradually becoming the preferred asset allocation for new investors (Gen-Z). Among Gen-X cryptocurrency investors (born before 1980), 77% are optimistic about cryptocurrency's long-term growth potential. Gen-Z (born 1997-2006) prioritizes trading convenience and safety in crypto investments, reporting that 'two bitcoins' provide a better sense of financial security, valuing it over a 'million-dollar down payment' on the first house. Overall, Gen-Zs are three times more optimistic about cryptocurrency, when compared to real estate.

US Stock Trading Surges Nearly 90% Year-on-Year

According to Futu's platform data, Hong Kong's investment categories further diversified in 2024, with stocks and funds remaining the top choices, while cryptocurrency has gained significant traction.

Data shows that the appetite for US stocks continued to rise, with US stock total client assets and trading participants growing 88% and 32% year-on-year in 2024, respectively. Based on trading frequency statistics, 2024's top five sectors were AI Technology, Renewable Energy, WallStreetBets Stocks, Cryptocurrency Concept Stocks, and Healthcare/Pharmaceuticals, while 2025's most promising industries include AI Technology, Healthcare/Pharmaceuticals, Renewable Energy, Consumer Staples, and Finance.

"Given the array of geopolitical risks, inflation, and policy shifts, it is understandable that the respondents are uncertain about their financial stability. Portfolio diversification remains a key strategy for effectively mitigating financial risks. Investors should monitor the performance of various assets across different regions and volatility levels, considering allocations with lower risk correlations. For instance, while capturing opportunities in cryptocurrencies amid digital economic development, investors might want to look into major technology companies listed on U.S. exchanges to capitalize on AI advancement. Similarly, they could also explore undervalued stocks with investment potential in the Hong Kong market (such as high-dividend Chinese state-owned enterprises and growth-oriented tech stocks), as well as companies with stable dividend policies and bonds," said Arnold Tam, Chief Analyst at Futu.

"The survey shows most people in Hong Kong believe diverse income streams are key to combating economic uncertainty. Investing to counter inflation and earn passive income remains preferred, demonstrating a desire to earn outside their traditional income streams. Futu remains committed to providing convenient, efficient, and secure investment services, and, with this in mind, we will continue to introduce various investment products, aiming to build a 'one-stop investment platform' that simplifies investing. Last year, we launched cryptocurrency trading functionality that covers four spot trading pairs including Bitcoin and Ethereum with USD and HKD, enabling our clients to trade virtual assets confidently on a licensed platform. At Futu, we plan to keep expanding investment categories, enhancing products and user experience to help investors capture opportunities," said Daniel Tse, Managing Director at Futu.

Please visit the page for more report details.

Futu Secures Six Consecutive Years of HKEX Awards Leading in Futures, Options, and Currency Futures Trading Volumes Among Retail Brokers

Futu Trustee Is Recognized as "Hong Kong Best Trust Administrator"

Futu Concludes Largest Retail Investors Event in Hong Kong, Looking into the Future of Smart Investing with 12,000 Participants

Futu Secures Six Consecutive Years of HKEX Awards Leading in Futures, Options, and Currency Futures Trading Volumes Among Retail Brokers

Futu Trustee Is Recognized as "Hong Kong Best Trust Administrator"

Futu Concludes Largest Retail Investors Event in Hong Kong, Looking into the Future of Smart Investing with 12,000 Participants